AWKNF: A Psychedelic's Stock Exhibiting Recent Price Appreciation

Introduction

Awakn Health Sciences Corp. (AWKNF) came to my attention during a review of psychedelic stocks which have exhibited recent price appreciation coupled with a surge in average daily volume. The company’s trading pattern over the past 10-day time span is an egregious example of this metric as explained in detail elsewhere in this article.

A glance at AWKNF

The company was formed on 6/15/21 via a reverse takeover transaction (RTO) and began trading on the OTCQB on 8/12/21. AWKNF is a biotechnology company with clinical operations, developing and delivering psychedelic therapeutics (medicines and therapies) to better treat addition, with a present focus on alcohol use disorder. (AUD) The company’s revolutionary proprietary therapies intend to help clients learn more adaptive ways to respond to addictive urges, cravings, and the underlying psychological processes that drive them. and will deliver these therapies in its clinics. The clinics will allow AWKN to earn revenue while also enabling the company to test, refine, and update these in therapies based on real-world evidence, while also developing a number of new chemical entity (NCE) via their development program. (Source: Company website)

Image Source: Unsplash

AWKN best-in-class leadership team

CEO Anthony Tennyson has assembled an impressive cadre of experts including:

- Prof. David Nutt- Chief Research Officer

- Prof. Celia Morgan- Head of ketamine assisted psychotherapy for addiction

- Dr. Ben Sessa- Chief Medical Officer

A detailed biography of each of these eminently qualified individuals is available on the company website.

2021/2022 business development roll-out strategy

During the above time frame, the company plans on developing

the following multiple scalable revenue streams:

- Clinics from 2021

- Partnerships from 2022

AWKNFs turnkey approach will include access to the company’s proprietary ketamine-assisted psychotherapy treatment protocols and therapy manuals, starting with the ketamine for reduction of alcoholic relapse treatment program (KARE) as well as these ancillary services:

- Training: online and in-person training for practitioners delivering the ketamine for reduction of alcoholic relapse treatment program (KARE) under license.

- Advisory: quality, safety, risk, and operations advice.

- Data & Analytics: access to the Compan bespoke digital patient management technologies, AI voice assessment, and monitoring tools.

Although alcohol use disorder (AUD) affects 5% of the global adult population, only 16% of those suffering from AUD seek treatment and there is a 70% relapse rate within the first 12 months for those that do seek treatment. AWKN believes that the company can significantly remediate this statistic at a much lower price point, and therefore and grow the global treatment industry market exponentially from its present $17.5B annually.

YTD stock performance

(Click on image to enlarge)

As the above chart indicates, AWKN has increased from $1.48 on 8/12/21 when the stock began trading on the OTCQB to $2.30 on 10/30/21 which represents an increase of 54.4%. Of added significance is that AWKNFs has gained 42% in the ten most recent trading sessions on an average daily volume of 50,110, which is 500% of the 10-day average daily volume of 10,020. This is a strong indicator that more investors have been willing to buy AWKNF at increasingly higher prices during this period. Several developments that may have contributed to an increased interest in the stock are detailed in the next section of this article.

Recent AWKNF developments

The following recent developments may have contributed to an increased interest in the stock:

- On 10/28/21 AWKNF announced the progression of its program into lead optimization working with Evotec, a global platform company.

- On 10/28/21 Mind Cure Health Inc.(MCURF) signed a letter of intent (LOI) with Awakn Life Sciences Corp.(AWKNF) to distribute ketamine protocol for alcohol use disorder into Clinics Across United States and Canada.

- On 10/27/21 Anthony Tennyson, CEO of Awaken Life Sciences Corp. presented at the Benzinga Global Small Cap Conference which readers of this article are encouraged to view here.

- On 10/26/21 Mind Cure Health Inc. completed a strategic equity investment of $500,000 in Awakn Life Sciences Corp.

- On 10/26/21 Mind Cure Health Inc.(MCURF) disclosed that the company intends to enter into an agreement with AWKN to be AWKN’s global provider of data collection, research and integration support technology and, in addition, develop a telemedicine platform for the exclusive distribution of AWKN’s proprietary ketamine-assisted psychotherapy for alcohol use disorder through MINDCURE’s iSTRYM platform.

The collaboration between AWKNF and MCURF is a bellwether event that will fast-track AWKNs entry to North America as MCURF has a presence in 9 U.S. states and 2 Canadian provinces and is a significant endorsement of AWKNFs growing credibility in this emerging sector.

