Amgen Is Attractively Valued

Amgen (AMGN) stock has delivered impressive returns in the past year, the biotech leader is up by more than 30% in the past 12 months. However, only because the stock is performing well, this doesn't mean that it is overvalued at current prices.

On the contrary, when considering valuation multiples, cash distributions, and multi-factor return drivers, Amgen looks well positioned for solid returns going forward.

Understanding Where We Are Coming From

Amgen in particular, and the biotech sector in general, have delivered big returns in the past 12 months. To some degree, this is due to the coronavirus pandemic, since both investors and governments are becoming increasingly conscious about the central role that biotech innovators play in the society and in the economy.

In addition to this, the sector has been hurt by regulatory uncertainty, patent expirations, and competition from biosimilars in the past several years. Many of the most profitable biotech companies have traded at aggressively low valuations due to the pricing pressure and regulatory risk that the sector has faced. Amgen was excessively cheap before this rally, and now the stock remains more than reasonably priced.

With Bernie Sanders and Elizabeth Warren losing gravitation in the U.S. political landscape in recent months, the regulatory uncertainty weighing on the biotech sector is dissipating to a good degree, and this is a strong catalyst for the sector.

Competition from biosimilars is a particularly relevant risk factor affecting Amgen, and this will create uncertainty in the middle term. But Amgen is also looking forward to important data from programs with promising potential across three therapeutic areas, inflammation, oncology, and cardiovascular disease in the near term.

Biosimilars are not only a threat but also an opportunity for the company, and Amgen has the financial resources to continue growing through both internal developments and acquisitions.

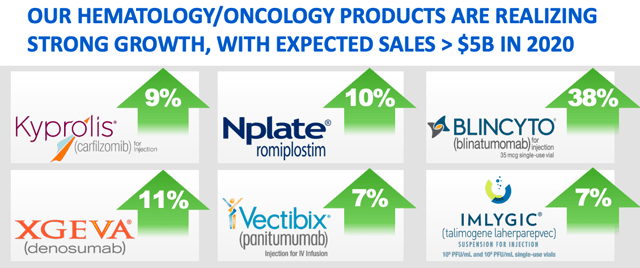

Source: Amgen

The company has a healthy balance sheet, and it retains nearly 40% of revenue as free cash flows. This financial strength should allow Amgen to continue developing and buying new promising drugs over the years.

Valuation Multiples

Based on current earnings estimates, Amgen is trading at a forward P/E ratio of 15.4, a substantial discount versus forward P/E ratio of 23.26 for the median company in the healthcare sector. Similarly, the price to free cash flow ratio stands at 15.18 for Amgen versus a median price to free cash flow ratio of 18.74 for companies in the sector.

The table below shows the average earnings estimates for Amgen in the next five years and the valuation levels implied by those estimates. Based on forwarding-looking earnings expectations, Amgen stock is more than reasonably priced at current levels.

| Fiscal Period Ending | EPS Estimate | YoY Growth | Forward P/E |

| Dec 2020 | 15.34 | 5.03% | 15.4 |

| Dec 2021 | 16.97 | 10.61% | 13.93 |

| Dec 2022 | 18.69 | 10.17% | 12.64 |

| Dec 2023 | 19.59 | 4.79% | 12.06 |

| Dec 2024 | 21.29 | 8.69% | 11.1 |

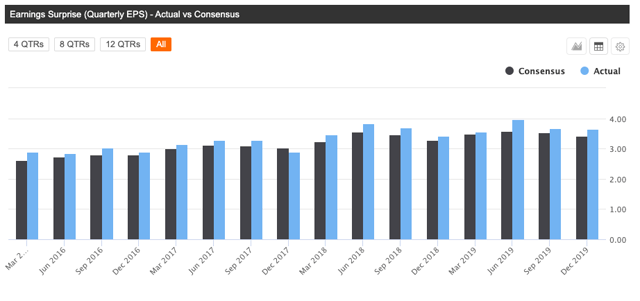

It is also important to note that Amgen has delivered earnings numbers above Wall Street expectations in 15 of the past 16 quarters. This indicates that management tends to underpromise and consistently outperform expectations over time.

Source: Seeking Alpha

Amgen is already quite attractively valued when looking at current earnings and future earnings expectations. If the company can continue outperforming expectations in the future, such as it has done in the past, the stock would be even more undervalued than what current metrics are indicating.

Cash Distributions

It is one thing to say that a company is attractively valued in comparison to the earnings or cash flows that the business is producing, since this can sound like an ephemeral idea to many investors. However, when it comes to cash distributions via dividends and buybacks, undervaluation becomes a far more tangible and material concept.

Amgen distributes a large share of its cash flows to shareholders, the company allocated $7.8 billion to buybacks and $3.5 billion to dividends last year. Versus a market capitalization value of $139 billion, this means that investors in Amgen are being well rewarded with a buyback yield of 5.6% and a dividend yield of 2.52%. Considering both dividends and buybacks together, total shareholder yield amounts to 8.13%.

We are living in times of historically low interest rates, with the yield on a 10 year Treasury bond closing at less than 0.6% last week, so big cash payments from Amgen look like a tempting proposition in comparison to alternatives in the fixed income markets, especially since the company has strong cash flow generation and a solid balance sheet.

