BABA Bad Or BABA Beautiful? Stock Market (And Sentiment Results)

Is Alibaba…?

-

The best A.I. play in China right now.

-

The “equivalent to owning a ‘China A.I. ETF.'”

-

The cheapest way to play A.I. globally.

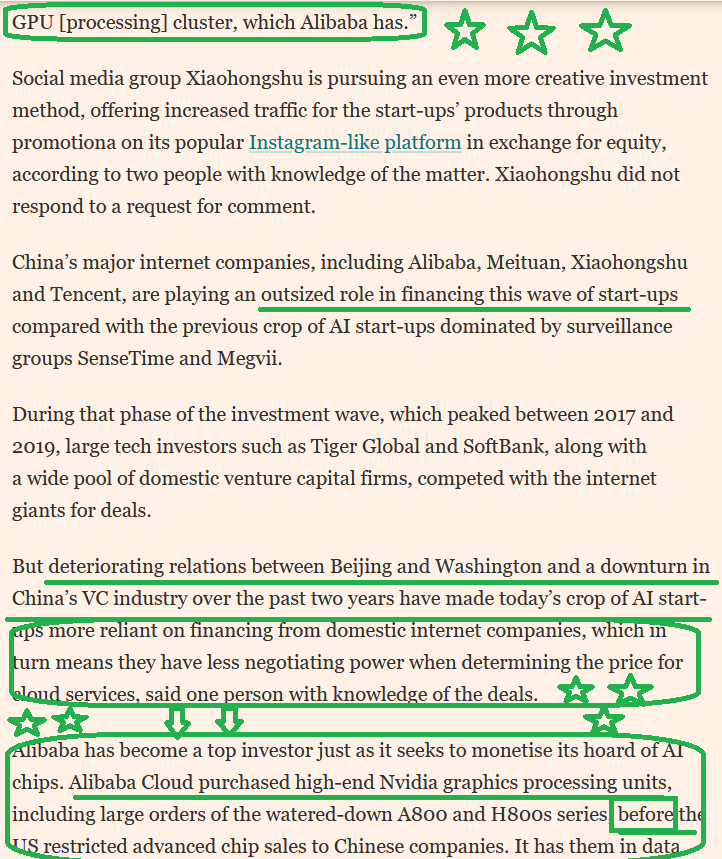

This recent article in the Financial Times lays out the nuance required to address these three points:

Alibaba Earnings – More Than Meets The Eye

While everyone was misdirected and focused on this misleading headline:

Here’s what they missed:

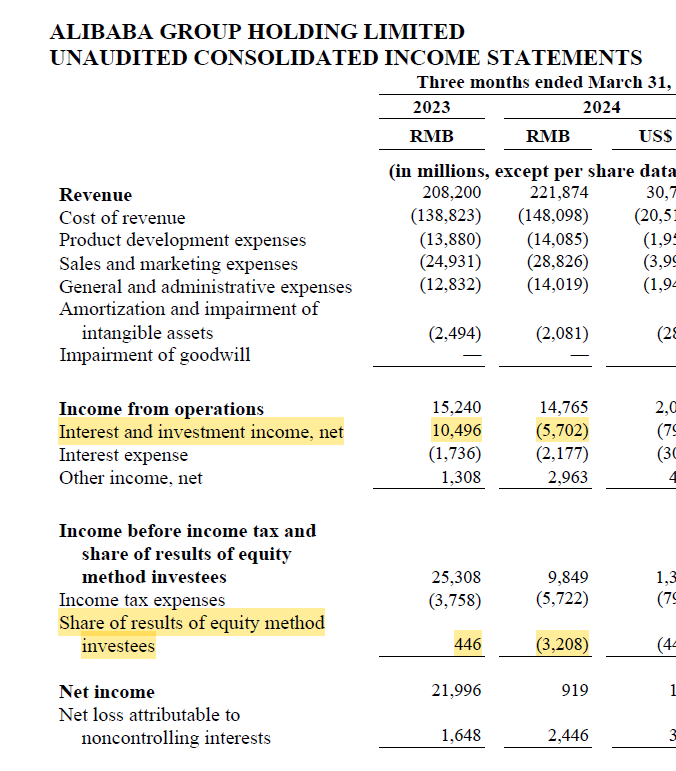

1) The “miss” in bottom line earnings was primarily attributable to “mark-to-market” losses on the long-term equity holdings in their securities portfolio – NOT THE UNDERLYING OPERATING BUSINESSES.

