Are Netflix Shares Being Overlooked?

Image Source: Unsplash

Netflix (NFLX - Free Report) shares have shown a nice level of relative strength in 2025, gaining 5% compared to the S&P 500’s 8% decline. It’s worth noting that shares are decently insulated from the ongoing tariff talks, though the company is reliant on a healthy consumer.

The stock has quietly been red-hot over the past year in general, gaining 50%. It seems that the AI frenzy took many eyes off the once-beloved stock, unable to find inclusion in the polarizing Magnificent 7 group either.

Image Source: Zacks Investment Research

Notably, the streaming titan is on deck to report quarterly results this week, likely reflecting the most popular on the reporting docket. Let’s take a closer look at how the company currently stacks up and what to expect.

Netflix Earnings

Though down roughly 4% from what was expected in mid-January, the revisions picture for NFLX’s upcoming print has remained stable since, with the current $5.74 Zacks Consensus EPS estimate suggesting 8.7% year-over-year growth.

Image Source: Zacks Investment Research

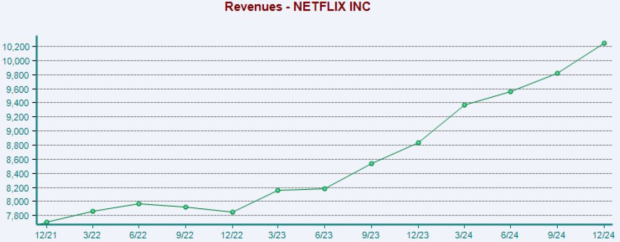

Sales expectations have largely remained positive, with the $10.5 billion expected up marginally since January and reflecting a 12.5% pop from the same period last year. The company overall continues to be a growth machine, with ad-supported plans providing many benefits over recent periods.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Continued member growth continues to be a massive tailwind, with the company exceeding our expectations concerning paid membership additions in each of its last six periods. As mentioned above, ad-supported plans and crackdowns on password sharing have aided the company significantly, enabling it to capture lower-income consumers while also expanding its base.

Image Source: Zacks Investment Research

Are Netflix Shares Expensive?

Netflix shares presently trade at a 35.4X forward 12-month earnings multiple, which compares to a 33.8X five-year median and a steep 72.1X five-year high. The current PEG ratio works out to 1.8X, again above the 1.5X five-year median but a fraction of 3.9X five-year highs.

The current 35.4X forward 12-month earnings multiple reflects an 80% premium relative to the S&P 500, with the stock also carrying a Value Style Score of an ‘F’.

Our current consensus expectations suggest 23% EPS growth in FY25 and 21% in FY26, helping to explain the elevated multiples.

Image Source: Zacks Investment Research

Bottom Line

Netflix shares have been quietly strong over the past year thanks to strong quarterly results stemming from successful efforts that include a password sharing crackdown and ad-supported membership plans.

The stock’s relative strength in 2025 can’t be overlooked either, with shares acting as a small safe haven during the recent tariff talks. Still, the company isn’t entirely shielded from these developments, as they also impact the consumer.

We’ll learn much more from the company this week, with its results expected on Thursday, April 17th, after the market’s close.

More By This Author:

Seeking Income? 3 High Yield Stocks Worth A LookSeeking A Volatility Shield? 2 Stocks Worth A Look

Volatility Presents Opportunities: A Positive Stance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more