Are Alphabet Shares A Buy Here?

Image Source: Unsplash

The beloved Mag 7 group has cooled off in a big way over recent months after big multi-year runs, raising some eyebrows among investors.

While the group’s performance in 2025 has left much to be desired, consistently strong top and bottom line growth gives them staying power for many years to come.

And this week, a member of the elite squad, Alphabet (GOOGL - Free Report), is on deck to report quarterly results. But is the recent underperformance a buying opportunity? Let’s take a closer look at what to expect in the tech titan’s quarterly release and how it currently fares.

Advertising & Cloud Results Remain Key

Headline expectations for Alphabet have reflected an overall stable trend, with expectations primarily remaining unchanged over recent months. The current Zacks Consensus EPS estimate of $2.01 suggests 6.3% year-over-year growth, whereas forecasted sales of $75.5 billion suggests a 12% move higher.

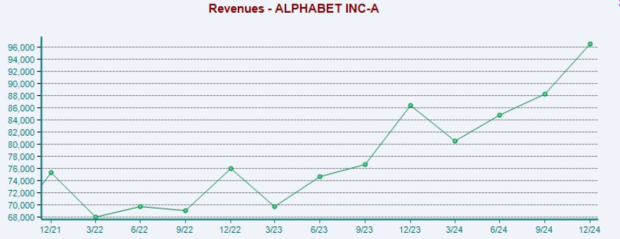

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

As usual, the company’s Advertising results will be a strong focus, which account for the bulk of Alphabet’s sales overall. For the period, the Zacks Consensus estimate for Advertising sales stands at $66.3 billion, reflecting 7.7% growth year-over-year.

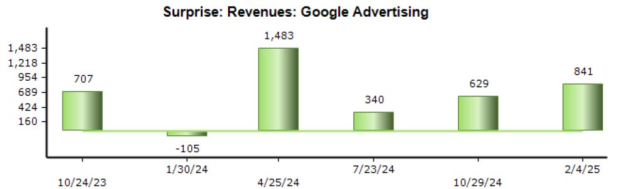

As shown below, Alphabet has regularly exceeded our consensus expectations on the metric, with just one miss over the last six quarters. The company’s advertising results will likely be boosted by AI implementations that have delivered more relevant results for consumers.

Image Source: Zacks Investment Research

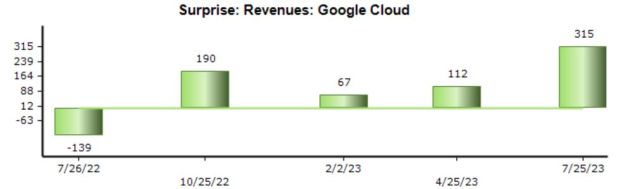

Another key metric to watch in the release is the company’s Cloud results, which have also been positive over recent periods. Our consensus estimate for Cloud sales stands at $12.1 billion, reflecting a 27% jump from the year-ago period.

The Cloud growth rate here is quite significant, though it does reflect a small deceleration from the prior period’s 30% year-over-year growth rate.

Image Source: Zacks Investment Research

Are GOOGL Shares a Buy?

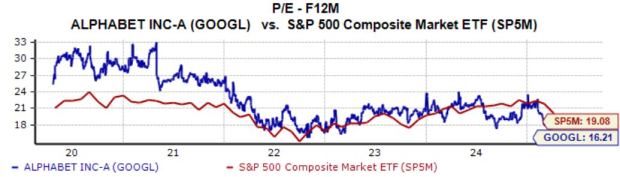

The above-mentioned risk-off environment over recent months has caused the company’s valuation multiples to come down significantly, with the current 16.2X forward 12-month earnings multiple reflecting a 15% discount relative to the S&P 500.

And the current PEG ratio works out to 1.0X, rounding out the valuation picture nicely.

Image Source: Zacks Investment Research

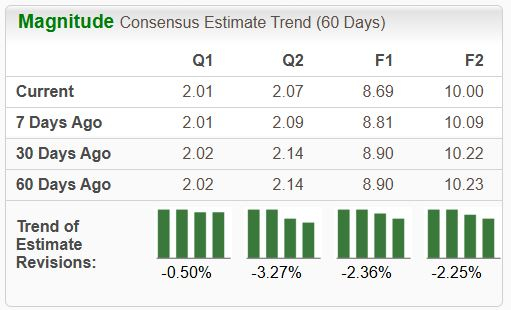

While the valuation picture remains attractive on a relative basis, Alphabet’s EPS outlook has taken a hit across the board over recent months, a bearish signal from analysts. Positive guidance and commentary during the earnings call can certainly shift the earnings picture from negative to positive, and investors with a near-term timeframe should wait for more clarity.

Image Source: Zacks Investment Research

Bottom Line

Beloved Mag 7 member Alphabet is on deck to report quarterly results this week, with investors looking for clarity following a rough start to 2025. Analysts haven’t moved their EPS and sales expectations much for the period to be reported over recent months, with the valuation picture remaining fair.

While the downward pressure has delivered an opportunity to scoop up shares at a discount, investors should remain cautious in the near term given the negative EPS outlook. From a long-term standpoint, there is no doubt that the stock will remain a strong selection for any portfolio given its immense earnings and sales power that will stay for years to come.

More By This Author:

3 Consumer Facing Reports To Watch This WeekAre Netflix Shares Being Overlooked?

Seeking Income? 3 High Yield Stocks Worth A Look

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more