Assessing The Probabilities Of A Recession In The Middle Term

Recession risk has been a major factor through 2019, and chances are that investors will remain concerned about the economic environment in the coming months. Some areas of the economy are clearly moving in the wrong direction, geopolitical risk is elevated, and some analysts are even considering that the global economy is stumbling towards disaster.

With the economic cycle reaching extended levels and manufacturing activity being under pressure, economic growth will probably remain subdued over the coming months. Nevertheless, when looking at the data on a broad scale, a recession does not look like the most probable outcome over the next 3 to 6 months.

The Big Question

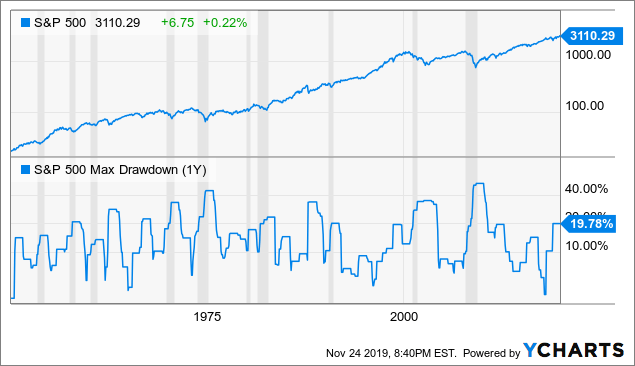

The chart shows the historical evolution of the S&P 500 index, with grey areas representing recessions. Below we can see the maximum drawdown, meaning the maximum decline from the peak, in each year.

The market can have considerable declines without a recession. In fact, the S&P 500 had a decline of almost 20% in 2018 with no recession during that year. However, the chances for a bear market are increased when there is a recession, and the severity of those bear markets is also much worse.

(Click on image to enlarge)

Data by YCharts

The two most devastating bear markets in recent history, the explosion of the dot com bubble in 2001 and the credit bubble in 2008, were driven by deep recessions. After the 2008 crisis, we have experienced no recessions in the U.S., and market pullbacks were relatively shallow and short-lived.

It is not much of a stretch to say that bear markets outside of recessions should be bought, while bear markets accompanied by recessions should be avoided as much as possible.

Considering the historical relationship between recessions and the stock market, which is not linear but it is in fact quite strong, assessing the chances for a recession in the middle term can make all the difference in the world in terms of risk management and portfolio strategy.

The Framework

Making economic forecasts is remarkably challenging, and it is practically impossible to estimate the numbers with precision over long periods of time. Importantly, the future is always a matter of probabilities as opposed to certainties, and we need to acknowledge that there are all kinds of variables - some of them even unknown - that can have an unexpected impact on the economy.

Importantly, analyzing the hard evidence is far more effective than relying too much on economic theories and politically-biased opinions.

The main approach is looking at the hard data with an open and objective mind in order to assess what the weight of the evidence is indicating about the chances of a recession, and hence a bear market, in the next 3 to 6 months.

The Warning Flags

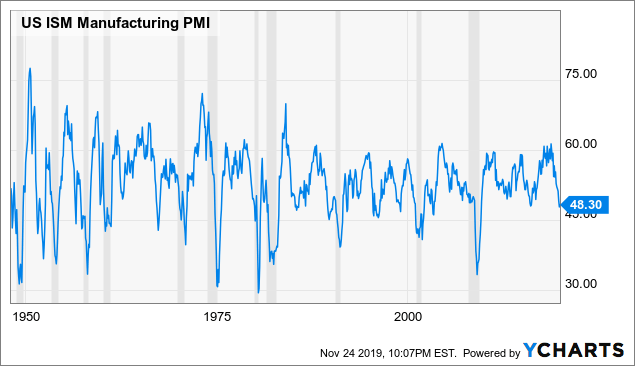

When we look at the different areas of the economy, there is a clear weakness in sectors such as manufacturing and international trade, which is closely related to the trade war uncertainty. The ISM manufacturing index stands at 48.3, with levels below 50 signaling a contraction in manufacturing activity.

(Click on image to enlarge)

Data by YCharts

We have already seen some material slowdowns in manufacturing activity in 2011 and 2015 during the current cycle, and the economy as a whole still managed to avoid a recession. However, that doesn't change the fact that manufacturing is the weakest spot in the U.S. economy and the biggest reason for concern over the coming months.

The Conference Board Leading Economic Index is also moving in the wrong direction, with the index declining for 3 consecutive months and the growth rate in the index turning negative recently.

A big share of the weakness in the leading index can be explained by weak manufacturing data, although employment also showed some weakness in October. The LEI index is not a full-blown red flag at this stage, but it is clearly a warning sing to continue watching.

