Amazon Soars To Record High On Solid Guidance, Improving AWS Results

Image Source: Unsplash

With mixed earnings from META and MSFT (both down) and GOOGL (up) yesterday, today attention turns to the other two Mag7 giants, AAPL and AMZN, with the latter reporting right after the close, and the former waiting the usual 30 minutes. With sentiment turning darker in the market throughout the day, these two companies may be critical to restore the upward momentum or else it could get ugly.

With that in mind, Amazon appears to be doing what it can to buck the downbeat mood by reporting results which the market clearly is impressed with. Here is what the world's largest retailer just reported:

- EPS $1.95 vs. $1.68 q/q, beating estimate $1.58

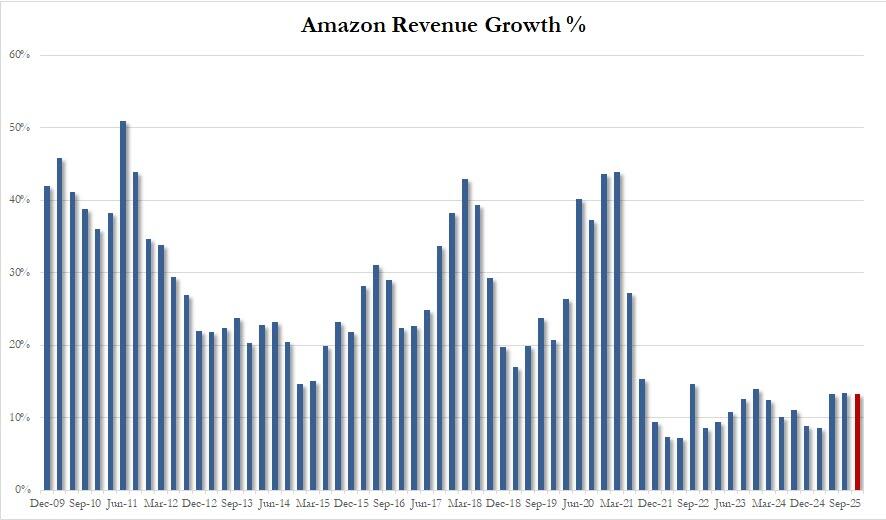

- Net sales $180.17 billion, +13% y/y, beating estimate $177.82 billion

- Online stores net sales $67.41 billion, +9.8% y/y, beating estimate $66.93 billion

- Physical Stores net sales $5.58 billion, +6.7% y/y, beating estimate $5.56 billion

- Third-Party Seller Services net sales $42.49 billion, +12% y/y, beating estimate $42.05 billion

- Subscription Services net sales $12.57 billion, +11% y/y, beating estimate $12.49 billion

- Third-party seller services net sales excluding F/X +11% vs. +10% y/y, beating estimate +10.8%

- Subscription services net sales excluding F/X +10% vs. +11% y/y, missing estimate +10.7%

Geographically the results were strong all around:

- North America net sales $106.27 billion, +11% y/y, beating estimate $104.96 billion

- International net sales $40.90 billion, +14% y/y, beating estimate $40.77 billion

So far so good, with every line time beating. But what the market was especially focused on was the high margin AWS data, and here numbers also beat solidly:

- AWS net sales $33.01 billion, +20% y/y, beating estimate $32.39 billion

- Amazon Web Services net sales excluding F/X +20% vs. +19% y/y, beating estimate +17.9%

Turning to operating profits, here the results were rather mixed:

- Operating income $17.42 billion vs. $17.41 billion y/y, missing estimate $19.72 billion

- Operating margin 9.7% vs. 11% y/y, missing estimate 11.1%

- North America operating margin +4.5% vs. +5.9% y/y, missing estimate +6.98%

- International operating margin 2.9% vs. 3.6% y/y, missing estimate 4.02%

As for fulfillment expenses, these came in slightly above estimates, as did the seller unit mix. These may deteriorate iftariffs rise:

