Are Tesla Moonshots Priced Into Its Share Price?

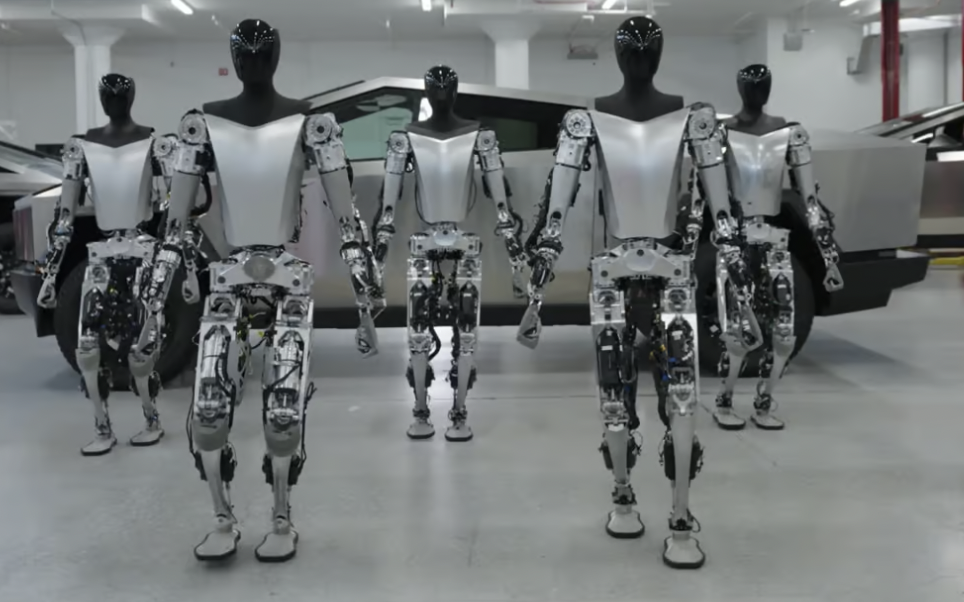

Major technology gains are coming — paradigm shifts in Artificial Intelligence-related fields — including embodied AI in humanoid robots. A few months ago, someone on Twitter/X said in 20 years there will be a billion humanoid robots, to which Tesla’s Elon Musk agreed, marking it as a HUGE proclamation.

Nearly everyone (initially) doubts this narrative. However, I’m confident it’s a question of when, not if, a billion humanoids walk the earth (and colonize Mars). For the purposes of this article, I assume a billion have been deployed by 2050. While still 5+ years away, humanoids will boost global productivity & GDP growth by slashing the cost of making things. The 2030s could be a decade of tech-driven deflation. Once a major company like Tesla gains a substantial, sustainable competitive advantage in labor costs, everyone will have to follow (or become uncompetitive).

Why should readers accept this remarkable premise? Well, with prospective labor savings of up to 50%, what are the reasons for humanoids NOT becoming commonplace in manufacturing, factory, retail, warehouse, delivery, construction, mining, etc.? My first question is, why does the tsunami of new robots have to be humanoid? They don’t, most existing industrial robots are not. However, massive amounts of R&D is going into humanoids. The world is built by and for humans, so humanoids make the most sense for maximum flexibility in dealing with real world environments like a factory floor. More importantly, advances in AI will go predominately to humanoids, not single-purpose robots. The game-changer is the combination of [capable robots + AI].

What if society doesn’t want humanoids, won’t there be systemic unemployment? It looks like humanoids will largely fill roles people don’t want. For example, millions of jobs in countries like Japan & China. In those countries with aging populations, there are not enough people to maintain robust labor forces. Consider this report from labor consultant / recruiter Korn Ferry.

