Amazon Crashes After Missing Revenues, Guiding Far Below Consensus

With the bulk of the FAAM(N)G stocks reporting somewhat mixed earnings so far, with NFLX, FB, and AAPL disappointing offset by solid results from Google and Microsoft, investors were keenly looking for a tiebreaker from today's Amazon AMZN earnings, where the biggest question for Amazon is how sustainable are the growth trends that boosted its performance during the pandemic. The Internet giant was one of the biggest beneficiaries of shifts in consumer and business behavior last year while continuing to grab market share in the cloud.

Many consumers flocked to buy things online as they wanted to avoid infection at physical stores. Further, Amazon Web Services revenue soared on back of rising usage from Internet digital services - including remote-working software, video streaming, and gaming. But with the wider availability of vaccines and as employees start to return to physical offices, the risk is some of these trends may start to reverse. Bloomberg also notes that investors will be also looking for any commentary on the future prospects for regulation and antitrust legislation.

Questions aside, Amazon shares - which spent much of 2021 in a tight range - rallied in recent weeks, rising from $3500 to just over $3700 before giving up half the gains in the past few days. The stock has been approaching an intraday record of $3,773.08 that was set in early July, although so far it has been unable to surmount it.

Is this the quarter that finally propels Amazon stock to new all-time highs?

Looking ahead, Amazon - in its first quarter under new CEO Andy Jassy who may or may not join the analyst call later today, as a reminder Jeff Bezos hadn't joined an earnings call since 2009 -is expected to post revenue of $115 billion, up 29% from a year earlier, with EPS of $12.28, up 19%. Both would be records for the second quarter. Looking at Amazon's cash machine, analysts expect AWS to pull in $14.1 billion in the second quarter, up 31% from a year earlier. The unit’s growth has slowed in recent years and lags that of smaller cloud-computing rivals Microsoft and Google.

As Bloomberg notes, a forward-looking question for today: How is Amazon’s profitability going to shake out after the company added millions of customers, hundreds of warehouses, and hundreds of thousands of employees in the past year?

* * *

So with that in mind, how did Amazon do in Andy Jassy's first quarter as the company's new CEO? Well... not so good: not only did the company miss on the top line and operating income but guided much lower than Wall Street expected.

- Net Sales $113.1B, up 27 Y/Y but badly missing estimates of $115.1B

- EPS $15.12, beating estimates of $12.28

- Operating Income $7.7BN, missing est. $7.82B

- AWS net sales $14.81 billion, beating estimate $14.18 billion

- Free cash flow increased to $16.8 billion for the trailing twelve months, compared with $11.7 billion for the trailing twelve months ended March 31, 2020.

Looking ahead, the company's guidance was unexpectedly ugly, with the high end of expectations missing sell-side consensus

- Q3 Net Sales $106.0B to $112.0B, badly missing Wall Street est. $118.75B

- Q3 Operating income between $2.5 billion and $6.0 billion, also missing estimates of $8.11BN

Commenting on the results, Amazon's new CEO Andy Jassy said that “over the past 18 months, our consumer business has been called on to deliver an unprecedented number of items, including PPE, food, and other products that helped communities around the world cope with the difficult circumstances of the pandemic. At the same time, AWS has helped so many businesses and governments maintain business continuity, and we’ve seen AWS growth reaccelerate as more companies bring forward plans to transform their businesses and move to the cloud."

