Attention Retail Shoppers – Walmart Is Different

Walmart is different, and not just because it’s so big. The nearly $600 billion chain’s quarterly sales and profit defied the gloom gathering over consumers and retailers. Boss Doug McMillon shrugged off such concerns, a sentiment that proved contagious. What works for the Walton family, however, doesn’t necessarily work for America.

The company’s core strength is now groceries. In the United States, Walmart claims 30% of a market that also includes Kroger and other grocers, according to investment bank Solomon Partners. Customers are less fickle about their food shopping than their restaurant or home-renovation spending. And unlike so many other vendors, Walmart didn’t charge more to grow profitability through the pandemic. Its gross margin has held at a relatively steady 24%, even though McMillon said U.S. prices overall have been “slightly deflationary.”

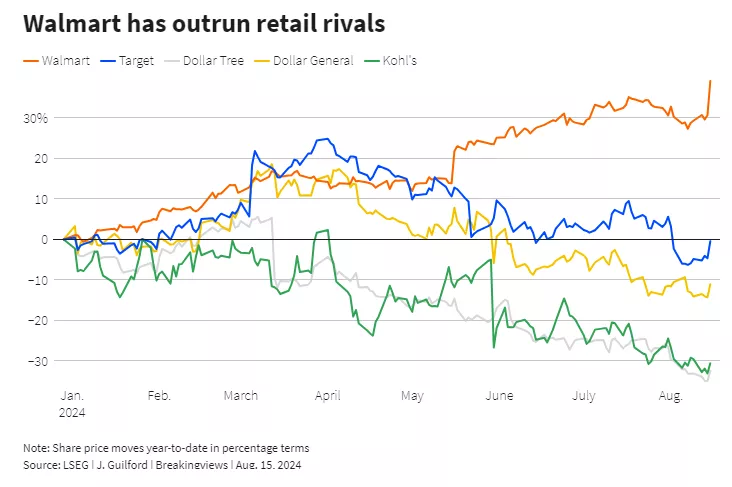

His rosy outlook on Thursday helped lift not just Walmart’s share price, but also those of peers Target, Gap, Kohl’s and others. The widespread optimism may not be warranted, though. Walmart’s cheap staple goods attract inflation-pinched, yet higher-income, shoppers, a group the company is specifically targeting because they’re apt to buy more stuff. General merchandise sales started improving for the first time in 11 quarters.

A litany of business lines – including e-commerce, memberships and advertising – are all growing quickly for Walmart, which helps it keep prices down. Most retailers can’t say the same. Slowing U.S. employment growth, dwindling surplus savings and murky economic indicators are reasonable worries for investors. McMillon’s smiley face is largely confined to Walmart.

Context News

Retailer Walmart said on Aug. 15 that it generated about $169 billion of revenue in the three months to July 31, an approximately 5% increase from the same period a year earlier and slightly higher than what analysts were expecting, according to Visible Alpha. The company’s quarterly operating income grew 8.5% year-over-year, to $7.9 billion, while sales at U.S. stores open for at least the previous 12 months grew 4.2%. CEO Doug McMillon said Walmart isn’t “experiencing a weaker consumer overall.” Walmart’s stock price opened roughly 8% higher following the results, while those of other chains, including Target, Dollar Tree and Kohl’s, also increased. The S&P 500 Index was up a little more than 1% midday.

More By This Author:

U.S. Retail Earnings Update - Friday, Aug. 16

S&P 500 Earnings Dashboard 24Q2 - Friday, Aug. 16

Russell 2000 Earnings Dashboard 24Q2 - Thursday, Aug. 15

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more