Amazon Plunges After Forecasting 50% Surge In Capex To $200BN

Image Source: Unsplash

In our AMZN earnings preview, we said that the price reaction from META and GOOGL "leaves Amazon in a precarious place as it prepares to report earnings after the close today: does it project some berserk number or does it risk being conservative? After all, the only thing that will matter is the capex forecast (the earnings will likely be good enough)."

Well, we were wrong: the earnings were not good enough: the company missed on earnings and its guidance was rather week. And so before we even get to the biggest shock of the report - the company's CapEx guidance - here is what the company reported for Q4:

- EPS $1.95, missing estimates of $1.96... an ugly miss at the very top.

Revenue was a bit better, and even though several items (physical stores, third party sellers missed), AWS was stronger than expected.

- Net sales $213.39 billion, beating estimate $211.49 billion

- Online stores net sales $82.99 billion, beating estimate $82.3 billion

- Physical Stores net sales $5.86 billion, missing estimate $5.88 billion

- Third-Party Seller Services net sales $52.82 billion, missing estimate $53.16 billion, net sales excluding F/X +10%, estimate +11.2%

- Subscription Services net sales $13.12 billion, beating estimate $12.74 billion, net sales excluding F/X +12%, estimate +10.4%

The good news is that the most important revenue item, AWS, beat:

- AWS net sales $35.58 billion, beating estimate $34.88 billion; net sales excluding F/X +24%, estimate +21%

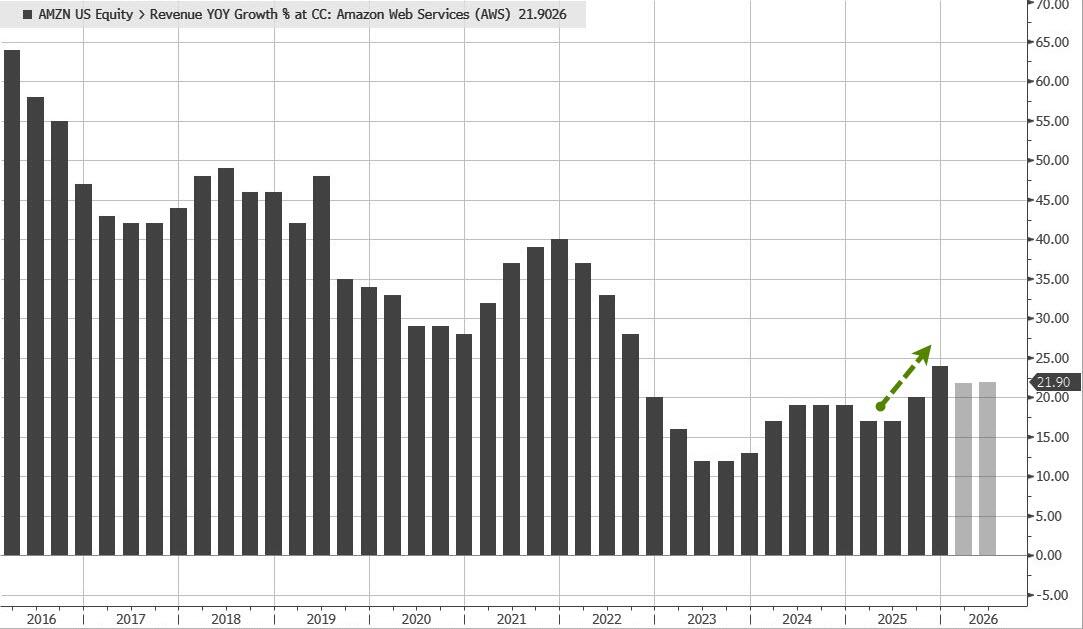

This was an impressive number as the 24% YoY increase in AWS revenue not only smashed estimates, but was the highest in three years: remarkable growth for a business that keeps growing and has a more difficult base effect to "beat" every quarter.

Geographically the results were disappointing with North America missing, offset by strength in International

- North America net sales $127.08 billion, missing estimates of $127.21 billion

- International net sales $50.72 billion, beating estimates of $49.74 billion

Going down the line:

- Operating income $24.98 billion, beating estimate of $24.82 billion; this included charges of $1.1 BN

- Operating margin 11.7%, in line with the estimate of 11.7%

- North America operating margin +9%, beating estimate +8.51%

- International operating margin 2.1%, missing estimate 4.27%

- Fulfillment expense $30.83 billion, below estimate $31.42 billion

In its release, the company said that demand was strong for AI, Chips, Robotics, and all other Existing Offerings.