Source: Brendan Ahern

2)

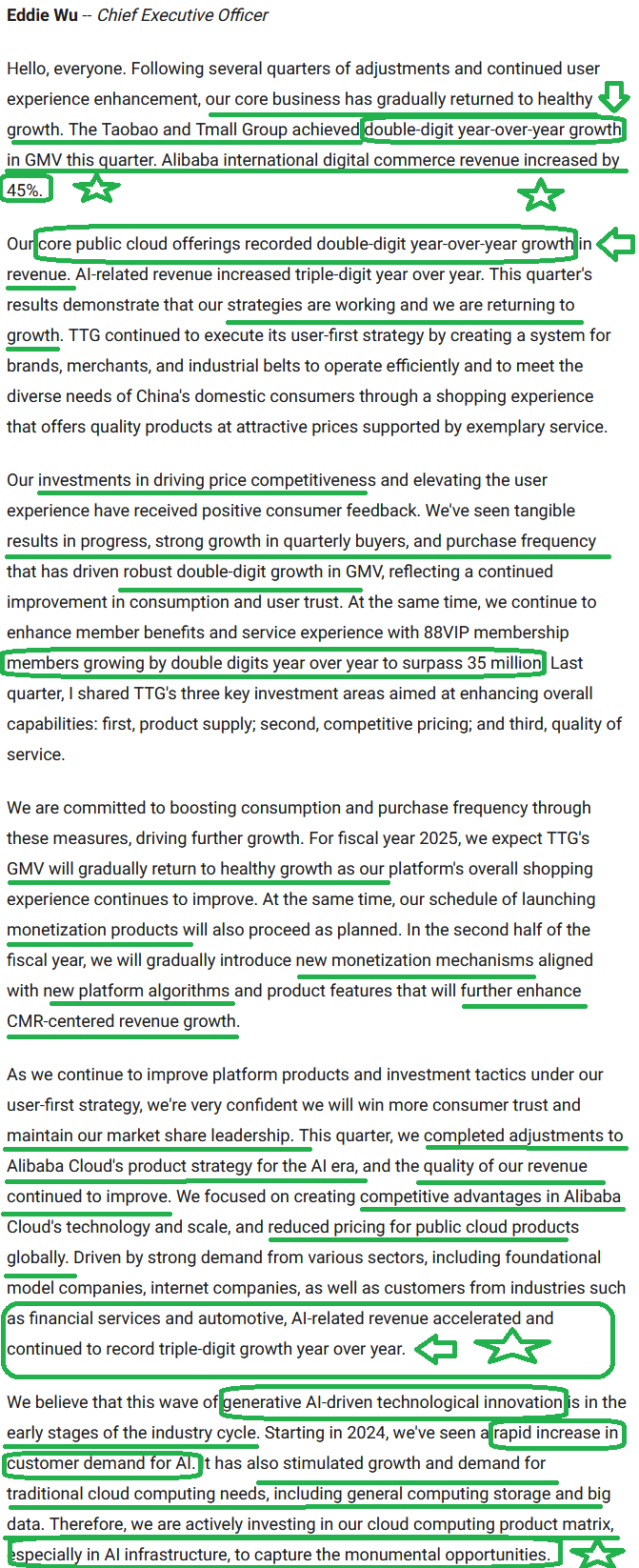

- Double-Digit your GMV growth

- Triple-Digit yoy AI Revenue Growth

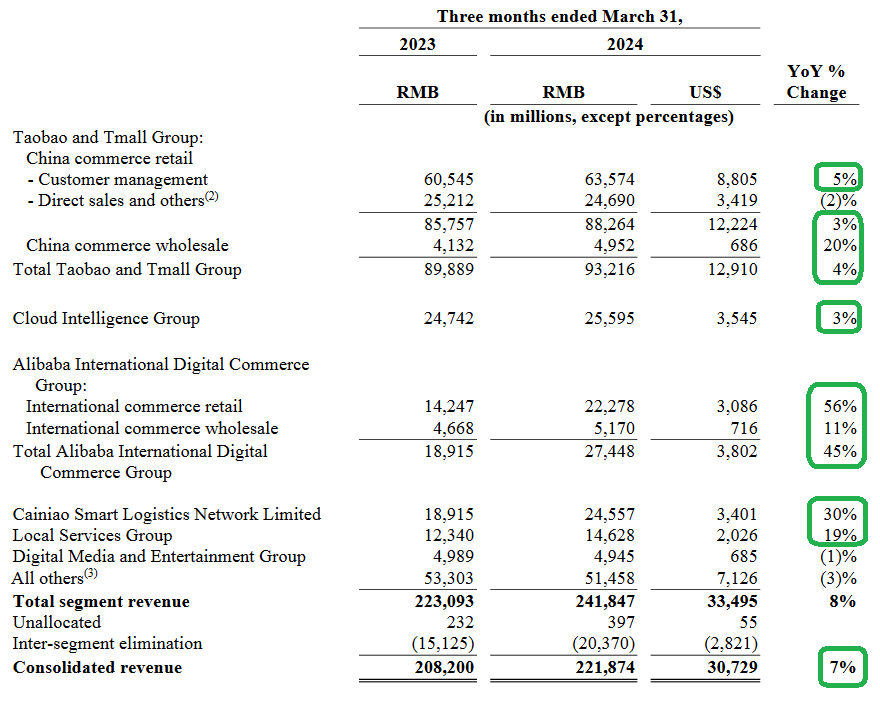

- 7% yoy revenue growth for the quarter

- $12.5B share buyback for fiscal year 2024

- $4B dividend fiscal year 2024

- Net Income (adjusted for mark-to-market pubic security loss) was -11% versus the misleading headline.

- Free cash flow was $2.1B for the quarter (decline attributable to massive capex for cloud business growth and dividend to shareholders)

