As Markets Crashed, The Swiss National Bank Went On A FAAMG Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and short up confidence. That joke is now the truth.

Now that the Fed is openly buying corporate bonds and fallen angels, what was once absurd humor has become sad reality. And while we wait for the Fed to admit it too will be buying stocks soon - we just need that pesky next crash before Powell commits - other central banks have no such qualms.

Take the SNB.

We previously reported that the hedge fund that is not only publicly traded but also moonlights as the Swiss central bank, which allows it to print money and effectively purchase any security it wishes with a zero-cost basis suffered its biggest loss in history, reporting a loss of $32.7 billion on its massive equity portfolio. Yes, the SNB along with the BOJ, is unique in that it does not pretend to not buy stocks and does so quite openly.

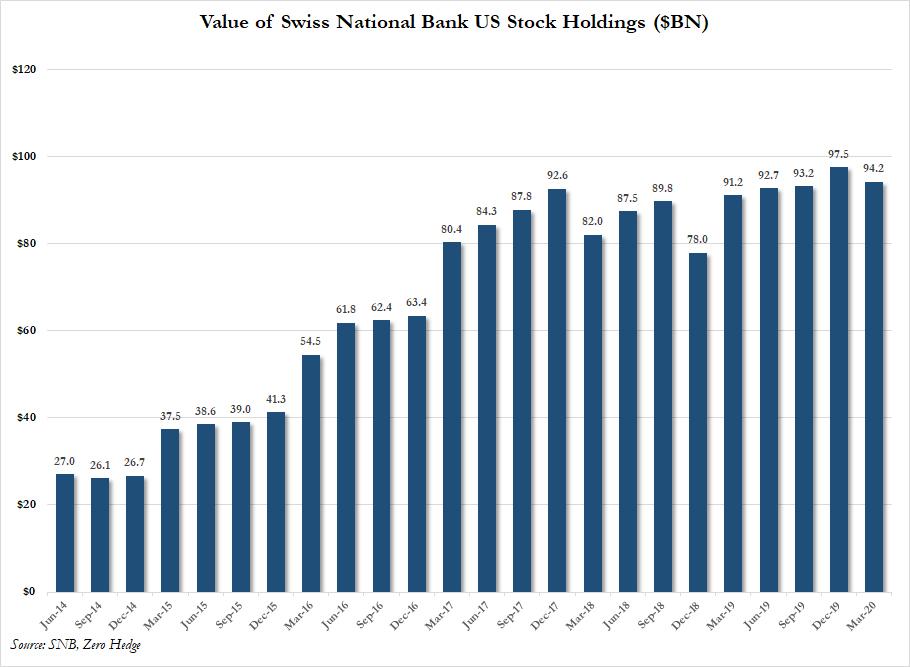

So openly, in fact, that in the past 5 years, the value of its US equity holdings increased more than threefold, from $26.7 billion in Dec 2014 to $97.5 billion in Dec 2019.

(Click on image to enlarge)

What about in the first quarter of 2020 when after hitting an all-time high, stocks crashed in March?

As one can see in the chart above, the total value of SNB stock holdings barely budged from Q4 2019 to Q1 2020 despite the 30% crash in the market in March.