- Fulfillment expense $27.68 billion, +12% y/y, estimate $27.49 billion

- Seller unit mix 62% vs. 60% y/y, estimate 60.7%

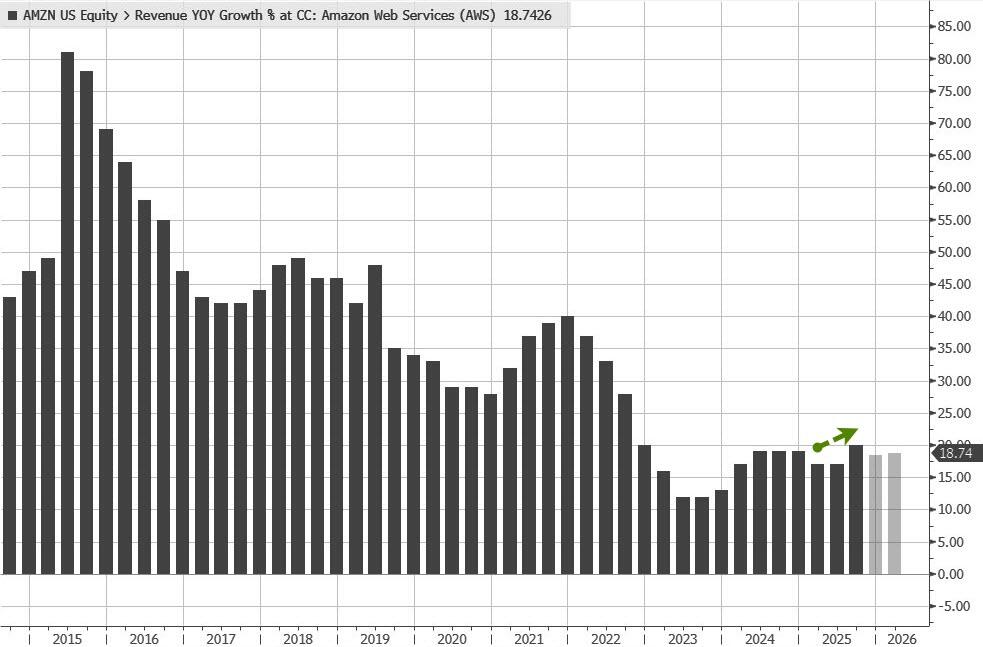

Of the above, the most notable highlight was AWS which grew revenue by 19.7% (stronger than the 19% year ago) to $33.0BN, above the sellside estimate of $32.39BN. That said, despite the latest quarterly beat, the growth rate is clearly slowing but not enough for the market to care right now:

