Asana, Inc. Stock Price Trends: Poised For Takeoff Or Set To Decline?

Before delving into the stock’s performance and its potential as an investment, let’s take a closer look at the inner workings of Asana, Inc.

Asana, Inc. is a leading technology company that specializes in providing innovative solutions for various industries. Founded in 2010, Asana, Inc. has established itself as a key player in the market, offering a wide range of products and services catering to the evolving needs of businesses and consumers.

With a strong focus on research and development, Asana, Inc. has consistently delivered cutting-edge technologies that have revolutionized how industries operate. Their commitment to innovation has earned them a reputation for excellence and reliability.

Asana, Inc. has experienced significant growth in terms of financial performance over the years. As of the latest available data, their annual revenue stands at $1.5 billion, showcasing their ability to generate substantial income. Moreover, their net profit margin has consistently remained strong, indicating efficient management and profitability.

The company's success can be attributed to its diverse portfolio of key products. They offer a range of software solutions, including enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and supply chain management (SCM) solutions. These products enable businesses to streamline their operations, enhance productivity, and improve overall efficiency.

Asana, Inc. has expanded its offerings to include hardware products such as servers, networking equipment, and storage solutions. Asana, Inc. has positioned itself as a one-stop-shop for businesses seeking integrated technology solutions by providing a comprehensive suite of software and hardware solutions.

In conclusion, Asana, Inc. is a prominent technology company known for its innovative products, strong financial performance, and commitment to customer satisfaction. With a diverse range of software and hardware offerings, they continue to shape the future of various industries while maintaining a solid financial standing.

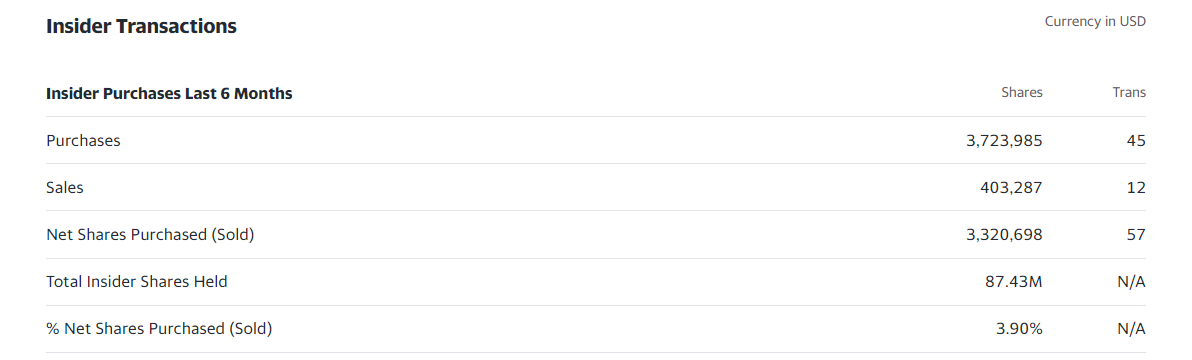

Asana, Inc. Stock Price Forecast: Insider Insights

Something unusual is occurring with Asana, Inc. The CEO, Moskovitz, has made substantial investments totaling over 1.54 billion over the past two years. Interestingly, most of these purchases have been made at significantly higher prices.

Moskovitz is participating in an SEC-sanctioned “automatic buy program.” This program involves publicly announcing his intention to accumulate a large stake in Asana, Inc. by regularly purchasing significant blocks of shares.

In the past month, for instance, Moskovitz has acquired an additional 160,000 shares in the price range of $22.44 to $22.82. Over the past three months, there have been 19 insider buys at Asana, amounting to 703,872 shares.

Insiders collectively own 40% of the outstanding shares of Asana. Specifically, Moskovitz himself owns an impressive 39.3 million shares.

Notice how not only the CEO, but also other insiders are eagerly acquiring shares. Yahoo Finance reported a remarkable 45 transactions involving nearly 3.8 million shares. Such a substantial purchase suggests strong confidence among insiders in an underlying opportunity.

Asana, Inc. Stock Price Forecast: Will it Soar or Plummet?