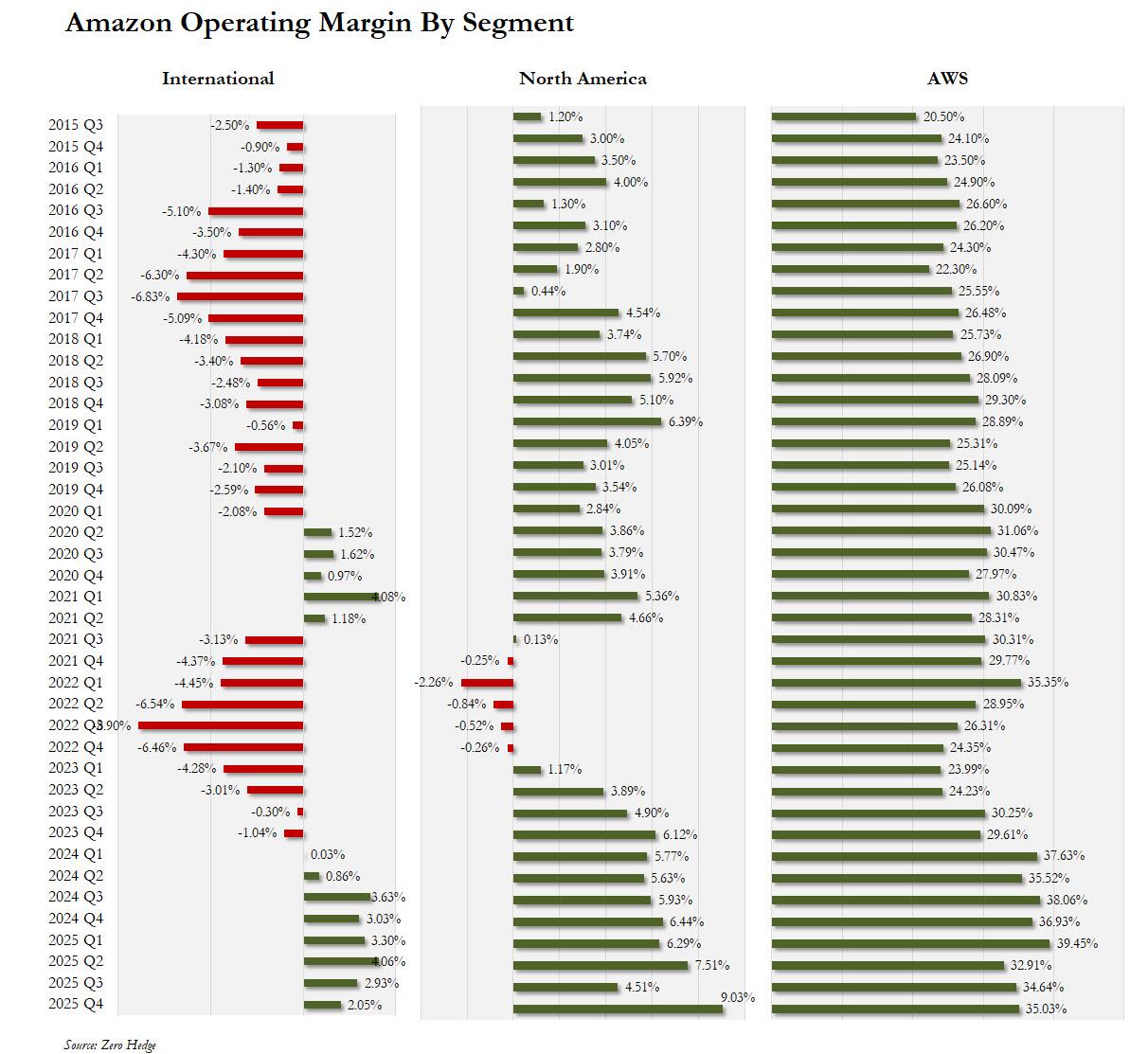

While AWS sales growth was solid, just as impressive was the the margin for the segment also increased from 34.64% in Q3 to 35.03%, just beating the median Wall Street estimate of 35%. Elsewhere, North American profit unexpectedly jumped to $11.472 billion, resulting in a profit margin of 9.03%, beating estimates of 8.51%, while international margins dropped to to 2.05% from 2.93%, missing estimates of an increase to 4.27%.