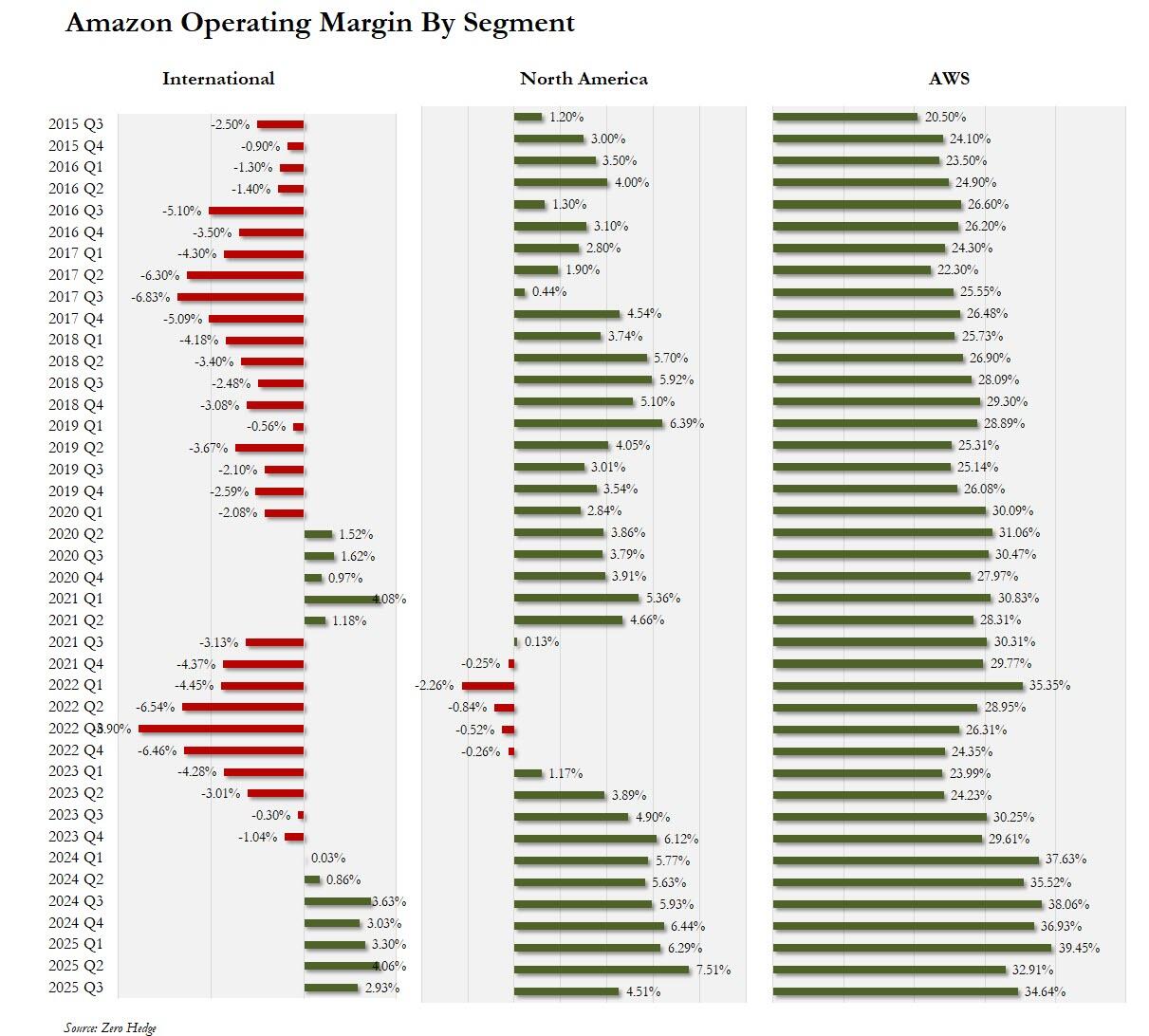

While AWS sales growth was solid, just as impressive was the the margin for the segment also increased from 32.9% in Q2 to 34.6%, beating the median Wall Street estimate of 33.95%, if below the recent average from the past two years. Elsewhere, North American profit dropped to $4.789 billion, resulting in a profit margin of 4.51%, missing estimates of 5.9%, while international margins dropped to to 2.93%, and also missing estimates of 3.6%.

(Click on image to enlarge)

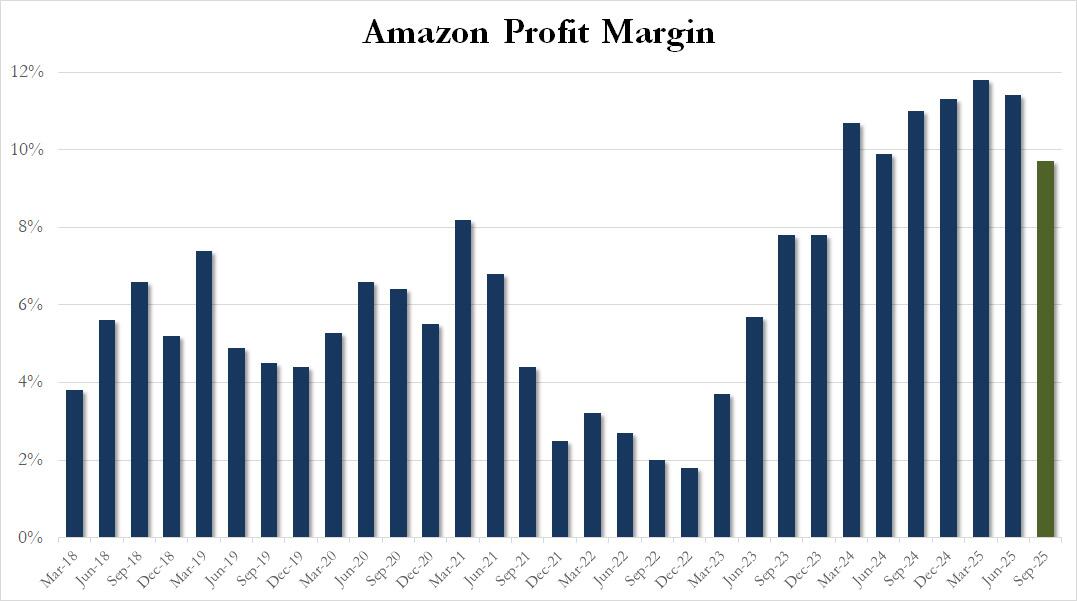

As a result of the drop in AWS profits, Amazon's consolidated operating margin posted a sequential drop and in Q3 declined from 11.4% to 9.7%, the lowest since 2023.

However, while the above data was solid, it was the company's guidance that cemented the stock's surge after hours; that's because the company projected revenue and profit in the current quarter which was seen as coming in above Wall Street expectations.

- Net sales are expected to be between $206.0 billion and $213.0 billion, or to grow between 10% and 13% compared with fourth quarter 2024, the mid point coming in above the estimate of 208.45BN

- See operating income is expected to be between $21.0 billion and $26.0 billion, compared with $21.2 billion in fourth quarter 2024, the midpoint also beating the est. of $23.78BN

This means that revenue growth in Q3 is expected to print 13.2% YoY, just above the 13% in the current quarter and a continuation of the very solid recent growth.

In response to the solid guidance and the AWS results which came in above expectations, the spiked after hours, and surged just over $20, or nearly 9%, rising to a new all time high...

(Click on image to enlarge)

... as attention now turns to AAPL.

More By This Author:

EBay Shares Plunge Most Since 2005 As Soft Outlook Overshadows Solid EarningsECB Keeps Rate Unchanged As Expected

Meta, Google, Microsoft Capex Wrap

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more