AT&T And Discovery Mega-Merger: What’s The Outlook For Discovery?

Mergers and acquisitions occur quite frequently in the capital markets, but in terms of scale, media coverage, and importance for dividend investors, the impending transaction between AT&T (T) and Discovery (DISCA) is one of the largest in recent memory.

AT&T is undoing some of the merger activity it completed in the past decade and trying to refocus its business. Prior to the merger, AT&T was a Dividend Aristocrat thanks to its 30+ years of rising dividends.

Meanwhile, Discovery shareholders want to know the outlook for the stock, particularly its future growth prospects and whether it will pay a dividend post-merger.

Discovery will immediately grow its content library quite substantially, and the financial terms seem fair to both.

In this article, we’ll take a look at the transaction itself, what the spin-off of WarnerMedia means to Discovery’s outlook, and whether or not we might see the company pay a dividend in the future.

Transaction Overview

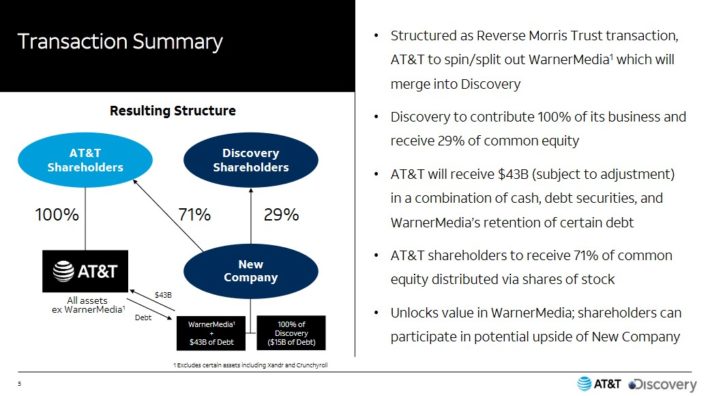

Let’s begin with the terms of the deal, and as we can see below, the companies have elected to use a Reverse Morris Trust transaction. Essentially, this type of transaction allows AT&T to create a tax-free spinoff of WarnerMedia by immediately merging it into Discovery.

Source: Investor presentation, slide 5

WarnerMedia will be spun off into a new company, which will then merge with the existing Discovery business with the latter’s shareholders owning 29% of the new company, and AT&T shareholders taking the remaining 71%.

As a result, AT&T will receive $43 billion of cash and equivalents as part of the deal, which amounts to compensation for shareholders for the WarnerMedia business.

Related: To see a detailed analysis of the merger from the perspective of AT&T, click here.

The goal of this transaction is to take the content and media portion of AT&T’s current business that doesn’t necessarily fit strategically with the remainder of the business and allow AT&T to refocus its business on telecom and broadband, while Discovery greatly expands its content library.

We see the move as favorable for both companies, and we think Discovery’s growth prospects could be improved following the completion of the transaction, which is currently slated for April 2022.

