BABA Double Zigzags Push Prices Lower

(Click on image to enlarge)

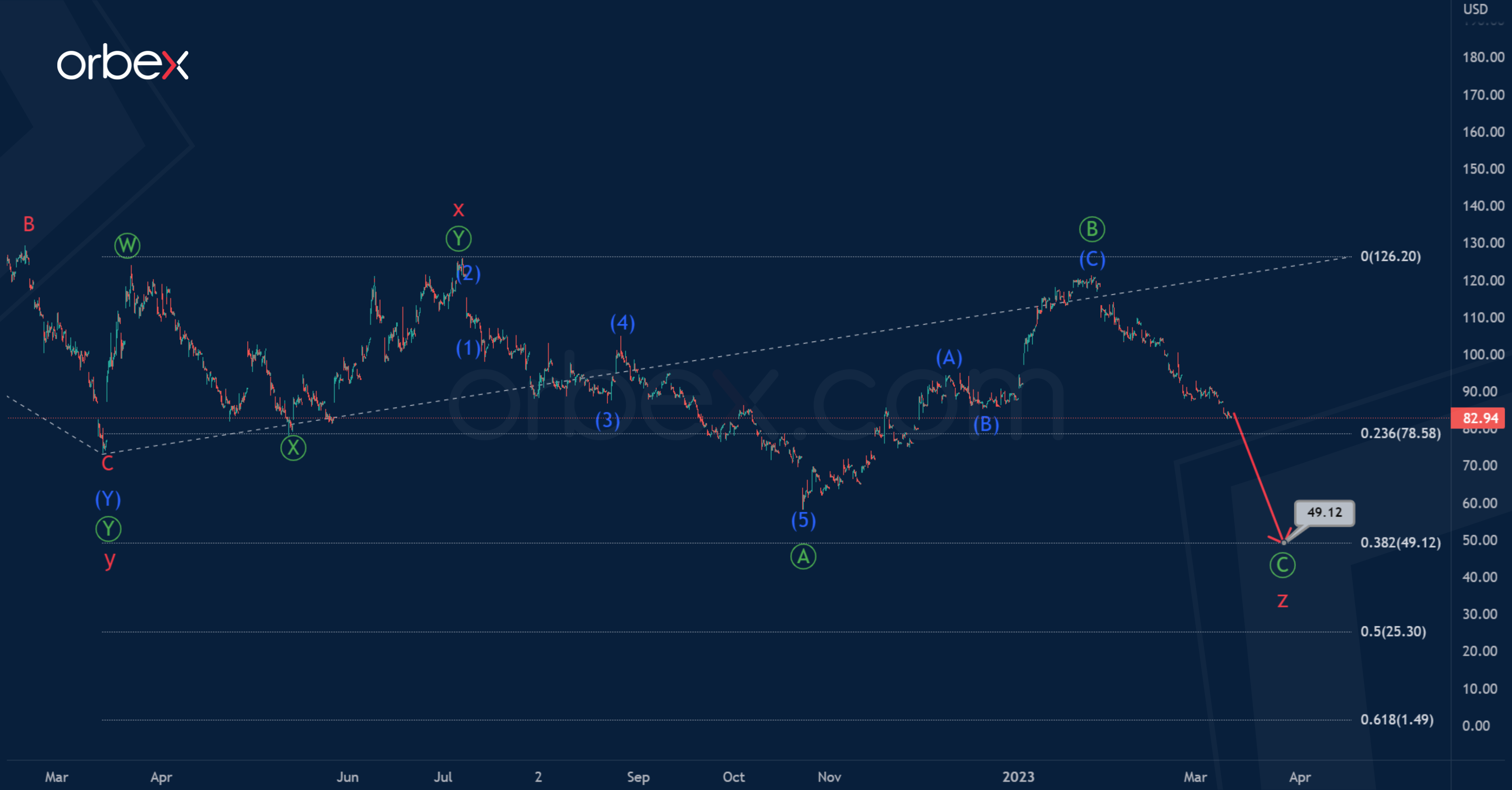

In the long term, Alibaba Group Holding (BABA) seems to be forming a bearish trend.

On the current chart, the completed actionary wave y and the second small intervening wave x are double zigzags.

At the time of writing, the formation of the final actionary wave z is taking place. This will likely take the form of a primary zigzag Ⓐ-Ⓑ-Ⓒ.

The primary impulse Ⓐ and correction Ⓑ have ended. So, we can expect a decline to 49.12 in the sub-wave Ⓒ. At the specified mark, wave z will be 38.2% of wave y.

