Amazon Hits Record High On Blowout Earnings And Guidance

With the bulk of the FAAM(N)G stocks reporting somewhat mixed earnings so far, with NFLX and MSFT disappointing offset by solid results from Google and Apple (although one wouldn't know it looking at today's stock price), investors were keenly looking for a tiebreaker from today's Amazon AMZN earnings, where according to Bloomberg, the biggest question for Amazon is how sustainable are the growth trends that boosted its performance during the pandemic. The Internet giant was one of the biggest beneficiaries of shifts in consumer and business behavior last year.

Many consumers flocked to buy things online as they wanted to avoid infection at physical stores. Further, Amazon Web Services revenue soared on back of rising usage from Internet digital services - including remote-working software, videostreaming, and gaming. But with the wider available of vaccines and as employees start to return to physical offices, the risk is some of these trends may start to reverse. Bloomberg also notes that investors will be also looking for any commentary on the future prospects for regulation and antitrust legislation.

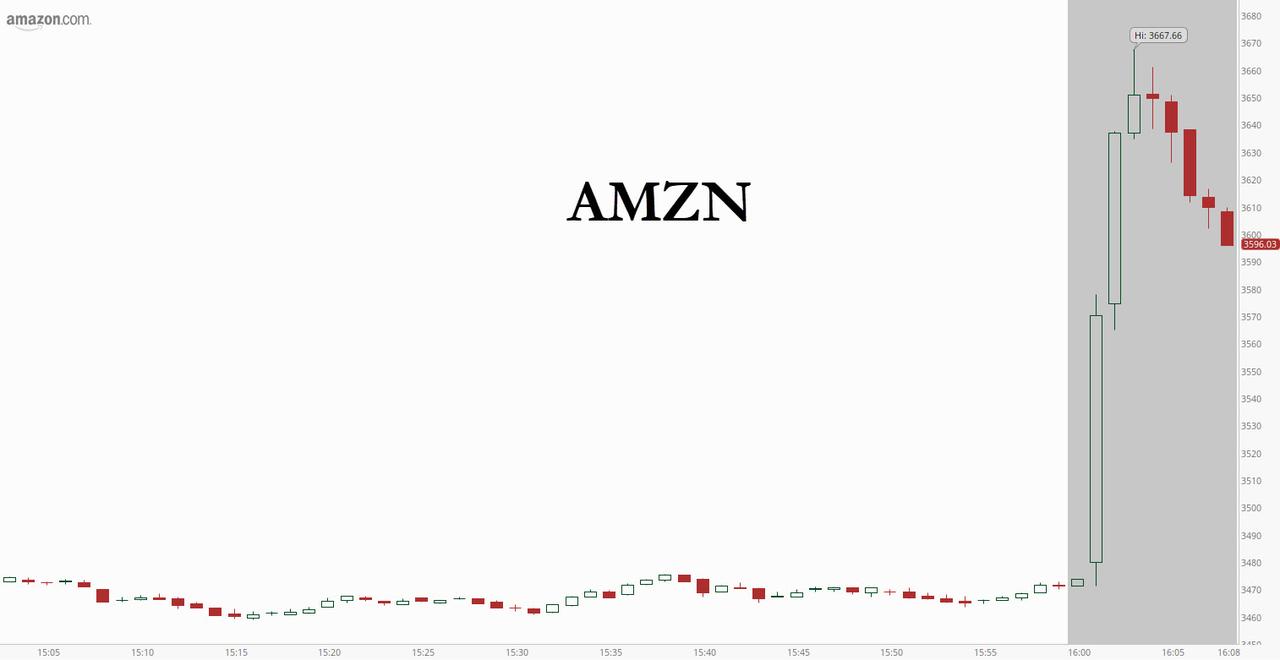

Questions aside, Amazon shares rallied in recent weeks, gaining about 18% off a year-to-date low in March. The stock has been approaching an intraday record of $3,552.25 that was set in early September. Shares rose about 0.3% Thursday ahead of results.

