Amazon's Blowout Quarter: It Is Not Too Late To Buy

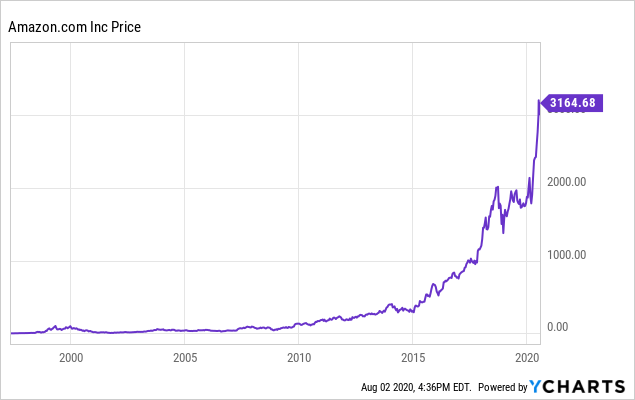

Amazon (AMZN) delivered spectacular earnings last week, and the numbers propelled the stock to near-record highs, at $3164 per share. This kind of performance always generates some mixed reactions among investors when it comes to analyzing a position in Amazon at current prices.

The company clearly is firing on all cylinders, but many investors consider that it is already too late to jump on the Amazon train at these levels. A healthy dose of skepticism is always a good approach. However, staying away from Amazon only because it has appreciated strongly in recent months can be an expensive mistake.

Past performance and valuation can be remarkably different things; when the fundamentals are moving in the right direction, a rising stock price does not mean that the stock is overvalued at all. Amazon is one of the strongest companies in the world, and the stock still has what it takes to continue delivering solid returns for shareholders in the years ahead.

Price Is Not Valuation

Amazon has delivered amazing returns for investors over the long term, and recent gains have accelerated, with the stock rising by almost 70% in the past year. Enormous returns, combined with the fact that the stock price is unusually elevated at above $3100, can give the impression that the stock is already too expensive to consider buying.

Data by YCharts

Traditional valuation metrics provide the same impression. Amazon is currently trading at a forward P/E ratio above 73 times earnings estimates for next year, which obviously looks like a very demanding price tag, even for a high-quality stock.

However, past returns do not reflect forward-looking valuation, and the price to earnings ratio is hardly the best indicator to use for a high-growth company such as Amazon.

Investors with a basic understanding of finance and valuation obviously know that the stock price itself does not tell us anything about the valuation. Valuation is about comparing the company's future earnings and cash flows versus the current stock price, as opposed to assessing the evolution of the stock price alone.

However, anchoring is a powerful and well-documented bias. It is very human to believe that the company could be overvalued when you see the stock price rising exponentially. For many investors, both individual investors and professionals, psychological biases such as anchoring can be very hard to overcome.

Imagine for a second that you are a professional fund manager who has missed the epic rally in Amazon for considering the stock overvalued over the past several years. In that situation, it is very likely that you are now going to stick with your position and say that the stock is even more overvalued than before, even if you could probably see things differently if you looked at Amazon stock with fresh eyes. The ability to change your mind can be enormously beneficial, but it is a rare ability that only the best investors have.

The price to earnings ratio is simply misleading because Amazon is investing massive amounts of money on future growth opportunities, so current earnings as reflected by accounting standards do not reflect the company's true earnings generation capabilities. In cases like this, cash flows are a much more clear reflection of business fundamentals.

Valuation Is Not Unreasonable At All

In the case of Amazon, the stock price is increasing, but so are the company's cash flows. Operating cash flow increased 42% last quarter to $51.2 billion for the trailing twelve months, compared with $36 billion for the trailing twelve months ended June 30, 2019.

Based on these numbers, Amazon stock is currently trading at a price to operating cash flow ratio of around 30. Considering that cash flows are growing at full speed, this valuation is not unreasonable at all.

Even more interesting, a sum of the parts valuation for Amazon can highlight the fact that the stock is far cheaper than it seems to be at first sight.

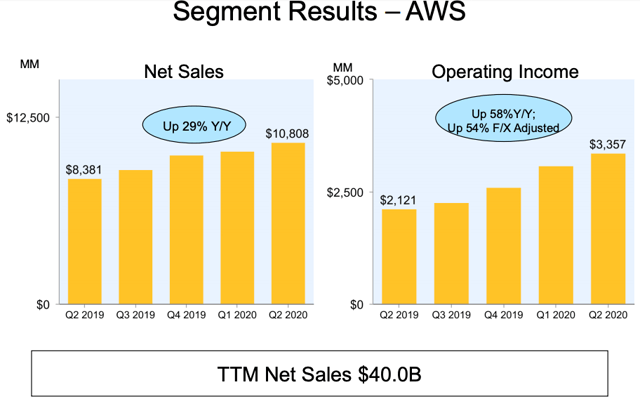

Amazon Web Services is facing increasing competition, but revenue still grew 29% last quarter, and operating income expanded by 58%. Due to scale advantages in AWS, Amazon is enjoying an expansion in profitability in this segment, and operating income reached 31% of revenue last quarter.

