ATVI: There's One Born Every Minute

Recommendation Summary

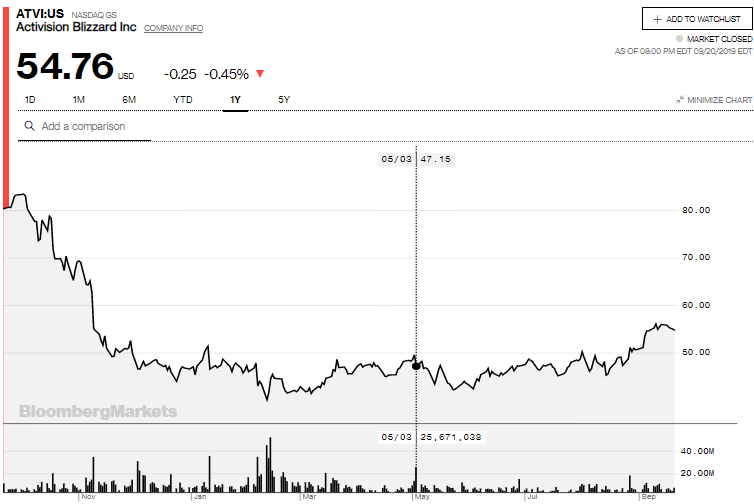

*Source: Bloomberg

After a 41% drop in October last year, ATVI’s stock has been in a literal stagnation for 10 months until recently, so is there value to be had in the coming years?

The company does seem to be cheap at first glance, but after a deeper look at the fundamentals I do not find the company fairly valued compared to its market price today. I have found the company to be overvalued by ~30%, I believe the market has underemphasized the big disruptions going on in Activision’s latest acquisition, Blizzard and the loot box controversies stirring up talk of possible legislation.

Catalysts to decrease the price in the next 6-12 months include the continued ban of loot boxes in more countries, possible economic slowdown and the possible failure of the GaaS model.

Some of the risks included in this analysis include the release of the new Warcraft Reforged later this year or beginning of next which the market could overreact to and an increase in market share in mobile gaming.

Company Background and Overview

Activision Blizzard (ATVI) is an American video game and film holding company. It has several companies underneath it, including Treyarch, Infinity Ward, High Moon Studios and Toys for Bob. Some of the major games produced by the company include Call of Duty, Guitar Hero, Tony Hawk's, and Spyro through Activision's studios, World of Warcraft, StarCraft, Diablo, Hearthstone, and Overwatch through Blizzard Entertainment, and mobile titles including Candy Crush Saga through King.

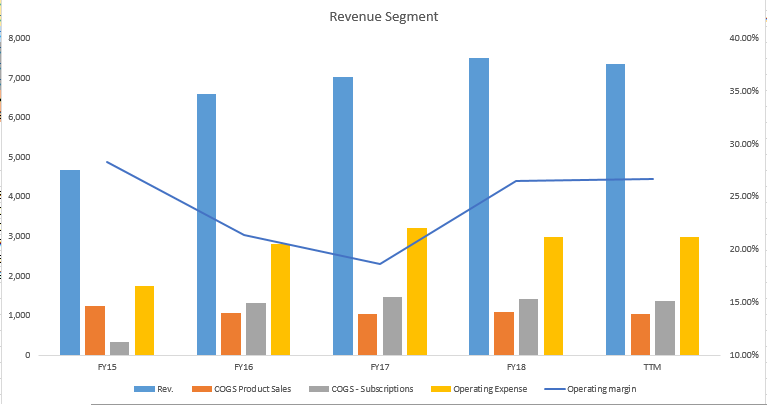

In the last 3 years (including TTM) the company has experienced a modest increase in revenues at an average of around 4% per year mostly fueled by an increase in subscription and loot box revenues. This coupled with implementing the “games as a service” business model and cost-cutting measures like employee layoffs and shuttering Heroes of the Storm esports segment has made ATVI continue increasing profits throughout the last year, but I do not find this to be sustainable in the long-term.

