B2Gold Just Turned On Its Goose Mine – So Why Is Wall Street Still Sleeping On This Stock?

Image Source: Unsplash

B2Gold (NYSE: BTG) has just reached a major milestone: its Goose Mine in Canada is now operational, marking the beginning of a production ramp that could reshape the company’s future.

This project alone has the potential to transform B2Gold from a mid-tier miner into one of the most compelling growth stories in the gold sector. Added to this are the Gramalote project in Colombia and the Fekola underground expansion in Mali, giving the company a strong pipeline of growth for the years ahead.

Yet despite these developments, Wall Street hasn’t caught on. Gold is trading at record highs, B2Gold has delivered strong earnings growth, and its balance sheet remains nearly debt-free—yet the stock continues to trade well below peers and its own historical levels. Goose could represent a significant part of B2Gold’s overall value, but the market is still pricing in heavy political risk from Mali while overlooking the upside from Canada and Colombia.

The disconnect raises a critical question: is Wall Street underestimating B2Gold’s ability to capture record gold prices and turn its pipeline into shareholder value, or is short term volatility keeping this hidden gem under the radar?

Let’s break it down using the IDDA Framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in B2Gold, ask yourself:

Do you want exposure to a gold producer with one of the most attractive growth pipelines in the industry?

Are you looking for a miner with a nearly debt-free balance sheet and disciplined focus on organic, project-driven expansion instead of risky M&A?

Do you believe record-high gold prices, combined with B2Gold’s production ramp-up, can drive significant upside as the market re-rates the stock closer to peers?

B2Gold’s stock has historically been volatile, even as gold reached all-time highs, making it more suitable for investors with a higher risk tolerance. While the stock has delivered strong gains since last year, it still appears undervalued relative to its fundamentals and growth pipeline compared to peers.

For long term investors, B2Gold offers leverage to the bullish gold cycle and meaningful growth potential as new projects ramp up. For short term investors, volatility may create opportunities, but risks such as political instability in Mali and overbought technical conditions remain important watchpoints.

IDDA Point 3: Fundamentals

B2Gold (BTG) is a Canadian gold producer with mines and projects across Africa, Asia, and the Americas. The company has steadily grown its output and is now entering a new phase of expansion with several major projects coming online. This diversification helps reduce reliance on any single region and supports more stable long-term growth.

The Goose Mine in Canada is the centerpiece of this strategy. Now operational, it is expected to become one of B2Gold’s most important contributors and could represent a significant share of future production. Alongside Goose, the Gramalote project in Colombia and the underground expansion at Fekola in Mali are positioned to add further strength, making up the backbone of B2Gold’s growth pipeline.

Financially, the company is on solid ground. Revenues have been climbing, profit margins are improving, and cash flow remains strong even as B2Gold invests heavily in new projects. While near-term spending has pushed free cash flow into negative territory, this is tied to growth investments rather than weakness in the core business. Importantly, costs remain competitive compared to current gold prices, giving the company room to stay profitable.

B2Gold is also disciplined in how it manages capital. The company carries very little debt and has avoided diluting shareholders. Management has chosen to reduce dividends temporarily so that more funds can be directed toward growth projects, a move that has already been rewarded by strong stock performance. Their focus on organic growth, rather than risky acquisitions, reflects a cautious but value-driven approach.

From a valuation perspective, the stock still looks cheap relative to peers. B2Gold trades at a discount compared to both its own history and the wider sector, suggesting the market has not fully recognized its growth potential. With a clean balance sheet, new projects ramping up, and gold prices near record highs, the company offers both near-term leverage to the gold cycle and attractive long-term growth prospects.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Growth Pipeline – New projects like Goose in Canada, Gramalote in Colombia, and the Fekola expansion in Mali are set to boost production and diversify B2Gold’s operations.

Attractive Valuation – The stock trades much cheaper than many of its peers, leaving plenty of room for upside as the company grows.

Strong Finances & Discipline – B2Gold has very little debt, avoids shareholder dilution, and focuses on steady growth rather than risky acquisitions.

