American Express Hit Target Extending In Wave ((5))

Image Source: Unsplash

American Express Company (AXP), is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average.

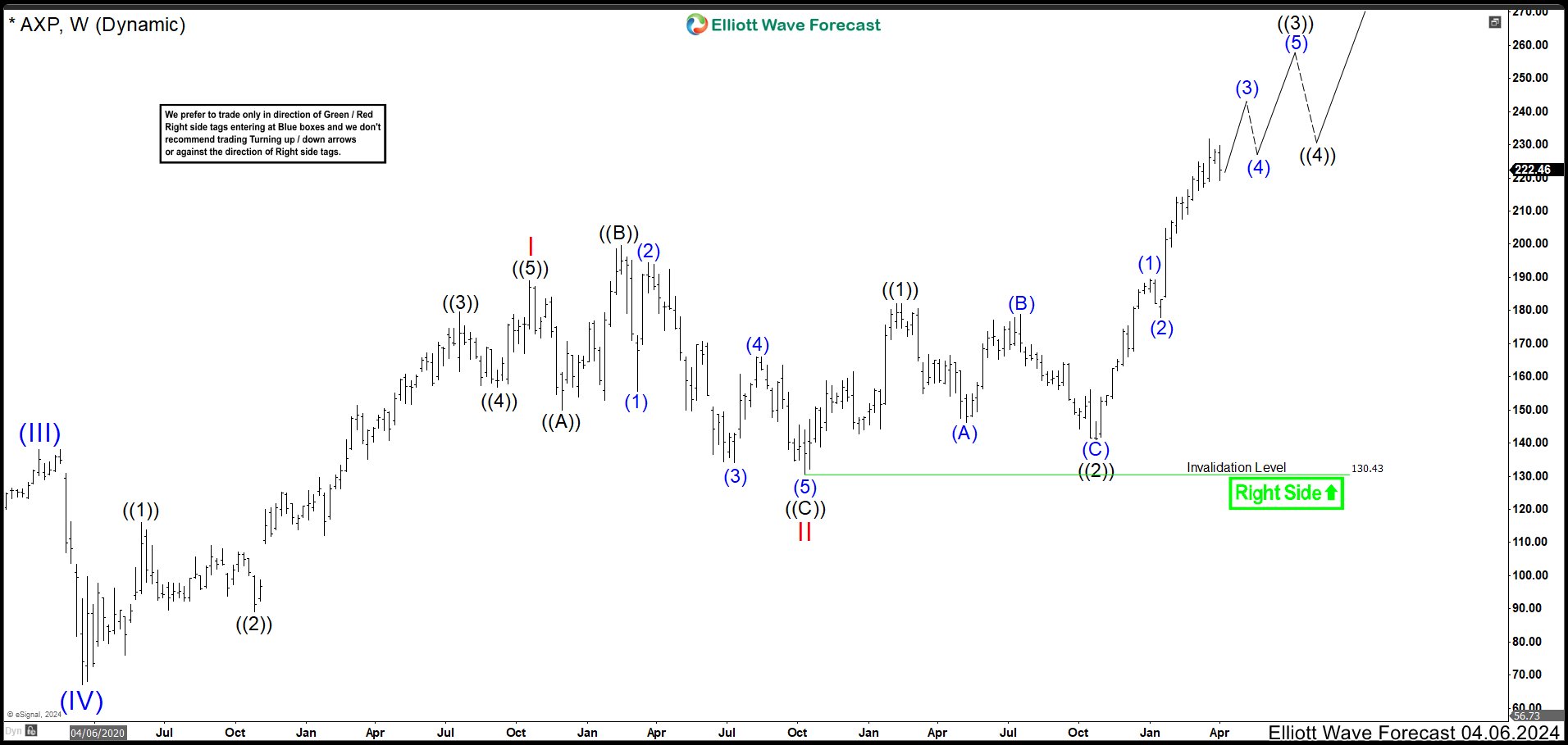

AXP Weekly Chart April 2024

The stock has been building an extension as wave (V) of ((I)). Wave I ended at 189.03 high. Then, wave II built an expanded flat correction ending at 130.65 low. The wave ((1)) of III completed at 182.15 and pullback as a flat correction ended wave ((2)) at 140.91. From here, AXP started a strong rally that was wave ((3)) of III and we were looking for buying opportunities to trade in favor of the trend.

