Apple Jumps After Beating Across The Board, Announcing Massive $90 Billion New Stock Buyback

Image Source: Unsplash

With all other super-tech companies reporting solid earnings (ok, AMZN fumbled on AWS guidance on the call, but its earnings were also stellar) and successfully propping up a market that is on edge every single day over which insolvent regional bank JPMorgan will swallow next, all eyes were on the results from the last giga-cap Kahuna, the world's largest company, Apple.

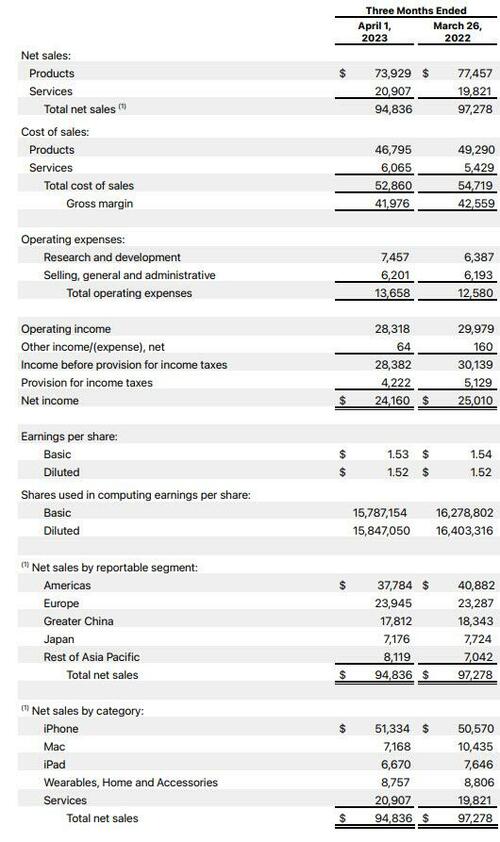

For the second quarter, Wall Street is expecting revenue of about $92.6 billion, a sharp decline from the over $97 billion reported in the year-ago quarter. That’s in-line with Apple’s estimate that Q2 will follow a similar trajectory to the decline in Q1. If the numbers hold, that means Apple will be reporting an annual decline two quarters in a row, a nearly unprecedented event for the iPhone maker.

If the estimates for the quarter are accurate...

- iPhone revenue: $49 billion, down from $50.6 billion

- iPad revenue: $6.7 billion, down from $7.6 billin

- Mac revenue: $7.7 billion, down from $10.4 billion

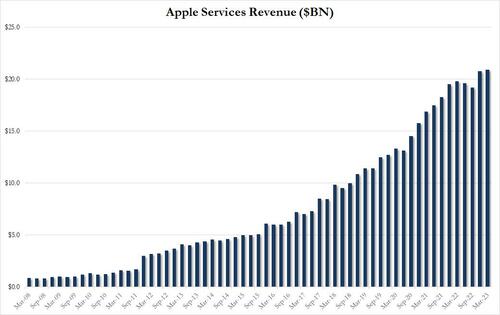

- Services revenue: $21.1 billion, up from $19.8 billion

- Wearables/Home/Accessories revenue: $8.5 billion, down from $8.8 billion

... Apple will be reporting declines in every single one of its product categories but will see growth in services according to Bloomberg. Last quarter, Wall Street was off quite a bit on some of its numbers, including wearables and the Mac, though Apple already told us this time around there would be an overall decline and a negative hit toward the Mac and iPad, so these estimates will probably be fairly accurate.

While a weak quarter is priced in, focus will fall squarely on June quarter guidance where Goldman previewed an expectation for AAPL to guide June revenues to decline -3% yoy, with Products revenue down y/y and Services revenue growth.

With Apple stock dramatically outperforming ahead of earnings -- shares are up more than 27% year-to-date and have outperformed the Nasdaq 100 Index - a disappointment here could shake not only AAPL stock but the broader market. Indeed, blowout results from Microsoft and Meta may have set the bar too high for Apple, and today’s report may make for "sobering reading" according to Bloomberg.

One final point: it is hardly a secret that AI has been the buzzword of earnings season for tech so far. The full phrase or just “AI” was mentioned dozens of times across the earnings releases and analysts calls for Meta, Amazon, Alphabet (parent of Google) and Microsoft. It was also the focus of many analyst questions. In Apple’s case, we’ve heard little publicly about what they’re doing in the field including on their progress in self-driving cars. Siri, the AI-powered voice assistant, is also a focus of interest and frustration for lots of users.