Below you can find the main revenue segments broken down:

*Source: Company filings and author’s own estimates

Investment Thesis

Currently, I believe the market sees ATVI as one of the leaders in the PC gaming market fueling this is the latest Black Ops 4 release which outdid sales of the previous Black Ops 3 title in 2015 and the new Crash Team Racing: Nitro Fueled which in June came in at number-one as the best-selling game in the UK.

However in the long run I think the stock could continue experiencing a downfall because of the reasons listed below:

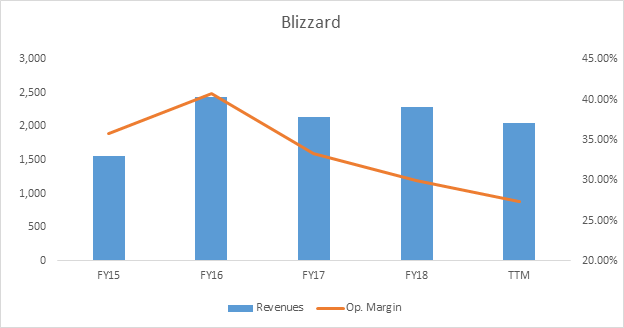

Blizzard acquisition still weighing heavy

*Source: Company filings and author’s own estimates

Blizzard is considered to be a unique company bringing in exclusive value to the gaming market. Despite being slow in its development cycles Blizzard has solidified its market position by releasing hit and memorable franchises like Diablo, Warcraft, Starcraft, World of Warcraft and Hearthstone.

Instead of Activision building on the success of the company mentioned above, we have seen disruptions within Blizzard causing some of the older creative staff leaving the company. Bellow you will find a list of the people who left Blizzard after the Activision acquisition:

• Mike Morhaime – CEO, Co-Founder and President

• Amrita Ahuja – CFO – 8 years with the company

• Nate Nanzer – Overwatch League commissioner – 4 years with the company

• Mar Pierce - Co-founder

• Kim Phan – Global Product Director Of Blizzard Esports – 13 years with the company

• Brian Stolz - Chief People Officer

Instead of the acquisition solidifying the company’s position I have seen it causing more disruption than synergy. With some of the staff leaving the company and operating margin experiencing a downwards trend I do not find Blizzards acquisition bringing the expected results.

Considering all this I find that there is significantly more downside to the Blizzard acquisition than the market has priced in. I expect Activision to continue struggling with Blizzard’s established company culture, thus not optimizing the company’s full potential in the future.

With an average revenue decline of 5% in the last 3 years combined with the lack of political synergy between Activision and Blizzard and the economic slowdown, I have lowered the expectation of Blizzards future performance for the next 5 years. I expect an overall average of 0.9% revenue growth per year in the next 5 years and then returning to a 2.5% terminal value in year 10 and beyond. I also expect the lack of optimization I mentioned above, to weigh in on operating margins in the future. With the assumptions mentioned above I got to an equity value for Blizzard of $5,752 million:

*Source: Author’s own estimates

Games as a service

The GaaS model revolves around giving games a long or indefinite stream of monetized new content over time to encourage players paying to support the game. More and more companies have their operating margins and revenue growth determined by the effectiveness of their GaaS model and ATVI is no exclusion. The main idea behind the GaaS model is to concentrate the company’s resources into one blockbuster of a game in order to make the game profitable in a longer period of time, thus increasing company margins overall. I see this model falling flat in the long term as games like Destiny 2, Anthem and Battlefront exposed the models flaws, by having buggy releases and lacking content therefore not meeting sales expectations. As sales of Destiny 2 disappointed, so did its retention rate and at the end ATVI broke up with the developers of the game, Bungie.

