Another 75 Point Hike?!

(Click on image to enlarge)

On Friday morning the BLS reported that the US economy added 263,000 jobs in September – a solid report. But the S&P dropped 2.80% and the Nasdaq 3.80%. Why? Because we are once again in the “bad news is good news” mindset.

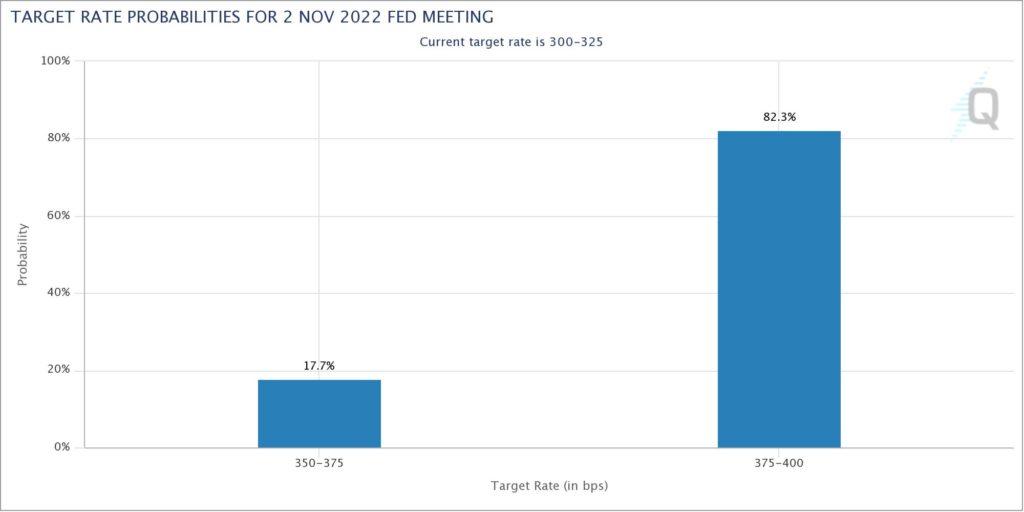

Bad news means the economy is weakening which raises the probability that the Fed will ease off the gas pedal in its mission to crush inflation. Good news means the economy is strong and lowers the probability that the Fed will do so. After Friday’s September Jobs Report Fed Futures were pricing in an 82% chance of another 75-point hike on November 2. Hence essentially all of the gains from Monday and Tuesday – which got the technicians so excited – were erased by Friday.

This week the focus will be on the September CPI Report to be released Thursday, October 13 at 8:30 am EST.

With the Nasdaq closing essentially at the lows for the year and the Fed still hellbent on not appearing wishy washy on inflation the path of least resistance remains down.

More By This Author:

Use The Bounce To Clean Up Your PortfolioMU: Demand Has Collapsed

KMX: Consumers Are Scrapping Discretionary Purchases