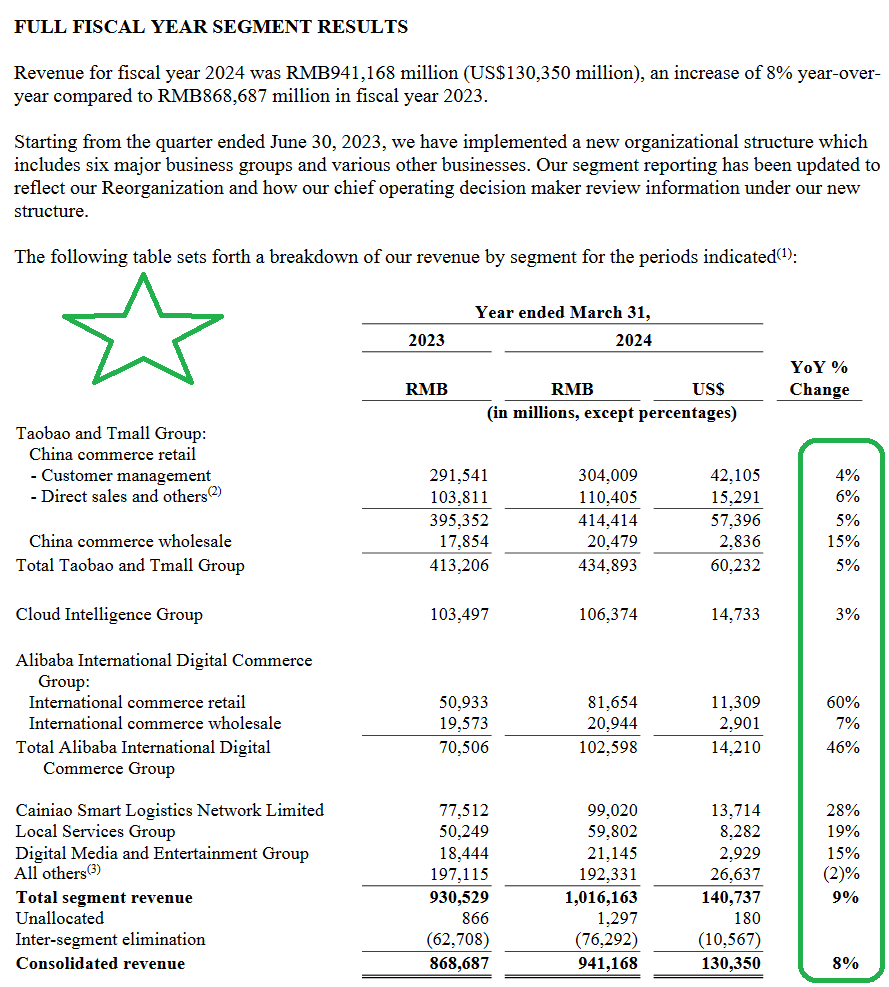

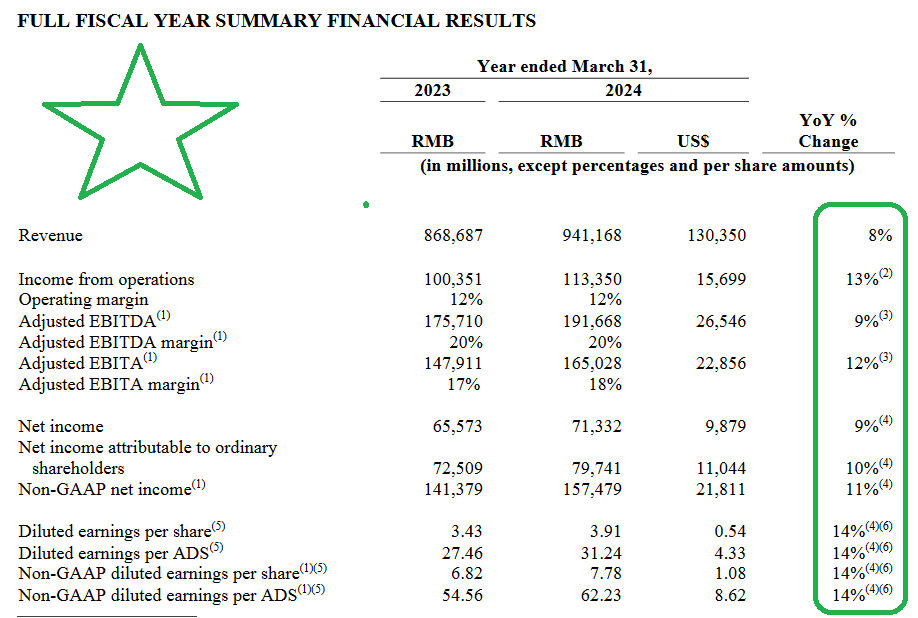

- 8% revenue growth for fiscal year 2024

- 13% income from operations growth for fiscal year 2024

Adjusted EBITDA growth of 12% for fiscal year 2024

(Click on image to enlarge)

3)