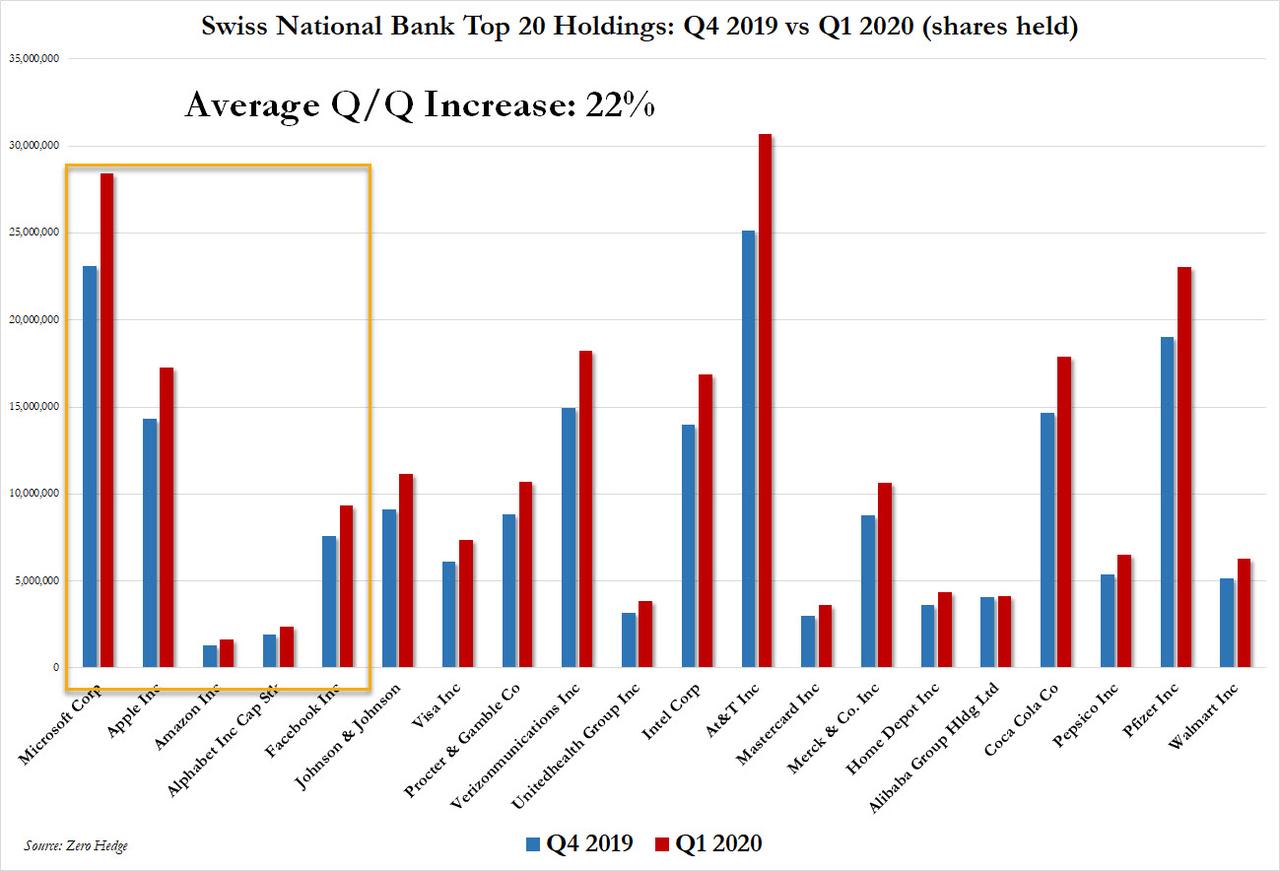

How is that possible? Simple: after the SNB kept its total holdings relatively flat for the past year, conserving its dry powder for just the right occasion, occasion materialized in March, and the Swiss National Bank went on a buying spree as markets crashed, adding roughly 22% (on average) to its top positions.

(Click on image to enlarge)

(Click on image to enlarge)

And the punchline: the SNB added approximately 22% to its holdings of each of the FAAMGs in Q1 as follows:

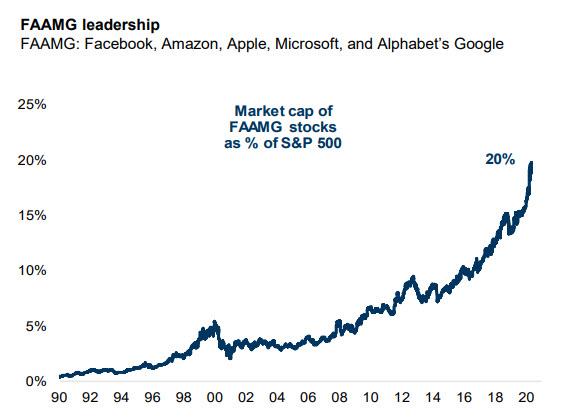

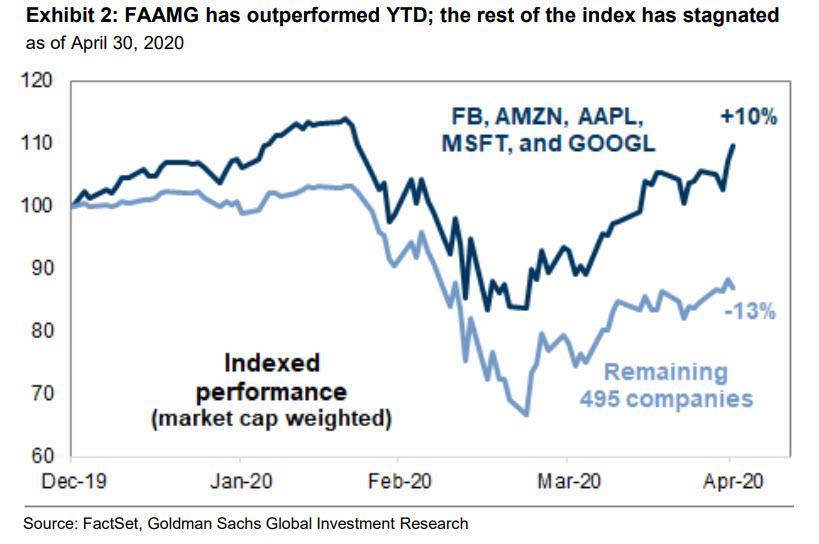

So for all those wondering who was going crazy bidding up all the megatech names, which are now up more than 10% YTD while the rest of the market is down 13%...

(Click on image to enlarge)

... even as even Warren Buffett sat on the sidelines waiting for the other shoe to drop, now you know and all you need to replicate the SNB's performance and buy FAAMGs without a care in the world, is your own (legal) printing press to print digital money out of ones and zero and buy anything and everything in the name of preventing the system from collapsing.

Source: SNB

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more