Risks

Political Risk in Mali – Unstable conditions in the region could impact one of B2Gold’s largest mines.

Volatility – The stock often swings sharply, which may mean sudden pullbacks even in a strong gold market.

Market Slow to React – Despite strong progress, the stock remains undervalued compared to peers, and it could take time before Wall Street fully re-rates it.

Investor sentiment on B2Gold is positive, but the stock still lags behind soaring gold prices and peers, leaving it undervalued. The market seems overly cautious, focusing on Mali’s political risks while overlooking progress at Goose, Gramalote, and Fekola. With strong gold demand driven by rate cut expectations, inflation fears, and global tensions, the outlook for miners is favorable. B2Gold’s disciplined, diversified approach sets it apart, and despite volatility and cautious analyst targets, many see the stock as undervalued with solid upside potential.

Sentimental Risk: High

IDDA Point 5: Technical

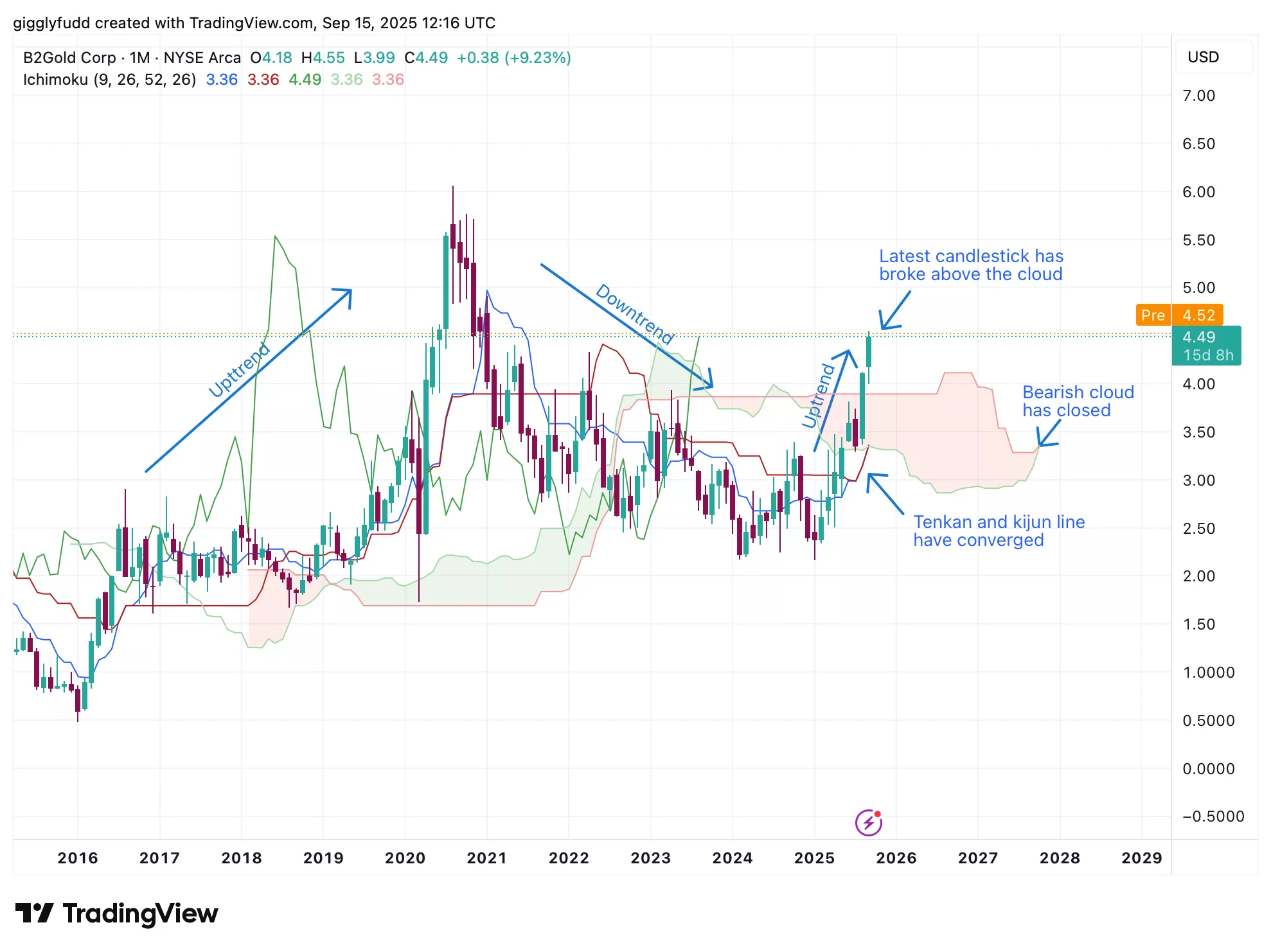

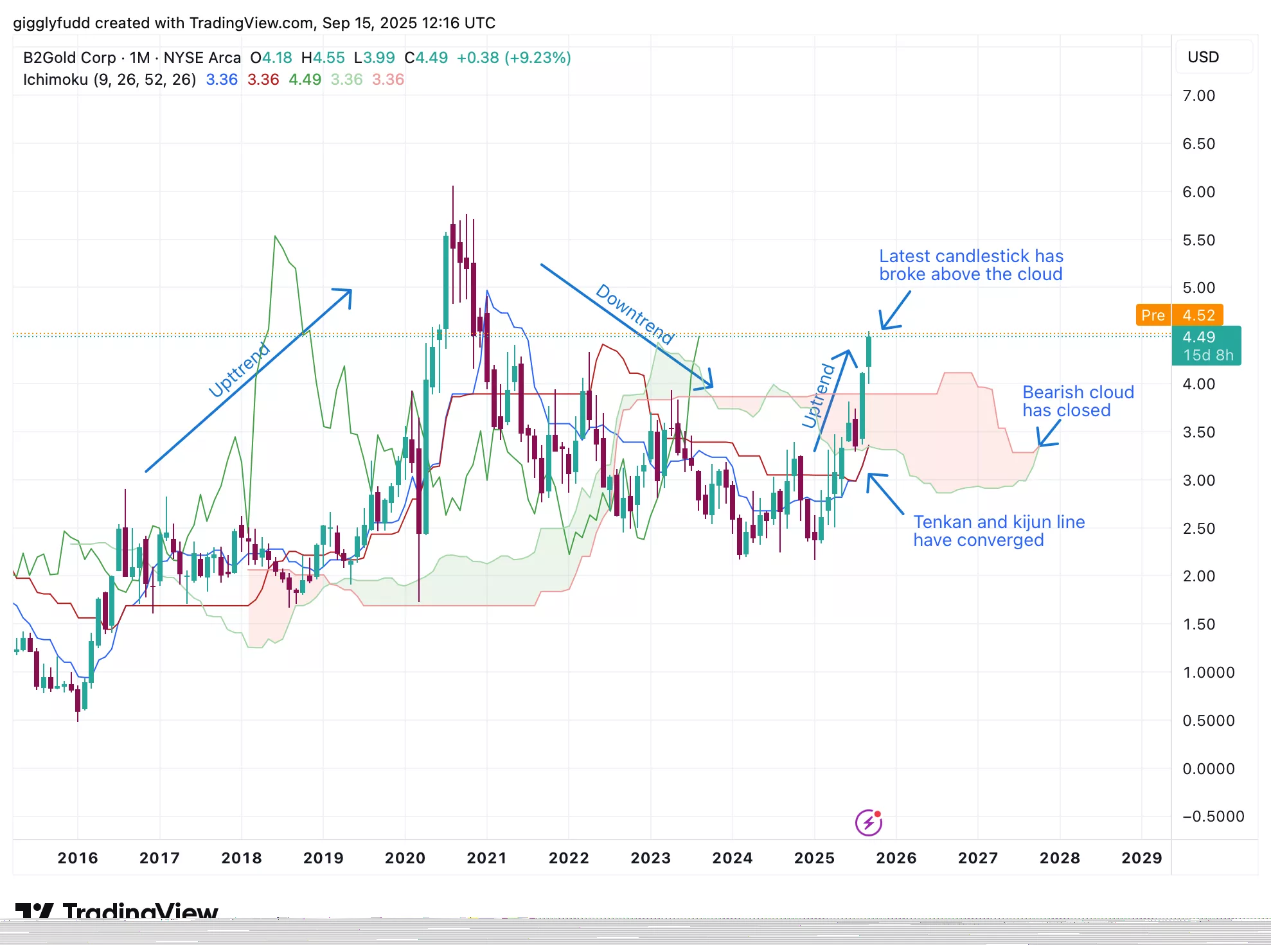

On the monthly chart

The latest candlestick is bullish and has broken above the cloud, which was previously acting as a resistance zone, reinforcing long-term upward momentum.

The bearish cloud has now closed, signaling the end of bearish momentum, though no new cloud has formed yet.

The Tenkan and Kijun lines have converged but have not yet crossed.

