Apple Down 7% Year To Date On Iphone Weakness: Buy Or Hold The Stock?

Image Source: Unsplash

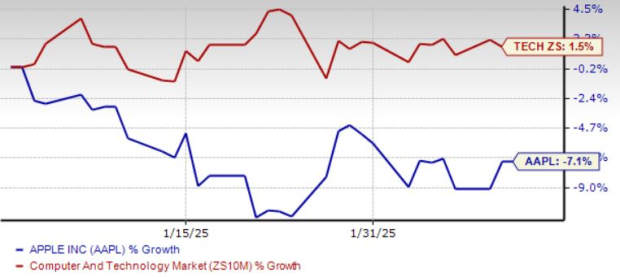

Apple (AAPL - Free Report) shares have declined 7.1% year to date, underperforming the broader Zacks Computer & Technology sector’s 1.5% growth. The company has been suffering from sluggish demand for iPhone in China amid increasing competition from the likes of Huawei and Xiaomi as well as lack of Apple Intelligence.

Although iPhone sales decreased 0.8% year over year to $69.14 billion in first-quarter fiscal 2025, Apple saw better iPhone 16 sales in those regions where Apple Intelligence was available. iPhone’s active installed base grew to an all-time high and saw a record level of upgrades in the reported quarter. As per Kantar, iPhone was a top-selling model in the United States, Urban China, India, the U.K., France, Australia and Japan.

Although Greater China sales decreased 11.1% year over year, Apple benefited from strong sales in a number of emerging markets, including India. In first-quarter fiscal 2025, the iPhone was the top-selling model in the country. The company saw double-digit growth in the installed base in the emerging markets.

AAPL Stock’s Performance

Image Source: Zacks Investment Research

Apple launched the first set of Apple Intelligence features in U.S. English for iPhone, iPad and Mac, and introduced more features and expanded to more countries in December. Apple Intelligence is now available in Australia, Canada, New Zealand, South Africa and the U.K.

In April, Apple is set to launch the next level of language updates with Apple Intelligence, including French, German, Italian, Portuguese, Spanish, Japanese, Korean, simplified Chinese, and localized English to Singapore and India. This is expected to boost iPhone upgrades and further increase in installed base.

However, will this push the stock higher in 2025? Let’s dig deep to find out.

Can Service Momentum Aid Apple’s Prospects?

AAPL’s Services business is expected to drive top-line growth. It now has more than 1 billion paid subscribers across its Services portfolio, more than double what it had four years ago. The expanding content portfolio of Apple TV+, Apple Music and Apple Arcade, as well as the growing user base of Apple Pay, has helped drive subscriber growth.

Although Apple’s business primarily runs around its flagship iPhone, the Services portfolio has emerged as the company’s strong growth driver. In the fiscal first quarter, Services revenues grew 14% year over year to $26.34 billion and accounted for 21.2% of sales.

The Services business benefits from the growing demand for Apple TV+ content and the adoption of Apple Pay. It has expanded Tap to Pay on iPhone to more markets, including the U.A.E., Chile, Japan, Canada, Italy and Germany. Apple Pay is now available in countries like Egypt and Uruguay. The expanding content portfolio of Apple TV+ is noteworthy.

Apple expects the March-end quarter’s (second-quarter fiscal 2025) revenues to grow low double digits on a year-over-year basis.

AAPL Estimates Show Downward Trend

The Zacks Consensus Estimate for Apple’s second-quarter fiscal 2025 earnings has declined 4.2% to $1.61 per share over the past 30 days, indicating 5.23% growth from the figure reported in the year-ago quarter.

Apple’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average earnings surprise being 4.39%.

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Apple Shares Overvalued

The AAPL stock is not so cheap, as the Value Score of D suggests a stretched valuation at this moment.

Apple is trading at a premium with a forward 12-month P/E of 30.45X compared with the sector’s 26.88X and higher than the median of 29.85X, reflecting a stretched valuation.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

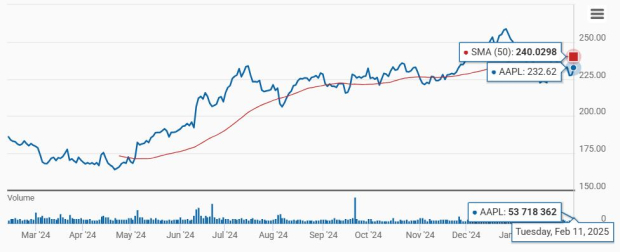

AAPL shares are now trading below the 50-day moving average, indicating a bearish trend.

Apple Trades Below 50-day SMA

Image Source: Zacks Investment Research

AAPL Shares: Buy, Sell or Hold?

Apple’s AI push with Apple Intelligence is noteworthy. However, it is still playing catch up with the likes of Microsoft (MSFT - Free Report) , Alphabet (GOOGL - Free Report) and Amazon (AMZN - Free Report) .

Although the Services business has emerged as AAPL’s new cash cow, with an expanding content portfolio for Apple TV+, we believe that Apple Intelligence will take some time to go mainstream.

Hence, we believe that Apple’s near-term growth prospects do not justify a premium valuation.

AAPL currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

More By This Author:

Stocks To Watch As Trump Announces 25% Tariffs On Steel & Aluminum

5 Heavy Construction Stocks Worth Watching In A Thriving Industry

Buy Disney Or Qualcomm Stock After Crushing EPS Expectations?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more