An Uneventful Week For The S&P 500

After the previous week's Fed-driven volatile action, investors got some relief in the second week of May 2023.

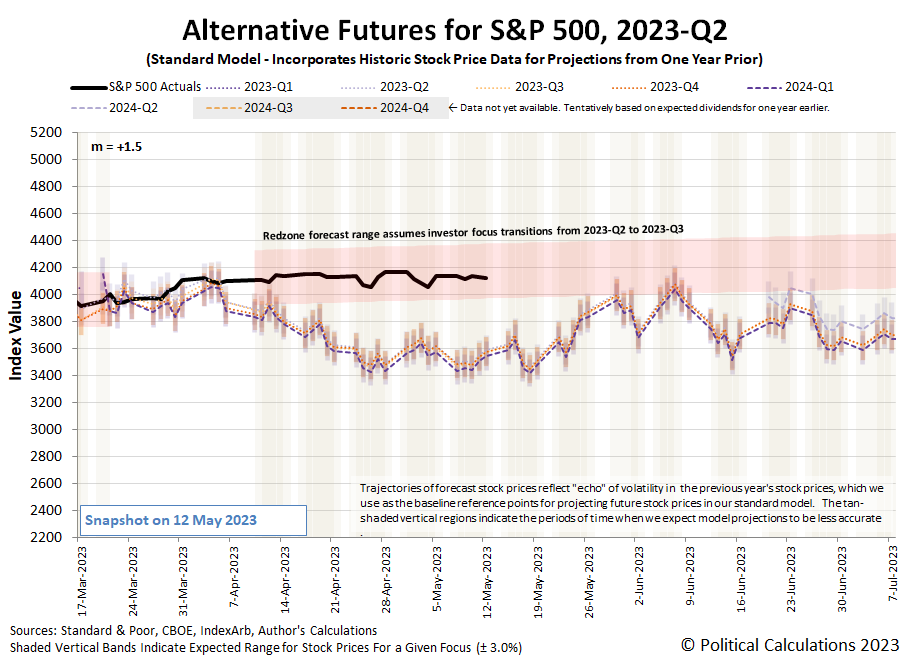

Despite the relative stillness, there wasn't enough positive news to offset the negative to boost the U.S. stock market higher. The S&P 500 (Index: SPX) closed the week at 4124.08, down 0.3% from the previous week's level.

The market's most distressed sectors continue to be those most negatively impacted by the Fed's series of rate hikes, which includes regional banks, commercial real estate investment trusts, and financial services firms. That assessment is based on our regular sampling of firms announcing reduced dividend payouts this month, which includes smaller firms that aren't found in the S&P 500.

Meanwhile, the larger cap firms that make up the index have been turning in better-than-expected earnings, so the news is not all gloomy. We'll revisit the earnings outlook for the S&P 500 later this week, but first, here's the latest update to the alternative futures chart.

The trajectory of the S&P 500 continues to track well within the redzone forecast range indicated on the chart.

But then, that's exactly what should be expected for such an overall uneventful week. Here is our summary of what passed for the week's market-moving headlines.

Monday, 8 May 2023

- Signs and portents for the U.S. economy:

- Bigger trouble developing in the Eurozone:

- Mixed economic signs for global economy out of Asia:

- BOJ minions worried about inflation overshooting their target:

- ECB minion doesn't say anything insightful:

- Wall Street ends near flat ahead of inflation data

Tuesday, 9 May 2023

- Signs and portents for the U.S. economy:

- Fed minions try to pretend they're not done with rate hikes, claim economy is slowing in "orderly" manner:

- Bigger trouble developing in China:

- BOJ minions say never-ending stimulus will never end, get reason to continue:

- ECB minions excited by high rates, thinking about hiking them higher:

- Wall Street closes down as focus shifts to inflation data, debt talks

Wednesday, 10 May 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to pivot away from rate hikes sooner after better-than-expected inflation report:

- BOJ minions say they'll say when they'll end never-ending stimulus, see faster growth in Japan:

- Non-ECB minion says ECB will be done with rate hikes this year, ECB minions say their rate hikes will be "more marginal" and are near peak:

- Nasdaq rallies as investors cheer inflation data, Alphabet

Thursday, 11 May 2023

- Signs and portents for the U.S. economy:

- Fed minions claim they'll keep interest rates high for "extended" time, admit climate change isn't serious financial risk:

- Bigger trouble developing in Asia:

- ECB minions think services are where their inflation problem is:

- Dow, S&P 500 fall with Disney; PacWest leads regional banks lower

Friday, 12 May 2023

- Signs and portents for the U.S. economy:

- Fed minions say they're not done fighting President Biden's "insidious" inflation with rate hikes, claiming they're on the right track:

- Stocks Fall as Banking, Inflation Concerns Linger

As in previous weeks, we've omitted the week's news coverage of the debt ceiling debate in Washington, D.C. in this week's summary. For all the headlines being generated about it, there's little sign it's contributing more than minimal noise to the trajectory of stock prices at this point of time. That may change and, if and when it does, we'll take note of whatever news it is that moves the needle for stock prices.

The CME Group's FedWatch Tool continues to indicate investors believe the Fed has reached the end of the series it began in March 2022 to combat President Biden’s inflation. The FedWatch Tool continues to project the Fed will hold the Federal Funds Rate at a target range of 5.00-5.25% until its 20 September (2023-Q3) meeting, at which time the Fed will initiate a series of quarter point rate cuts at six-to-twelve-week intervals to address building recessionary conditions in the U.S.

The Atlanta Fed's GDPNow tool projects a real GDP growth rate of +2.7% in 2023-Q2, up slightly from the +2.5% growth rate it anticipated a week earlier.

More By This Author:

Global Economy Heated Up, But Will It Continue?

Rebound In Trade Between U.S. And China Hides Troubling Developments

Older Teens, Younger Teens Experiencing Different Employment Trends

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more