(Click on image to enlarge)

Source: macro-ops.com

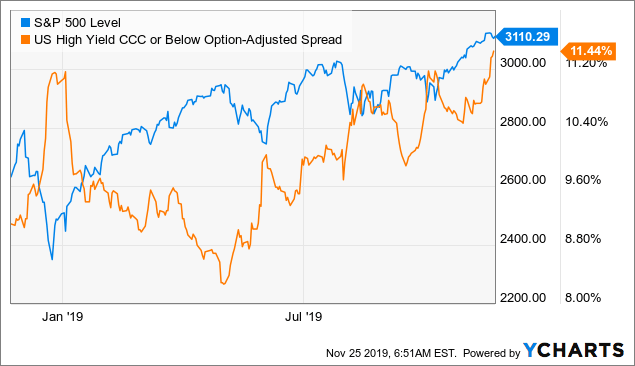

Another variable that needs to be watched closely in the coming months is credit spreads. The bond market is more risk-averse than the stock market, and rising credit spreads are many times a key leading indicator for signs of trouble in the economy.

Credit spreads, especially in the CCC segment have been moving higher in recent days. Most of the time, credit spreads are rising when stocks are falling, and vice-versa. But in recent days stocks and credit spreads are sending a conflicting signal.

It is unusual to see credit spreads rising when the stock market is performing well, so this potential divergence between risk appetite in the stock market and in the bond market merits some attention.

(Click on image to enlarge)

Data by YCharts

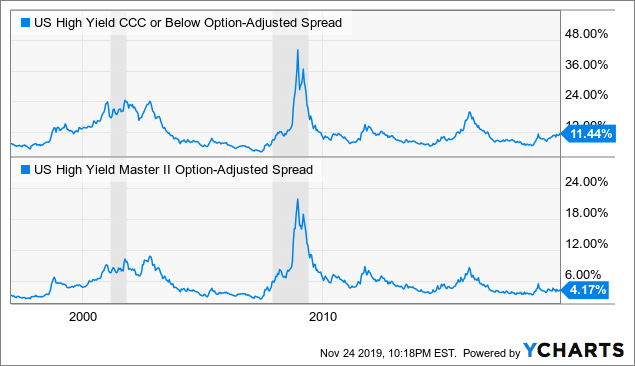

Just to be clear, both high yield spreads in general and in the CCC segment, in particular, remain at levels well below the levels that have anticipated recessions in prior years. In fact, credit spreads are actually quite low by historical standards.

(Click on image to enlarge)

Data by YCharts

Credit spreads are by no means signaling a recession nowadays, it is just that the fact that spreads are rising in times when stocks are also rising deserves close attention in the coming days.

If we see a sustained increase in spreads over the coming weeks and months, then this would clearly require some caution and perhaps a reassessment of the economic environment. For now, however, it is just a variable that should be closely watched.

The Strong Engines

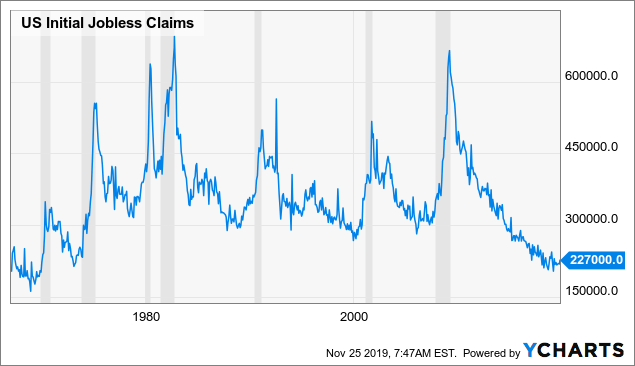

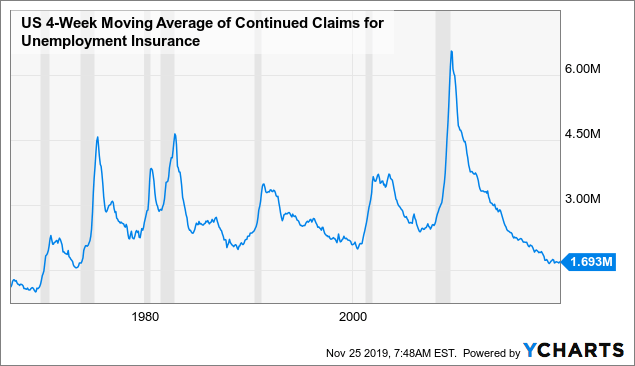

Employment is a key piece of the puzzle for the economy, and variables such as initial jobless claims and continued claims tend to increase when the economy is approaching a recession. The charts below show that the labor market is quite tight, which could be a reason for concern, but there is no visible sign of deterioration in the main trends.

(Click on image to enlarge)

Data by YCharts

(Click on image to enlarge)

Data by YCharts

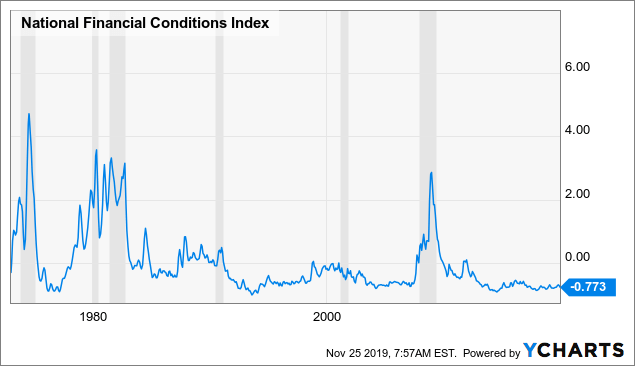

Financial conditions are considered to be tight when the Financial Conditions Index is above zero. Conditions generally tighten before recessions, and they remain quite comfortable as of the time of this writing.

