Apollo Medical May Be A Healthy Choice

Summary

- 100% technical buy signals.

- 19 new highs and up 66.04% in the last month.

- 247.46% gain in the last year.

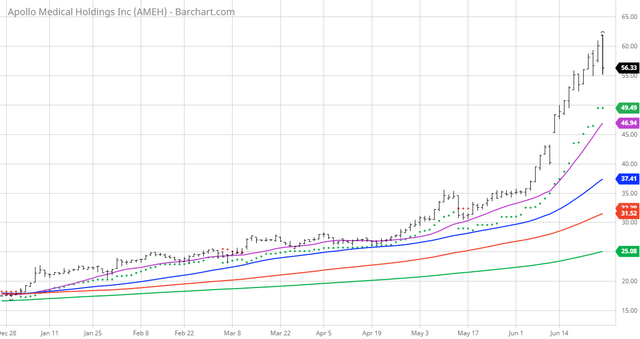

The Barchart Chart of the Day belongs to the healthcare management company Apollo Medical (Nasdaq: AMEH). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. That resulted in a watch list of 82 stocks. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 5/18 the stock gained 15.20%.

Apollo Medical Holdings, Inc., a physician-centric technology-powered healthcare management company, provides medical care services. The company is leveraging its proprietary population health management and healthcare delivery platform, operates an integrated, value-based healthcare model which empowers the providers in its network to deliver care to its patients. It offers care coordination services to patients, families, primary care physicians, specialists, acute care hospitals, alternative sites of inpatient care, physician groups, and health plans. The company's physician network consists of primary care physicians, specialist physicians, and hospitalists. It serves patients, primarily covered by private or public insurance, such as Medicare, Medicaid, and health maintenance organization plans; and non-insured patients in California. The company was founded in 1994 and is headquartered in Alhambra, California.

Barchart technical indicators:

- 100% technical buy signals

- 276.03+ Weighted Alpha

- 247.46% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 19 new highs and up 66.04% in the last month

- Relative Strength Index 70.91%

- Technical support level at 57.90

- Recently traded at 56.38 with a 50 day moving average of 37.42

Fundamental factors:

- Market Cap $3.31 billion

- P/E 46.89

- Revenue expected to grow 3.30% this year and another 49.90% next year

- Earnings estimated to increase 26.70% this year

- Wall Street analysts issued 1 buy recommendation on the stock

- 668 investors are monitoring he stock on Seeking Alpha

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AMEH over the next 72 hours.

Disclaimer: The Barchart Chart of the Day highlights stocks ...

more