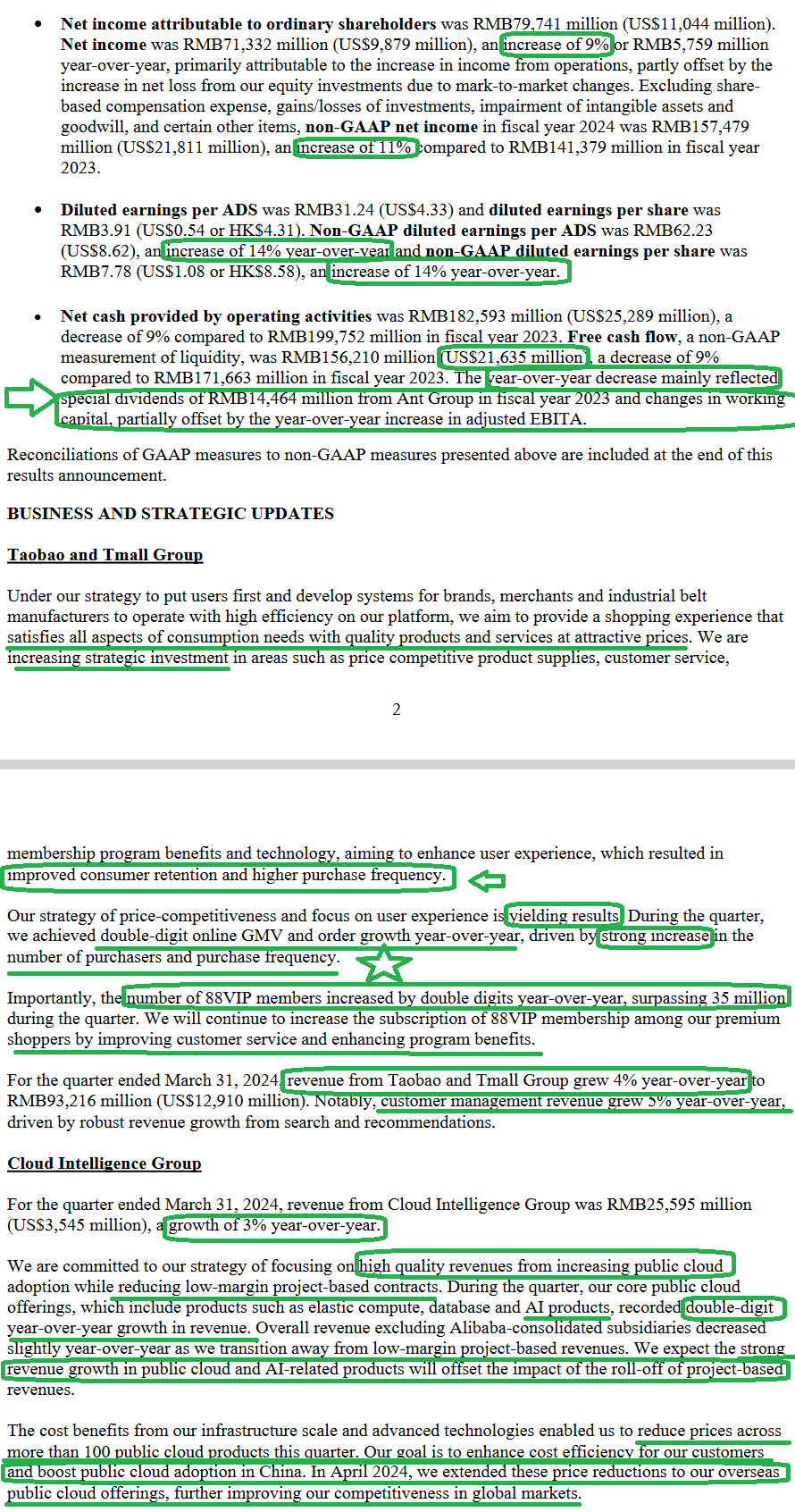

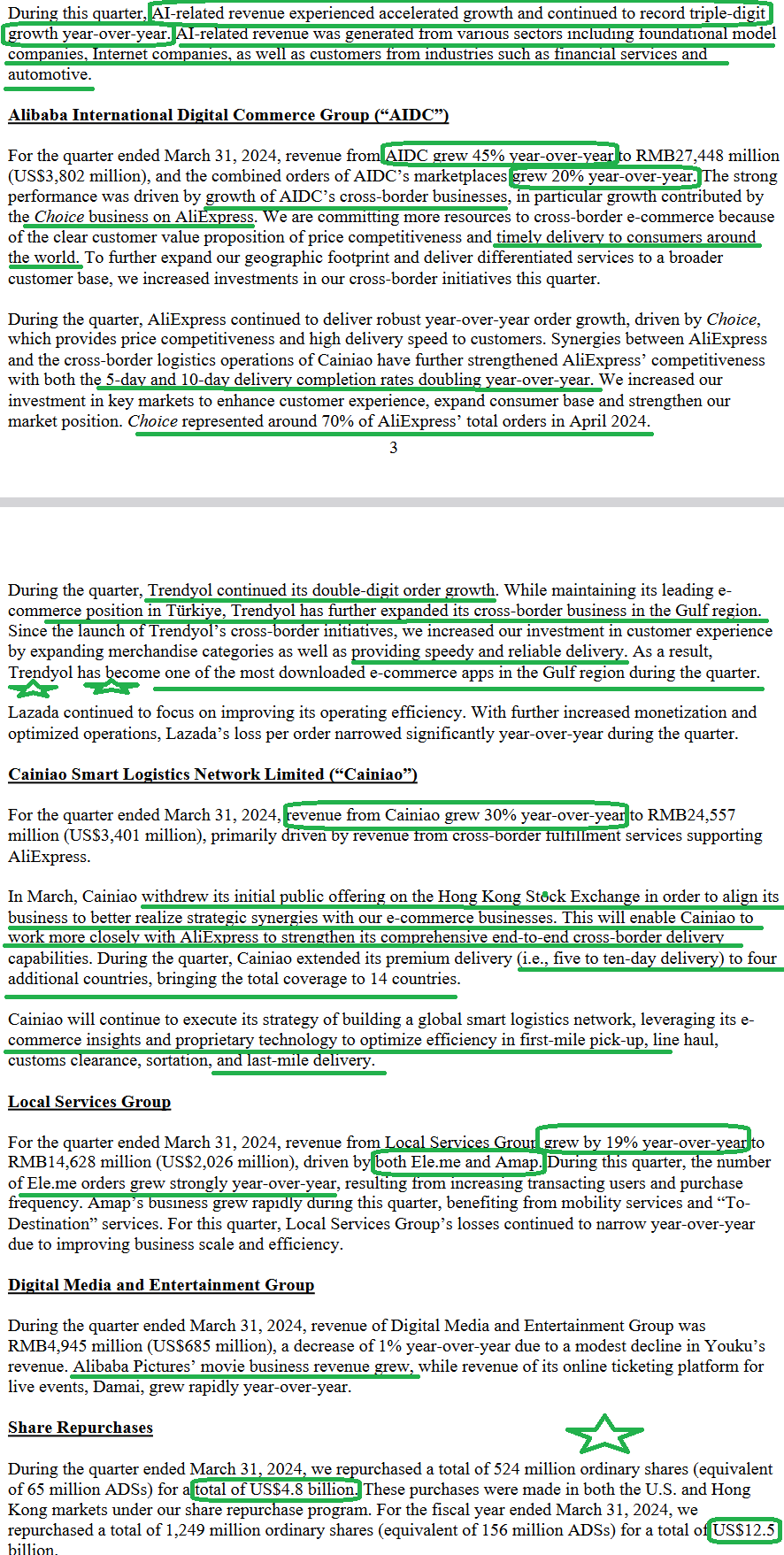

- Net Income was up 9% for fiscal year 2024

- non-GAAP Net Income was up 11% for fiscal year 2024

- Earnings per ADS up 14% for fiscal year 2024

- Free Cashflow was $21.6B after dividends paid out to shareholders and the absence of a special dividend from Ant Financial that was received in the prior year