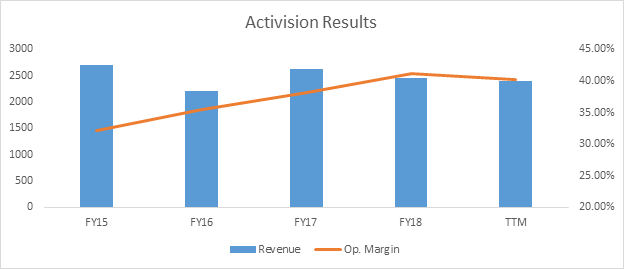

If we look at Activision’s results separately we will see a steady increase in margins, mostly fueled by the GaaS model, but in the meantime revenue hasn’t followed suit:

*Source: Company filings and author’s own estimates

While Activision reached a record breaking operating margin, a controversy earlier this year followed the company as it fired 800 employees with ATVI’s CEO Bobby Kotick saying:

“While our financial results for 2018 were the best in our history, we didn’t realize our full potential.”

If we look at the TTM numbers we can clearly see a slowdown in operating margin growth. I think ATVI expected this, fueled by lower releases and the GaaS model reaching its monetization limits. There are 2 main reasons which led me to believe that the GaaS model is reaching its limits. The first one is, the staggering growth of game releases per year. Even on Steam we can see drastic increases in year to year releases. With that said, as competition grows a single consumer has limited free time to spare as he has to choose from a vast amount of games released by the day.

The second problem I see with the GaaS monetization model is, the limit of money a consumer spends per month for gaming. As stated above the model revolves around the consumer continuously spending money in order to support a games non-stop development. In the last years as the economy grew consumer spending grew with it, but recently the economy, not only in the US, but worldwide is experiencing a slowdown. I expect the number of future games implementing the GaaS model to more than offset any possible increase in consumer spending, during a possible stagnant worldwide economy.

On top of the reasons listed above, a new country joined in with Belgium and the Netherlands on the loot box ban, the UK. Recently UK parliament banned all loot boxes until evidence proves they are considered safe for kids. I would expect more countries to join in on the ban in the future as more evidence of the danger of loot boxes emerges.

As economy slows down and the number of regular and GaaS games increases, the consumers limited free time and decreasing spending power could be the final nail in the coffin for the monetization model. I think there is significantly more downside in the GaaS model for the foreseeable future, than the market has attributed to it. I expect revenue growth especially in the Activision segment (which accounts for 33% of ATVIs overall revenue) to experience a significant slowdown to an average of 3% per year until reaching 2.5% in the terminal year, mainly supported by economic slowdown and increased year to year game releases.

In regards to operating margins, despite the 800 people layoff (which cuts costs by a hefty amount), I expect the resources spent in creating more content in games with roadmaps which are losing players will offset the gains made. Additionally the ban on loot boxes will also weigh in on margins, as the additional content produced by companies will be only limited to either adults or completely banned throughout games. Due to the reasons listed, I expect ATVI’s margins to go down to 37% in the next 10 years. Despite this looking a little optimistic, I think that companies like ATVI will find an alternative way to monetize their games. With all mentioned above I got to an equity value of $10,023 million for Activision. The specific decline in this segment would push down ATVI’s stock valuation by at least 14%.

*Source: Author’s own estimates

Mobile gaming

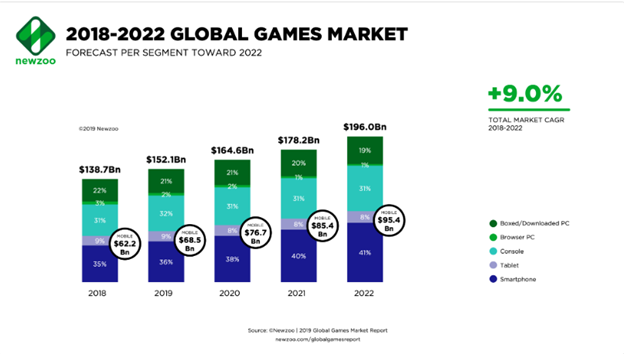

*Source: Newszoo

Mobile gaming has become the main revenue driver in the gaming industry. The majority of revenues (51%) is attributed to the mobile gaming market, as PC and consoles lag behind. Expectations of growth are looking bright as the expected growth of the mobile gaming market is 10.2% year on year outpacing console and PC revenue growth.

