AUR: Driving Innovation In The Driverless Trucking Business

Photo by Mohamed Nohassi on Unsplash

TM Editor's Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

Artificial Intelligence is already streamlining repetitive tasks. Now, it’s replacing human judgment – driving 18-wheelers for 1,000 miles with no one at the wheel. Aurora Innovation Inc. (AUR) designs AI-powered platforms that make this possible

I assumed autonomous driving would be limited to confined spaces like warehouses when I studied it a few years ago, but now it’s in the open. Alphabet Inc. (GOOGL)-owned Waymo provides 250,000 driverless taxi rides every week, and freight operators are sending dozens of driverless trucks across Texas each day.

True, these 18-wheelers have someone on board for backup, but they’re 100% autonomous. As the world leader with clear first-mover advantage, Aurora has partnered with other best-in-breed operators like Volvo, Toyota, Uber, and Paccar to produce the most-advanced 18-wheel trucks capable of fully autonomous operation.

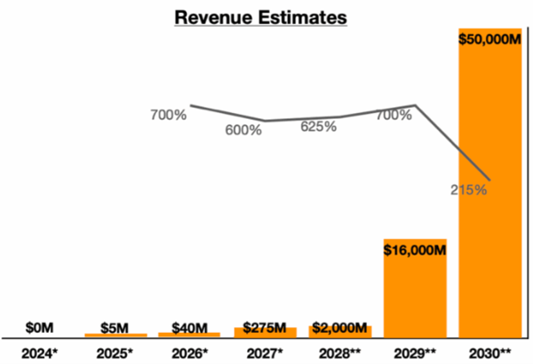

The company handles several dozen loads across the Southwest every day, and significant commercial expansion will begin next year. By 2030, Aurora aims to capture 5% of the $1 trillion annual US trucking market.

Operators appreciate Aurora’s ability to drive efficiency by removing the human element (fatigue, turnover, safety). Aurora benefits from the commitment of deep-pocketed partners like Amazon.com Inc. (AMZN) and FedEx Corp. (FDX). Together, they are revolutionizing an industry, and the potential payoff is significant.

My $26 initial price target follows logically from several facts and assumptions: The US trucking industry generates $1 trillion in revenue annually, and Aurora wants to capture 5% market share by 2030… implying $50 billion in revenue – comparable to Tesla Inc. (TSLA).

Since trucking stocks typically trade at a price to sales multiple of one, AUR’s $50 billion revenue target equates to $50 billion in market cap. Dividing $50 billion by 1.4 billion shares outstanding yields a price of $35 per share, which I discount at a rate of 5% for five years to arrive at $26.

Recommended Action: Buy AUR.

More By This Author:

COST And KMX: Two Consumer Stocks On Divergent PathsPYPL: Google Deal Shows CEO Is Delivering On His Promises

BILL: An Attractive Turnaround Play In The Fintech Space