What Discovery Will Look Like Post-Merger

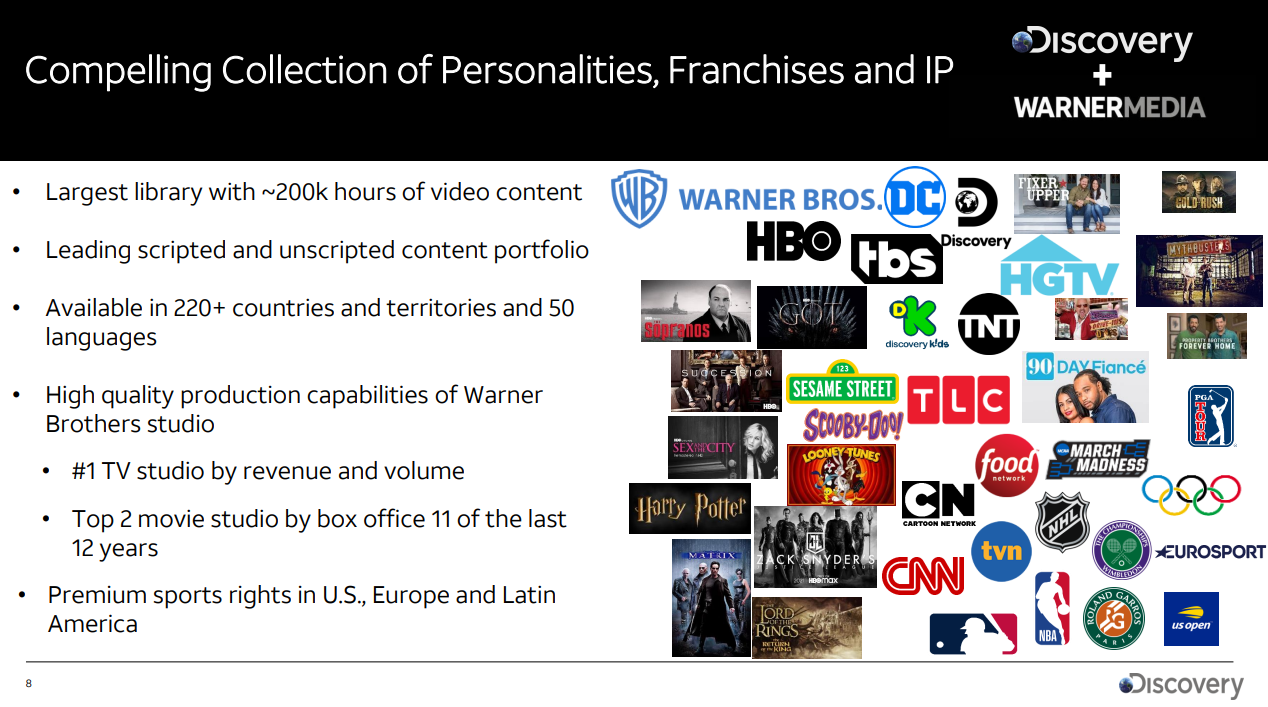

By consummating this transaction, Discovery’s content library will move from what is extremely reliant upon reality and documentary-style content to adding lucrative franchises like Warner’s movie business, HBO, TBS, Harry Potter, Lord of the Rings, and much more.

Source: Investor presentation, slide 8

Discovery will immediately move into the top spot in terms of TV revenue and volume, and become a massive player in scripted content, where it has very little today. Movies are another way Discovery stands to benefit from the merger, as Warner’s movie studio owns lucrative franchises, but also creates new content regularly.

Finally, Discovery is picking up a sizable live sports portfolio, and we think the addition of these lines of business could see Discovery with more stable revenue and earnings, and stronger, more diversified growth potential than the legacy Discovery portfolio.

Growth Prospects

Discovery is currently set to grow earnings at about 5% per year, on average, prior to the merger with WarnerMedia. That includes its current Discovery+ streaming service, which has proven quite popular, and its other content and licensing deals.