(Click on image to enlarge)

Data by YCharts

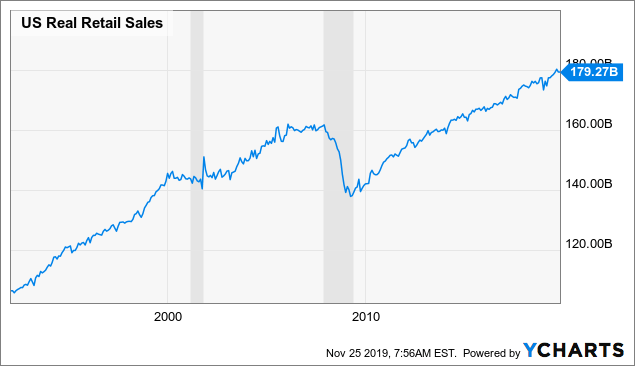

With the labor market remaining strong and financial conditions flexible, the consumer has enough spending power, and retail sales are not showing any signs of a recession on the horizon. If you have to follow a single sector in the U.S. economy in order to tell where things are going, that would be the consumer, and the data looks quite healthy nowadays.

(Click on image to enlarge)

Data by YCharts

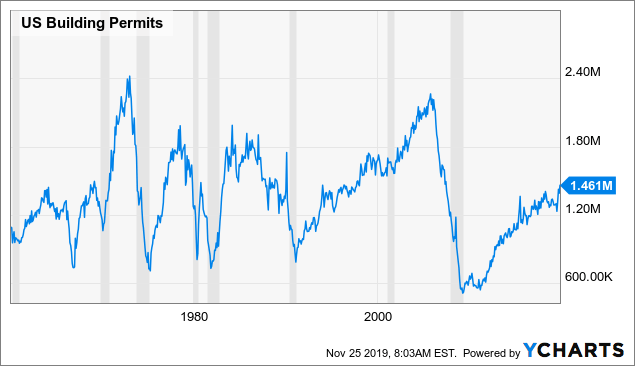

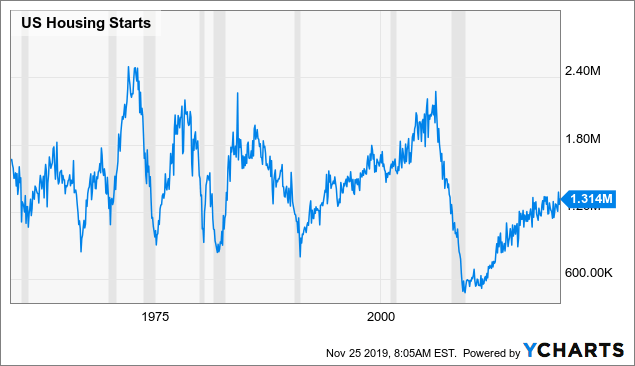

The real estate sector is also a major engine for the economy, variables such as building permits and housing starts tend to provide clear warning signs before a recession. Both indicators are clearly improving in recent months, so there is no recession at sight judging by the real estate data.

(Click on image to enlarge)

Data by YCharts

(Click on image to enlarge)

Data by YCharts

The Bottom Line

Manufacturing is the biggest reason for negativity right now, and it's starting to affect the leading indicators in general. The short-term increase in credit spreads is worth some close attention, but it makes no sense to expect a recession based on the current level of credit spreads.

Other indicators based on the job market, consumer spending and real estate, remain quite healthy, though. Based on the evidence currently at hand, the chances of the U.S. entering a recession in the next 3 to 6 months are around 30%-35%, so the environment looks quite benign.

The economic cycle is clearly extended, and the jobs market is very tight, so growth rates will probably remain subdued. The Federal Reserve is currently expecting a 2% increase in GDP for 2020, but the current evidence is indicating that this estimate could be too optimistic. Chances are that the Fed will need to revise this estimate lower in the middle term, and probably implement more monetary stimuli in the coming months.

Looking at the data from a holistic perspective, and barring any major mistakes from the Fed, a big escalation in the trade war or some other shock to the economy, the data is currently signaling slow economic growth in the coming months, arguably well below 2%, but the chances for a broad recession remain contained.

Slow economic growth in combination with low-interest rates and flexible monetary conditions, not only in the U.S. but also all over the world is a reasonably good environment for stocks. In fact, the market has performed quite well under these conditions over the past decade.

The environment is obviously dynamic, and if the evidence changes I will change my mind. We are in the business of making money and managing portfolio risk, not in the business of making forecasts and predictions.

That said, based on the evidence currently at hand, I am expecting slow economic growth, but not a recession, in the next few quarters. This is a rather favorable economic environment for the stock market in the middle term.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more