Are These Beaten Down Stocks Worth A Look? Super Micro Computer, NIKE

Image: Bigstock

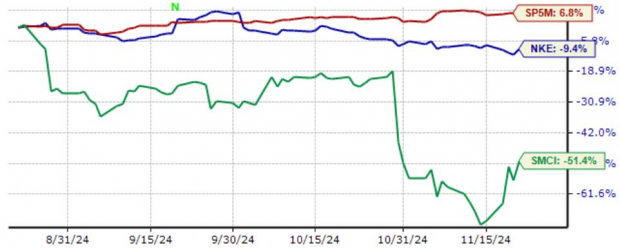

The performance of a few stocks over the last few months might have left a sour taste in investors’ mouths, with popular stocks such as NIKE (NKE - Free Report) and Super Micro Computer (SMCI - Free Report) unable to gain any meaningful traction.

Image Source: Zacks Investment Research

What’s been impacting shares? Let’s take a closer look at each.

Super Micro Computer vs. Hindenburg Research

Super Micro Computer shares have been decimated since making their all-time high in mid-March, a stark turnaround after an enormous run to begin the year. Shares faced pressure following a short report from Hindenburg Research accusing the company of accounting manipulation.

The company is a total IT Solution Provider for AI, Cloud, Storage, and 5G/Edge, fully explaining the buzz around the stock in 2024. The company’s reported sales have shot higher, penciling in triple-digit percentage year-over-year growth rates in each of its last three quarters.

Image Source: Zacks Investment Research

Super Micro Computer has had an interesting history, with the recent short report not the first time the company has been accused of fraud. In 2018, Super Micro Computer was temporarily delisted for failing to file financial statements, and by 2020, it was charged $17.5 million by the SEC for “widespread accounting violations.”

The company delayed the filing of its 10-K annual report back in August following the short report, bringing about further scrutiny. However, Super Micro Computer recently announced that it’s found another auditor, trying to regain listing compliance.

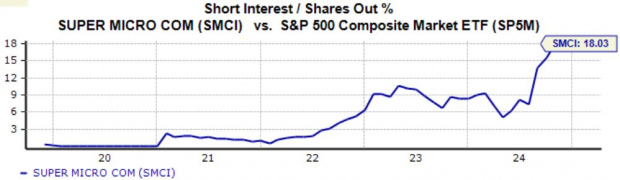

The news perked shares up a bit, recently well above their $17.25 per share 2024 low. It’s critical to note here that shorts have piled into the stock since the report, with the recent 18% short interest percentage reflecting a five-year high.

While the climb has been inspiring, there’s undoubtedly been some short-squeezing.

Image Source: Zacks Investment Research

Overall, too many questions and concerns surround the company currently to confidently state whether the recent plunge is a buyable dip. However, if Super Micro Computer's 10-K clears the hurdles and no more questions arise, it’s reasonable to expect the stock will take off again.

NIKE Fails to Win Over Consumers

NIKE shares faced considerable pressure following the release of its latest quarterly results due to an inability to capture consumers’ wants. Concerning headline figures in the release, EPS fell 25% year-over-year alongside a 10% decline in sales.

The performance on headline numbers jumps out, with the company’s top line primarily remaining stagnant and showing little growth over recent years. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Sales among the NIKE brand declined 10% year-over-year, with declines seen across all geographies. Wholesales revenues also fell 8%, NIKE Direct revenues fell 13%, and Converse revenues fell 15% year-over-year. Overall, the company’s brand and product offerings haven’t resonated with consumers over recent periods.

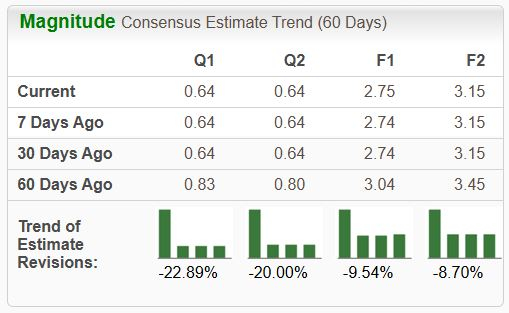

Analysts downwardly revised their earnings expectations across the board following the release, landing the stock into an unfavorable Zacks Rank #4 (Sell). The negative outlook here isn’t supportive of bullish price action, with the company’s inability to capture consumers’ wants remaining a thorn in the side.

Image Source: Zacks Investment Research

Bottom Line

Several popular stocks – Super Micro Computer (SMCI - Free Report) and NIKE (NKE - Free Report) – have faced negative price action over recent months, with each widely underperforming.

Concerning Super Micro Computer, the picture remains a bit too cloudy, though a newly-appointed auditor has perked shares back up modestly. It seems like a wait-and-see type of situation for the stock, with just too much unknown out there for investors to take a confident stance on.

NIKE's struggles have primarily been attributed to an inability to capture consumers’ wants, with its offerings not attracting consumers over recent periods. However, a newly-appointed CEO remains positive that the company can turn things around, but does realize it will take some time. The stock’s current Zacks Rank #4 (Sell) ranking alludes to near-term share weakness.

More By This Author:

AMD Vs. Nvidia: What's The Better AI Stock?

These 2 Companies Shattered Quarterly Records

These 3 Quarterly Reports Positively Shocked Investors: Tesla, Micron, Arista Networks