Asana Raises Productivity

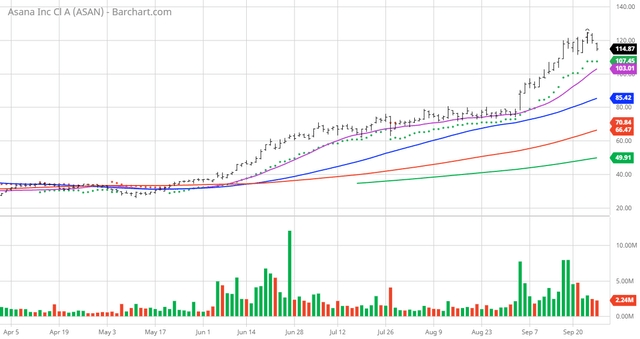

The Barchart Chart of the Day belongs to the work management software company Asana (NYSE:ASAN). I found the stock by sorting Barchart's Top 100 Stocks list first by the most frequent number of new highs in the last month then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 7/29 the stock gained 68.38%.

Asana, Inc., together with its subsidiaries, operates a work management platform for individuals, team leads, and executives in the United States and internationally. It provides a work management platform as software as a service that enables individuals and teams to get work done faster while enhancing employee engagement by allowing everyone to see how their work connects to the mission of an organization. The company was formerly known as Smiley Abstractions, Inc. and changed its name to Asana, Inc. in July 2009. Asana, Inc. was incorporated in 2008 and is headquartered in San Francisco, California.

Asana, Inc.

Barchart technical indicators:

- 100% technical buy signals

- 379.69+ Weighted Alpha

- 340.03% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 49.26% in the last month

- Relative Strength Index 64.94%

- Technical support level at 117.41

- Recently traded at 115.16 with a 50 day moving average of 85.41

Fundamental factors:

- Market Cap $22.08 billion

- Revenue expected to grow 57.50% this year and another 31.40% next year

- Earnings estimated to increase 14.70% tis year and an additional 1.00% next year

- Wall Street analysts issued 4 strong buy, 5 buy and 3 hold recommendations on the stock

- The experts on TipRanks gave the stock a 9 out of 10 rating

- 14,060 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more