AWKNF in the media

As the above chart indicates, AWKNF has gained widespread media coverage from several well-respected business magazines and news sources. AWKNF was recently named a “psychedelic stock to watch” by investingnews.com which underscored that it is the only company in the world providing evidence-backed ketamine-assisted psychotherapy for alcohol use addiction (AUD) through its near-term ketamine for reduction of alcoholic relapse protocol. On 10/18/21 AWKNF announced that it has retained the services of JRZ Capital LLC, an investor communications and public relations company, to assist the company to enhance its market awareness and communications strategy.

AWKNFs statement of financial position, income statement, and cash flow statements have markedly improved in 2021

Let us drill down into the company’s 3 core financial statements in order to provide some granularity to the heading above, shall we?

(Click on image to enlarge)

As shown above, AWKNF has $8.8M in cash, a healthy current ratio and adequate working capital based on their current run rate as of 7/31/21.

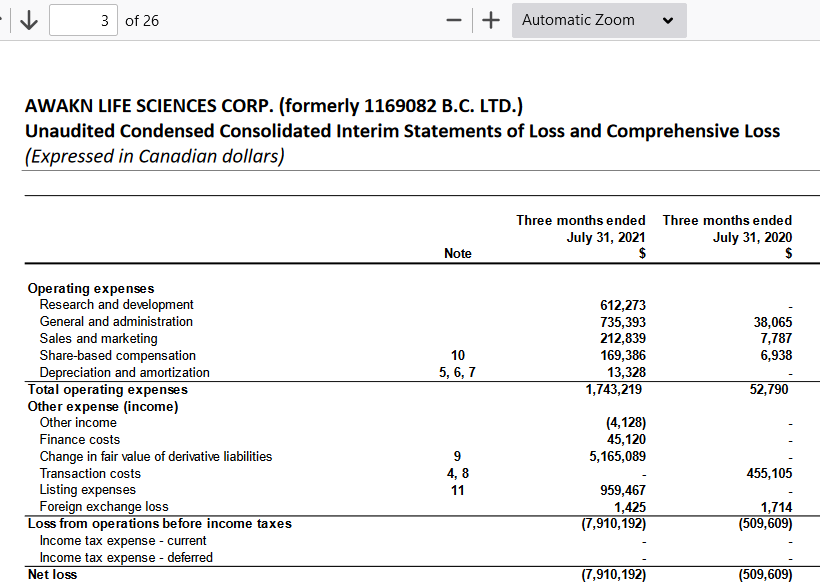

(Click on image to enlarge)

As shown above, AWKNF had a net loss of $7.9M for the 3 months ended 7/31/21. $5.2M or ~2/3rds of this loss was due to the change in fair value of derivative liabilities per Note 9 of the financial statements filed at sedar.com on 9/14/21.

As shown in the breakdown of the above, AWKNF received $7.5M from the proceeds from issuance of common shares, net. for the 6 months ended 7/31/21.

Valuation

Since AWKNF is a Stage 1 (developmental) company, traditional valuation metrics are not applicable. The current market capitalization of $56.8M pales in comparison to the addressable market the company may reasonably expect to capture in 2022 based on the significant milestones cited. Based on the company’s representations made on 10/22/21 that they expect to achieve more than $100M sales by the end of 2024, it is not unreasonable to project 2022 sales in the vicinity of $25M contingent on the success of their collaboration with MCURF. In my view, this supports an upward trajectory in AWKNF stock which may trend towards a new high in the foreseeable future.

Macro and micro caveats

Like all the constituent companies in this nascent sector, AWKNF may be hamstrung by the regulatory approval processes which oftentimes are lengthy, expensive, and inherently unpredictable, especially in this high-risk high-reward sector. But I believe that this is mitigated by their Tier I management team and extensive academic research data which will be of immense value in the capital markets going forward. On a company-specific level, there was a “going concern” comment in the aforementioned 9/14/21 financial filing which I believe the company can address satisfactorily as they develop a reliable revenue stream.

Conclusion

Based on the foregoing financial and operational review, I have added Awakn Life Sciences Corp. to my “speculative stocks to watch” list. I am particularly impressed by their compelling value proposition, “first mover” competitive advantage, and wide moat which is complemented by their best-in-class leadership team, long-term potential recurring revenue stream, significant addressable market, scalability, and truly transformative technology. All of these factors bode well for the company’s stated goal to fully integrate effective psychedelic-based treatment into mainstream healthcare to better treat addiction by addressing the underlying causes of these serious issues rather than treating the symptoms alone. I intend to follow the progress of AWKNF as they develop, refine and execute their business plan and I expect to write a follow-up article subsequent to the issuance of their audited financial statements.

<< Related Article: Awakn Life Sciences: Wake Up To The Huge Potential

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Good article, thanks.

Thanks, added this stock to my watchlist.