Many of the best cloud software stocks in the market are currently trading at price to sales ratios above 20 times revenue. This would mean that AWS alone could be worth more than $800 billion and more.

Source: Amazon

The Future Looks Brilliant

Valuation is always a dynamic concept as opposed to a static number. The true value of a business depends on future cash flow generation and the future can never be known for certain, only estimated. When we have new information about a company, we need to incorporate the new data and adjust our valuations accordingly.

The pandemic has produced a seismic shift in the economy, accelerating demand for online retail, cloud computing, and related technologies. Amazon has been one of the main enablers of this acceleration and also one of the top beneficiaries of this trend.

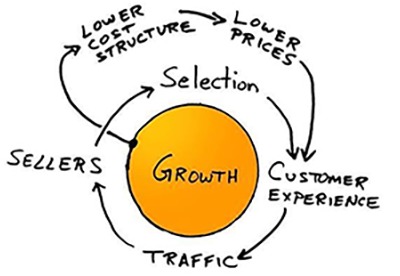

The company benefits from a powerful ecosystem and an unparalleled flywheel effect that creates a virtuous cycle over time. More customers attract more sellers to the platform, which creates a greater selection and a bigger scale to reduce costs and prices. This keeps attracting more customers and sellers to Amazon over time.

Source: Amazon.jobs

With revenue growing by 40% and reaching $88.9 billion last quarter, Amazon's flywheel is clearly running at full speed. The company incurred in $4 billion incremental COVID-19-related costs in the quarter, but operating income still increased to $5.9 billion versus $1.2 billion expected by Wall Street analysts. Not only is revenue growing at explosive rates, but profitability is also expanding much more rapidly than expected.

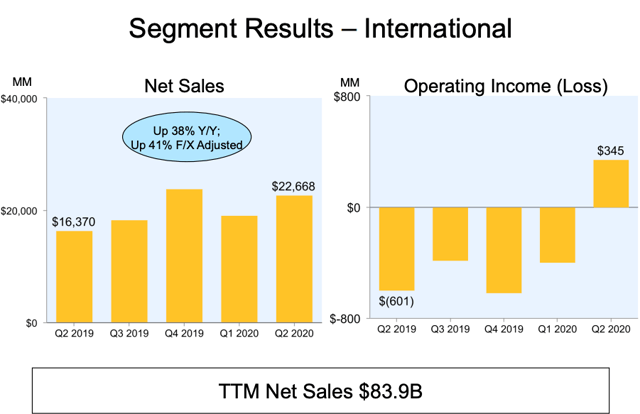

Moving forward, third-party sales are accounting for a larger share of overall sales, and these transactions generally carry higher profitability. Amazon even managed to turn a profit in international markets at the operating level last quarter, this bodes well in terms of future opportunities for international expansion over the years ahead.

Source: Amazon

The company is also building new growth drivers across different areas. Third-party seller services, which include commissions and any related fulfillment and shipping fees, grew 52% to $18.19 billion. Subscription services grew 29% to $6.02 billion and other sales, which is predominantly advertising, grew 41% to $4.22 billion.

Not only is Amazon growing strongly in the aggregate, but this growth is also being driven by multiple growth engines at the same time, all of them firing on all cylinders.

The Bottom Line

Amazon stock will probably be affected by regulatory risk and political noise in the near term, especially as the election date approaches. This can create some volatility around the stock price, but it will hardly be a game-changer for the business from a fundamental perspective.

The competitive landscape is evolving, with strong players such as Shopify (SHOP) growing at an outstanding speed. Online advertising companies such as Facebook (FB) and Google (GOOGL) also have growing ambitions to expand into online commerce. This competitive risk should be monitored closely, but the industry will provide enough room for multiple players to do well in the long term, and Amazon comes second to none in terms of competitive strength in its core markets.

Even when considering how far the stock has gone, Amazon is not unreasonably valued based on cash flow generation. The company is executing flawlessly during challenging times, and it has plenty of room for sustained growth in revenue and expanding profit margins in the years ahead.

Optionality is also a big plus when it comes to Amazon, as the company has proven to have an exceptional ability to expand into new areas and build new growth engines over time. Amazon has the strategic and financial resources, as well as the right management team, to continue innovating and surpassing growth expectations in the future.

I wouldn't say that Amazon is undervalued at current prices, but fairly valued is a reasonable assessment when considering the quality of the business. Buying a great company at a fair price can be a straightforward strategy for superior returns, and Amazon looks well-positioned to continue delivering market-beating returns in the years ahead.

Disclosure: I am/we are long AMZN, FB, GOOG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more

Enjoyed this article, good read

I sometimes thing there will be no end to how high #Amazon can go! $AMZN