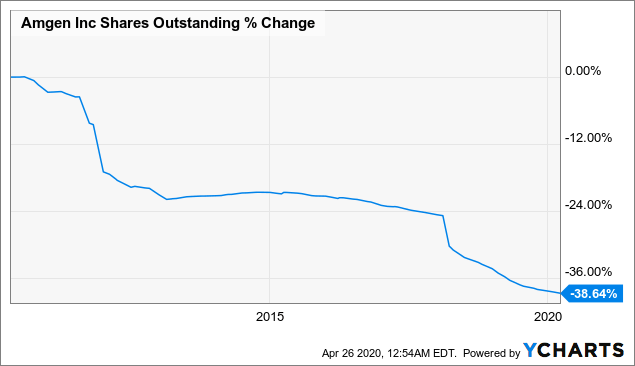

Amgen has an impressive track record of distributions over the long term. The company has repurchased over 38% of the total shares outstanding in the past decade.

Data by YCharts

Buybacks are a matter of intense discussion nowadays, but at the end of the day it all comes down to analyzing each particular case. When the stock is fairly valued and the business prospects are solid, repurchasing stock can be an effective and tax-efficient way to distribute capital to shareholders.

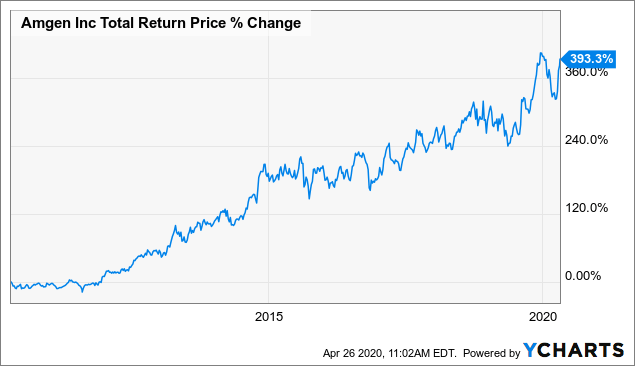

In this case, Amgen stock has delivered a total return of almost 400% over the past ten years, so buybacks have created a lot of value for investors. The company is investing its cash flows in an investment with remarkably strong returns: Amgen's own stock.

Data by YCharts

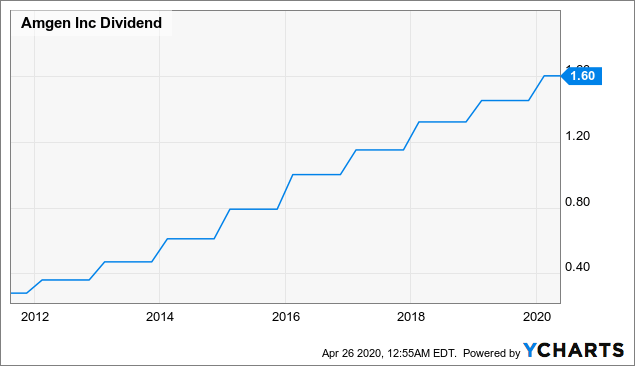

Dividends have consistently increased over time, and the dividend payout ratio is currently quite comfortable at nearly 41% of earnings. As long as the company keeps producing solid financial performance, Amgen has plenty of room to continue increasing dividends in the years ahead.

Data by YCharts

Multi-Factor Approach

Valuation should be interpreted in its due context. A company that generates strong profitability and consistently beats expectations deserves a higher price to earnings ratio than a business with below-average profitability and underperforming expectations.

However, it can be challenging to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

Amgen has a PowerFactors ranking above 99 as of the time of this writing. This means that the stock is in the top 1% of companies in the US stock markets based on financial quality, valuation, fundamental momentum, and relative strength together.

It is important to keep in mind that an algorithm such as PowerFactors is based on current data and current expectations about future data. This provides an assessment based on hard data as opposed to opinions, but it also has some limitations.

In essence, forward-looking returns will depend on the cash flows that the business can produce in the future. The algorithm is saying that Amgen is attractively priced based on current expectations and past history. But the company needs to continue bringing the right drugs to the market in order for those assumptions to materialize in the future.

Backtested data for quantitative algorithms should always be taken with a grain of salt. The backtest shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the long term, but this does not tell us much about how a specific company such as Amgen will perform in a particular year such as 2020.

In other words, the main strength of a quantitative algorithm is that it provides a quantifiable approach based on hard data to make investment decisions supported by evidence. However, investors should always assess the business behind those numbers in order to analyze if the numbers are sustainable or not going forward.

That being acknowledged, it is good to know that Amgen can deliver strong returns from current valuation levels if the company continues delivering solid performance going forward.

The Bottom Line

The biotech industry is aggressively dynamic, and Amgen will face rising competitive pressure in the coming years. Regulatory uncertainty and any potential pipeline setbacks are always key risk factors to keep in mind when analyzing a position in Amgen.

On the other hand, the company has both the strategic and financial resources to continue building new growth engines in the years ahead. Besides, the risk factors are already well known by the market and incorporated into valuation to a good degree. The risk vs. reward trade-off in Amgen looks favorable to the bulls at these prices.

Disclosure: I am/we are long IBB. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving ...

more