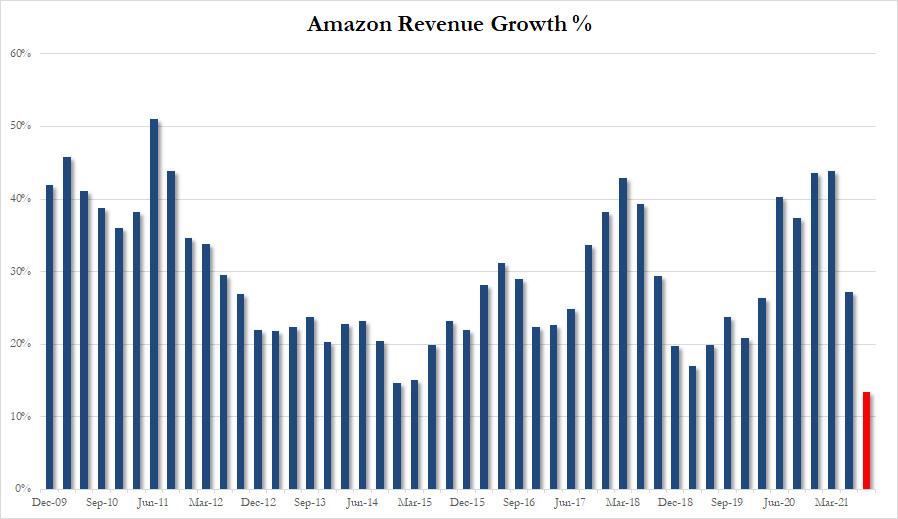

Digging into the numbers we find that the company's revenue grew by 27% in Q2, well below the 45.0%. it gets worse because the Q2 midline revenue of $109BN is projected to grow just 13.4% Y/Y, the slowest growth in the past decade.

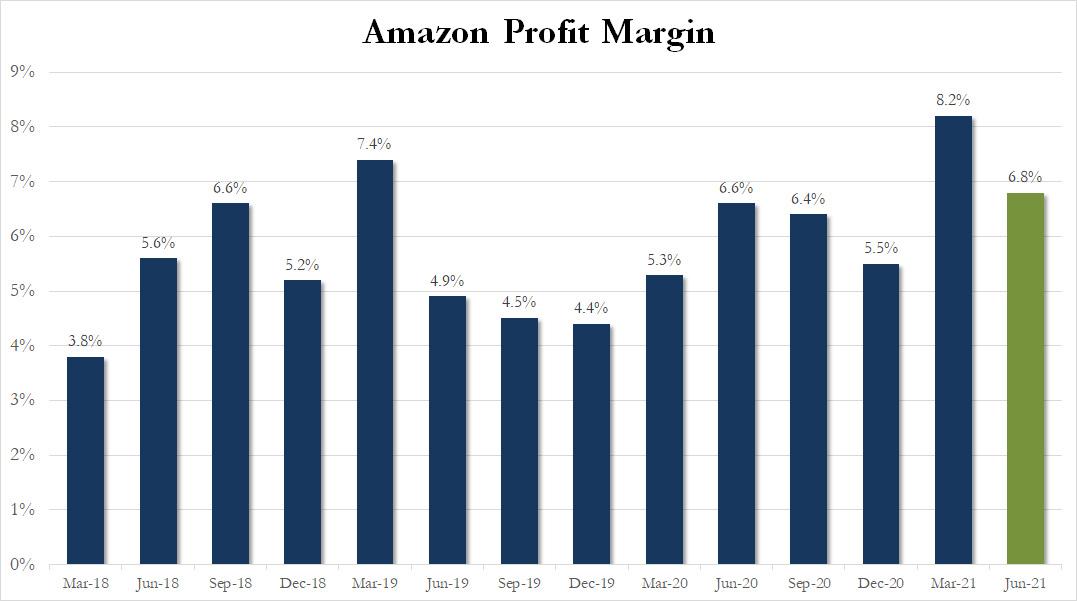

At the same time, operating margin slipped, dropping from 8.2%, which was the highest in recent history, to a far more mediocre 6.8%.

(Click on image to enlarge)