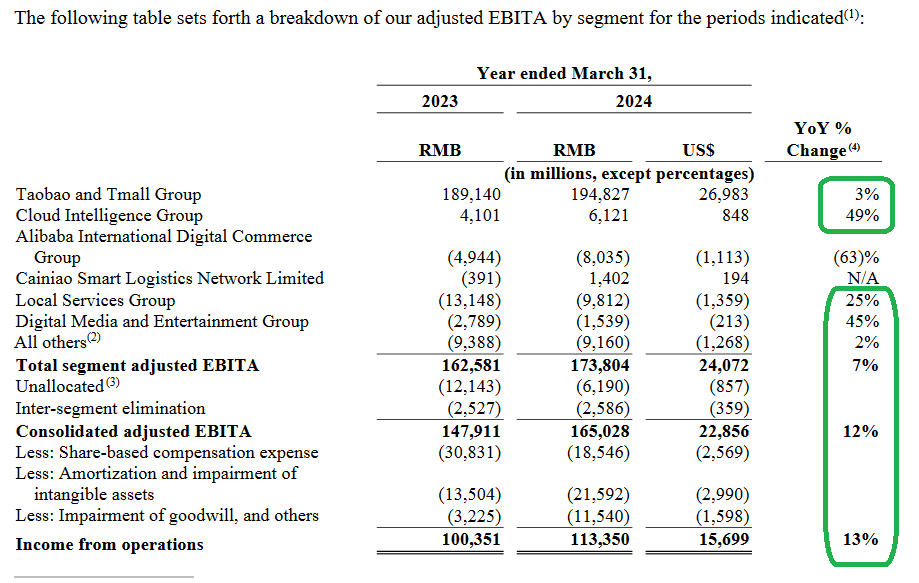

- Turnaround story working with improved customer retention and purchase frequency, double-digit online GMV and order growth and Taobao and Tmall Group revenue growth of 4%

- Cloud grew revenue 3% yoy despite cutting prices to gain share domestically and internationally.

4)

- AI-related revenue grew TRIPLE DIGITS year-over-year!

- AIDC (international commerce/AliExpress/Choice) grew 45% yoy

- Trendyol expanding aggressively in the Gulf region (one of most downloaded apps)

- Cainiao logistics grew 30% yoy

- Ele.me/Local Services grew 19% yoy

- Bought back $4.8B of stock for the quarter, $12.8B for the year.

5)

- The completed buyback means that your ownership in Alibaba (BABA) increased by 5.1% WITHOUT LAYING OUT AN ADDITIONAL DOLLAR FOR SHARES. How did that happen? You got bigger slices in the same pie as they retired stock.

- They increased the dividend by 66% this year – from $1/ads to $1.66/ads

- The primary listing in Hong Kong is expected to complete by August.