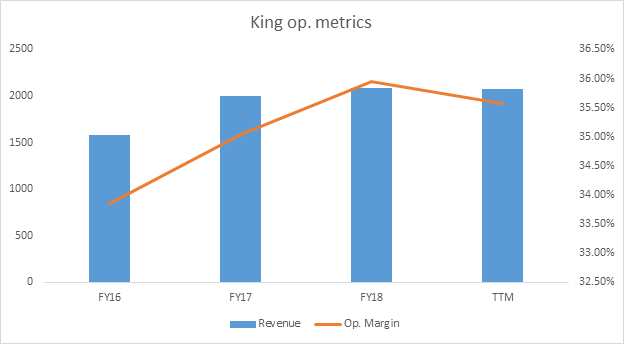

As the mobile market is outpacing the growth of all other markets and Candy Crush remaining one of the most played mobile games by player count to date, revenues and margins in the mobile segment of the company have been growing at a modest pace:

*Source: Company filings and author’s own estimates

Due to the assumptions mentioned above the growth of King will make up the biggest part of ATVI’s valuation. I think the expected economic slowdown will be offset by the rapidly growing mobile market. This is why I have valued King by growing their revenues by an average of 16% for the next 5 years, please keep in mind in the last 3 years King’s revenues have grown by an average of 10%. Additionally, since I do not expect the mobile market to experience the same turmoil as the PC market in regards to the “pay to win” debacle and the constant shift in the industry between different monetization systems, I have kept operating margins around the same numbers as today.

Considering all this, the equity value I got for King is $14,403 million.

*Source: Author’s own estimates

Despite my expectations of King’s revenues experiencing a surge in a positive direction, I do not think this will be enough to offset the slowdown in revenues and margins in Activision and Blizzard.

Catalysts

Catalysts in the next 12-24 months for the price to increase include:

GaaS model and loot boxes

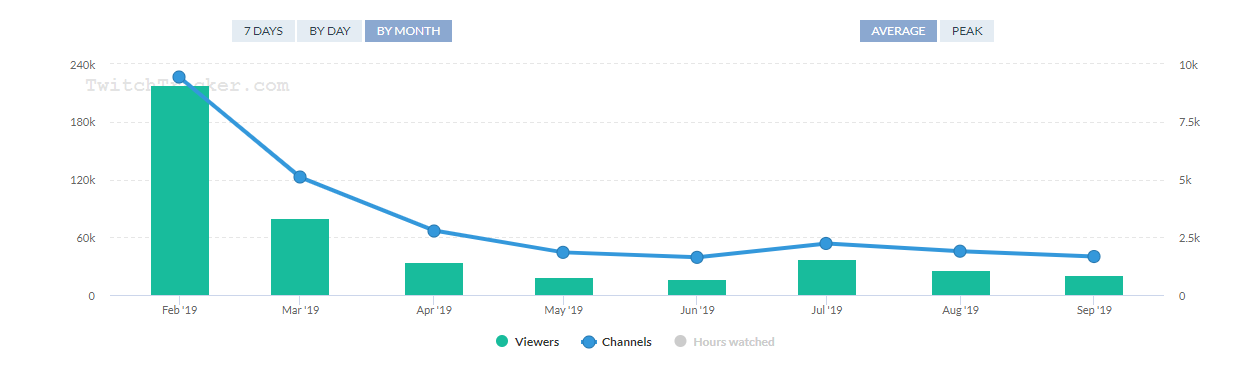

There is more than one example on the market that the GAAS system doesn’t work. We can start by including the recently released game Anthem, developed by ATVI’s rivals, EA. Despite the roadmap introduced by EA, in April more than half the players have abandoned the game. Another example is Apex Legends, released by EA. The game had the most successful launch of any battle royale game to date, but earlier this year an analysis from Polygon in April, revealed that the game has lost a big chunk of its player base and that can be seen in Apex Legends viewership numbers on Twitch:

*Source: Twitchtracker

With ATVI we saw the same dynamic with Destiny and Destiny 2. This could mean that the customer’s base in gaming is inconsistent and with an abundance of new releases every month, gamers switch to something new at faster-than-expected rates. The tempo at which Activision switches to a new monetization system here will be crucial, since the revenue from digital online channels makes up around 78% of total company revenues.

