Apple: The Numbers Look Good

Apple (AAPL) is a widely followed and much-debated stock. However, investors, financial analysts, and the media tend to put too much attention on the details when discussing Apple, and they often overlook the big picture.

Many analysts focus on the latest news and data points, trying to estimate to the second decimal place how many iPhones the company will sell in a particular quarter. However, the big picture is much more important than the small details, and missing the forest for the trees is a very common mistake when it comes to analyzing Apple stock.

The following paragraphs will be taking a look at Apple stock from a quantitative perspective, centering the analysis on four particularly important return drivers: Financial quality, valuation, fundamental momentum, and relative strength.

Impressive Financial Quality

Apple has one of the most valuable brands in the world, and the company's customers are notoriously loyal to its products and services. Brand differentiation, a strong cultural footprint, a reputation for quality, and a deep focus on design allow Apple to charge above-average prices for its products, which also means superior profitability for the company.

Most companies in the consumer electronics industry struggle to make any money nowadays, while Apple generates outstanding profitability levels. According to data from Canaccord Genuity, Apple has a market share of 18% in smartphones based on unit sales for the fourth quarter of 2017, but the company retains an impressive 87% of all profits generated in the smartphone industry.

The chart below shows key profitability metrics such return on assets (ROA), return on equity (ROE), return on investment (ROI), gross margin, net margin, and operating margin for Apple vs. the average company in the industry. The company is clearly superior to the average industry player by a wide margin.

It can be challenging for such a massively big company to find new growth opportunities that are big enough to move the needle in terms of global financial performance. However, Apple has still managed to deliver accelerating revenue growth in every quarter since the third quarter of fiscal year 2016.

Revenue in the iPhone segment grew 20% year over year last quarter. Unit sales increased by only 1%, but Apple realized a huge increase of almost 20% in the average selling price for the iPhone during the quarter.

In times when most smartphone manufacturers are aggressively competing on price to sustain market share, Apple is flexing its competitive muscle and realizing much higher prices for its products. The fact that customers are willing to pay higher prices for the iPhone while other players are offering plenty of lower-priced devices speaks volumes about the value of the Apple brand and the loyalty of its customer base.

The services business looks like a crucial growth engine for Apple over the years ahead. Services is now the second largest segment for the company behind the iPhone, accounting for 18% of revenue last quarter. Importantly, Apple produced $9.55 billion in revenue from services last quarter, a vigorous increase of 31% vs. the same quarter last year.

Everything indicates that services will continue outgrowing the rest of the company's businesses in the middle term, so this segment should gain participation in the overall revenue mix and become a key growth driver for Apple.

Not only that, but the services business is remarkably important from a strategic point of view. As customers become entrenched in Apple's ecosystem of services and applications, they are more likely to remain loyal to the company's products. If you are actively using Apple Pay, Apple Music, and iCloud, chances are that you will buy a new iPhone when it’s time to renew your smartphone.

Attractive Valuation

Even a world-class company can me mediocre investment if the valuation is too high. With Apple stock trading near all-time highs and the company reaching a market capitalization value of over $1 trillion, investors may be wondering if maybe it’s already too late to buy Apple stock. However, price performance and valuation can be remarkably different things, and Apple stock is very reasonably priced, if not downright undervalued.

The company is expected to make $11.76 in earnings per share during the current year and $13.57 next year. Under those assumptions, the stock is trading at a forward price to earnings of 19 and 16 times earnings, respectively. The price to free cash flow ratio for Apple currently stands at a much reasonable 14.5

By comparison, the average company in the S&P 500 index trades at a forward price to earnings ratio of 17, and the average forward price to earnings ratio for companies in the information technology sector stands at 19.

Looking at these numbers, it's hard to argue against the fact that Apple is reasonably valued, especially since the company is producing accelerating revenue growth and outstanding profitability metrics. Apple is substantially above average in terms of financial performance, so valuation ratios in comparison to the company's quality are clearly attractive.

Solid Momentum

Financial quality is about buying the right company, meaning a business that generates solid revenue growth and attractive profitability. Valuation is about paying the right price for the stock. Momentum, on the other hand, is about the timing in the position.

Financial performance analyzed in isolation doesn't tell the whole story behind a stock. The numbers in comparison to expectations can have a much stronger impact on stock price. If the company is doing better than expected, chances are that this will push the stock price higher over time.

