AppLovin: A Growth Stock Powering Innovation In Ad Tech And Gaming

Image Source: Pixabay

AppLovin (APP), a leading player in mobile technology, has continued to gain traction with its innovative ad technology and strong market positioning. As a company operating at the intersection of app development and mobile advertising, AppLovin’s dual approach positions it for robust growth in a competitive and rapidly expanding industry.

AppLovin Brief Video Overview

00:00:19

1. AppLovin’s Business Model: Dual Segments Driving Success

AppLovin focuses on app discovery, marketing, and monetization for mobile app developers. It operates through two primary segments:

- Software Platform: This includes a suite of tools leveraging artificial intelligence (AI), machine learning, and data analytics to optimize ad targeting and maximize developer revenues.

- App Portfolio: Owning a portfolio of mobile games allows AppLovin to test and enhance its software, creating a feedback loop that strengthens offerings for external customers.

This unique dual approach provides valuable insights and synergies, enabling the company to adapt quickly to market demands.

2. Expanding the Ad Tech Frontier

AppLovin’s reliance on AI and data-driven advertising solutions differentiates it in an increasingly complex digital advertising landscape. Its AXON technology, for instance, optimizes ad targeting, significantly improving returns for advertisers. This innovation, combined with its robust software platform, positions AppLovin as a leader in ad tech innovation.

Furthermore, strategic acquisitions, such as Adjust (a mobile analytics company), expand its capabilities, offering end-to-end solutions that span user acquisition, tracking, and monetization.

3. Riding the Wave of Market Growth

The global mobile gaming market has been booming, driving demand for AppLovin’s user acquisition and monetization services. The company’s platform capitalizes on this trend, benefiting from the rapid expansion of app-based ecosystems.

In Q3 2024, AppLovin reported a 39% year-over-year revenue growth, fueled by the success of its AI technology and the growing adoption of its ad platform.

4. Risks and Challenges

While AppLovin shows strong potential, several risks must also be considered:

- Dependency on Digital Ad Spending: Economic downturns could lead to reduced ad budgets, impacting revenue.

- Regulatory Pressures: Privacy changes, such as Apple’s App Tracking Transparency (ATT), could limit user data tracking and reduce ad effectiveness.

- Intense Competition: Giants like Google, Facebook, Unity, and ironSource could create a challenging landscape for AppLovin.

- Stock Volatility: As a relatively new public company, AppLovin’s stock may experience significant price swings.

5. Technical Chart Analysis

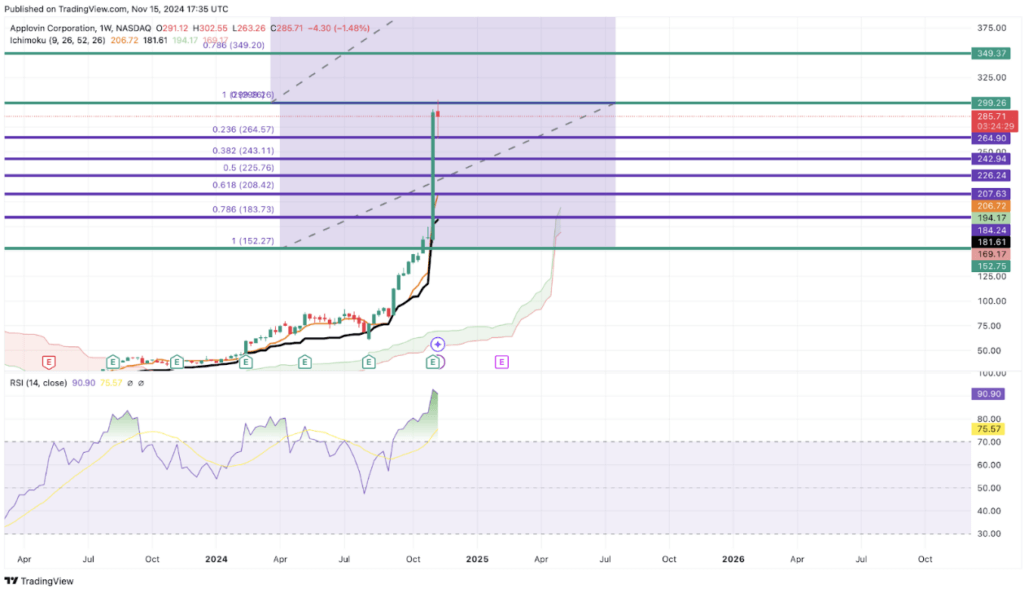

In my analysis of AppLovin’s technical chart, I’ve identified three potential buy limit levels: $264.90, $242.94, and $226.24.

These levels represent price points where I believe favorable entry could be found based on historical price action and key support areas. While AppLovin’s stock has experienced significant growth, I consider these levels as optimal points for those looking for a more favorable entry, particularly after recent price increases.

Despite the stock showing a steep uptrend and achieving a new resistance level of $291, the stock seems overvalued at the moment, with indicators like the RSI passing 80 suggesting potential near-term pullbacks. Given the recent market conditions and bullish sentiment, my strategy is to initiate a position at the current market price (CMP) and layer in additional buy limit orders at the identified levels.

This approach allows me to capitalize on any price pullbacks and position myself for potential upside as AppLovin continues to expand in mobile advertising and gaming.

Remember: Investing is personal, and what works for me might not be right for you. Always conduct your own research and invest according to your unique financial goals and risk tolerance.

(Click on image to enlarge)

6. Is AppLovin Stock a Buy?

AppLovin’s strong revenue growth, high EBITDA margins, and robust free cash flow all highlight its financial health. Coupled with its expanding ad tech capabilities and dual-segment strategy, the company appears to be well-positioned for sustained growth.

For investors with a high-risk tolerance seeking exposure to mobile advertising and gaming, AppLovin may present a compelling opportunity. However, given its recent valuation, waiting for a pullback may offer a better risk-reward profile.

As always, conduct due diligence and align investments with your financial goals and risk tolerance.

More By This Author:

Abbvie Stock Price Analysis – A Post-Humira Dip, New Drug Hopes, And Election Buzz – Is Now The Time To Buy?

SiriusXM Stock Price Analysis – SiriusXM Strikes Out On Its Own Sparking A New Era For Investors

Will “Trump Trade” Continue To Boost Stocks And Bitcoin In 2025?

Disclosure: I am not a financial advisor, and this is not financial advice. This information is for educational purposes only. The original post ‘AppLovin Stock Price Analysis A ...

more