Around The World Shopping Spree

TM Editors' Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

The US dollar is strong. The tendency for investors to invest their capital in domestic equities is irrational. So my bag is packed and it is time to circle the globe on the prowl for a few bargains. I saved you a seat so grab your calculator and some cash and we'll be on our way to scooping up a few quick picks from around the world.

The US dollar is strong. The tendency for investors to invest their capital in domestic equities is irrational. So my bag is packed and it is time to circle the globe on the prowl for a few bargains. I saved you a seat so grab your calculator and some cash and we'll be on our way to scooping up a few quick picks from around the world.

Canada

Before jetting off from North America, it is always worth a quick stopover in Canada to pick up some more Urbana (OTC:UBAAF).

Urbana has done well since I bought it and wrote it up in early in 2013. However, it still trades at a substantial discount to NAV; the management continues to eat away at that discount by paying a dividend and buying back shares.

The strong dollar creates an opportunity to buy more Urbana shares, capture the discount to NAV, and diversify currency exposure. Let's see if we can find additional such opportunities. So, time to get back on the jet for a quick hop across the Atlantic to...

France

With Bordeaux future prices firm due to demand linked to the Chinese bubble, I am going to skip the wine and instead load up on more Societe Fonciere, Financiere et de Participations/FFP (SFFFF) If you have 72.73 Euros to spare, you can buy a share and stick it in your backpack. It costs only 77% of NAV.

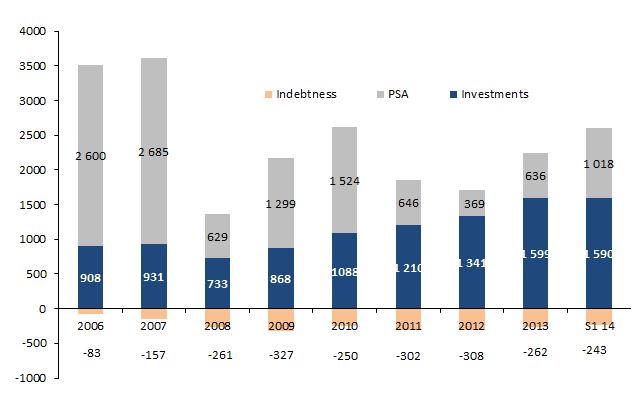

NAV has been growing:

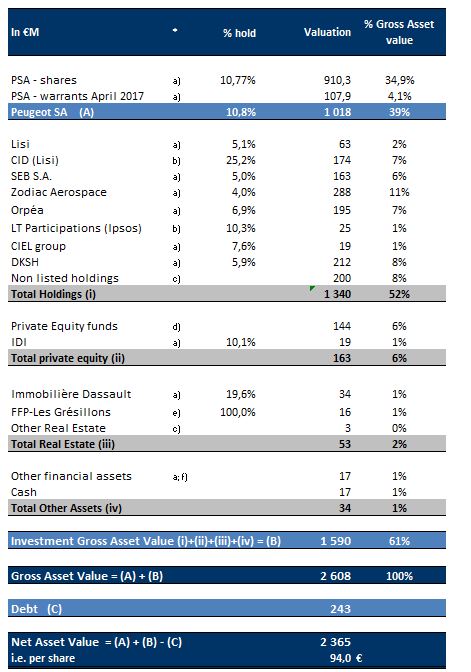

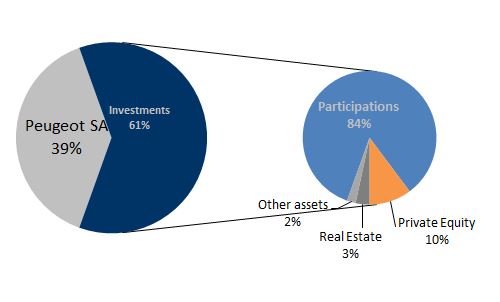

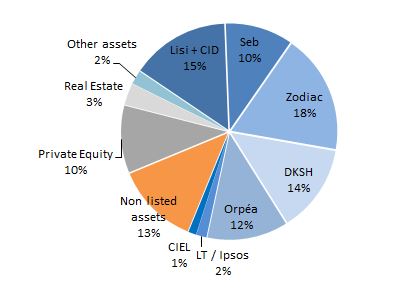

The biggest exposure is to Peugeot:

Here is what else they have:

This has been a long idea for some time and it has had a strong year so far, but it is still an opportunity. Onward.

Italy

A little Italian real estate would be nice. Qf Amundi Re Europa, which I mentioned in the past, costs less than half of its net asset value. This is still worth owning.

Don't get too comfortable because it is time for…

Ukraine

Ukraine has been having some trouble, but Ukrainians still eat eggs and so its largest agricultural company, Avangardco (OTC:AGVDY) could come out of it okay. Its share price has collapsed over the past year to 2.78 Euros.