On the monthly chart, from 2016 to August 2020, BTG was in a choppy uptrend, reaching an all-time high of 6.06. It then entered a prolonged choppy downtrend until 2025, but now appears to be recovering. This recovery is supported by the end of bearish momentum as the cloud has thinned and closed, though no future Ichimoku cloud has formed yet. An uptrend is beginning, with the latest candlestick breaking above the cloud that once acted as resistance. The Tenkan and Kijun lines have converged but not yet crossed, signaling market indecision. If upward momentum continues, a golden cross may form as the Tenkan crosses above the Kijun line, turning the Ichimoku cloud bullish and shifting it into a support zone.

(Click on image to enlarge)

On the daily chart:

The pattern shows a continued uptrend since March 2025.

The Ichimoku cloud remains bullish, signaling ongoing upward momentum and acting as a support zone.

With candlesticks positioned far above the cloud, a potential pullback is possible.

Since March 2025, the chart has shown a choppy uptrend with pullbacks consistently testing the cloud as support, which has continued to hold. The bullish cloud reinforces the upward momentum, but with candlesticks sitting far above it, the setup suggests the possibility of a near term pullback.

(Click on image to enlarge)

Investors looking to get in BTG can consider these Buy Limit Entries:

4.59 (High Risk – FOMO entry)

3.99 (High Risk)

3.64 (Medium Risk)

3.36 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

5.10 (Short term)

5.45 (Medium term)

5.73 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on B2Gold (BTG)