* * *

So with that in mind, how did Amazon do? Well, in the first quarter since Jeff Bezos announced his departure, we just had another blockbuster quarter for the online retailer which blew away consensus estimates and also guided solidly higher than expected, potentially tipping the scales bullishly for the mega techs. Here is a summary for Q1:

- Net Sales $108.5B, beating estimates of $104.56B

- EPS $15.79, beating estimates of $9.690

- Operating Income $8.9B, beating est. $6.11B

- AWS net sales $13.50 billion, beating estimate $13.09 billion

- Amazon Web Services net sales +32%, estimate +22.5%

- Q1 Online Stores Net Sales $52.90B, beating est. $50.63B

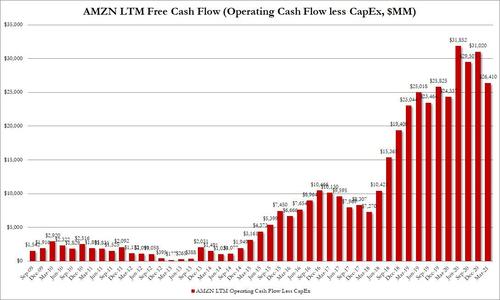

- Q1 Free cash flow increased to $16.8 billion for the trailing twelve months, compared with $11.7 billion for the trailing twelve months ended March 31, 2020.

Looking ahead, the company's guidance was once again stellar:

- Q2 Net Sales $110.0B to $116.0B, smashing Wall Street est. $108.35B, and assumes $1.5B of costs related to Covid-19

- Q2 Operating income between $4.5 billion and $8.0 billion, compared with $5.8 billion in second quarter 2020.

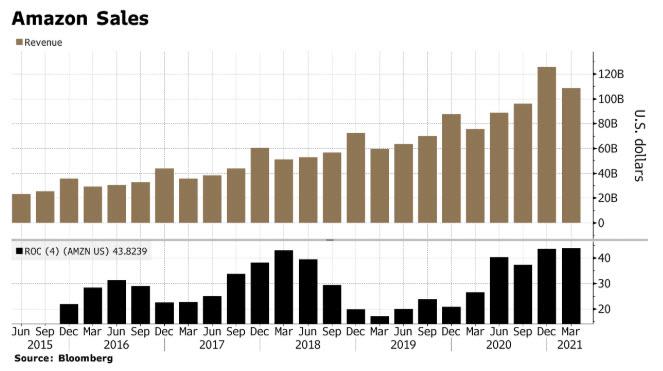

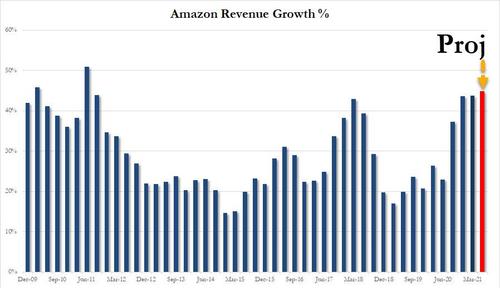

Digging into he number we find that the company's revenue grew by a whopping 43.8% in Q1, just above the 43.6% last quarter and the biggest increase since 2011, with Q2 midline revenue ($113BN) projected to grow an even more impressive 44.9%.

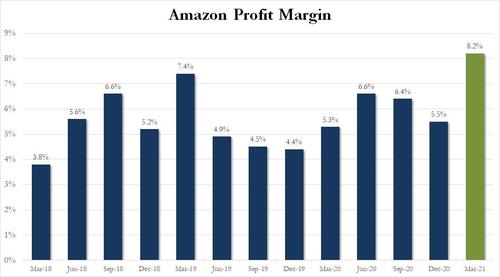

At the same time, operating margin rose dramatically, jumping from 5.5% to 8.2%, the highest in recent history.

