An Alzheimer’s Drug Could Supercharge This High-Risk Stock. Is It Worth A Buy Here?

Image Source: Pixabay

- vTv Therapeutics is a $156 million biopharma focused on small molecule drugs for Alzheimer’s, diabetes, and inflammatory disorders, all in clinical trials.

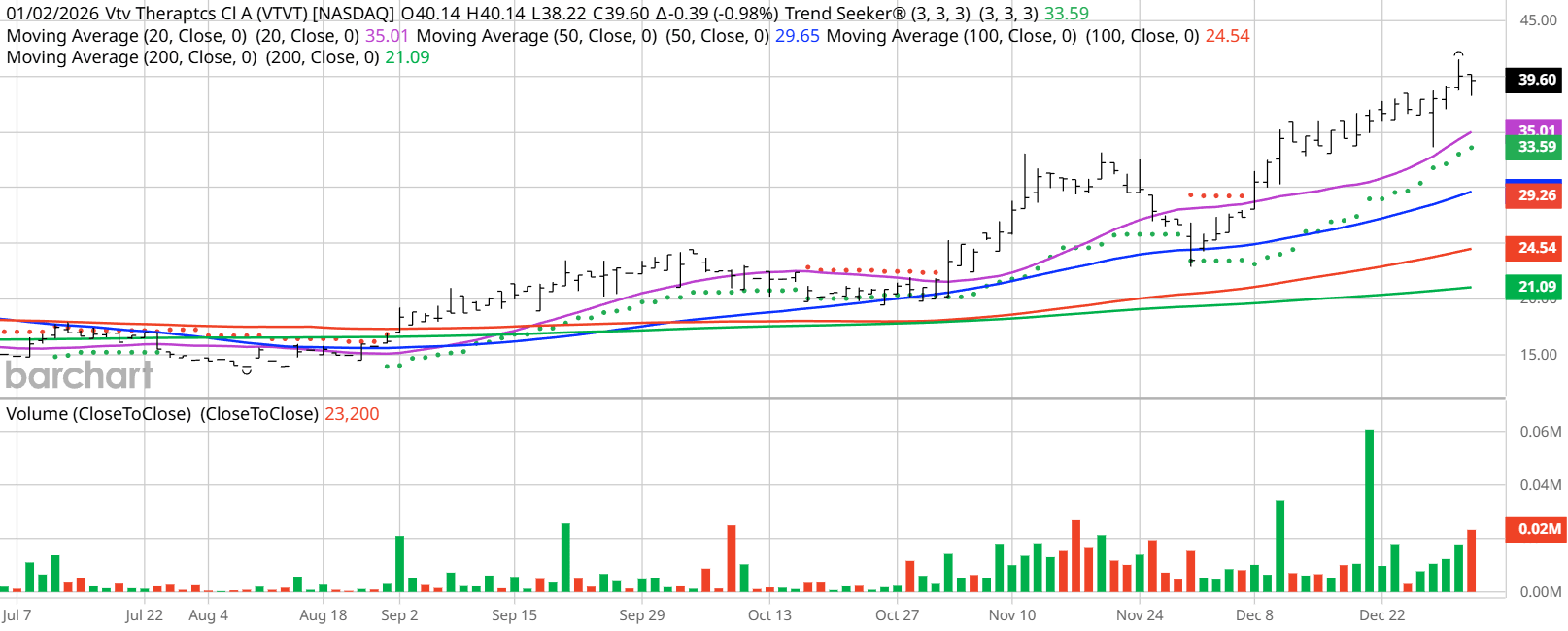

- VTVT has surged 182% over the past year, hitting a two-year high, with strong technical momentum.

- Wall Street leans “Strong Buy” with targets up to $47, but some advisors are more cautious.

- VTVT is a speculative, technically driven play with fundamentals highly uncertain due to all its revenue and earnings hinging on unproven pipeline assets.

Today’s Featured Stock

Valued at $156 million, vTv Therapeutics (VTVT) is a biopharmaceutical company engaged in the discovery and development of orally administered small molecule drug candidates to fill unmet medical needs.

Its drug candidate for the treatment of Alzheimer’s disease is azeliragon TTP488, which is in Phase 3 clinical trials, and it has other candidates for Type 1 and Type 2 diabetes, cancers, psoriasis, and COPD, among others.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. VTVT checks those boxes. Since the Trend Seeker signaled a new “Buy” on Dec. 8, the stock has gained 35.86%.

(Click on image to enlarge)

Barchart Technical Indicators for vTv Therapeutics

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

vtv Therapeutics scored a new 2-year high of $41.49 on Dec. 31.

- VTVT has a Weighted Alpha of +225.52.

- vTv Therapeutics has a 100% “Buy” opinion from Barchart.

- The stock gained 182.36% over the past year.

- VTVT has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $41.35 with a 50-day moving average of $30.06.

- vTv Therapeutics made 14 new highs and gained 51.55% in the last month.

- Relative Strength Index (RSI) is at 77.02.

- There’s a technical support level around $38.50.

Don’t Forget the Fundamentals

- $156 million market capitalization.

- Since both future revenue and earnings are dependent on drugs that are still in trial stages, it’s difficult to project future fundamentals on this stock.

Analyst and Investor Sentiment on vTv Therapeutics

- Wall Street analysts tracked by Barchart have given 2 “Strong Buy” and 1 “Hold” opinion on the stock with price targets between $35 and $47.

- Value Line ranks the stock “Average.”

- CFRA’s MarketScope Advisor rates the stock as “Sell.”

- Morningstar thinks even with the stock’s recent runup, it’s 22% undervalued with a Fair Value of $51.71.

- 76 investors following the stock on Motley Fool think it will beat the market, while 154 think it won’t.

- 35,850 investors are monitoring the stock on Seeking Alpha, which rates the stock a “Strong Buy.”

- Short interest is low at 0.42% of the float.

The Bottom Line on vTv Therapeutics

This stock is a purely technical play. Its low market capitalization makes it hard for short sellers to take a position, and its future revenue and earnings are just guesses.

More By This Author:

Play The Red-Hot Metals Market With This 1 Aluminum Stock

TechnipFMC - A Top Supplier To The Energy Industry

Aritzia Is Fashionable

Disclosure: On the date of publication, Jim Van Meerten had a position in: more