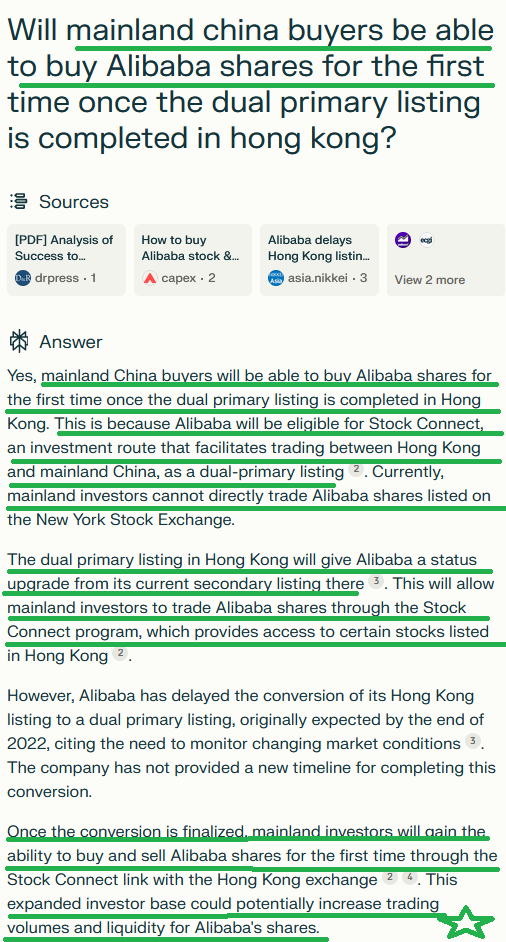

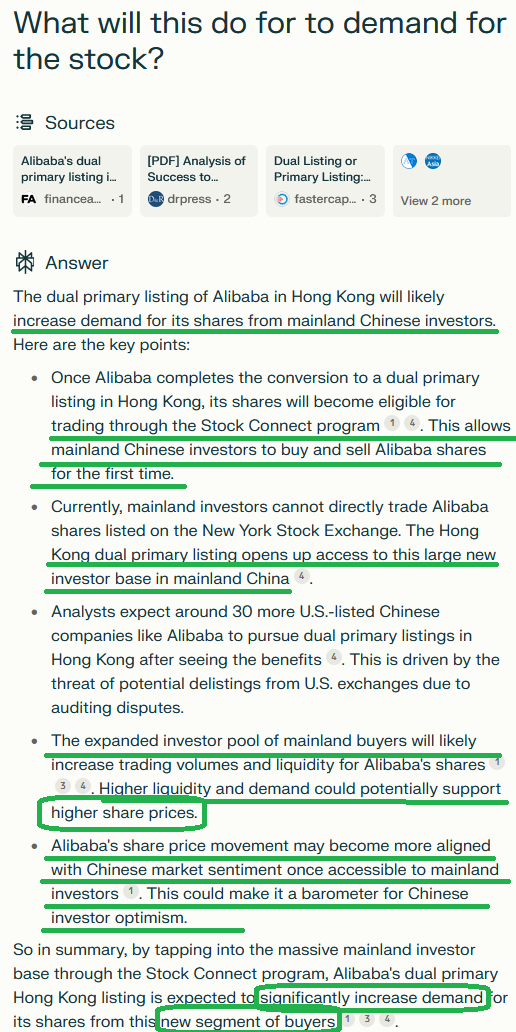

- I anticipate a rally in Alibaba shares as we get closer – over the summer – and institutions begin to get ahead of the new buying demand. What is the magnitude of the new buying demand? Try up to 180,000,000 new buyers (see explanation from Perplexity.ai below).

Here is the explanation from Perplexity.ai:

6) The company is BACK TO FULL ON GROWTH MODE:

7) Key segment highlights:

8) Highlights from Earnings Conference Call:

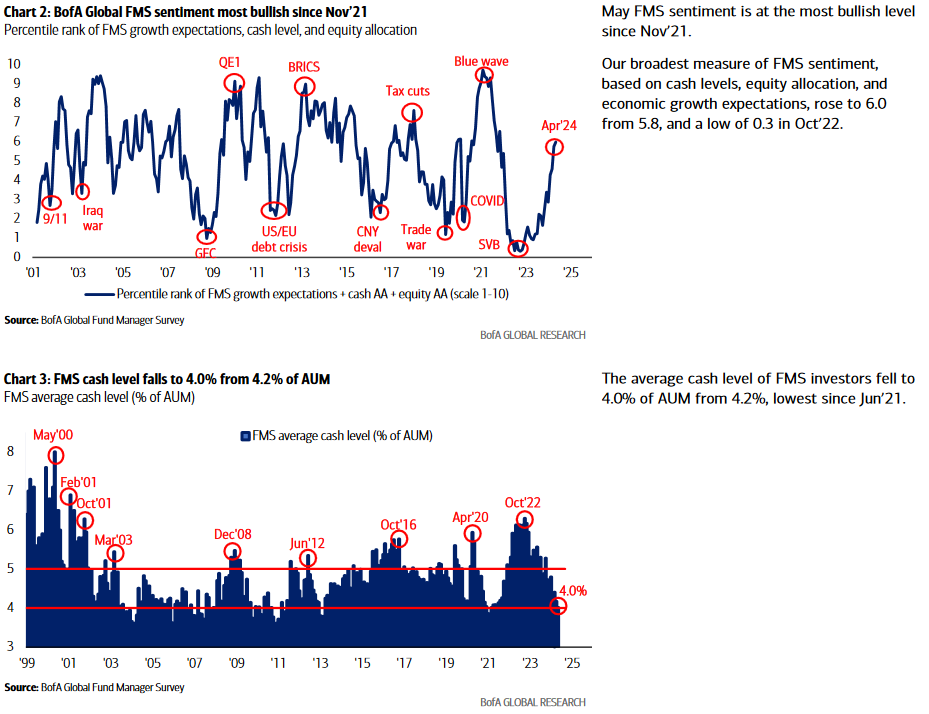

Bank of America Fund Manager Survey Update

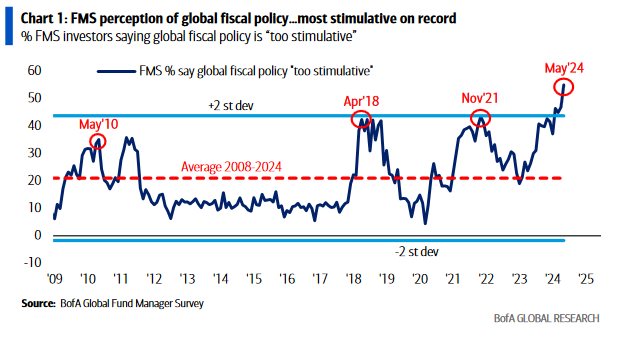

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey”. This month they surveyed 209 managers with $562B AUM.

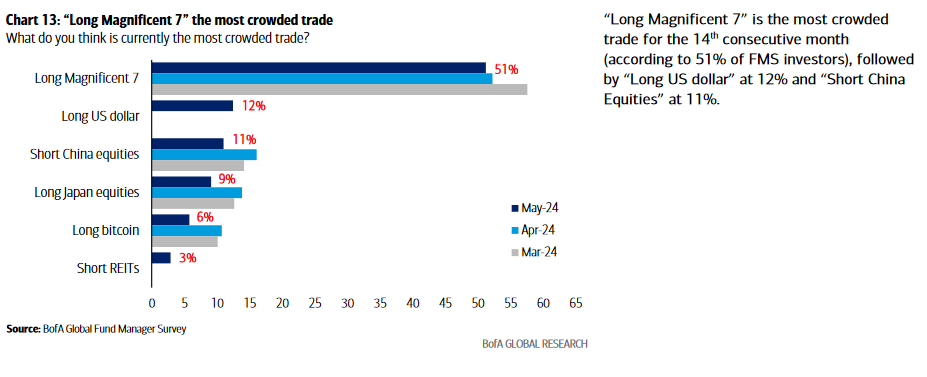

Here were the key points:

1) Managers are finding global fiscal policy to be too stimulative. They consistently have this view before continuation rallies in equities:

2) Sentiment is elevated, but not extreme:

3) Managers will lose on their long USD and Short China Equities “Crowded Trades” over time:

PayPal Update

On Friday I joined Julie Hyman on Yahoo’s Finance to do a segment called “GOOD BYE or GOODBYE!” In this segment I updated our thesis on PayPal (PYPL). Thanks to Julie and Hayley Marks for having me on:

Stanley Black and Decker (SWK) Update

The CEO did a good job of updating our thesis on Stanley Black and Decker this week on CNBC’s “Mad Money” with Jim Cramer. As Charlie Munger used to say, “I have nothing to add…”.

Now onto the shorter term view for the General Market:

The CNN “Fear and Greed” moved up from 39 last week to 60 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

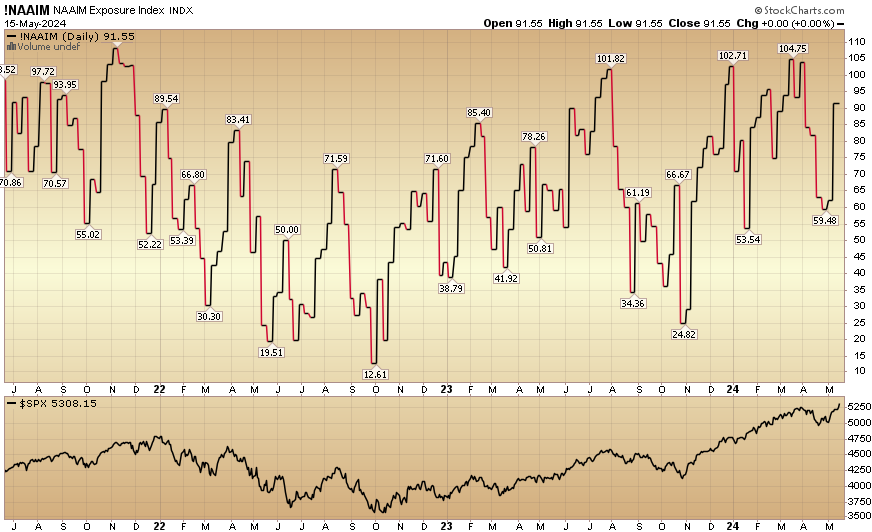

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 91.55% this week from 61.97% equity exposure last week.

More By This Author:

Are You Mad Or Glad? Stock Market (And Sentiment Results)

Powell’s, “Let There Be Light” Stock Market (And Sentiment Results)

More Work To Do? Stock Market (And Sentiment Results)

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.