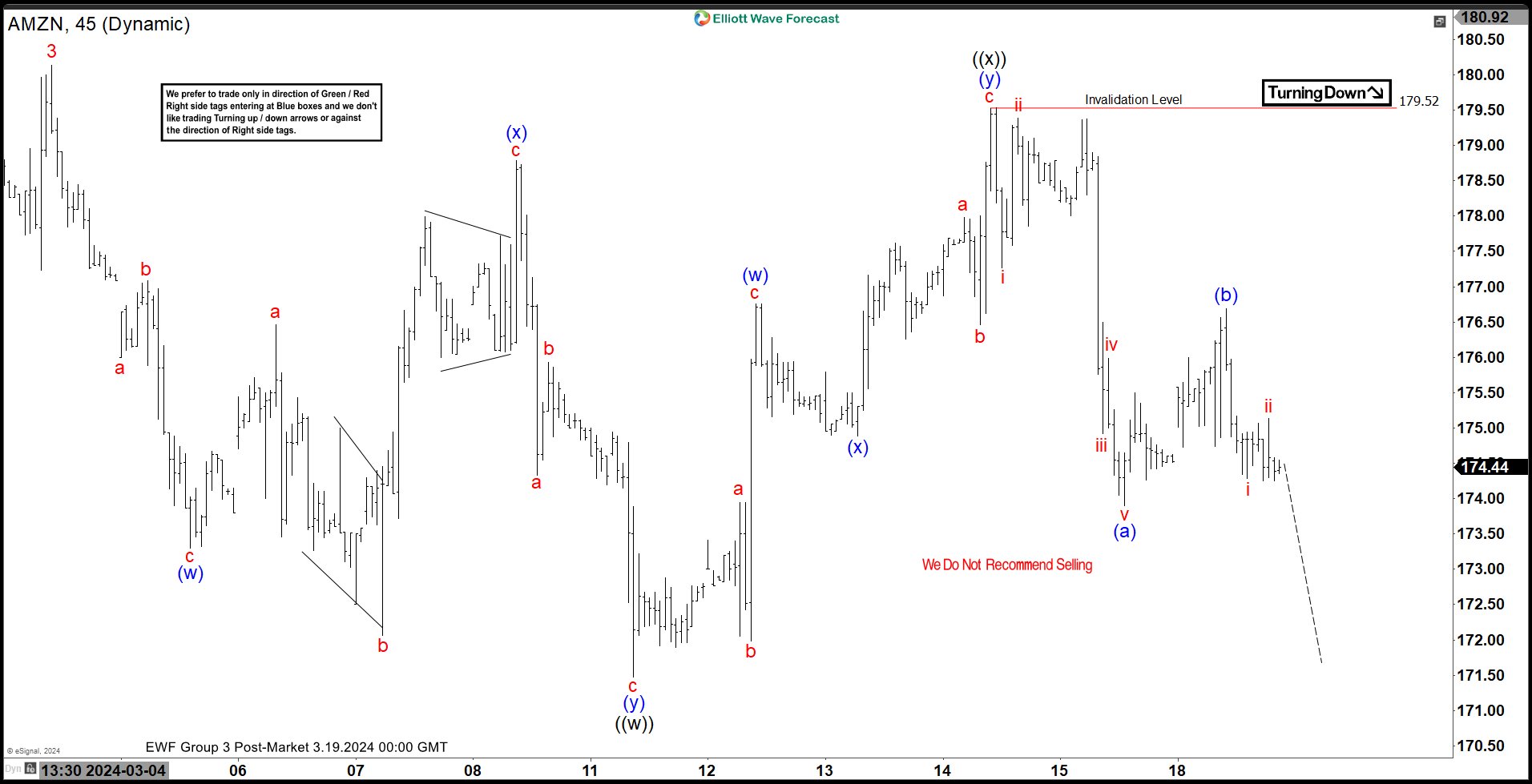

Amazon Looking For 7 Swing Correction

Image Source: Unsplash

Short Term Elliott Wave view in Amazon (AMZN) suggests that wave 4 is in progress as double three Elliott Wave structure. Rally to 180.14. Down from there, wave A ended at 176 and the rally in Wave B ended at 177.08. The stock then resumed lower in wave c towards 173.3 which completed wave (w) in a higher degree. Up from there, wave (x) unfolded as a flat structure. Up from wave (w), wave a ended at 176.46, and wave b ended at 172.06. Wave c higher ended at 178.79 which completed wave (x). The stock then turned lower in wave (y) with internal subdivision as a zigzag structure.

Down from wave (x), wave A ended at 174.33 and wave B ended at 175.93. Wave c lower ended at 171.47 which completed wave (y) of ((w)). The stock then bounced higher in wave ((x)) as another double three in a lesser degree. Up from wave ((w)), wave (w) ended at 176.76, and wave (x) ended at 174.88. Wave (y) higher ended at 179.52 which completed wave ((x)). Stock then turned lower in wave ((y)). Down from wave ((x)), wave (a) ended at 173.9 and wave (b) ended at 176.69. Expect the stock to extend lower in wave (c) of ((y)) to complete wave 4. The potential target lower is 100% – 161.8% Fibonacci extension of wave ((w)). This area comes at 165.54 – 170.88 where buyers can appear. Near term, as far as the pivot at 179.52 high stays intact, the stock has scope to extend lower.

AMZN 45 Minutes Elliott Wave Chart

AMZN Elliott Wave Video

Video Length: 00:04:36

More By This Author:

Costco Wholesale Grand Super Cycle Upside TargetBuying Opportunity In Marathon Digital Holdings In 7 Swings

DAX Short Term Should Stay Supported

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more