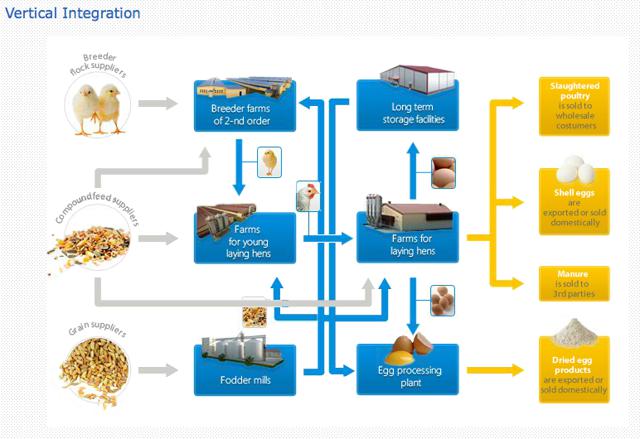

They are a fully integrated poultry and egg behemoth.

I intend to track their litigation for recoveries from the annexation of their facilities on the Crimea. This is a dicey situation, but at half of NAV and only two times earnings, it is a bargain. I am glad that we are getting out of here alive because it is onto…

Romania

In Romania, do as the Romanians do and buy some Fondul Proprietatea/FP. It is the world's largest closed end fund managed by Mark Mobius with shareholder Paul Singer looking closely over his shoulder. Shares cost 0.8930 RON for 1.1706 of NAV, which equals about a 24% discount. The manager has repeatedly bought back shares. They will become better known as they are going to have them listed in London (LSE:0OKS). Singer's Elliot Associates recently added to their stake in FP. I might, too. Now, time for…

Greece

For our Greek shopping excursion, consider picking up Dolphin Capital Investors (OTCPK:DOLHF), a real estate company with over 40% of their portfolio in Greece. It trades at a 68% discount to NAV. Dan Loeb's Third Point owns over 20% of its shares.

Time to rush through Turkey, Israel, and Nigeria.

Turkey

The Turkish Investment Fund (NYSE:TKF) trades at a 12% discount to NAV.

Israel

The Aberdeen Israel Fund (NYSEMKT:ISL) trades at a 14% discount to NAV.

Nigeria

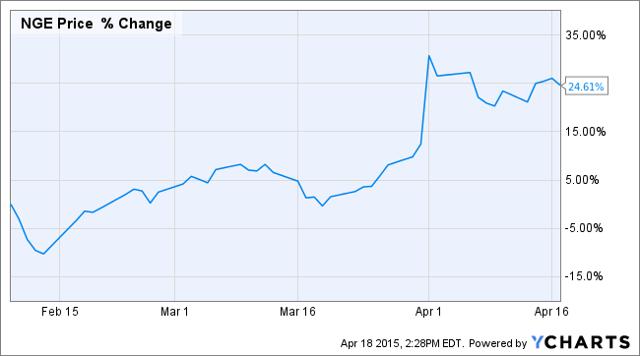

The Global X Nigeria Index ETF (NYSEARCA:NGE) strengthened since I wrote it up earlier this year.

If there is any mean reversion in the oil price or political stability, there could be substantial upside in foreign direct investment and business confidence.

Thailand

The Thai Fund (NYSE:TTF) trades at a 12% discount to NAV. I still like TTF and APWC.

Korea

For investors who want a lazy way to exploit the Korean preferred share class opportunity for a personal account, you can always buy shares of the Weiss Korea Opportunity Fund (LSE:WKOF)(WISKF). Andrew Weiss is a great investor and I expect his fund to continue to do well exploiting the underpricing of Korean prefs relative to their common shares. WKOF shares last traded at 131 Pence per share, a 5% discount to the 138.62 pence of NAV per share.

Venezuela

The price for Gold Reserve (OTCQB:GDRZF) has increased since I last wrote it up.

However, it still costs less than half of the money that Venezuela owes us.

Cuba

The US antitrust authorities will imminently clear the Reynolds (NYSE:RAI) deal with Lorillard (NYSE:LO) along with the divestiture package to Imperial Tobacco (OTCQX:ITYBY). Imperial is also a 50/50 JV partner with Cuba in Habanos S.A., which is the monopoly guarantor of Cuban cigars. Cuba is opening up to the world and ITYBY is one way to get exposure to that future.

We hit five continents and over a dozen countries with one bargain-priced souvenir from each. I hope that you enjoyed the trip.

Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value ...

more

I am really intrigued by international stocks, and I appreciate you giving some ADRs and OTC equivalents, but I wish you'd give insight into how to buy the ones not available here - and also, do you suggest buying an ADR, or the stock on its own exchange?