“…in a sweeping country-by-country analysis, the biggest issue isn’t that robots are taking all the jobs—it’s that there aren’t enough humans to take them. Indeed, the study finds that by 2030, there will be a global human talent shortage of more than 85 million people…”

Why should one believe the narrative of a billion humanoids when we were promised ubiquitous autonomous vehicles, where are all the robotaxis!?! Autonomous vehicles are far more complex than imagined, and require extremely high safety/regulatory protocols. By contrast, deploying humanoids in controlled factory settings is an order of magnitude easier.

Wait, tens of 10’s of millions of humanoids/yr., what!?! These are machines, think of them as units, not as HUMANoids. There are an 1.5 billion cars, EVs are robots on wheels. Making humanoid units weighing < 5% of a car is hardly a stretch. The steel industry produces a billion tons of steel/yr., 25M humanoids/yr., at 150 pounds each, would be ~2% of the steel sector.

Instead of a billion humanoids in 20 years, I assume that is reached in 2050. By then, the number of jobs humanoids can do, (better, faster & cheaper), will be significant. They will likely serve as in-home elderly care aids & personal assistants. Not many can afford a live-in maid / nanny at $1,200/week. How about a [maid, cook, nanny, security guard, elderly-care specialist & tutor] for $120/week!?!

In my discounted cash flow exercise I assume Tesla deploys 100M units. If there are 6-8 major humanoid OEMs, I think Tesla will one of them. Why? It’s a current leader in the field, it’s aggressively spending to succeed, it’s a proven risk taker & tech visionary, it has a strong team of engineers, and it has the financial strength to continue investing heavily.

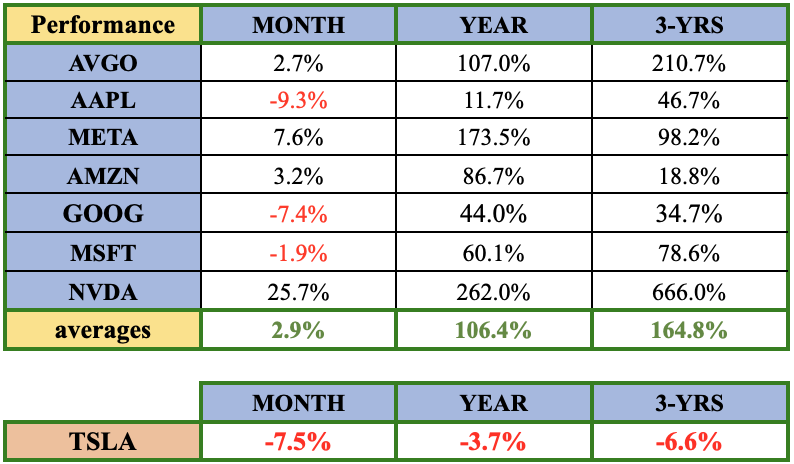

Does Tesla’s valuation incorporate the considerable option value of its looming army of Optimus worker drones? And, what about the potential value (discounted back to today) of full self-driving [“FSD“] software / robo-taxis & other segments? Tesla’s stock has lagged well behind Major tech giants for three years, suggesting it might not be getting enough credit for these opportunities.

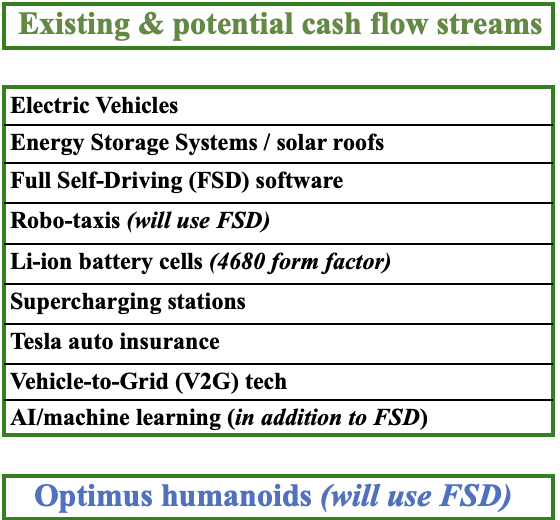

Admittedly, Tesla is overvalued compared to most automakers, but calling Tesla an automaker is like calling Amazon a book seller. Tesla’s moonshots are largely funded from EV + stationary energy storage earnings, and increasingly from FSD, supercharging stations used by other OEMs + Tesla auto insurance. That’s a huge de-risking factor not shared by privately-owned competitors.

