AT&T Inc: Is It A Buy?

Image Source: Unsplash

As part of an ongoing series, we will take a look at one of the stocks from our stock screeners, and review why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our screeners is: AT&T Inc.

AT&T Inc (T)

The wireless business contributes nearly 70% of AT&T’s revenue. The firm is the third-largest US wireless carrier, connecting 72 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 16% of revenue, include internet access, private networking, security, voice, and wholesale network capacity.

Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access, serving 14 million customers. AT&T also has a sizable presence in Mexico, with 23 million customers, but this business only accounts for 4% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV, but it does not consolidate this business in its financial statements.

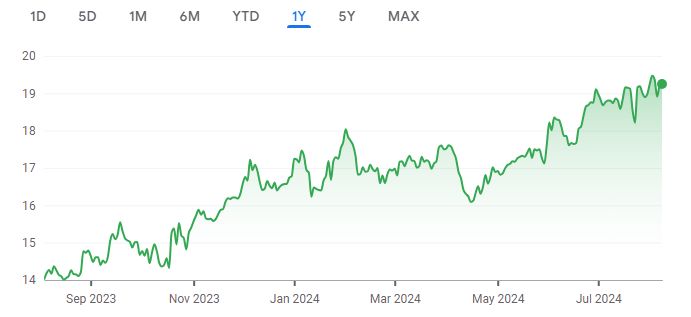

A quick look at the share price history (provided below) over the past twelve months shows that the price is up 37.40%. Here’s a brief look at why the company is undervalued.

Source: Google Finance

Key Stats

- Market cap: $138.03 billion

- Enterprise value: $298.66 billion

Operating Earnings

- Operating earnings: $24.69 billion

Acquirer’s Multiple

- Acquirer’s multiple: 12.10

Free Cash Flow (TTM)

- Free cash flow: $20.99 billion

FCF/MC Yield Percentage

- FCF/MC yield: 15.21

Shareholder Yield Percentage

- Shareholder yield: 6.00

Other Indicators

- Piotroski F score: 8.00

- Div yield percentage: 5.90

- ROA (five-year average percentage): 6

More By This Author:

Nike Inc (NKE) DCF Valuation: Is The Stock Undervalued?

Bristol-Myers Squibb Co: Is It A Buy?

American Express Co. DCF Valuation: Is The Stock Undervalued?

Disclosure: None.