As AI Cools, These Sectors Heat Up

Image: Bigstock

As market uncertainty and volatility continue to increase, investor sentiment has shifted. Defensive and value-oriented sectors are beginning to outperform, while high-growth areas—particularly technology, semiconductors, and AI—have come under pressure. The recent sell-off has hit these once-hot industries especially hard, as doubts have started to emerge around the massive AI infrastructure build-out.

In contrast, Energy has emerged as a clear leader in 2025, up 8.8% year-to-date, while Financials have gained 4.9%, as both have been outpacing the broader market. This sector rotation suggests investors are looking for stability, strong cash flows, and reasonable valuations.

Two stocks that stand out in this environment are HCI Group (HCI - Free Report), which has recently showed powerful price momentum while backed by a top Zacks Rank, and Chevron (CVX - Free Report), which recently staged a major technical breakout and could be poised for further upside.

Image Source: TradingView

Energy Stocks are Perking Up

Shares of energy stocks continue to trend higher as investors seek cash-generating assets in an increasingly uncertain market environment. Much like in 2022, when technology and more speculative stocks suffered sharp drawdowns, companies backed by real assets, such as those in the energy sector, are once again attracting renewed interest and capital.

Though Chevron doesn’t have a top Zacks Rank (as it currently has a Zacks Rank #3 (Hold) rating), it is still a company that generates tremendous cash flows while also enjoying a reasonable valuation. Chevron made over $15 billion in free cash flow in the trailing 12 months, giving it a respectable 5.1% FCF yield.

Especially compelling is the price action in Chevron's stock. After consolidating for nearly three years, the stock has broken out from this large, technical base. This action clearly indicates a major rotation of capital from institutional investors into the stock.

Image Source: TradingView

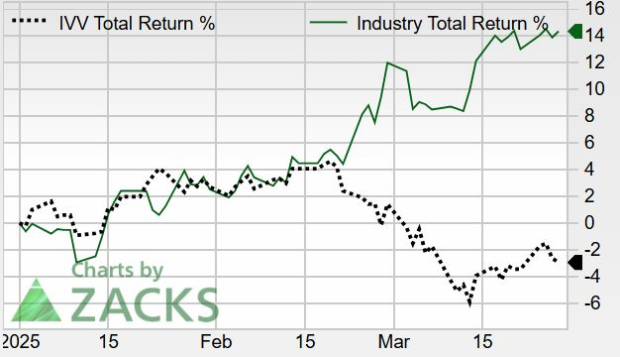

Insurance Stocks are Quietly Leading the Market

Financial stocks and, more specifically, insurance stocks have been another real, bright spot in the market. While the broad market index is down a few percentages year-to-date, the insurance sector has gained 14% over the same period. Like energy, some of the leading insurance companies enjoy huge profits thanks to the advantaged business model.

In addition to a Zacks Rank #1 (Strong Buy) rating, HCI Group has an incredible 19.7% FCF yield, which is well above the industry average and its 10-year median yield of 14.3%.

HCI Group expects sales growth of 17.5% this year and earnings growth of 102%. The company has recently been seen trading at 9.9x forward earnings, and the stock just made a new record high during Friday's session, indicating strong buying momentum.

Image Source: Zacks Investment Research

Should Investors Buy Shares in Chevron and HCI Group?

While AI and technology stocks falter, select names in energy and insurance appear to be breaking out on strong fundamentals and technicals. For investors seeking stability, cash flow, and upside potential in a shifting market, Chevron and HCI Group are two names that could be worth watching closely.

More By This Author:

Is IONQ Stock The Next NVIDIA And Worth Buying Now?Consider These Human Capital Management Stocks Amid A Resurgence In Market Volatility

M&A Watch: Buy Alphabet Stock Amid Plans To Acquire Cybersecurity Startup WIZ?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more