An Anatomy Of A Market Price Shift Using Microsoft

“Davidson” submits:

Hindsight is the best form of self-education. This is especially true when honing one’s investment skills. With the thousands on thousands of market predictions provided every year, few take the time to review market performance with financial performance and include simple changes in market psychology. Hindsight is most useful when comparing market performance against concurrent market psychology and financial performance.

Microsoft (MSFT), the 2nd largest component of the SP500 next to Apple (AAPL), provides a good example of the ‘mind-over-matter’ irrationality of market prices that has confused and frustrated investors for centuries. Many believe that Modern Portfolio Theory(MPT) of Nobel Laurate Markowitz(1952), the basis of accreditations globally for business, is the best model for investing. MSFT’s history as told through charts of its share price and financial metrics tells us markets are not as simple as ubiquitously taught MPT.

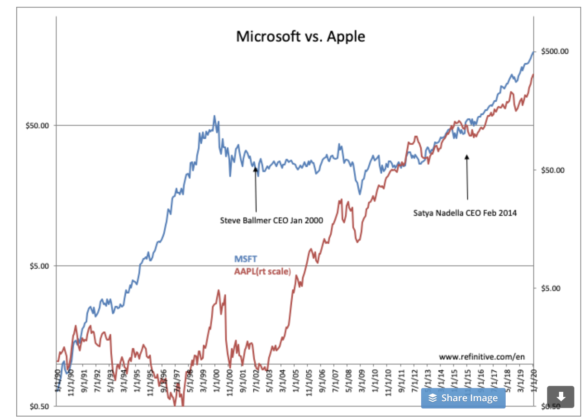

MSFT has been under a greatly-respected new CEO guidance since Feb 2014 and since Jan 2016 has soared just over 330% to become the 2nd largest component to its long-term rival APPL. APPL soared 345% over the same time period. What drove these price expansions? Was it Revenue expansion, an expansions in margins and Net Income? What occurred here that resulted in 300% gains for these already well known and substantial companies? The answer may be startling!

(Click on image to enlarge)

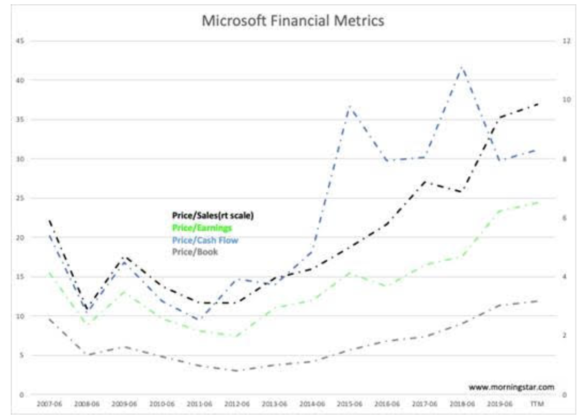

MSFT is used as the example because of its record of consistent management with smooth CEO transitions from Bill Gates to Steve Ballmer in 2000 and then from Ballmer to Satya Nadella in 2014. Very favorable market opinion with Gates as CEO slipped substantially under Ballmer has since been revived under Nadella. The financial performance reveals very healthy Revenue growth and margins which fell once Nadella took the reins In 2104. Gross Margins have not recovered even though Operating and Net Income Margins have returned to when Ballmer was CEO. The recent pop in Net Income came as a result of MSFT’s tax rate dropping from a normalized 20%-30% range to ~11% in 2019. There have been no increases of any magnitude that would justify the surge in MSFT share price since 2016. AAPL’s metrics even though showing excellent business margins reveal Revenue slowed dramatically with the passing of its creative-force Steve Jobs in 2012. AAPL’s Revenue growth since 2015’s $233Bill to 2019’s $260Bill has been 2.7% annually. So this justifies a 345% price gain?

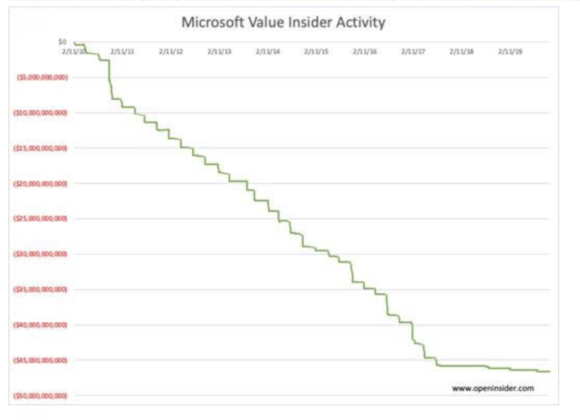

The insider buying history is presented for MSFT revealing no correlations with pricing or changes in financial trends. If one calculates and plots the net insider capital flow for MSFT one gets the chart shown. Since 2010, MSFT insiders have extracted $47Bill, according to openisider.com while the overall share count declined somewhat.

What becomes very obvious is that MSFT and competitor AAPL have not suddenly found new sources of revenue or profitability. Yet, a key metric, Pr/Sales has doubled for each without corresponding revenue growth with many glowing commentaries by analysts and investment managers. What has occurred has been a sharp shift towards optimistic market psychology without a corresponding underpinnings of financial performance. MSFT’s financial performance under CEO Ballmer was quite decent. Under CEO Nadella financials have been mixed to date. Even so, share performance under Ballmer was non-existent as prices soared for his replacement. Was it a difference in personality and presentations to analysts? This is impossible to measure but is the only explanation to differences in price performance during each’s tenure. Market psychology, in my opinion, plays a significant role in prices. Once, MSFT and AAPL developed price-uptrends and Momentum Investors have piled on.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

MSFT and AAPL are 2 of many examples of ‘mind-over-matter’. Most dismiss these instances as outliers with regards to MPT. One only has to begin a security by security examination to learn that the vagaries of market psychology brings unique pricing to every security. But, outliers to MPT are the rule. In fact, the rules between financial metrics and market pricing differ widely. There does exist a pattern of economic and business fundamental trends leading to positive market psychology over time and higher prices. Market history shows investors almost always discover companies growing Revenue and Net Income and once discovered rewards them with higher share prices. But, one must be diversified and patient for other investors to discover issues not previously discovered especially when many are chasing price trends of the likes of MSFT and AAPL.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more