I expect a downfall of the GAAS model and the switch time between it and a newly introduced monetization model to stagnate revenue growth in the company. Since the analysis is highly dependent on revenue growth I have explored the options of revenue growth by the combined company below.

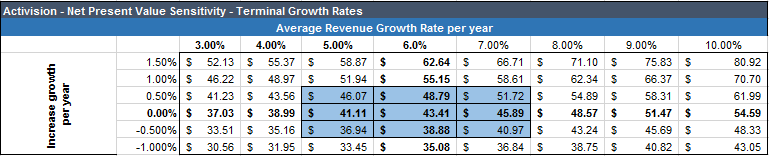

The difference between revenue growths of only .5% per year may account for a difference of over $3 - $4 per share in the base case assumption of my DCF analysis for the combined company (discount rate at an average of 10.56%, terminal revenue growth rate of 2.5%, revenue growth at 6% average for the next 10 years and an operating margin at an average of 32%):

Source: Author’s own estimates

As shown in the table above revenue growth rate here will be key. With an average growth rate of 3% per year for the last 3 years including TTM, I think 6% per year for the years ahead is fair. Can ATVI grow more than this, well it certainly could, but I have assumed that it is highly unlikely due to the following factors:

• By looking at several recent GAAS projects we can clearly see that the model is unsustainable by itself and tweaks must be added to it in order to be more sufficient. Effectively players leaving a current GAAS game for something newer or better severely hurts the revenue growth and margins of the company.

• Subscriptions, licensing and other revenues makes up 70% of ATVI’s total revenues. Revenues from loot boxes are also included in this number and I could imagine that a big chunk of these 70% come from them. As the trend goes and international outcry against loot boxes continues revenue growth in ATVI could slow down to even lower-than-expected levels. This in turn will lower margins as I expect costs to stay the same as in the future since despite of the big layoffs made ATVI’s job postings have surged in Q2 by 35%.

As a result, I believe that the 6% presented in the analysis is fair and resembles the risk in the market accurately.

Economic Slowdown

Even if the economy doesn’t come into a recession a slowdown is expected from many economists. An economic slowdown will be significant to ATVI’s valuation since it can negatively affect the earnings power of the consumer. This may make the market realize a bigger pricing imperfection in ATVI’s share price. If this event takes place it could be represented in ATVI’s guidance for the following year.

As earning power slows down and game abundance increases future revenue growth for ATVI could be challenged. In addition the market has a very low-entry level and a new quality product can easily replace another for some remainder of time. I expect the total increase in products on the market to bring companies like ATVI to hire more people in order to be able to keep up with new content releases regularly. This could help ATVI retain their current customer base, but increasing it could be harder since gamers tend move rapidly between products as shown with sharp player decreases in games like Apex Legends.

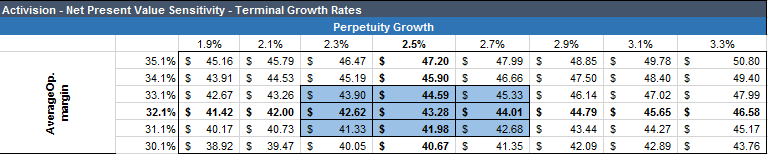

I have tied a possible economic slowdown to perpetuity growth and the rapid increase in products and staff to operating margins:

Source: Author’s own estimates

Even if my valuation seems too conservative, with a 3.3% growth in perpetuity and an increase in margins to an average of 35% it still puts ATVI at a valuation of $10 below today’s stock price of ~$56.

