Amazon: Accelerating Cash Flows And Attractive Valuation

Image Source: Unsplash

Investment decisions supported by a simple and straightforward thesis are often the most profitable and effective ones. Amazon (Nasdaq: AMZN) has consolidated its position as an indestructible powerhouse with rock-solid competitive strengths, and the business is well on track to generating healthy and growing cash flows in the years ahead. Importantly, current market conditions are creating an opportunity to buy Amazon stock at compelling valuation levels.

Outstanding Fundamental Quality

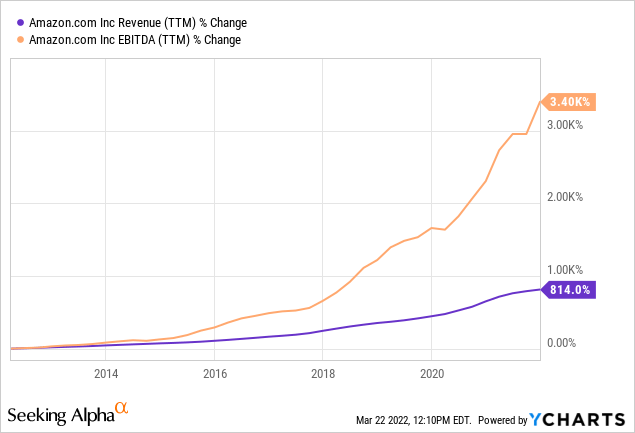

Amazon has an impeccable track record of revenue and cash flow generation over the years. The big question for investors is whether the company can continue on the long-term path to wealth creation going forward.

Data by YCharts

This is where competitive advantages - or moats - are so critically important. In simple terms, competitive advantages are the business characteristics that allow a company to protect its revenue and cash flow from the competition.

"Frequently, you'll look at a business having fabulous results. And the question is, ‘How long can this continue?’ Well, there's only one way I know to answer that. And that's to think about why the results are occurring now - and then to figure out the forces that could cause those results to stop occurring." Charlie Munger

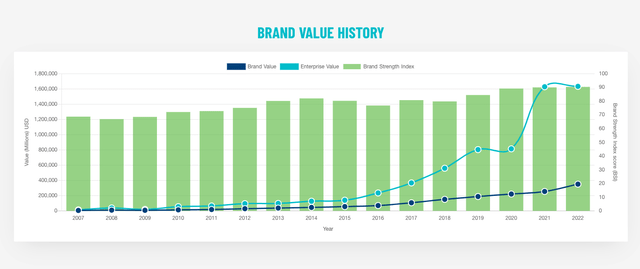

In Amazon's particular case, the company's fabulous results are sustained by multiple sources of competitive advantage. The most evident one is brand value. Amazon is a customer-obsessed company that has built an outstanding reputation among consumers over the years due to its efficient delivery network and world-class customer service.

When you buy something via Amazon, you have a healthy degree of confidence that the product will arrive as expected and on time. If anything is wrong, Amazon will probably fix the problem and/or compensate you for the inconvenience.

Customer trust is an invaluable asset, but Interbrand estimates the value of the Amazon brand at around $249.2 billion.

Interbrand

With over 200 million prime members and an unparalleled logistics network, scale is another key source of competitive advantage for Amazon. The larger the scale of the business, the bigger the company's ability to spread fixed costs on a large number of products, reducing fixed costs per unit and creating a self-sustaining cost advantage as the company keeps gaining scale.

There is also a network effect in play. More customers attract more sellers to the platform, which creates a greater selection and a bigger scale to reduce costs and prices. This keeps attracting more customers and sellers to Amazon over time. The same dynamic is at play in Amazon Web Services, more scale produces more efficiency and cost advantages as revenue grows.

The company has both the strategic position and the financial resources to continue investing in all kinds of opportunities. For example, Amazon reported revenue from advertising for the first time ever last quarter, with the number exceeding $9.7 billion and growing 33% year over year. This is a highly attractive industry with compelling margins and plenty of room for expansion in the years ahead.

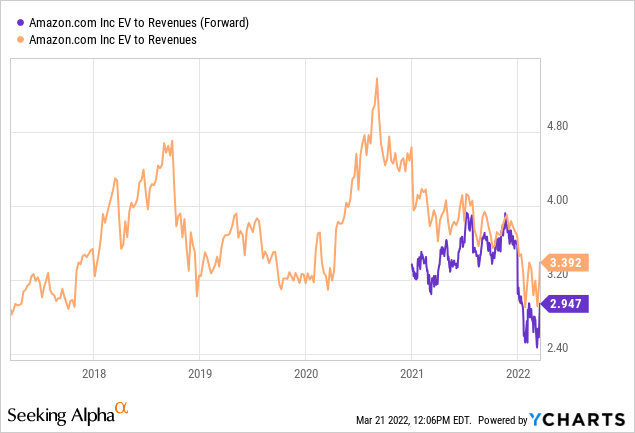

Attractive Valuation Levels

Amazon is a relatively large and stable corporation in the tech world, so it doesn't have the same degree of volatility that you typically find in smaller growth stocks with more explosive price moves. Amazon is down only 12% from its highs of the year, which is a relatively mild correction in comparison to the sharp drawdowns experienced by smaller-capitalization growth stocks.

However, you don't necessarily need a sharp price decline to make valuations attractive when the fundamentals are moving in the right direction. The Enterprise Value to Revenue ratio currently stands at 3.4, which is at the low end of the valuation range for Amazon over the past 5 years.

