Analyzing Retail Earnings In A High-Tariff Economy

Image Source: Unsplash

- With more than 98% of the earnings reports already in, we can safely say that it has been a good reporting cycle, with the growth pace showing a notable accelerating trend and companies comfortably beating consensus estimates.

- Total earnings for the 491 S&P 500 companies that have reported results are up +14.8% from the same period last year on +5.8% higher revenues, with 76.4% beating EPS estimates and 65.2% beating revenue estimates.

- The reporting focus is shifting to the Retail sector, where the brick-and-mortar operators are on deck to report results in the days ahead. However, more than half of the Zacks Retail sector companies have already reported Q4 results.

- For the Zacks Retail sector, we now have Q4 results from 98.3% of the sector’s market capitalization in the S&P 500 index. Total earnings for these companies are up +28.8% from the same period last year on +6.0% higher revenues, with 75.9% beating EPS estimates and 72.4% beating revenue estimates. Excluding Amazon’s results from the reported Retail sector numbers, the Q4 earnings and revenue growth rates adjust down to +3.0% and +4.3%, respectively.

Tariffs Amplify Retail Sector’s Earnings Woes

The earnings focus lately has been on the Retail sector, with big-box operators coming out with quarterly results, though headlines about tariffs have been stealing the thunder. Target (TGT - Free Report) and Best Buy (BBY - Free Report) became the latest retailers to report good-enough results for the holiday quarter, but Target guided lower on comps while Best Buy didn’t provide any guidance.

Tariffs are a much bigger headwind for Best Buy than Target, as almost all of its products are sourced from abroad, with China and Mexico as the major exporting markets. Target noted on the call that they have significant exposure to fresh produce in Mexico but rely on domestic supplies for roughly half of their cost of goods sold and have plenty of flexibility in their supply chain. That said, management cited tariffs as one of the reasons for the downgraded comp guidance.

Beyond Target and Best Buy, the restrictive tariff regime is problematic for retailers as they will have to absorb all or part of the tariff-driven increased product cost if they can’t pass it on to their customers for competitive reasons. That’s a hit to their margins. It will burden customers if they pass on the incremental cost increases, potentially weighing on sales.

Part of Target’s reduced comp guidance reflected signs of weakness in February that were also corroborated by other macroeconomic data like consumer confidence, jobless claims, and the internals of the latest ISM readings. This has raised concerns in the market that the tariff impositions have likely exacerbated these softer February readings.

Best Buy’s results showed strong performance during the holidays, with the company coming out with its first positive comp growth since the 2021 Q3 period. In addition to the company’s new sales measures during the holidays, Best Buy noted favorable demand trends in the mobile phones and computer categories, reflecting product innovation and replacement demand.

Given the new tariffs, it’s uncertain to what extent these favorable trends will remain in place. The company had estimated that the earlier 10% tariff on China was a roughly 100 basis points negative hit to comps.

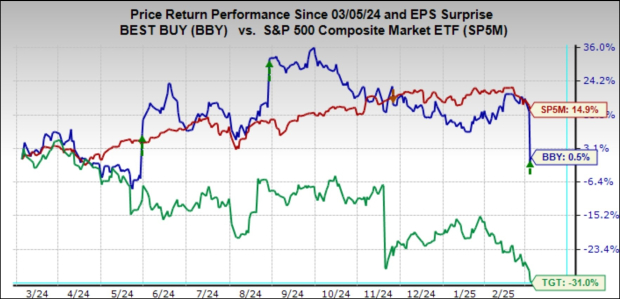

Unlike Target, Best Buy shares had held up relatively better prior to this quarterly release. But the stock has given up most of its earlier gains, as seen in the chart below that shows the one-year performance of Best Buy and Target relative to the S&P 500 index.