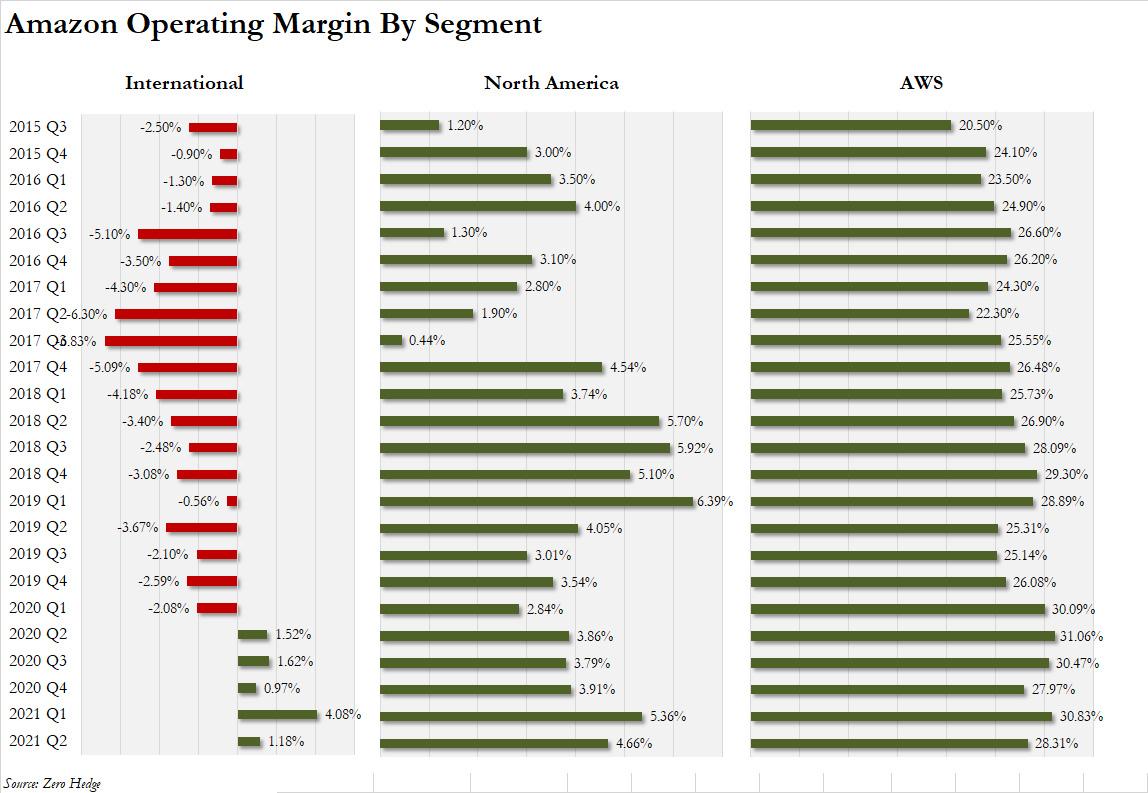

A look at margins also showed an unpleasant drop in both North American and Intl retail margins, while the AWS margin of just over 28.3% was one of the lowest since the start of the covid pandemic, raising investor concerns that margins may have peaked.

(Click on image to enlarge)

The silver lining is that at least AWS sales picked up modestly, rising 37% Y/Y to 14.8%, beating estimate. However, this was more than offset by growth in online stores which slowed significantly to just 16%, the lowest since 2019.

Amazon's total Free cash flow (including leases and obligations) was another ugly mark, tumbling more than 62% Y/Y to just $12.146 billion for the trailing twelve months.

(Click on image to enlarge)

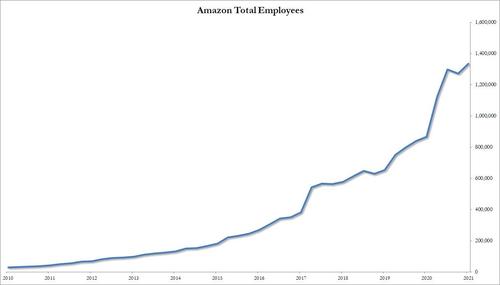

Despite the ugly results, the company resumed its hiring ways and after a small dip in Q1, the company employees hit a new record high of 1.335 million.

If hitting the analyst estimates on the nose is a negative for the megacap tech stocks, then missing them altogether will take a toll.

Amazon’s 2Q net sales ended up missing alongside their 3Q forecasts. Web services are in line with estimates, though with $1 billion of costs related to the virus.

Could this be the end of the pandemic-related spending boom? This morning’s economic data suggested consumer spending was still roaring, but the early takeaway from Amazon suggests perhaps that could also come to an end. Note, this company also has a massive shipping and distribution network that in the depths of the pandemic didn’t end up being profitable, but rather a weight.

The stock predictably is crashing after hours, down almost $200 to $3,418.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Interesting, and certainly a demonstration of rotten attitude.! Profits growing obscenely and yet complaining that they were not quite as big as last week. Sorry to be so very blunt about it, but with that much profit any complaint about it not being enough has an offensive stench.