Assets To Buy Before Inauguration Day

No pain, no gain

We need to address the 800-pound elephant in the room…

Because while I’m incredibly bullish on Trump’s long-term plans for America, in the short-term there are significant challenges that pose severe economic and social risks.

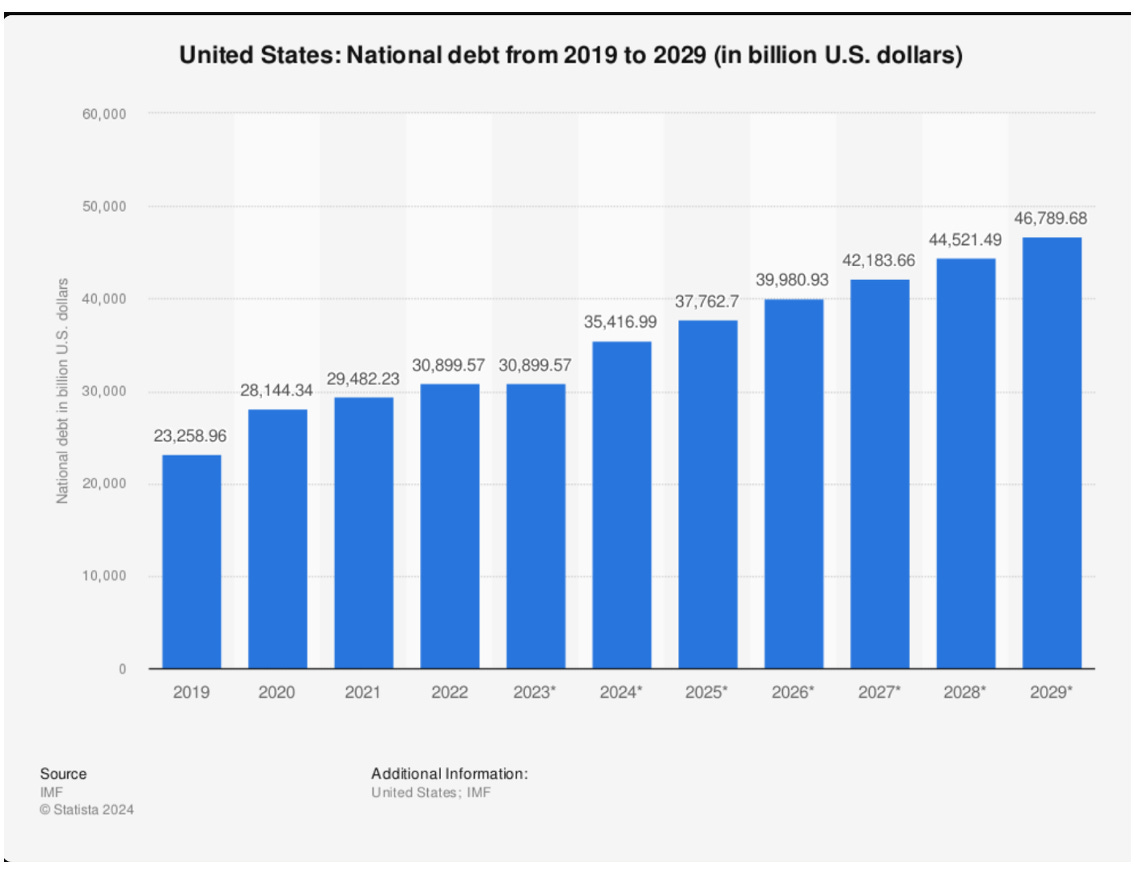

First and foremost is America’s out-of-control national debt.

It now stands at a staggering $36 trillion… and the IMF expects it to surpass $44 trillion by 2028, with the interest payments alone rising by $1 trillion every 90 days.

Back in 2010, I first began warning that our government was adopting policies – namely, printing money to buy back its own bonds – that would lead to both a financial and a social crisis. I warned that, throughout history, societies that debased their currency to protect the ruling class always experienced a shocking rise in violence, disorder, prostitution, gambling, and other forms of anomie.We accurately predicted all the things that followed, and not just the financial problems of higher prices and the loss of Americans’ purchasing power. We specifically warned that America would lose its AAA rating. We predicted the rise of violent protests like Occupy Wall Street, the Freddie Gray riots in Baltimore, and Black Lives Matter riots that followed. We told millions of people that America’s government would become vastly more dictatorial and would soon control how you lived, worked, and traveled – which no one believed – until all of those things happened too, in the spring of 2020.

But what’s going to happen will be much, much worse.

According to The Wall Street Journal, President-elect’s Donald Trump’s economic plan (tariffs, military expansion, and tax cuts) will cost $7.5 trillion in additional deficits over only four years. But… what no one has figured out yet these estimates are all based on increases to the rate of government deficit spending.