Image Source: Zacks Investment Research

Tech Sector’s Earnings Outlook Begins to Shift

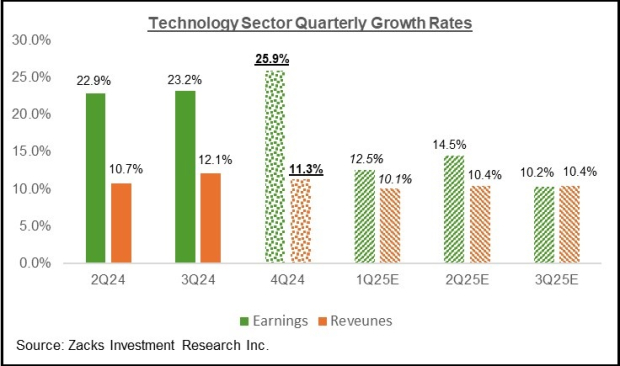

The Tech sector has been a significant growth driver in recent quarters, and we saw the same trend at play in 2024 Q4. For Q4, Tech sector earnings are expected to be up +25.9% from the same period last year on +11.3% higher revenues, the 6th quarter in a row of double-digit earnings growth.

This would follow the sector’s +23.2% earnings growth on +12.1% higher revenues in 2024 Q3. As the chart below shows, the sector’s growth trajectory is expected to continue in the coming quarters.

Image Source: Zacks Investment Research

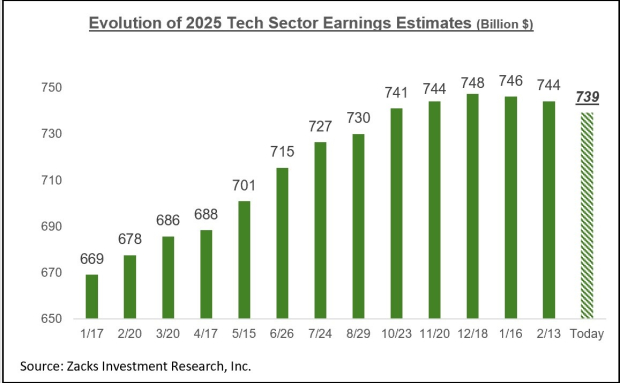

The Tech sector has also been among those few sectors that have steadily enjoyed an improving earnings outlook, with estimates steadily increasing. However, the more recent data on this count shows a shift in the revisions trend, as the chart below of aggregate 2025 earnings estimates for the sector shows.

Image Source: Zacks Investment Research

The Earnings Big Picture

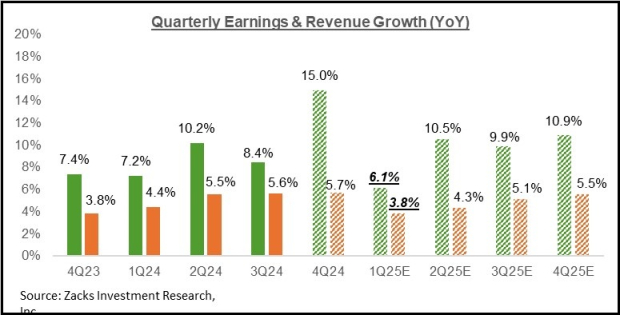

The chart below shows expectations for 2024 Q4 in terms of what was achieved in the preceding four periods and what is currently expected for the next four quarters.

Image Source: Zacks Investment Research

l is the only sector whose estimates have increased). Sectors suffering the most significant cuts to estimates include Conglomerates, Aerospace, Construction, Basic Materials, Autos, and others. Unlike other recent periods, estimates for the Tech sector have also been under pressure.

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

In fact, 2025 is expected to have nearly all Zacks sectors enjoy earnings growth, with 6 of the 16 Zacks sectors expected to produce double-digit earnings growth. Unlike the last two years, when the Mag 7 group drove all or most of the aggregate earnings growth, we will have double-digit S&P 500 earnings growth in 2025, even without the contribution from this mega-cap group.

More By This Author:

Q4 Earnings Cycle Continues: Retail Results In FocusRetail Earnings: An In-Depth Analysis

Home Improvement Retailers Face Tough Earnings Environment