AMD Q1 Earnings, Guidance Steamroll Estimates Amid Across-The-Board Strength

Advanced Micro Devices, Inc. AMD reported Tuesday stellar quarterly results. The company issued above-consensus revenue guidance for the second quarter and raised its revenue growth guidance for the fiscal year 2021.

AMD's Key Q1 Numbers: AMD reported first-quarter non-GAAP earnings per share of 52 cents compared to 18 cents per share in the year-ago quarter. Revenues climbed 93% year-over-year from $1.79 billion to $3.45 billion.

The consensus estimates had called for EPS of 44 cents on revenues of $3.21 billion. AMD had guided to revenues of about $3.2 billion, plus or minus $100 million.

Rival Intel Corporation INTC reported last week a better-than-expected first quarter but the stock pulled back on mixed guidance, lackluster Datacenter performance and skepticism regarding the company's foundry strategy.

AMD's non-GAAP gross margins came in at 46%, flat with the year-ago quarter and up 1 percentage point from 45% in the previous quarter.

Cash, cash equivalents, and short-term investments at the end of the first quarter stood at $3.12 billion.

"Our business continued to accelerate in the first quarter driven by the best product portfolio in our history, strong execution, and robust market demand," said Lisa Su, AMD president, and CEO.

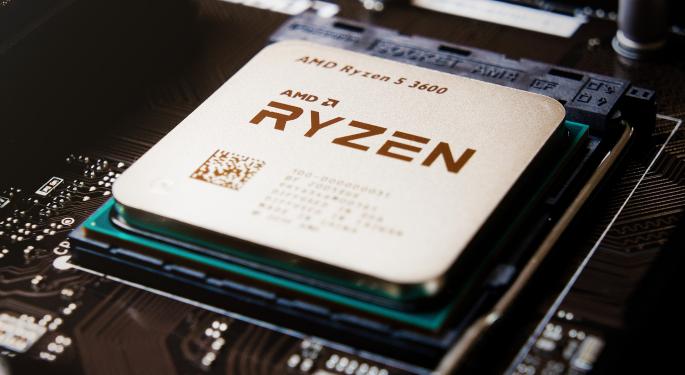

AMD's Segmental Performance: Among the segments, Computing and Graphics fetched revenues of $2.10 billion or roughly 61% of the total. This segment grew its revenues 46% year-over-year and 7% quarter-over-quarter. The company attributed the strength to Ryzen processor and Radeon graphics product sales growth.

"We had outstanding year-over-year revenue growth across all of our businesses and data center revenue more than doubled," Su said.

Enterprise, embedded, and semi-custom segment saw revenue growth of 286% year-over-year and 5% sequentially to $1.35 billion, or 39% of the total revenues.

The year-over-year increase was driven by higher semi-custom product sales and EPYC processor revenue, AMD said. Semi-custom products include processors used for cryptocurrency mining.

Rosenblatt Securities analyst Hans Mosesmann said ahead of the results, quarterly revenues were likely to have been driven by a less seasonal PC and game console market and continued strength in data center EPYC.

AMD's Key Quarterly Developments: In early March, AMD unveiled the AMD Radeon 6700 XT graphics card for 1440p PC gaming experience. It also introduced Ryzen PRO 5000 series mobile processors with Zen 3 architecture.

During the quarter, Xilinx, Inc. XLNX shareholders voted to approved the programmable chipmaker's pending acquisition by AMD. The companies expect the transaction to close by the end of 2021, subject to other customary closing conditions, including the receipt of required regulatory approvals.

AMD's Outlook: AMD guided to second-quarter revenues of about $3.6 billion, plus or minus $100 million, representing 86% year-over-year growth and a 4% quarter-over-quarter increase. Analysts, on average, estimate revenues of $3.29 billion.

The quarter-over-quarter growth, according to the company, is premised on Datacenter and gaming growth.

Non-GAAP gross margin for the quarter is estimated at 47%.

The company raised its full-year revenue growth guidance from 37% previously to 50%, while the Street is modeling 39% growth.

AMD's Stock: AMD started 2021 strongly, carrying over the momentum that was seen for much of 2020.

From a high of $99.23 on Jan. 11, the stock retreated and the weakness was exacerbated by the sector-wide sell-off in the tech space seen in early March.

From a low of $73.96 on March 8, the stock has recovered but is still trading down about 7% for the year-to-date period.

Reacting to the results, AMD shares were rallying 3.26% to $87.99 in after-hours trading.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.