These numbers don’t mean that the national debt is going to grow from $35 trillion to $42 trillion under Trump. What no one will say out loud is that these figures are in addition to the ongoing surge in mandated transfer payment spending. And those obligations mean the U.S. is already on track to rack up at least $22 trillion in new deficit spending over the next decade.

This combination of out-of-control, unfunded, and legally mandated spending (on Social Security, Medicare, etc.) along with the new spending programs proposed by both Trump and Harris mean that more than $30 trillion in new debt will be added over the next decade. That is more or less double the amount of debt we owe today. Measured against the size of our economy, our debt is going to soar past all previous records, including during the Civil War and World War II.

It’s a runaway train. And although Trump has made noise about cutting spending, it’s not happening anytime soon. What’s more, the cuts made will be far smaller than anyone expects.

“Reality distortion” field

Steve Jobs was famous for having what one of his colleagues called a “reality distortion field.”

His ability to manifest results at Apple (AAPL), especially in product development, was based on getting people around him to believe they could build things that had never been built before – in a matter of days, not years. (If you don’t know the story, the development of Gorilla Glass is a perfect example of Jobs’ reality distortion field at work.)

I believe Trump has a similar reality distortion field. He knows that America’s economy, and our society, have been warped by progressive politics, and he believes (correctly) in the American people. Restoring our property rights (by reducing regulatory burdens) and slashing the cost of the government will allow America to grow out of its debt burdens and restore a broad prosperity to the middle class.

Trump’s reality distortion field, however, is blinding his supporters into thinking that this will happen without major dislocations in the markets. And, indeed, into thinking that he’ll be able to make far more massive cuts to government spending than he actually will.

Unfortunately, decades of woeful financial management have left our country more at risk than ever before to an enormous debt-fueled economic collapse – witness the huge rise in bankruptcies this year.

Most at risk? The U.S. consumer. Credit card debt is up 214% from $350 billion in 2008, to a record high $1.1 trillion today. Auto loans are up 100% from $800 billion in 2008, to a record high $1.6 trillion today. Student loans are up 200% from $600 billion in 2008, to a record high $1.8 trillion today. As employment declines (we’ve seen nine straight months of declining employment) and consumer debt defaults mount, there’s a rising likelihood of massive consumer debt default.

And while I’d love nothing more than to see the government slash spending, end the deficits, and balance the budget… the fact is that the only real way to make any meaningful changes to our disastrous fiscal situation would be to cut entitlement programs and mandatory spending.

That is never going to happen. It would be political suicide for any politician... even Trump.

And while it is possible for us to grow our way out of this fiscal black hole if Trump unleashes the full economic might of America… it’s not going to happen overnight. It could take years, even decades, to claw our way back.

That’s why, at least for now, if there’s one thing you can bet on with absolute certainty… it's that America will continue amassing ever greater debts.

And this is why before you buy any of Trump’s Secret Stocks… you first need to ensure you’re protecting your existing wealth.

Gold… and Gold 2.0

Because as Trump spends trillions of dollars… as the Federal Reserve continues to debase the dollar… and as interest rates remain elevated for far, far longer than expected… the real value of your money will continue to erode.

And in a world where overly-indebted governments print ever more fiat currency and inflate away their obligations… you can all but guarantee more capital will flow to alternate stores of value… like gold and crypto.