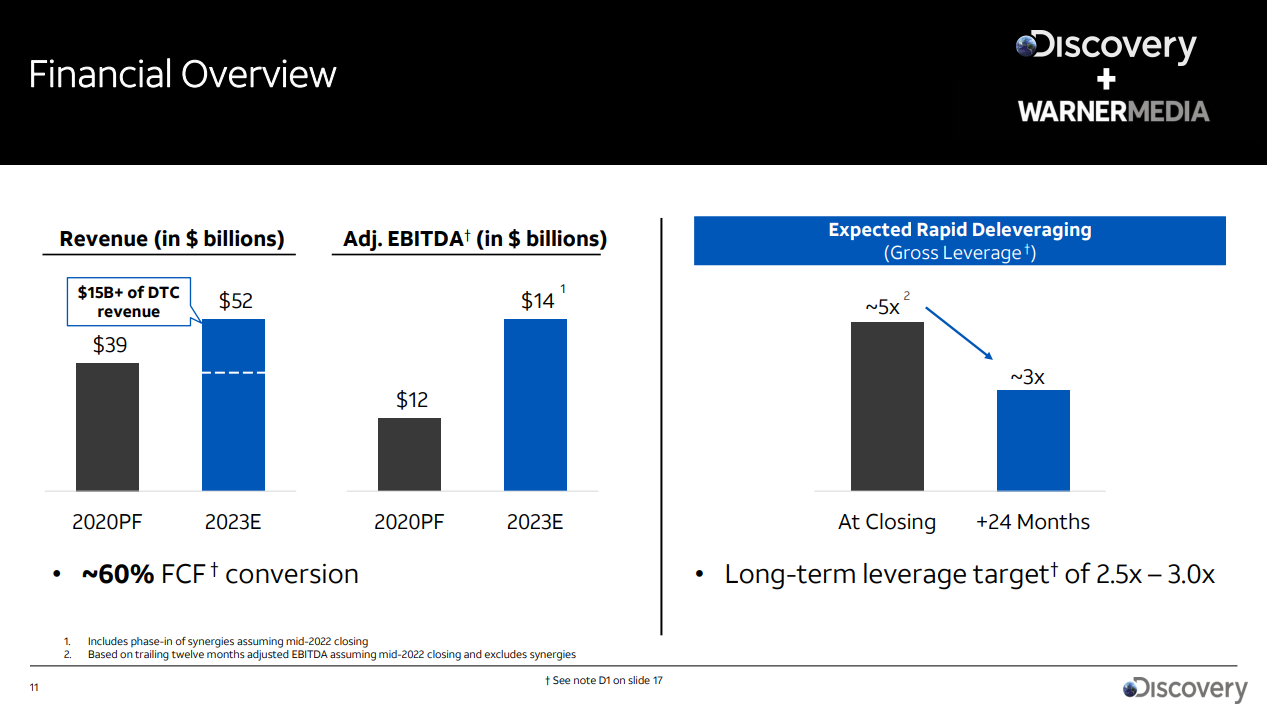

However, its revenue is set to soar once the merger is complete, moving from about $12 billion annually today, to more than $40 billion once WarnerMedia is part of the company.

Source: Investor presentation, slide 11

We can see that Pro-forma revenue for the Discovery/WarnerMedia business would have been about $39 billion in 2020, and that management believes it can be $52 billion by the end of next year. That reflects the massive content library that Discovery is gaining, and it means total revenue could be ~4X in the next 18 months or so.

That’s impressive growth, and it implies that the combined entities would see something like low double-digit annual growth in revenue on a pro-forma basis from 2020 to 2023.

Adjusted EBITDA is slated to grow at a slower rate, with projections of the combination growing from an estimated $12 billion in 2020 to $14 billion in 2023, but we still see Discovery’s post-merger earnings growth opportunity as meaningful.

This is particularly true because Discovery should be able to significantly deleverage post-transaction. The company is set to have a leverage ratio of about 5X at closing, but expects to see it at 3X or less two years after. That will not only provide the company with more financial flexibility, but will also reduce the burden of interest expense on the company’s earnings.

Combined, we see Discovery’s earnings growth profile as enhanced following this period of deleveraging, which will then allow further content development investment in Discovery and WarnerMedia.

In addition to that, Discovery and WarnerMedia are looking to save at least $3 billion annually in currently redundant costs, which will accrue significant benefits over time to the company’s margin profile.

These benefits won’t likely be seen until at least 2023, but we see this as another significant tailwind for not only earnings growth, but free cash flow generation that can be used for content investment or further deleveraging.

Dividend Prospects & Valuation

Discovery doesn’t currently pay a dividend, but we believe that could change following the merger. Discovery currently produces more than $4 per share annually in free cash flow, which it uses to invest in new content, servicing debt, and buying back its own stock to reduce the float.

While the company may not elect to immediately pay a dividend following the merger, we believe that once the deleveraging process is completed, which shouldn’t take more than two years, the company will be very well-positioned to begin returning cash to shareholders via dividends. Given the hesitancy to pay a dividend up to this point, we believe Discovery would start with a small dividend, but its free cash flow generation post-merger will be more than sufficient to support a dividend of less than $2 per share.

In addition, the valuation of Discovery is very attractive, as the stock goes for just 9 times this year’s earnings estimates. Not only does that make the stock attractive from a capital appreciation standpoint, but because the valuation is so low, if a dividend is initiated, the yield should be enticing as well.

Final Thoughts

While the transaction that will see Discovery take over WarnerMedia’s business is somewhat unusual and complicated, we like the deal from Discovery’s perspective. The WarnerMedia business gives Discovery a very strong existing portfolio of lucrative properties and gives Discovery an instantaneous leadership position in live sports and scripted content, where Discovery doesn’t really compete today.

It will roughly quadruple the current size of the revenue base for Discovery and should provide robust cost synergies that will help with earnings growth in the coming years. Finally, the deleveraging that management has committed to will boost the company’s flexibility, and afford it the ability to begin paying a dividend in the years to come.

Given all of these factors, including the attractive valuation, we like Discovery as a buy heading into the merger.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

How do you think #Disney's fight with the state of Florida will affect the $DIS stock price?