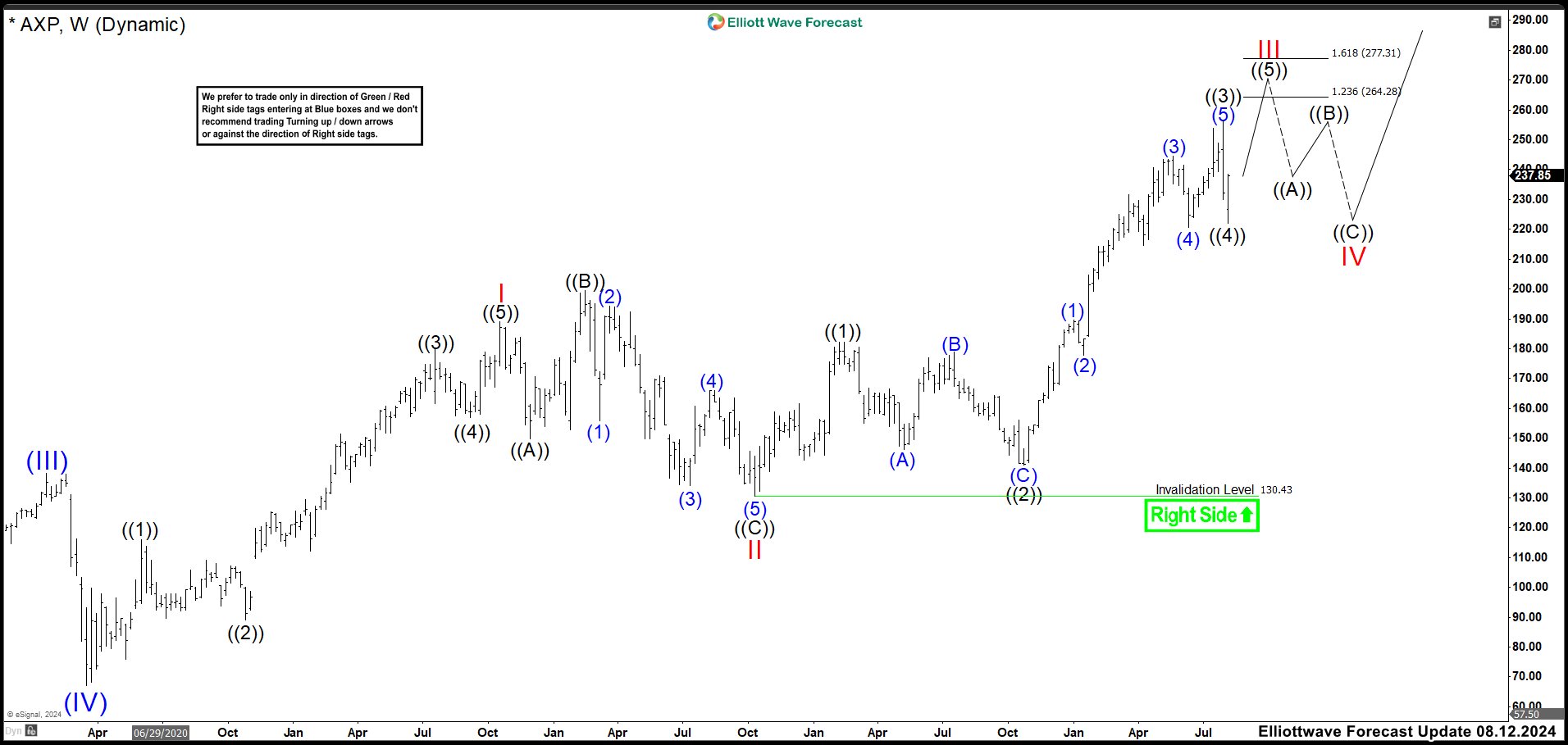

AXP Weekly Chart August 2024

After 4 months, AXP continued the rally as expected. It ended wave (3) of ((3)) at 244.41 high. The pullback as wave (4) finished at 220.74 low and the market resumed to the upside in wave (5) of ((3)). This cycle ended at 256.24 high and we had strong pullback as wave ((4)) retesting last wave (4) low around 222.03. The market was trading in wave ((5)) higher. If there was not more extensions, this wave ((5)) of III could reach 264.28 – 277.31 area where AXP could begin a large correction in wave IV.