(Click on image to enlarge)

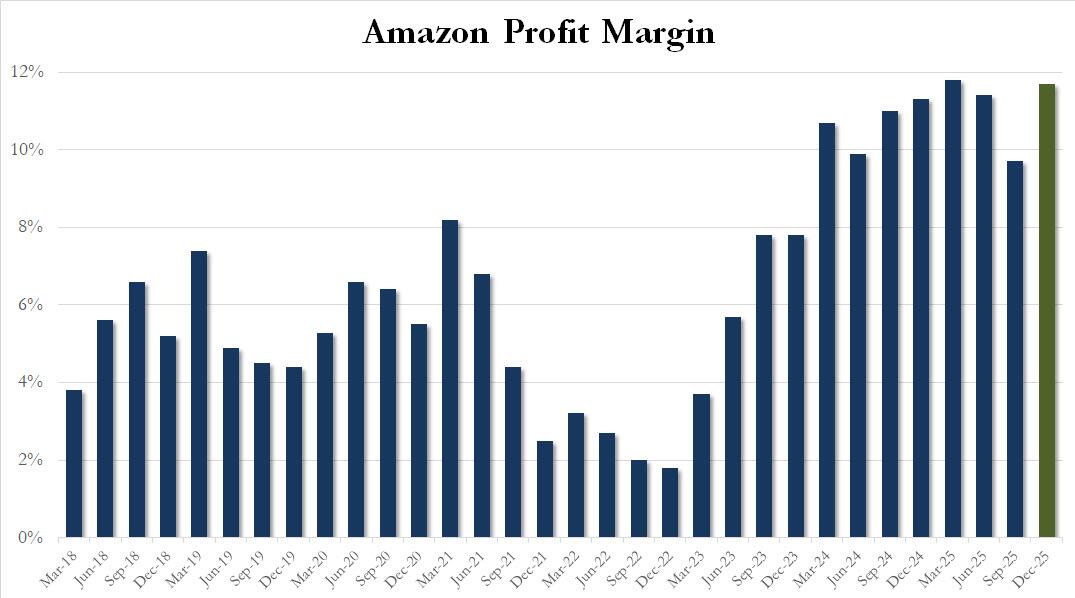

As a result of the drop in AWS profits, Amazon's consolidated operating margin posted a notable jump and in Q4 increased 9.7% to 11.7%, just shy of an all time high.

However, while the above data was ok, it was the company's guidance that led to an immediate collapse in the stock price after hours. No, it wasn't the revenue, although that did come in a bit weak:

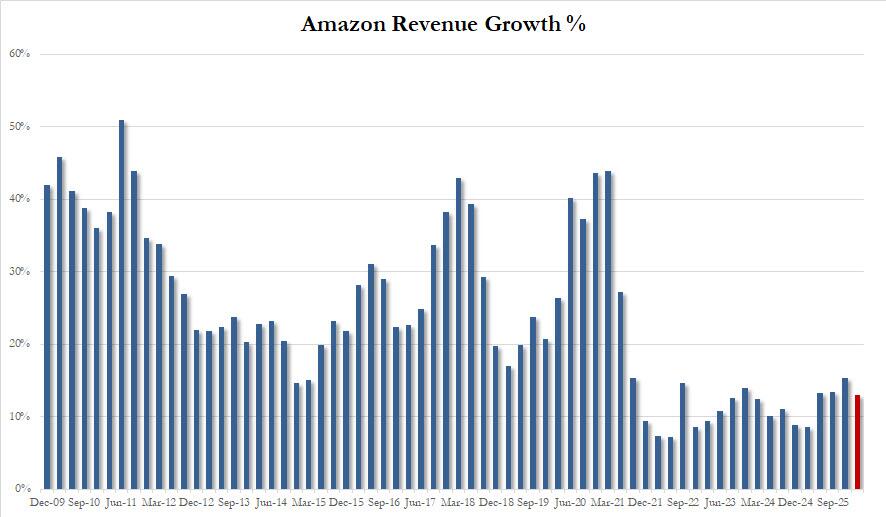

- Net sales are expected to be between $173.5 billion and $178.5 billion, or to grow between 11% and 15% compared with first quarter 2025. The midpoint is a bit weak compared to the median estimate of $175.54 billion.

The projected 13% revenue growth is on the low-end of where the company has been in the past year.

