Back To Reality: The Earnings Recession Has Arrived

Sentiment became euphoric Thursday on the back of META earnings yesterday afternoon sending the Nasdaq up 3.25% and the S&P 1.47%. Unfortunately – as I suggested in my blog this morning (“The Bear Market Has Been Cancelled”) – price was diverging from fundamentals and Apple (AAPL), Google (GOOG/GOOGL), and Amazon (AMZN) earnings – just out after the close – have confirmed that suspicion.

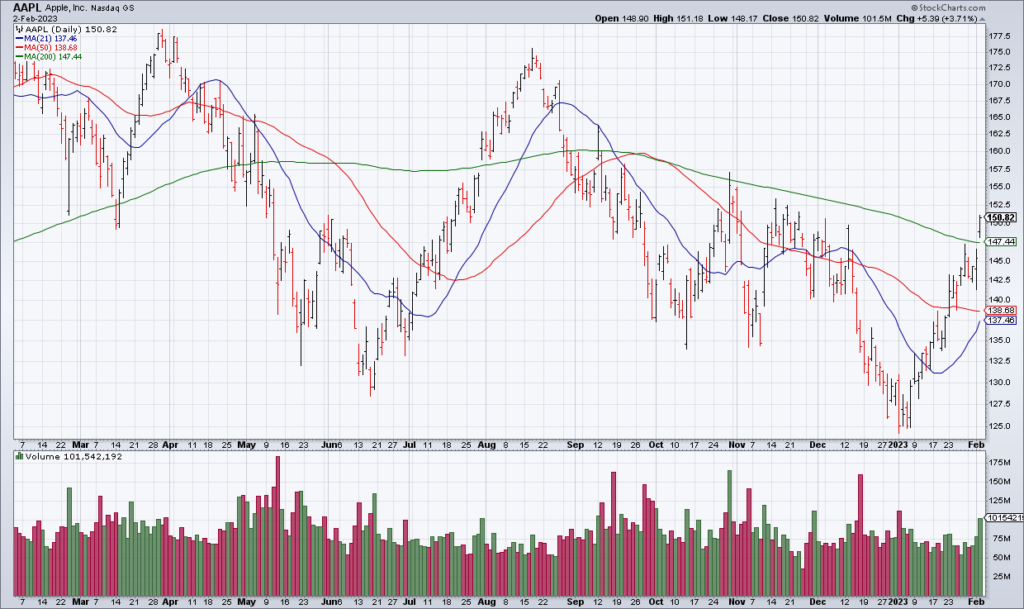

(Click on image to enlarge)

$AAPL | Apple Q1 Earnings:

— Benzinga (@Benzinga) February 2, 2023

- EPS $1.88 (EST. $1.94)

- Revenue $117.15B, (Est. $121.10B)

- iPad Sales $9.396

- Greater China Net Sales $23.905B

- iPhone Sales $65.77B

- Services Revenue $20.766B

- North America Net Sales $49.278B

- Wearables Revenue $13.482B

Apple $AAPL Earnings - Ouch! pic.twitter.com/Ovnpp5pn9b

— Barchart (@Barchart) February 2, 2023

Let’s start with the most important stock in the world: AAPL. While AAPL broke out above its 200 DMA today, its fundamentals are actually breaking down and so its stay in that territory is likely to be short-lived. Revenue declined 5.5% and Net Income 13.4% from a year ago, misses on both the top and bottom line. AAPL shares are currently -4% in the after-hours.

(Click on image to enlarge)

$GOOGL Alphabet Q4 Earnings:

— Benzinga (@Benzinga) February 2, 2023

- EPS $1.05 (Est. $1.18)

- Sales $76.05B (Est. $75.69B)

- Q4 Google Cloud Revenue $7.315B, Up From $5.541B YoY

- Q4 2022 Google Advertising $61.239B Vs $59.042B YoY

Google $GOOG trading lower in after hours trading after reporting earnings pic.twitter.com/tfmR1121WT

— Barchart (@Barchart) February 2, 2023

GOOG/GOOGL also broke out above its 200 DMA today but the fundamental story is the same. Revenue was only +1% and EPS declined 31% year over year.

(Click on image to enlarge)

$AMZN Amazon Q4 Earnings:

— Benzinga (@Benzinga) February 2, 2023

- EPS $0.03 (Est. $0.17)

- Sales $149.20B (Est. $145.45B)

- Sees Q1 2023 Net Sales $121B-$126B (Est. $125.11B)

Amazon $AMZN trading lower in after hours trading after reporting earnings pic.twitter.com/7x8vKEGA75

— Barchart (@Barchart) February 2, 2023

Same story with AMZN: the stock got ahead of fundamentals. The crown jewel of AMZN is Amazon Web Services (AWS) – their cloud business – and revenue growth in that segment decelerated to +20%. AMZN’s 1Q23 revenue guidance also came in light as you can see in the tweet above by Benzinga.

In last weekend’s Market Preview, I said that this week was “poised to be epic” and it has not disappointed. Unfortunately for the bulls, it looks like it will be ending on a sour note.

More By This Author: