Bad News For Nvidia Bears

History Repeating Itself Or...?

To start this issue, some food for thought from Oakmark’s Bill Nygren:

There have been two technologies in my career that seem similar to the artificial intelligence (AI) excitement boosting tech stocks today – computers and the Internet.When I was in business school in 1980, there was so much market interest in the computer manufacturers that IBM was the largest market cap company, and the industry was referred to as “IBM and the Seven Dwarfs” (Burroughs, UNIVAC, NCR, Control Data, Honeywell, General Electric and RCA). Suffice it to say that profits from computer manufacturing disappointed for all eight companies.

Then in 2000, amidst “dotcom” hysteria, the largest cap Internet companies were Cisco, America Online (AOL) and Yahoo!. AOL and Yahoo! ended up nearly worthless, and Cisco, at a lower share price than in 2000, has lost 80% relative to the S&P 500. We think these results should give pause to anyone believing the AI winners have already been determined.

What’s the saying about pioneers often ending up with arrows in their backs?

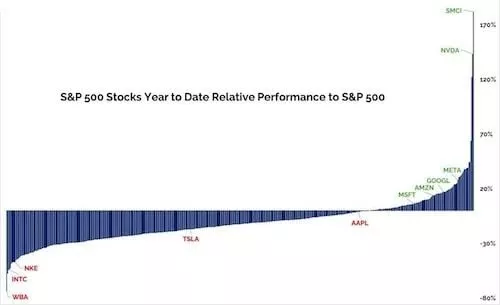

Today, with just a handful of AI-related stocks driving the S&P 500 to new highs, is this a case of history repeating itself or could this time around indeed be different?

Which brings us to...

Bad News For Nvidia Bears

In an attempt to put our money where our proverbial mouth is, we decided to put on our big boy pants and look at expressing a bearish view on Nvidia with options. But we weren’t all too happy with what we found.

Here’s our back-of-the-envelope analysis we shared with Insider Newsletter readers recently:

Would buying put options make any sense at least from a longer-term perspective (until December 2026 or 2.5 years out)?If we were to buy an ATM put ($123 strike, December 2026 expiry), it would cost about 30 points (near enough).

So breakeven (at expiry) would be at $93 or about a 24% fall. A 100% return would be at $63 (about a 50% fall for Nvidia) and 200% at $33 (a 73% fall).

Hmm, not impossible to achieve, but also not all that attractive (the payoff isn’t high enough).

What about something a little exotic, say an OTM bear put spread. So let’s buy the 100 strike and sell the $74 strike against it (as one trade). That spread would cost about 9 points.

So breakeven would be at $91 ($100-$9) — or a 25% fall in Nvidia — while you’re looking at a 100% return at $82 (a 33% fall) and max profit would be if Nvidia was to close at or below $74 with a 189% return (a 39% fall).

While these are all rather realistic outcomes (especially when taking Bill Nygren’s historical parallels above into consideration), the potential returns just aren’t high enough to justify the capital at risk.

So we’re putting this one in the “too hard” pile and moving on to find something else where the risk/return profile is a no-brainer.

All Things Transitory...

Feels like a lifetime ago, when — back in February 2020 — we started warning that COVID lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now an almost daily reminder in our daily lives. We set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things "transitory."

Today, we have a couple of reports from Insider members from different corners of the world.

First up, a note from member Dancebuff:

U.S. $65 for breakfast with my son today, including tip, at a local non-fancy diner, not even organic. He had crab eggs Benedict and iced coffee, I had two scrambled eggs with included fruit, and a side of fried avocado (delicious, never heard of it). Insane price! This is why I never eat out anymore.

Member MarcCH chimed in from Switzerland:

The prices are much higher than even Switzerland without presumably things not being to the Swiss standard. I paid 42 Euros (US $45.36) this morning for an unlimited buffet breakfast for two adults, two kids, and our toddler eats free. We are staying at a family beach holiday place in Tuscany. The food and the coffees were superb. Italian salaries and property prices are obviously much lower than in California, but it is far better value and the food is real.

And member Kathryn from New Zealand:

Well it is certainly not any cheaper here in NZ. Had lunch with some friends and a bowl of soup (leek and potato) and 1 Kombucha cost 28 dollars. Like others we mostly cook at home and seldom eat out. In fact I have noticed that the quantity and quality at restaurants has gone down quite a bit. For example at a local brew pub you used to be able to get a blue cheese venison burger for about $23. Now that same burger has gotten smaller and does not come with any sides (such as chips) and sells for $28. For fries or chips add another $6. So $34 for a burger and chips (fries).

To tame soaring inflation, the mainstream press came up with a solution...

_638566452797199282.webp)

Here’s the gist:

Worried that inflation is coming down too gradually? The Romans had a not-so-subtle solution: Anyone suspected of ratcheting up prices faced execution.

Brilliant!

Brussels Bureaucrats Strike Again

Over in Europe, the pointy shoes are at it again, doing what they do best — using Orwell’s 1984 as a manual and attempting to regulate everything that moves.

The musical piece by Italian DJ Gigi D'Agostino from 1999 is played in many soccer stadiums in Germany when goals are scored. However, UEFA (Union of European Football Associations) has banned the song from being played during European Championship matches after it was also outlawed in Germany due to its misuse.

Sorry, wrong article...

_638566453226822711.webp)

This shouldn’t come as a surprise to anyone paying attention to the big picture. Here’s what we mean...

Take a look at this chart of unfunded pension entitlements in major European countries between 300% and 500% of GDP. Mix this in with collapsing demographics, and you’ve a recipe for debt disaster.

_638566453406823266.webp)

It’s why, in our view, the collapse of the EU is not only probable, but now imminent.

It’s also why the pointy shoes going after Twitter X is not a coincidence. In fact, expect to see more of that as Brussels bureaucrats try to consolidate and hang onto power and censor any dissenting views that threaten their reign.

Week’s Humour

Before we proceed, a word of caution — what you’re about to see might be triggering to the most sensitive amongst us.

When Chris shared it in the last Insider Newsletter issue, a “polite gentleman” accused us of being paid Russian propagandists (if there ever was a check headed our way, it must’ve got lost in the mail). So consider yourself warned!

Now, if you haven’t seen it yet, this video from Tucker Carlson’s recent visit to Australia is one for the records. He eviscerated the mainstream media as they attempted their usual tricks on him. It’s well worth a watch and guaranteed to put a smile on your face.

Meet the Australian media. pic.twitter.com/IyiEqihPkb

— Tucker Carlson (@TuckerCarlson) June 26, 2024

And finally, a reminder that nothing is forever (and that goes for the exponential growth in AI stocks, inflation, and EU, too)...

_638566454089959533.webp)

Have a great start to the new week!

More By This Author:

A Giant Sucking SoundMarkets Out Of Whack

Gold On The Move; Revisiting Bitcoin

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

_638566452242761239.webp)

_638566452411945437.webp)