Before long, the EV business will be become brutal. As great an EV company as Tesla is, it can’t compete in EVs priced well below US$25k. Luckily, it won’t matter. By 2030, Tesla and others will be delivering EVs (10’s of millions/yr.), into the robotaxi market. However, most will earn a tiny fraction of the high-margin, recurring revenue from EV software that Tesla will. Outside of China, Tesla’s FSD is likely to become a Top-3 contender. Tesla will license FSD to other OEMs, and deploy it internally in its own robotaxi division. Software, not hardware, is Tesla’s future.

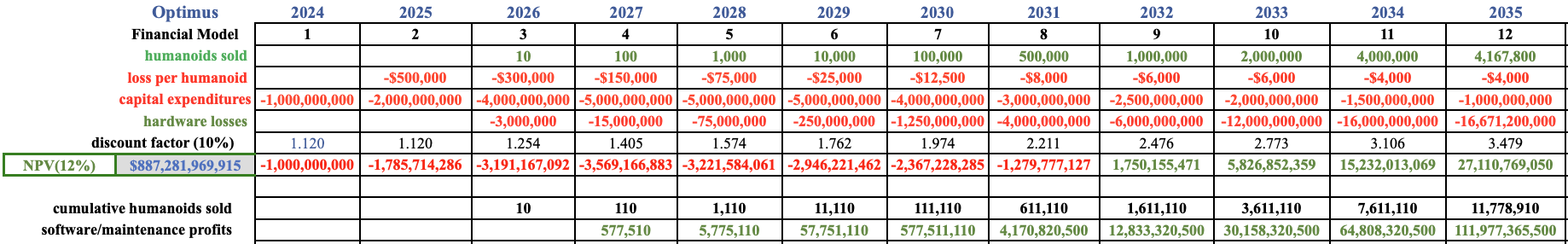

More than any non-Chinese, high-tech peer (besides Google & Amazon), Tesla will remain well funded to invest $10+ billion/yr. on R&D (across all platforms, not just Optimus). Two things give me comfort in analyzing Optimus. First, it hardly matters how large a cap-ex assumption one uses. Why? Future cash flow from the brain of Optimus, (the FSD operating system) grows so incredibly large, it covers Optimus cap-ex many times over.

Second, even if Tesla gives its robots away for free, software margins alone could make Optimus a massive success. If Tesla were to charge $3/hr. per humanoid, software profits (assumed 75% margin) could reach nearly $100 billion in 2034 — assuming Tesla had sold a total of ~7.6M units.

