ASML & TSM: Why You Should Focus On Chip Manufacturers

Image Source: Pixabay

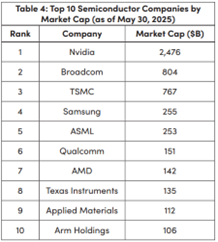

The market capitalization leaderboard for semiconductors continues to highlight the divergence between IP ownership and physical production. US firms dominate the top rankings — Nvidia Corp. (NVDA) at $2.476 trillion, Broadcom Inc. (AVGO) at $804 billion — but that masks how irreplaceable the manufacturing layer has become in a geopolitically fractured world.

Key fabrication and tooling players like Taiwan Semiconductor Manufacturing Co. (TSM), Samsung, and ASML Holding NV (ASML) remain undervalued by comparison. This valuation gap reflects investor focus on scalability and software leverage.

In today’s semiconductor market, location defines exposure, not necessarily strength. Nvidia, Broadcom, and Advanced Micro Devices Inc. (AMD) — all US-headquartered — are rewarded for their innovation, commanding premium valuations and massive market capitalizations. But their products are inseparable from the Asian manufacturing ecosystem. TSMC, Samsung, and ASML remain irreplaceable at the physical layer of chip production.

In today’s semiconductor market, location defines exposure, not necessarily strength. Nvidia, Broadcom, and Advanced Micro Devices Inc. (AMD) — all US-headquartered — are rewarded for their innovation, commanding premium valuations and massive market capitalizations. But their products are inseparable from the Asian manufacturing ecosystem. TSMC, Samsung, and ASML remain irreplaceable at the physical layer of chip production.

Tariffs, meanwhile, distort incentives. They penalize final assembly hubs like China without reshoring critical stages such as wafer fabrication or back-end packaging. This imbalance creates investment opportunities — and risks.

US design-centric firms gain margin leverage, but companies controlling equipment, lithography, or memory — like ASML, Applied Materials, and SK Hynix — are the real backbone of global production.

Investors should pay close attention to companies bridging these two worlds: Those that own irreplaceable manufacturing capacity and are structurally tied to Western markets. ASML and TSM remain critical infrastructure. Applied Materials Inc. (AMAT), Lam Research Corp. (LRCX), and KLA Corp. (KLAC) control the tools that keep fabs alive.

Nvidia and Broadcom may lead the stock market — but it’s the factory floor that decides who can actually deliver.

More By This Author:

OSK: A Long-Term Dividend Play In The Specialty Vehicle BusinessXLK: A Familiar Tech Fund That Offers Benefits In This Volatile Market

Nasdaq 100: As Market Fate Hangs In The Balance, Watch These Levels

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more