With all that in mind, moments ago AAPL just reported fiscal Q2 results which may keep the market levitation going for at least a few more days after it blew away both top and bottom line expectations (despite some weakness in Mac, iPad and services revenues):

- EPS $1.52 vs. $1.52 y/y, beating estimates of $1.43

- Gross margin $41.98 billion, -1.4% y/y, beating estimates of $40.98 billion

- Revenue $94.84 billion, -2.5% y/y, beating estimates of $92.6 billion (Bloomberg Consensus)

- Products revenue $73.93 billion, -4.6% y/y, beating estimates of $71.91 billion

- IPhone revenue $51.33 billion, +1.5% y/y, beating estimates of $48.97 billion

- Mac revenue $7.17 billion, -31% y/y, missing estimates of $7.74 billion

- IPad revenue $6.67 billion, -13% y/y, in line with estimates of $6.69 billion

- Wearables, home and accessories $8.76 billion, -0.6% y/y, beating estimates of $8.51 billion

- Service revenue $20.91 billion, +5.5% y/y, missing estimates of $21.11 billion

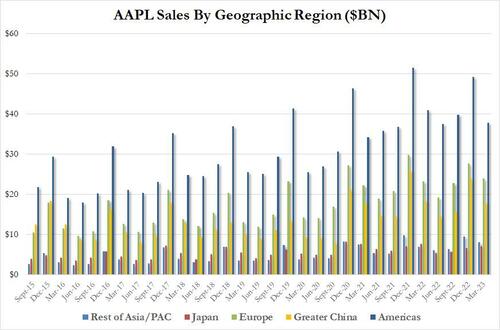

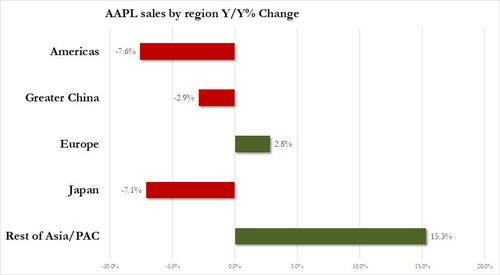

- Greater China rev. $17.81 billion, -2.9% y/y, beating estimates of $17.16 billion

- Cash and cash equivalents $24.69 billion, -12% y/y

And while we wait for the company's guidance during the 5 pm call, the market will be happy to hear that Apple has just authorized a new, record $90 billion stock buyback, as CFO Luca Maestri said: "given our confidence in Apple's future and the value we see in our stock, our Board has authorized an additional $90 billion for share repurchases."

Looking at the revenue breakdown, Apple beat consensus in half the categories and missed in the other half, notably iPad and Macs:

- iPhone revenue $51.33 billion, +1.5% y/y, beating estimates of $48.97 billion

- Mac revenue $7.17 billion, -31% y/y, missing estimates of $7.74 billion

- IPad revenue $6.67 billion, -13% y/y, in line with estimates of $6.69 billion

- Wearables, home and accessories $8.76 billion, -0.6% y/y, beating estimates of $8.51 billion

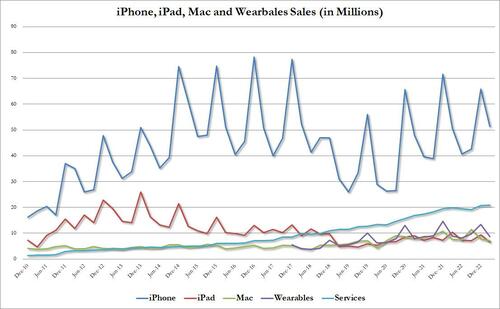

The good news here is that IPhone sales not only blew away expectations by over $2 billion, but were up compared to the same period last year to $51.3B billion. Analysts had expected a small dip. According to Bloomberg, "the iPhone 14 did well better than expected in Q2 after supply chain issues were resolved. The iPhone hit a March quarter record."

Of note, as previewed above, Mac sales are down for the second consecutive quarter to $7.17B. Industry analyst IDC released grim figures last month saying that Apple saw its worst decline in computer shipments in over 20 years during the quarter.

Moving on, iPad sales were $6.67 billion, about in line with estimates and resuming a slog of declines after a holiday season jump in its last report. Finally, while wearables saw a modest Y/Y decline in revenue, it beat estimates modestly.

What is more concerning is that AAPL appears to be reaching a "double top" in product revenue:

Here is what CEO Tim Cook told shareholders in the press release:

“We are pleased to report an all-time record in Services and a March quarter record for iPhone despite the challenging macroeconomic environment, and to have our installed base of active devices reach an all-time high”

While that may be true, the 5.5% increase in Services revenue to a below expectations $20.9 billion was disappointed with consensus hoping for a $21.1 billion number.

One other place where investors may have been pleasantly surprised was China sales, which at $17.812 billion, beat the estimate of $17.16 billion.

That said, the number was still a 2.9% drop, while however was small compared to the biggest decline which took place right in the good ole' US ofA, where sales tumbled 7.6% Y/Y.

The stock initially exploded higher after the company trounced expectations and following news of the massive $90 billion new buyback, but after algos dug into the numbers, they have since faded much of the move with the stock just barely in the green in afterhours trading.

(Click on image to enlarge)

More By This Author:

Qualcomm Plunges After Smartphone Demand Weakness Persists

Fed Hikes 25bps As Expected, Signals 'Hawkish Pause'; Warns Of 'Tighter Credit Standards'

Oil Plunges To Most Oversold In Two Years Amid CTA Shorting Frenzy

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more