Valuation

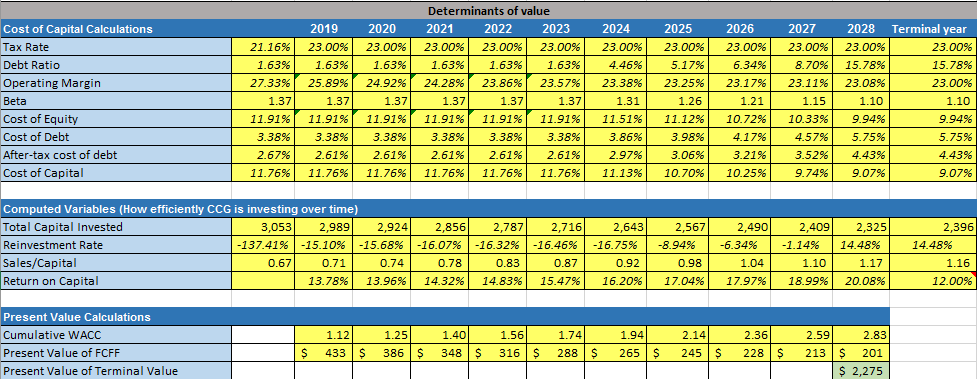

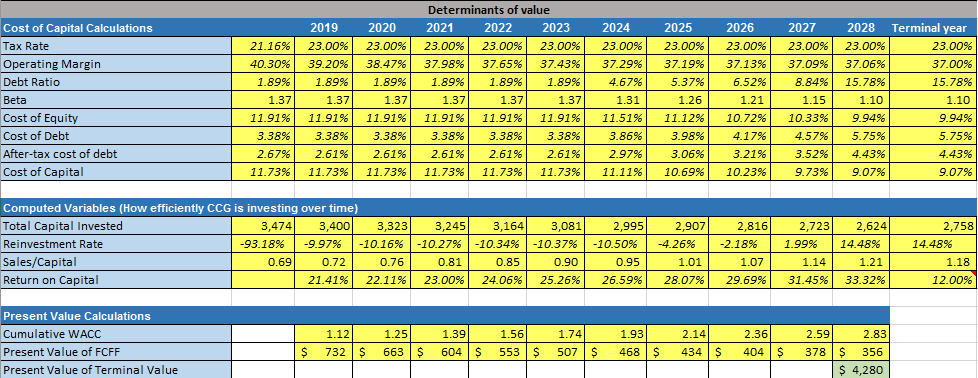

DCF Analysis

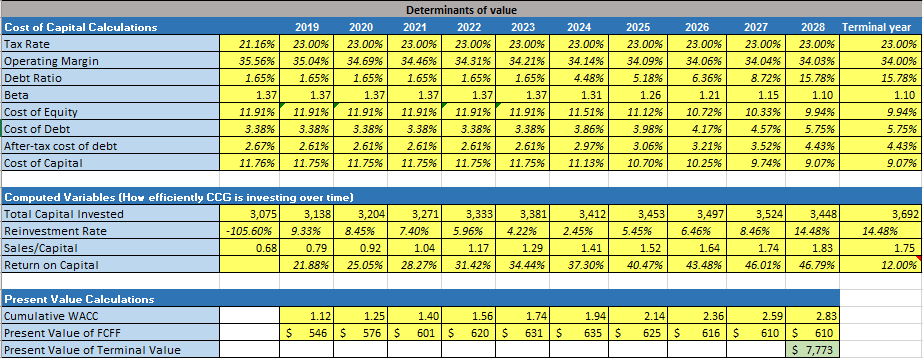

The analysis I have done here is a base case scenario built on ATVI’s current and expected future performance in the market presented above:

• An average WACC for the next 10 years of 10.87% - This WACC represents an ERP of 7.36% (this is the average for companies having global operations), an average beta of 1.37 for the entertainment industry reaching 1.10 in normalized growth years

• An average revenue growth for the next 10 years of 6% per year and 2.5% terminal growth – This assumption takes into account the possible slowdown of revenue growth due to loot box regulations across countries, the failure of the GaaS model and the expected slowdown of the economy in both US and Europe.

