AT&T's (T) WarnerMedia Sale To Discovery Gets EC Approval

AT&T Inc.’s (T - Free Report) game-changing deal with Discovery, Inc. (DISCA - Free Report) for the divesture of its WarnerMedia business recently got a big boost, with the European Commission granting unconditional antitrust clearance for the transaction. AT&T expects the merger to be completed by mid-2022. The transaction aims to spin off the carrier’s media assets and merge them with the complementary assets of Discovery.

The antitrust clearance enables both the companies to move a step closer to the formation of Warner Bros. Discovery, a premium entertainment firm with enviable media content under a single platform. Post completion of the deal, AT&T will receive $43 billion in a combination of cash and debt securities and will own 71% of the new entity, while Discovery will own the remainder. The transaction is expected to enable the carrier to trim its huge debt burden and focus on core businesses. The separation of the media assets is likely to offer the company an opportunity to better align its communications business with a focused total return capital allocation strategy.

Moreover, a focused entertainment company is likely to be better placed to capitalize on the booming direct-to-consumer (DTC) streaming services market and unlock value from media assets. This, in turn, could help AT&T to reinvest in the new entity for more content and digital innovation in order to scale the global DTC business. The transaction is expected to generate cost synergies of $3 billion per year resulting from technology, marketing and platform savings with the consolidation of DTC capabilities and elimination of duplicate initiatives.

AT&T is increasingly focusing on its customer-centric business model to attract and retain customers for a lower churn rate. The company is witnessing healthy momentum in its postpaid wireless business with increased adoption of higher-tier unlimited plans. This, in turn, is expected to result in year-over-year growth in wireless customers, as the industry continues to benefit from a healthy uptick in demand amid the lingering coronavirus scare. The company aims to profitably increase its postpaid subscriber base leveraging its network quality and market penetration capabilities.

At the cusp of 2022, AT&T is poised to benefit from the impending 5G boom. As the first carrier in the industry, the company has unveiled its 5G policy framework that will hinge on three pillars — mobile 5G, fixed wireless and edge computing. In order to have a seamless transition among Wi-Fi, Long-Term Evolution and 5G services, AT&T intends to deploy a standards-based nationwide mobile 5G network. Its 5G service entails the utilization of a millimeter-wave spectrum for deployment in dense pockets. In suburban and rural areas, it intends to deploy 5G on mid- and low-band spectrum holdings. It believes that as the 5G ecosystem evolves, customers can experience significant enhancements in coverage, speeds and devices. An integrated fiber expansion strategy is expected to improve the broadband connectivity for both enterprise and consumer markets, while steady 5G deployments are likely to boost end-user experience.

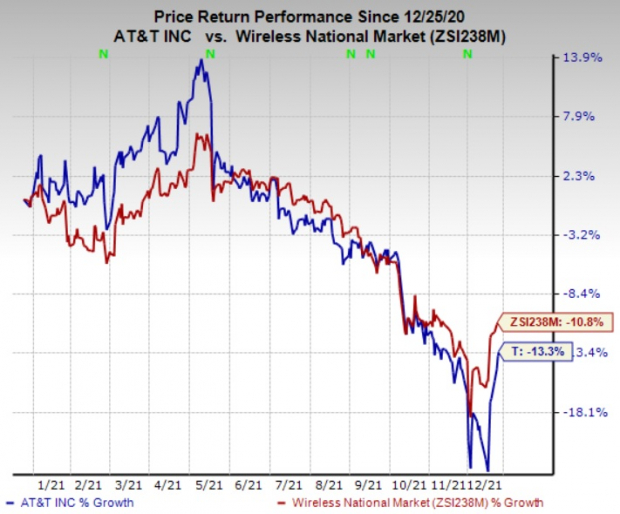

The stock has lost 13.3% in the past year compared with the industry’s decline of 10.8%. Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #3 stock.

Image Source: Zacks Investment Research

A better-ranked stock in the broader industry is Clearfield, Inc. (CLFD - Free Report), sporting a Zacks Rank #1.

Clearfield delivered an earnings surprise of 50.8%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 68.2% since January 2021. Over the past year, Clearfield has gained a solid 216.7%.

Sierra Wireless, Inc. (SWIR - Free Report) carries a Zacks Rank #2. It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 14.5%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more