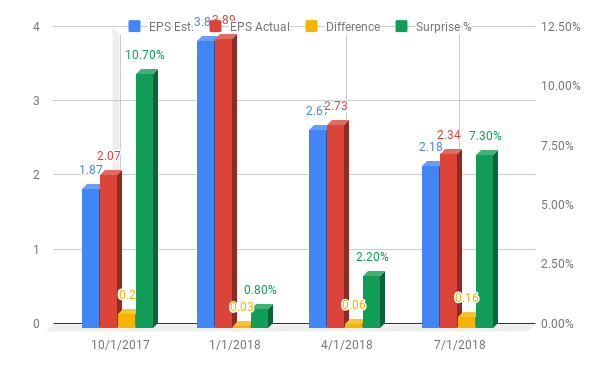

Apple has reported better than expected earnings numbers over the past four consecutive quarters. The chart shows the expected earnings number, the actual reported figure, and the difference between earnings and expectations both in absolute and percentage terms.

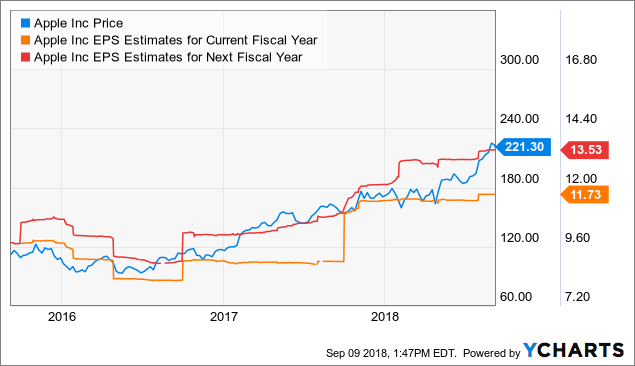

Since mid-2016 Wall Street analysts have considerably raised their earnings expectations for Apple in both the current year and next fiscal year. Like usually happens, the stock price and earnings forecasts tend to move in the same direction over time.

As long as this trend remains in place, rising earnings estimates should be a strong upside fuel for the stock.

Vigorous Relative Strength

Relative strength tends to be sustained over time. In other words, stocks that are outperforming the market in general and the sector in particular tend to continue doing so over the next few months more often than not.

Besides, money has an opportunity cost. When you buy a stock with mediocre returns, that capital is not available for investing in companies with superior potential. This means that you don't want to just buy stocks that are doing well, you really want to buy stocks that are doing better than others.

Apple is substantially outperforming both the SPDR S&P 500 (SPY) and the PowerShares (QQQ) on a year-to-date basis. In terms of relative strength, the stock doesn't leave much to be desired.

Putting It All Together

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for Apple: financial quality, valuation, fundamental momentum and relative strength.

The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There's clearly a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns and vice versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Apple is among the best 10% of stocks in the market based on the quantitative algorithm. The company has a PowerFactors ranking of 99.5, and it enjoys strong metrics across the four factors considered: Financial quality, valuation, fundamental momentum, and relative strength.

Historical performance does not guarantee future returns, and performance numbers for quantitative systems should always be interpreted with caution, since the future is always a matter of possibilities and probabilities as opposed to certainties.

A quantitative system can tell you that a specific group of companies with certain quantitative attributes has a good chance of delivering market-beating returns over long periods of time, but it does not tell you much about a particular stock.

In the case of Apple, the smartphone industry is maturing on a global scale, especially when it comes to high-end devices. Since Apple can't continue rising prices for the iPhone indefinitely, it makes sense to expect some kind of deceleration in revenue growth in the iPhone segment over the coming years.

Apple will need to successfully transition toward services and/or add more products to its portfolio if it's going to sustain revenue growth in the years ahead. Management seems to be on the good track to achieving this, but this transition is still an important risk factor to consider.

The quantitative system alone does not tell you the whole story - it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Apple stock.

That being acknowledged, making investment decisions based on quantified data is certainly a sounder approach than relying entirely on emotions and subjectivity when picking stocks. Besides, looking at the big picture makes more sense than obsessing too much about the small details. If the quantitative evidence is any valid guide, Apple stock well positioned for attractive performance going forward.

Disclosure: I am/we are long AAPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more