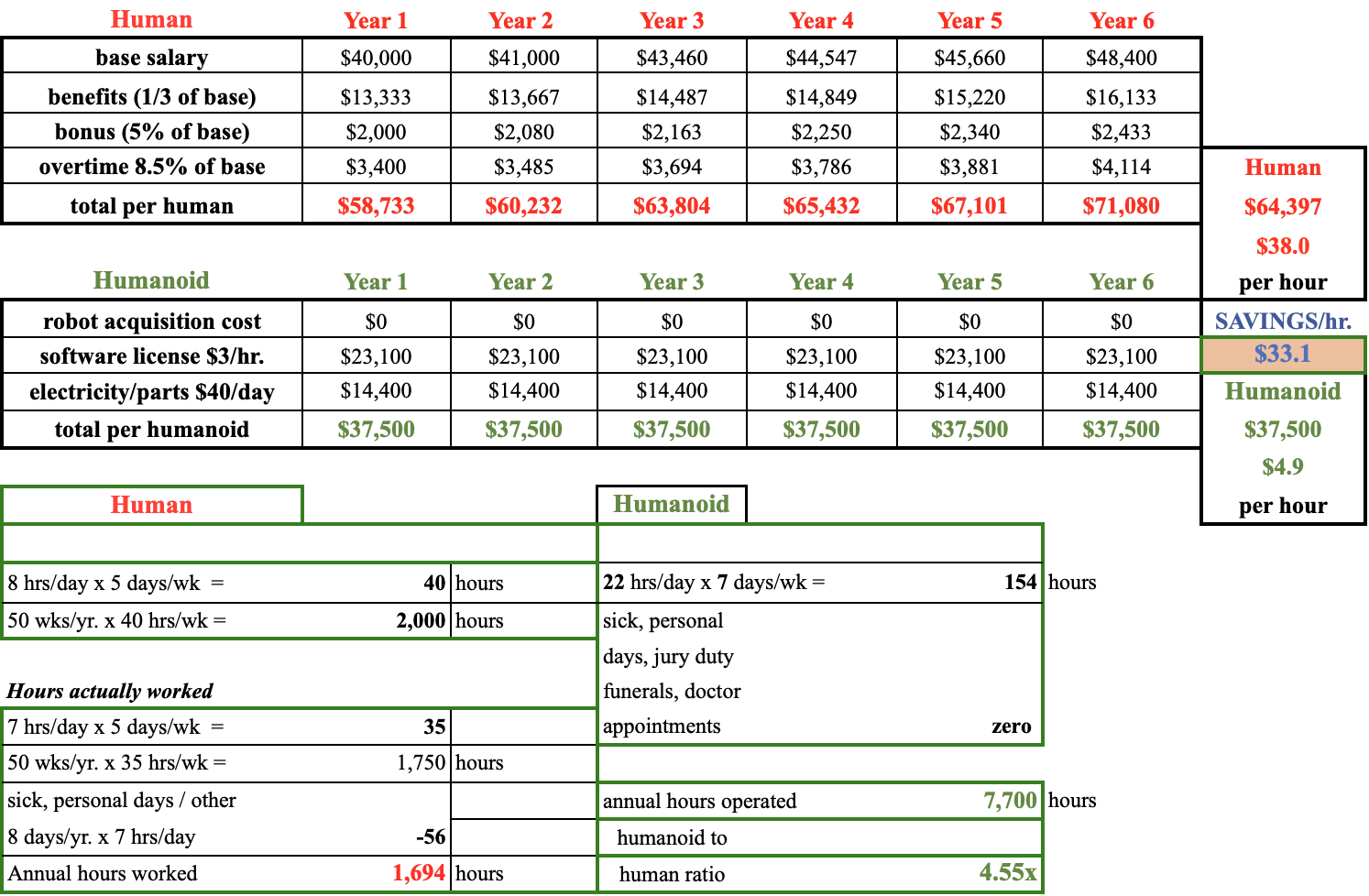

A massive humanoid workforce makes tremendous sense. Factory workers are typically paid for 40 hrs/wk, 50-wks/yr., or 2,000 hours. But, they take breaks, get tired, distracted, leave early & call out sick… So, 2,000 hours is more like 1,694 {see chart below}. I estimate U.S. factory workers will make an average of $64.4K/yr. (incl. benefits estimated at 1/3 of salary + overtime) in the next six years. $64.4k/1,694 hours is $38/hr.

Actually, humans are even more costly than that, they sue their employers, get injured, steal things, break equipment & require business insurance to cover, “workman’s comp.” Humans require bathrooms, locker & lunch rooms, medical & daycare centers, large parking lots, air conditioning / heating, and so on. They frequently quit, retire or get fired. Worker turnover & training is a significant incremental expense.

Humanoids could eventually work 4.55x longer than people. Why? People work 5 days/wk, humanoids 7. People –> 8 hrs/day (7 incl. breaks), robots –> 22 hrs/day, no breaks (2 hrs/day charging & maintenance). And, humanoids will one day be more productive than people (fewer mistakes, faster, lifting heavier loads). Yet, it’s early days, Tesla plans to deploy ~60 robots in-house by next year.