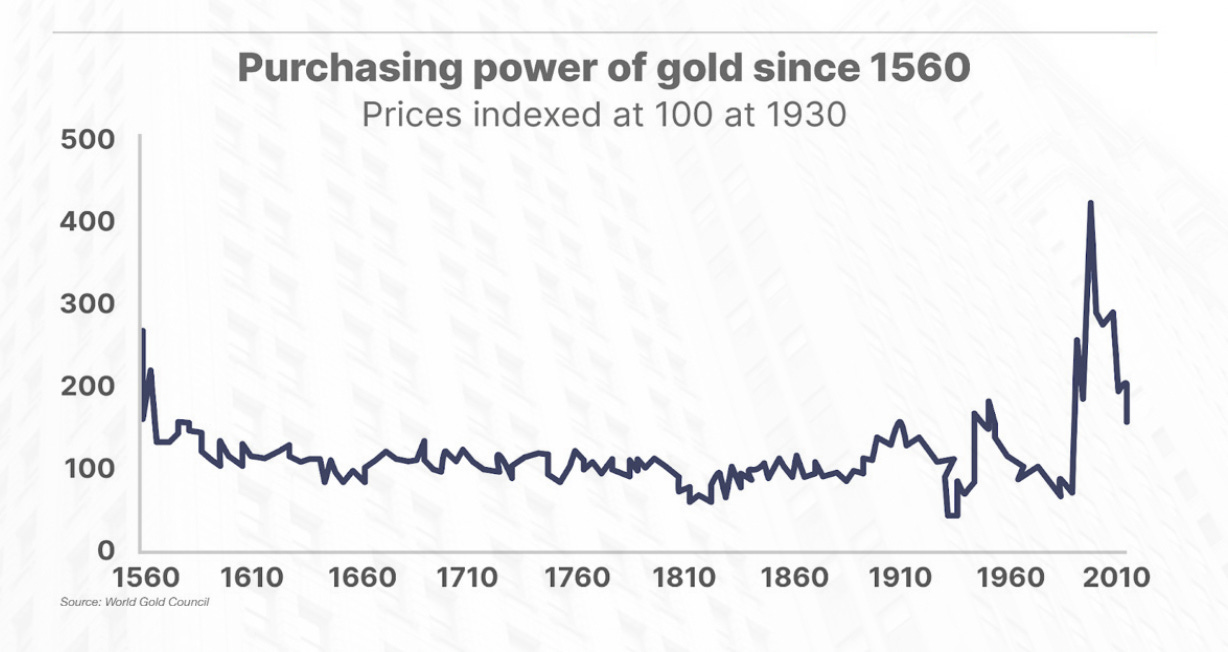

Gold, simply put, is never going away. Over the past decade, the price of gold is up more than 100%. Since the Great Financial Crisis and our government’s decision to sacrifice the dollar to bail out the banks – and all of the bailouts that have followed – gold has gone from around $700 per ounce to $2,600 today. That’s a 270% increase. Sure, Bitcoin is up enormously more. So are certain stocks. But if you’re looking for the most reliable way to protect your wealth from the destruction of the dollar, you can’t beat gold.

Various items have served as money throughout human history: shells, beads, salt, rocks, livestock, and countless paper or “fiat” currencies. But only gold has maintained its monetary value for thousands of years.

That is not a coincidence. Gold is still here because it meets all the characteristics of good or “sound” money, as explained by the Greek philosopher Aristotle nearly 2,500 years ago:

• Scarce: Sound money must be limited in quantity and difficult or energy-intensive to produce.

• Durable: Sound money must not tarnish, decay, or change through time or exposure to the elements.

• Portable: Sound money must be easy to transport and store.

• Divisible: Sound money can be split into smaller units if necessary.

• Fungible: Individual units of good money must be identical and interchangeable.

Gold isn’t perfect money. But it alone has stood the test of time because it meets these requirements better than anything else we humans have tried so far.

But today, there’s a new form of gold on the world’s markets – Bitcoin.

I believe Bitcoin will remain a fixture in the world’s economy for centuries, because it has many advantages over gold that will continue to attract investors.

Bitcoin is, like gold, a peer-to-peer method of exchanging value. Bitcoin, like gold, is no one else’s liability. It is a tangible form of value, representing a “proof of work” that is every bit as real as the gold’s. But, even more so than gold, it enables privacy and instant exchange, across the entire world. It exists fully outside the scope of governments and central banks, making it the most legitimate international reserve currency of all. That’s why I believe every investor should have some exposure to both Bitcoin and gold as the ultimate stores of value and safe havens against currency debasement.

However, there’s one important caveat to consider before deciding whether or not to own Bitcoin. That is, one must be prepared to stomach tremendous price swings in this asset, including regular declines of 50 - 70% or more.

That said, there’s never been a better time to invest in “Gold 2.0” than right now, as we enter the era of Trump 2.0.

The pro-crypto tone of the incoming Trump administration is fueling all virtual assets (including – and most importantly – Bitcoin). Trump has named a former PayPal (PYPL) executive the “White House AI & Crypto Czar,” and a similarly crypto-friendly new head of the U.S. Securities and Exchange Commission (“SEC”) – which has long been sand in the eyes of the U.S. crypto scene. The regulatory overhang on cryptos – what if Uncle Sam were to outlaw all cryptocurrencies? – is vanishing.

All of the above is why the first financial step I recommend you take is to ensure a significant portion of your wealth is stored in both Bitcoin and gold.

Not for the upside potential – although I do believe both will perform phenomenally over the long term – but to protect your purchasing power from currency debasement. In my Permanent Portfolio, which is available to all my Big Secret on Wall Street readers, I recommend allocating 25% of your capital to these two assets.

What to do next

In addition to physical gold and traditional Bitcoin, I’d like to suggest a couple of less widely-known ways to maximize your profits on each one. These are assets most investors aren’t aware they should buy before the election... and before government spending takes a steep ramp upwards.

More By This Author:

Starve the Beast

The Real Purpose of Government

Gasoline and Matches