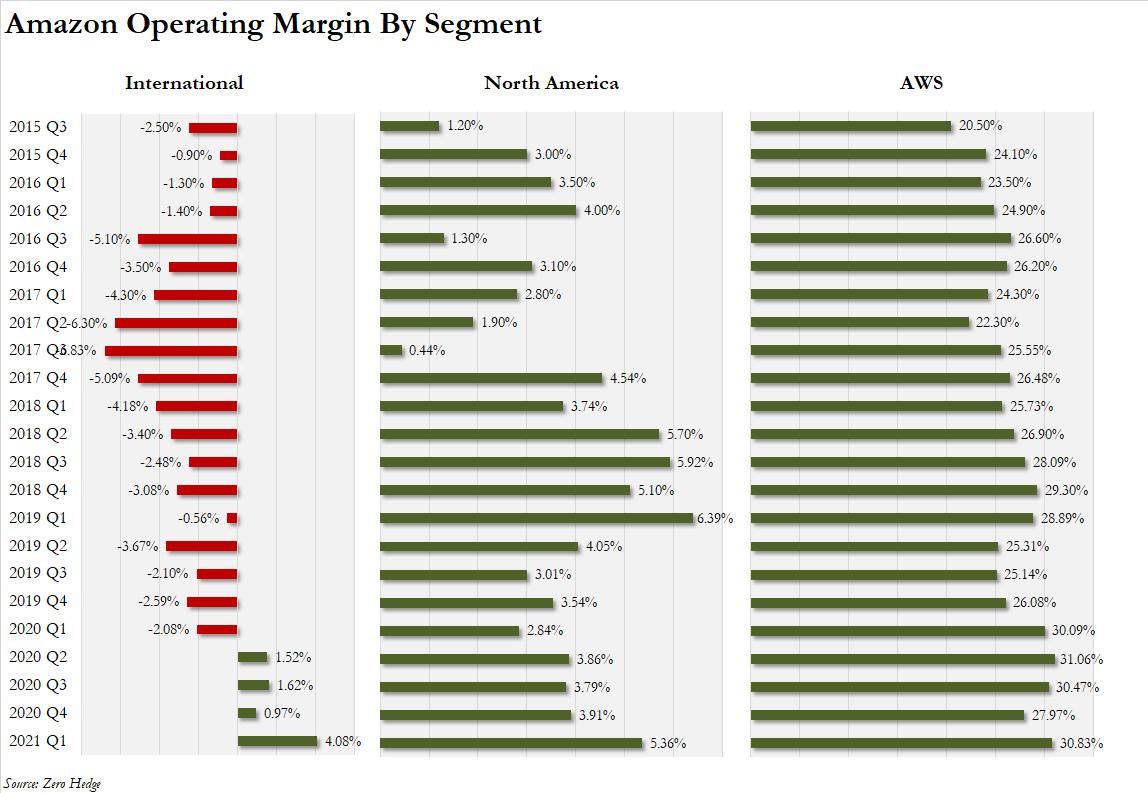

A look at margins showed a remarkable improvement in both North American and Intl retail margins, while the AWS margin of just under 31.8% was a solid rebound from the drop in Q4 to 27.9%, potentially easing investor concerns that margins at the unit may have peaked.

Amazon's total Free cash flow (including leases and obligations) was $26.410 billion for the trailing twelve months, up 9% from $24.337BN a year ago.

And speaking of AWS, revenue rose by 32.1%, far above the 22.5% analysts consensus. And as shown in the chart above, operating margin was up solidly both year over year and especially, sequentially.

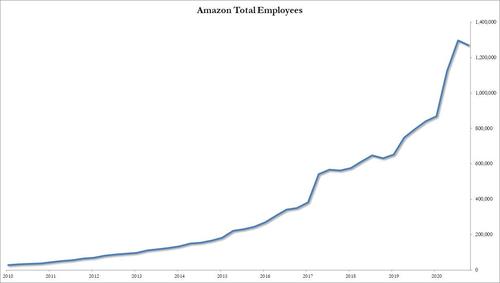

Curiously, for the first time in two years, the company's employees actually dropped.

Bottom line: the first post-Bezos quarter was nothing short of a "grand slam" with revenue and earnings smashing expectations, as did cloud computing sales and income. Looking ahead, the outlook for the current quarter also beat expectations, easing concerns about a post-pandemic let up in sales.

The stock predictably has surged after hours, hitting a new all-time high of $3,667.66 before retracing some of the gains.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Mid-Q1 Bezos announced that he would step down in Q3. So there is NO actual basis to call these 'post-Bezos' results.