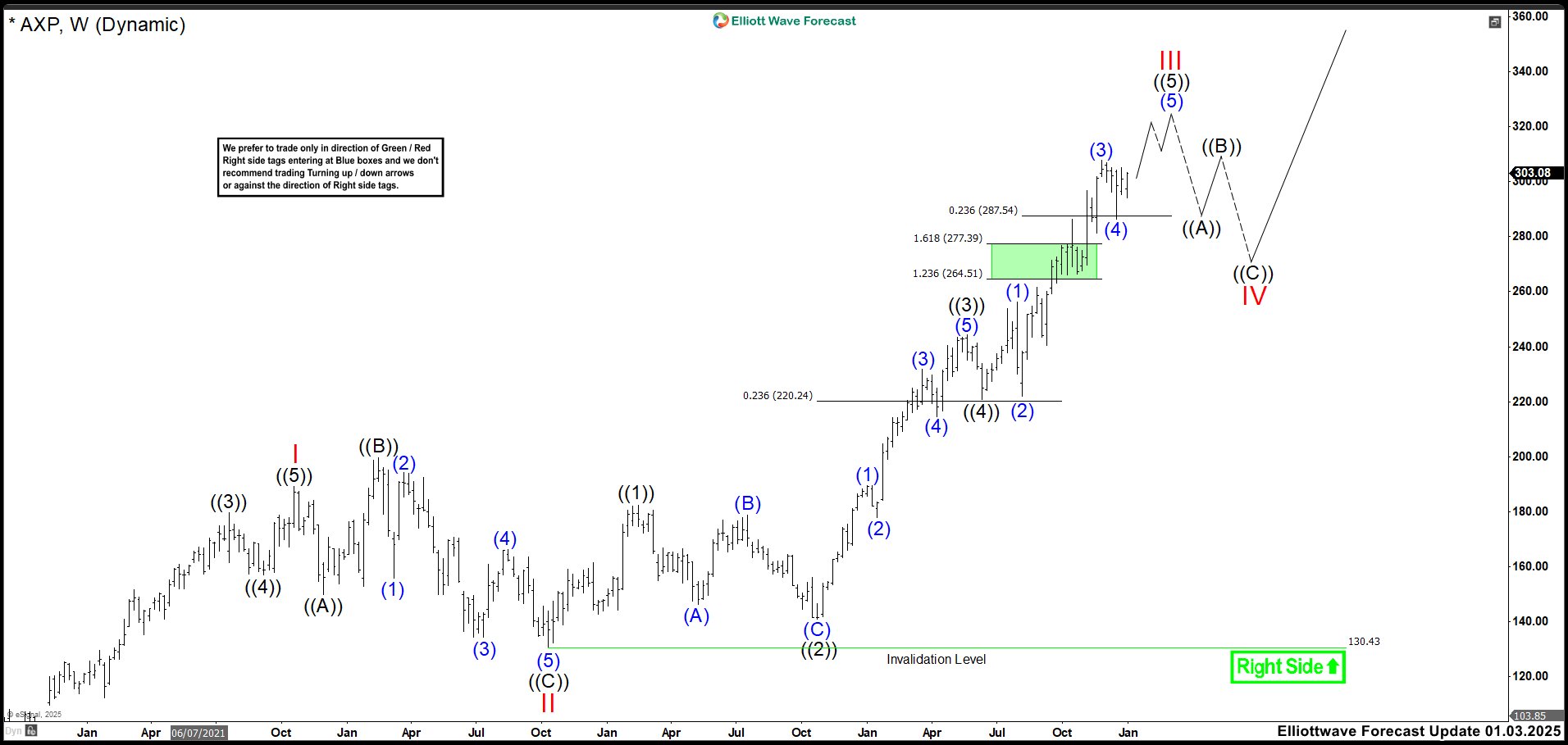

AXP Weekly Chart January 2025

The rally continued as expected hitting the target of 264.28 – 277.31 area. The market has extended the wave ((5)) and the structure looks incomplete. With this extension, we adjusted a little bit the count. Also, we can see how wave 4s pulled back to the typical level of 23.6% Fib retracement of wave 3. Wave ((4)) retraced to 220.24 and wave (4) to around 287. Currently, AXP is trading in wave (5) and it could reach to 320.00 before starting wave IV correction. We cannot deny more extensions, inclusive we are using a conservative view because AXP could still be trading in wave ((3)). For now, we are going to wait for a reaction lower from around 320.00 to retest the 280.00 – 290.00 area and see how the market structure is developing.

More By This Author:

Gold Miners Junior (GDXJ) Zigzag Correction in ProgressElliott Wave View: Dow Futures Looking For Double Correction

Advanced Micro Devices Inc. Bearish Sequence Calls For More Downside

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more