• Operating margin at an average of 32% for the next 10 years – This represents lower costs in the future as the company continues optimizing its operations. But it also takes into account the slower than expected benefits from both R&D and marketing.

• Sales to capital ratio starting at 0.75 and reaching 1.1– This assumption represents a lower sales to capital ratio compared to the global entertainment industry of 1.32. I do not expect the company to reach industry levels with the assumptions made above, due to lower-than-expected returns in the future from loot boxes and the GaaS model. Despite this I take into account that a shift into a different monetization system may bring the company to increase its sales/capital ratio.

Please keep in mind that the analysis is highly sensitive to the performance of the GaaS model and uncertain player behavior. However I think these numbers are quite fair. I have set the capital expenditure number to grow alongside revenue growth, since I do take into account the fact that ATVI will continue reinvesting its capital in order to continue to grow.

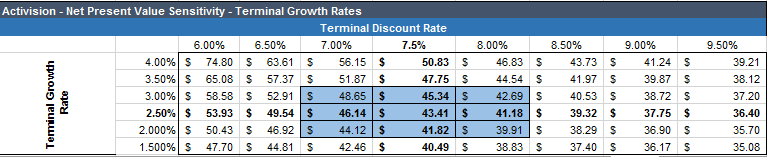

Here is the most relevant sensitivity table based on key variables in this analysis, such as the discount rate, terminal growth rate, and revenue growth and margins:

Source: Author’s own estimates

Even in a more optimistic scenario if the economy turns out to be better than expected and the terminal growth is 3% the company will still seem to be overvalued by more than $10 as of today.

If of course both my revenue growth assumption and operating margin miss the mark and I turn out to be completely wrong ATVI’s stock price won’t still be worth a buy considering today’s stock price of ~$55:

The key takeaway from this analysis is that even in a big upside scenario the valuation implies a difference compared to today’s share price, at best, of approximately 8%. Even if one of the two catalyst mentioned above turns out to be false I still think there is still a strong downside to the stock.

Risks

Risks in the next 12-24 months for the price to increase include:

Release of Warcraft III Reforged

I expect the release of Warcraft III Reforged to be a huge success if done right. Warcraft III was considered a legendary game back in the days and despite the game being released in the year 2002, it still has an active community even today. The game could bring a big part of the old community back alongside many new players to the genre. Warcraft III Reforged is expected to be released later this year, but I do not think that it will make a large turnaround for the company in terms of underlying value because of these reasons:

• This is a remastered game, the only way it could bring long lasting value to the company financially is an implementation of loot boxes or a GaaS model. Implementing any of the monetization models I think will bring a huge backlash from the community, thus sending the stock in a downwards trend.

• As gamers are not consistent with only 1 single genre of games, a new game release could disrupt Warcraft III’s player base. With new eagerly awaited games like Cyberpunk 2077 releasing next year, the battle for player’s time will be very heated.

I think the release of Warcrat III Reforged will send the stock in an upwards trend, but it will be more due to overreaction than to underlying value.

Rapid mobile market growth

As the mobile market grows, King’s revenues will increase with it. As the market grows 10.2% year on year I expect King to make up around 45% - 50% of ATVI’s revenues in the future. This could bring the company’s overall revenue growth to new highs, but as seen in the table above even with better than expected results the upside in this analysis doesn’t seem too lucrative with only an 8% gain in share price.

Key Takeaways

Despite my analysis showing close to a $10 discrepancy in the share price, due to the upcoming release of Warcraft 3 Reforged I would wait for the stock to reach new highs before considering taking a short position. I think market overreaction may send the stock back to around $60 - $65 per share.

Overall I think that not only ATVI, but the whole gaming industry is overvalued and an economic slowdown may help the market realize this.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I have no ...

more

What's your take on $ATVI now?

I get where you are going with this, I really do. The dumb thing for me would be to double down, but honestly I am sure there is value there I just dont think it's still as much. But I suppose as the industry continues consolidation its stock price will continue growing as it acquires more studios.