(Click on image to enlarge)

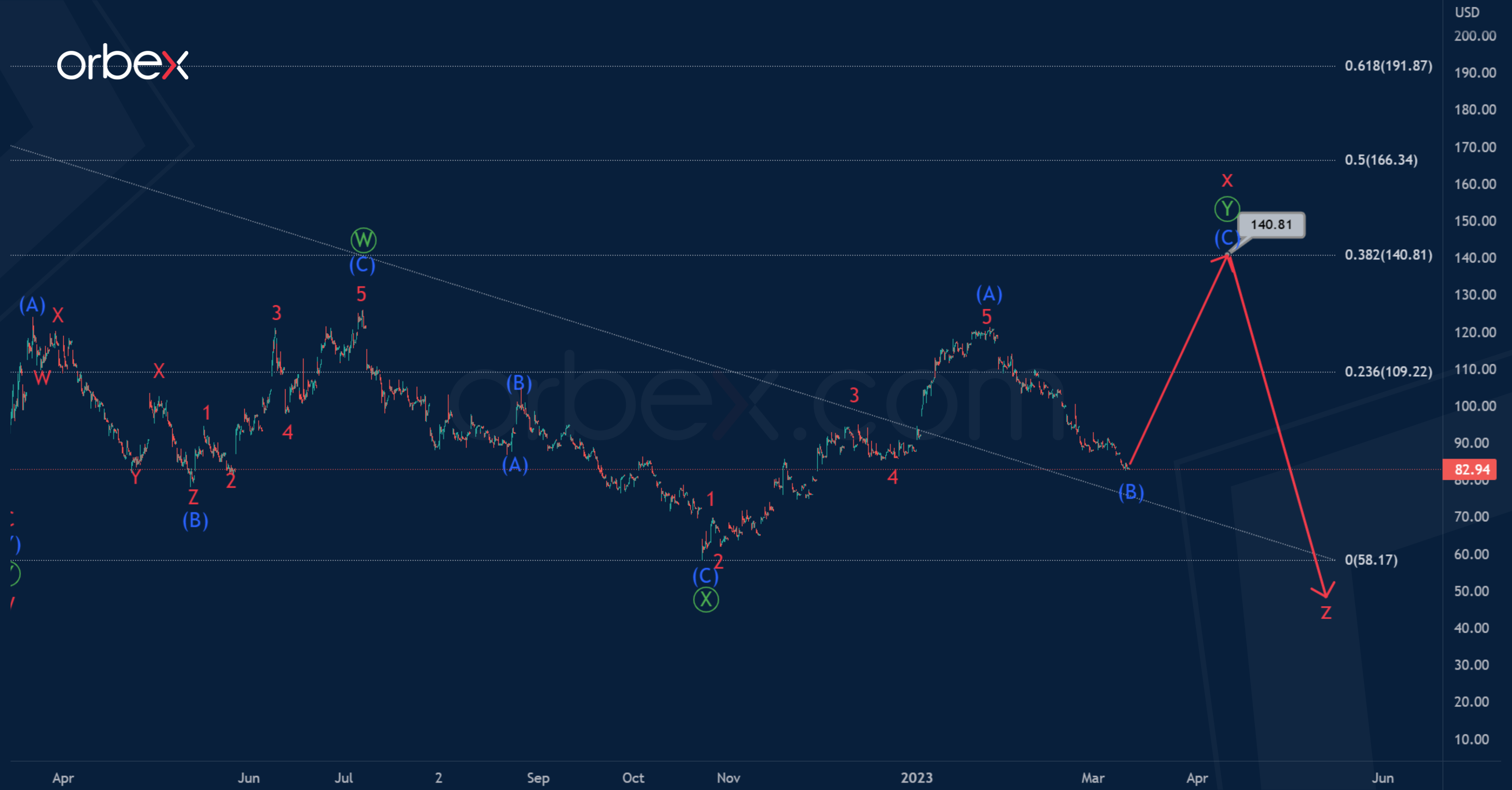

In the second variant of the markup, we see the continuation of the intervening wave x. This will be a double zigzag of the primary degree Ⓦ-Ⓧ-Ⓨ. The first two zigzag sub-waves Ⓦ-Ⓧ look finished.

Most likely, wave Ⓨ could take a zigzag structure of the intermediate degree (A)-(B)-(C), as shown in the chart. Impulse (A) and correction (B) look formed.

The price growth in the intermediate wave (C) can reach 140.81. At that level, cycle intervening wave x will be at 38.2% of actionary wave y.

More By This Author:

Intraday Analysis – USD Struggles For Bids

How Worried Should Forex Traders Be Over The SVB Crisis?

NZDUSD Decline In The Final Zigzag Ⓑ

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number ...

more