B2Gold has just switched on its Goose Mine, a milestone that could reshape the company’s future – and yet Wall Street still seems slow to notice. With Goose now contributing alongside the Gramalote project in Colombia and the Fekola underground expansion in Mali, the company has one of the most compelling growth pipelines in the gold sector.

Combined with a nearly debt free balance sheet and disciplined, project-driven strategy, B2Gold is quietly building the foundation for long-term shareholder value at a time when gold prices are sitting at record highs.

Still, the market isn’t fully pricing in this progress. Political risks in Mali remain an overhang, short-term volatility is high, and technical signals suggest a possible pullback after a strong run.

Conservative analyst targets and cautious sentiment mean that B2Gold continues to trade at a discount compared to its peers – even as Goose alone could justify a significant portion of its value.

Key Takeaways:

The reason Wall Street might be “sleeping” on B2Gold is not because of weak fundamentals, it’s because the market is over discounting risk while underestimating the impact of Goose and its broader growth pipeline. For long term investors, BTG offers rare upside: leverage to record gold prices, undervalued assets, and disciplined execution. For short term investors, momentum is strong, but risks around political instability and overbought conditions mean patience and well-placed entries could be the smarter play.

Overall Stock Risk: High

More By This Author:

Oracle Stock Soars On $455b AI Cloud Deals – Can Investors Bet On It Catching Google By 20303 Reasons Wall Street Could Be Wrong About Salesforce Stock

Meta Just Committed $600 Billion – And Wall Street Isn’t Paying Attention (Yet)