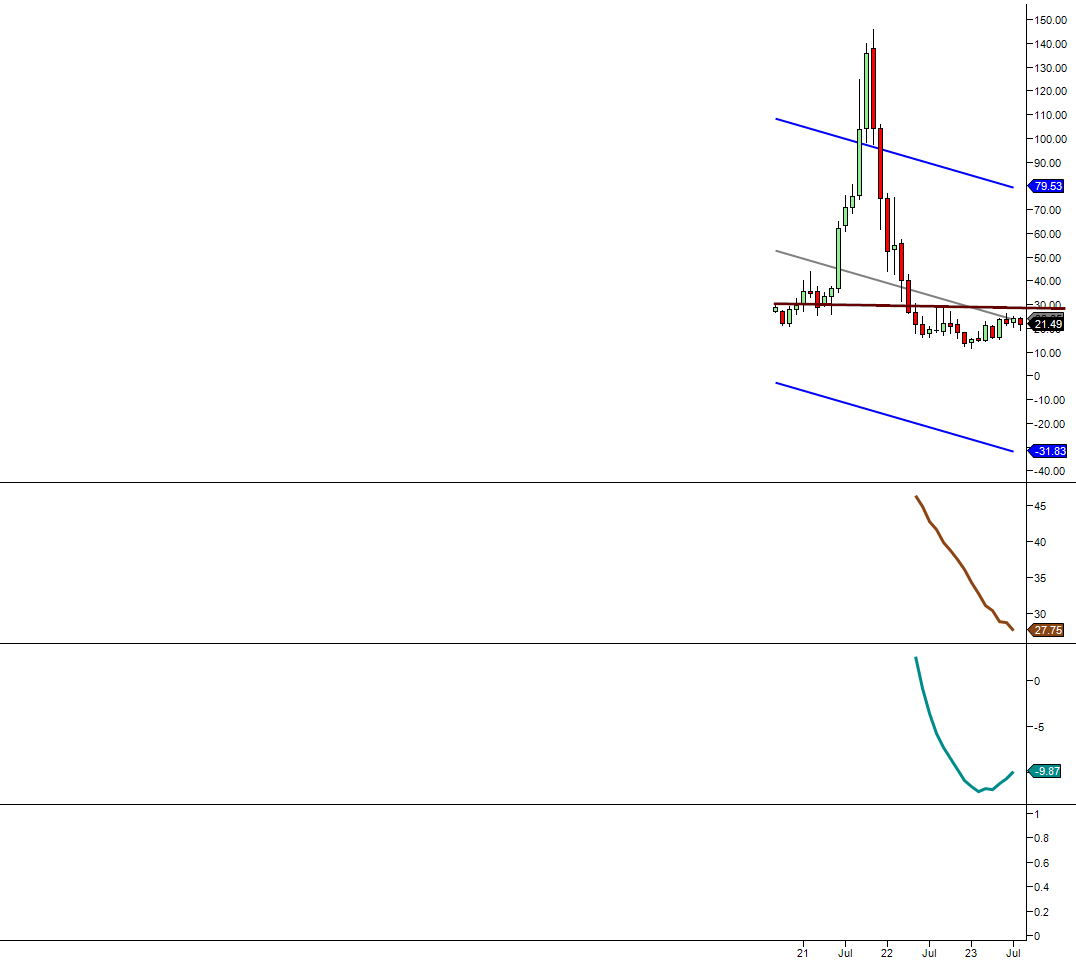

The long-term outlook is poised for a significant shift once the stock consistently closes at or above $33 on a monthly basis. Upon achieving this milestone, there’s minimal resistance until it reaches $45. However, before breaching this threshold, expect a highly volatile ride.

Another encouraging factor is the stock’s trading pattern, forming a relatively extended channel. Such channel formations often precede upward breakouts, particularly following a substantial pullback, and this stock has indeed endured a significant one.

The recommended strategy for this opportunity involves dividing your investment into 3-4 portions and deploying them incrementally. Remember, as with all investments, success hinges on effective risk management, so avoid going all-in on this stock.

For those willing to take risks, it might be worth considering the Jan. 2025 30 leaps during a pullback. Never deploy all your funds in one go when dealing with options. Furthermore, never allocate funds to prospects you cannot afford to part with. When options are mentioned, the term “weapons of mass destruction” may come to mind. However, when used appropriately, prospects can be transformed into mass-production instruments.

More By This Author:

Dividend Investing Strategy: A Guide to Building Long-Term WealthWhat Happens If The Market Crashes?

Dollar Rally: Is It Ready To Rumble?