Amid Fed Cut Chatter, Investors Should Stay Focused On The Long Term

Image source: Pixabay

As for the unemployment rate, it remains low by historical standards. But it has been trending a bit higher. Last month when the unemployment rate was 4.3%, Fed Chair Jerome Powell said: “We do not seek or welcome further cooling in labor market conditions…The time has come for policy to adjust.”

It was one of the more explicit signals that rate cuts would begin soon, a development most market participants welcome. Of course, there are also voices brushing off the rise in unemployment as they argue that the Fed should wait longer until inflation is defeated more definitively.

But we continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario, where inflation cools to manageable levels without the economy having to sink into recession.

It would take a number of rate cuts before we’d characterize monetary policy as being loose, which means we should be prepared for relatively tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be relatively unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy. Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

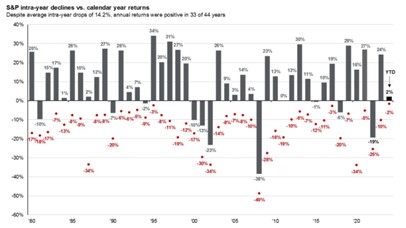

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. Since 1950, the S&P 500 has seen an average annual max drawdown (i.e., the biggest intra-year sell-off) of 14%.

More By This Author:

ADX: A High-Yielding, Diversified CEF Worth Looking IntoORCL: Another Great Quarter With Strong Datacenter Business Growth

International Business Machines: A Less Obvious AI Play That's Powering Ahead

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more