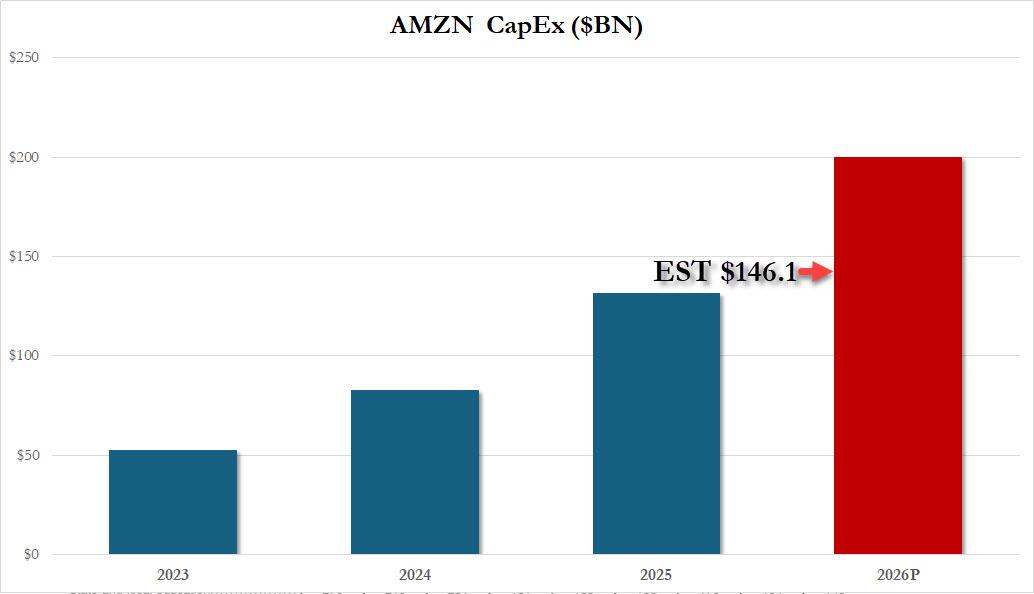

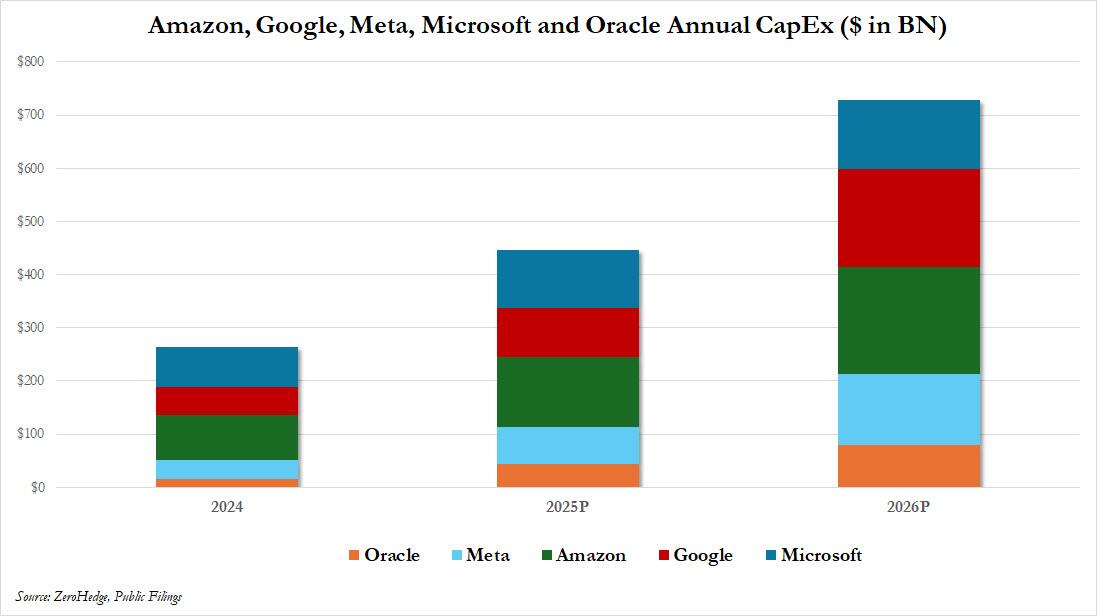

But while revenue guidance was disappointing, if a bit muted, it was the company's capex guidance - a first for AMZN - that stole the show, because with Wall Street estimates of $146.1 billion in 2026 capex, the company went and reported that it expects to invest about $200 billion in capital expenditures in 2026, a 50% increase from 2025 and an openly ridiculous number, one which is more than a quarter higher than the consensus estimate! Needless to say, there is just not enough grid capacity and electrical power to satisfy the $700BN in CapEx guidance among the Mag7s.

The number was so shocking that even though Wall Street may have been ready to give AMZN the benefit of the doubt for its solid AWS performance and impressive margin bounce, the CapEx guidance was just so gargantuan, there was no way the stock would jump especially after yesterday's GOOGL debacle. Putting the updated capex numbers in context, the 5 bighyperscalers now expect to spend over $700BN in capex next year. The only problem: there is nowhere near enough electrical capacity to feed all these brand new data centers.

And so AMZN crashed after hours, sliding as much as 11%, and trading around $200. Another $15 drop from here, and the stock will be where it last traded in 2021...

More By This Author:

$49 Wegovy Copycat Pill Sparks Selloff In Novo SharesGoogle Goes Wild After Hours After Beating Estimates, Projects Mindblowing CapEx

WTI Holds Losses As Freezing Temps Sparked Massive Drop In US Production

Disclosure: Copyright ©2009-2026 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more