Another Yearly High: Is AMD Stock Set For More Gains Ahead?

Sometimes you just can’t get enough of a good thing. This kind of sentiment might apply right now to semiconductor giant Advanced Micro Devices (AMD).

The stock continued its yearly surge, notching another 52-week high today and closing at $41.29 per share. AMD climbed to the summit of the S&P 500 top performing stocks after recording gains of more than 100% year-to-date.

Contributing factors for the extended rally this year include AMD’s earlier partnership with Google on its Stadia cloud gaming service, which utilizes a custom AMD GPU. Additionally, last week AMD announced that Tencent, which now has more than 1.1 million active servers, will use the chipmaker’s second-generation EPYC processors for its cloud-computing service.

Rosenblatt’s Hans Mosesmann doesn’t think the rally is about to end anytime soon. After hosting an institutional investor meeting with AMD management, the 5-star analyst came away with a smile, noting, “Given AMD’s superior performance in 2019 and ambitious CPU/GPU roadmaps for the next several years, there was keen interest in our meetings particularly from longer term investors. Our confidence in the company’s strategy is enhanced.”

Mosesmann is “setup for steady Eddy share gains” and reiterated his Buy rating along with a target price of $52. Not only does this imply upside of 30%, it also suggests a new all-time-high is on the cards. (To watch’s Mosesmann’s track record, click here)

The analyst also noted that while Intel’s recent shortages at the low end of the CPU market might have benefitted AMD, the company refutes that as a reason for its success. Although this sector has traditionally been AMD’s bread and butter, the company “is selling into the mid-to-high end of desktops, and even notebooks” and has other targets in its sight: “In 2020, AMD expects it to be the year of mobile Ryzen with 7nm set to ramp (deep wins in consumer/commercial) and where we see the company’s relative advantage significantly better than in desktops given the need for performance, core-counts, efficiency, and battery life.” The analyst said, concluding, “AMD’s 3-year roadmap, strategic partnerships, and new product roll-outs point to socket wins that are “sticky”, sustainable, and long-term focused.”

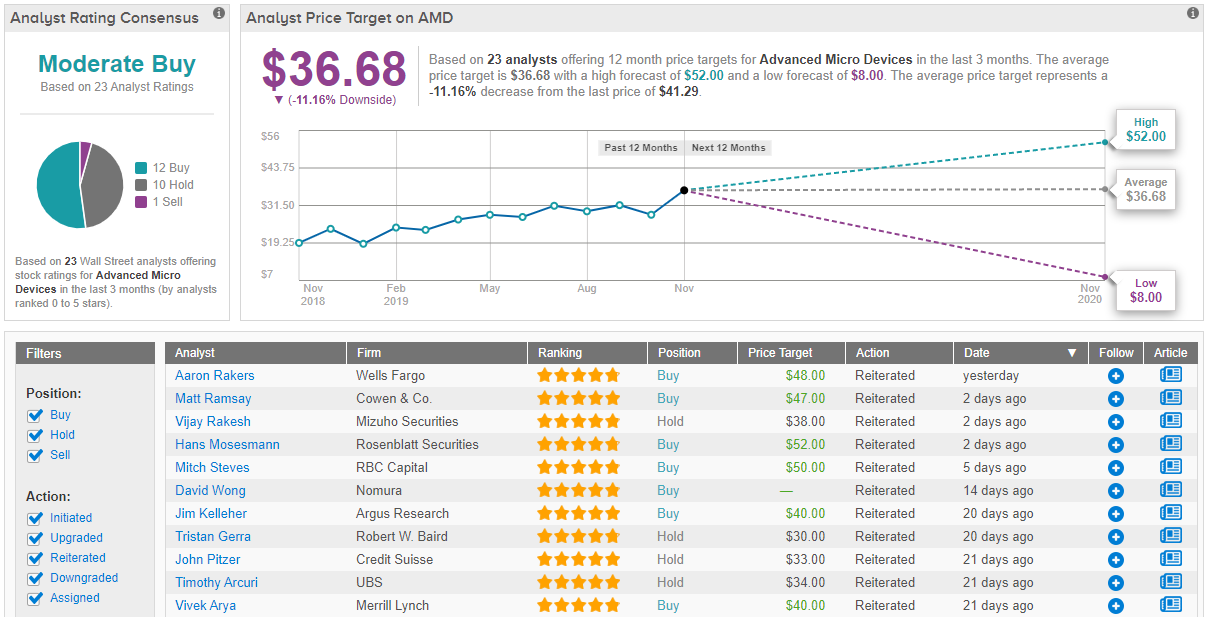

Interestingly, in contrast to Mosesmann’s bullish stance, the Street is lukewarm at present regarding the chip giant’s prospects. Based on 21 analysts tracked by TipRanks in the last 3 months, 12 rate AMD a “buy,” 10 suggest “hold,” and one recommends “sell.” The 12-month average stock-price forecast stands at $36.68, marking an 11% downside from where the stock is currently trading. This could be down to analysts not yet updating their price target or simply down to the fact some might believe AMD has rallied too far this year and is due a pullback sometime soon. Time will tell.

(See AMD stock analysis on TipRanks)

Disclaimer: TipRanks is an independent cloud based service that measures and ranks ...

more