In my financial thought experiment, Tesla gives humanoids away for free. I assume operating costs for the manufacturer are $3/hr. (per bot), as software licensing (paid to Tesla), plus $40/day/bot incurred by factory owners for electricity, consumables, batteries, parts, etc. Therefore, at scale, the all-in cost to operate an Optimus unit could be under $5/hr. (before taxes) vs. $38/hr. for a person, a $33/hr. savings. And, that differential will only grow as humanoid productivity improves beyond that of a person.

I show Optimus deployments ramping up to 4M units/yr. in 2034, then increasing +4.2%/yr. through 2050 for a total 100M units. I estimate total capital expenditures (cap-ex), [for Optimus only], through 2035 at $36 billion. However, Optimus shares manufacturing, logistics, engineering & software resources with other Tesla platforms, most notably FSD, so that $36 billon figure could be lower. Still, doubling it to $72B cuts the Net Present Value (“NPV“) by < 2%!

The NPV of software licensing cash flow from 100M humanoids amounts to $432 per Tesla share vs. Tesla’s stock price of $175. Although that’s a discounted value (12% disc. factor), it’s not a risked figure. One could haircut it by half if one thinks Tesla will sell 50M units, another 50% if one believes Optimus margins will be well below 75%, 50% again for other reasons. Those 3 haircuts bring the option value to a still meaningful $54/shr.

On the other hand, given the extraordinary labor savings, (~$33/hr.) manufacturers could pay Tesla more than US$3/hr./bot. Perhaps $9/hr. gets paid to Tesla, $9/hr. is paid in taxes, leaving $15.hr. in savings for factory owners. Manufacturers would still be saving 48% in labor costs. If Tesla could charge $9/hr., instead of $3/hr., it could enjoy massive success on one third of the 100M unit scenario. The problem is — the estimated $54-$432/shr. in option value won’t be recognized next month or next quarter. People are not good at embracing major technological changes, and are especially bad at conceptualizing events 15-25 years from now. It could take the deployment of 1,000’s of humanoids before clear evidence of a paradigm shift is detected.

The lower Tesla’s share price due to near-term concerns, the more important that $54-$432/shr. is. EV & energy storage are stepping stones to Tesla’s future as an AI/Robotics behemoth. Optimus is far from a sure thing, but a Major humanoid market seems very likely. Even if China dominates humanoids like it does low-priced EVs, it may be shut out of western markets for geopolitical / national security reasons.

The same analysis of Optimus could be applied to FSD / robotaxis with another large NPV per share outcome. The ultimate success of Optimus & robotaxis is tied to the same FSD software system. BOTH Optimus & robotaxis could reach tipping points around the same time.

If one’s convinced humanoids will NOT be a huge deal, or that Tesla will not be a Top 6 or 8 player, then reading this article might have been in vain. Although I can’t say for sure Optimus will thrive, how can anyone know it won’t? That’s why I call it, “option value.”

There are five companies in the world valued at > a trillion dollars, averaging nearly $2 trillion. Tesla’s valued at $560B. It will be a hell of a lot easier for Tesla to triple to $1.7 trillion than for Microsoft to triple to $9.0 trillion! In the end, Tesla may trade sideways in the next 3, 6, 12, or 18 months… who know, but I strongly believe that options like Optimus are way undervalued. Optimus offers compelling upside potential to Tesla’s share price, even if it takes years to play out.

More By This Author:

NuGen Medical’s Needle-Free Injection Could Be Game-Changer

Frontier Lithium: Down, Down, Down — But Not Out

Is Standard Lithium The Next Producer In The U.S.?

I have no existing or former relationship with any company mentioned in this article. I own shares & call options in Tesla & Google.

Disclaimer: The content of this article is for ...

more