Data by YCharts

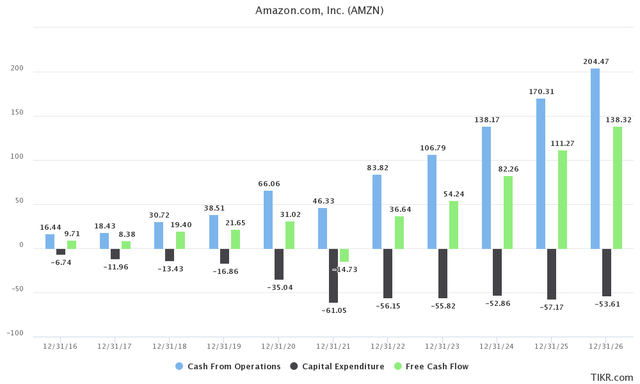

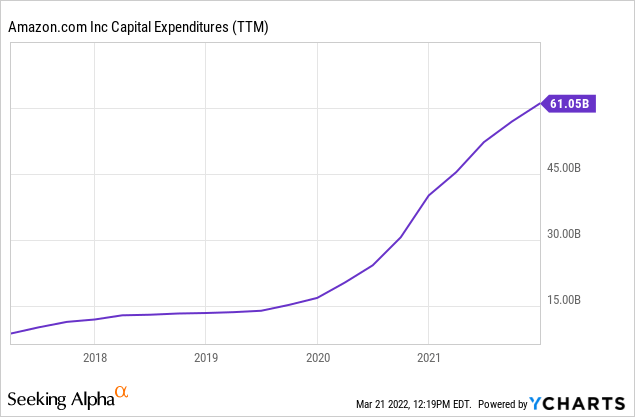

Amazon has experienced a tremendous surge in capital expenditures lately. From less than $17 billion in CAPEX for 2019 to over $61 billion in 2021.

The company is making the right move by allocating gargantuan sums of capital to cloud computing, logistics, and distribution investments.

The scale that Amazon has reached because of these investments is unparalleled and almost impossible to replicate by smaller competitors. This capital is being well invested in creating the foundations for long-term growth.

Nevertheless, these moat-building investments are expensive, and currently a drag on the company's cash flows.

Data by YCharts

The chart below shows operating cash flow, capital expenditures, and free cash flow for Amazon in recent years, as well as the forward-looking consensus estimate among the Wall Street analysts following the stock.

Even if analysts are expecting CAPEX to remain elevated in the years ahead, operating cash flow growth should drive a substantial expansion in free cash flow generation over the near term.

TIKR

Wall Street analysts are on average expecting Amazon to make $155 and $203 in cash flow per share during 2022 and 2023. Under these assumptions, the stock is trading at a forward price to cash flow ratio of 20.6 and 15.7, respectively.

This is hardly excessive for such a high-quality business, and it is not much of a stretch to say that Amazon is undervalued at current prices.

A sum of the parts valuation would also look quite compelling. The company made $62.2 billion in AWS revenue during 2021, with revenue growth exceeding 40% year over year in Q4 and operating margin consistently in the neighborhood of 30% for this business. Annualized revenue run rate was actually $71 billion at the end of the quarter.

If we give Amazon Web Services a price to sales ratio of 15 on trailing revenue, which is rather conservative, this business alone is worth $933 Billion. A price to sales ratio of 20, which is not unreasonable at all by industry standards, gives us a market value of $1.24 Trillion for AWS.

As of the time of this writing, Amazon has a market cap value of $1.6 Trillion, so it is fair to say that a big part of this valuation is justified by AWS alone.

Most companies tend to see a deceleration in growth as they gain size over time. It is obviously much easier to generate rapid percentage growth from a smaller revenue base. Amazon is no exception to this rule, and revenue growth rates will most probably slow down in the years ahead.

At the same time, however, Amazon is making a larger share of total revenue from attractive segments like AWS, third-party sales, and advertising. Third-party sellers provided 56% of all unit sales in Q4, the highest fourth-quarter mix ever, and the trend has been well in place for several years.

These areas are far more profitable and more attractive than first-party retail sales. This increased focus on highly profitable segments should have a positive impact on both cash flow generation and valuation levels for Amazon going forward.

Risk And Reward

The e-commerce business is facing some headwinds in the short term due to factors such as tough year-over-year comparisons, supply chain issues, and rising inflation having an impact on disposable income.

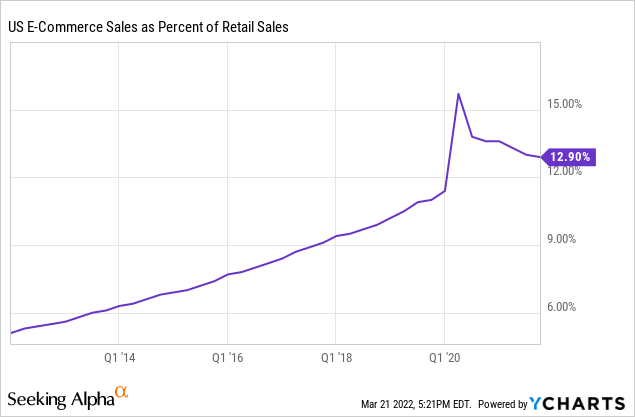

Over the long term, however, e-commerce will keep accounting for a larger percentage of retail sales, as the lines between the physical and digital world are getting increasingly blurred all over the world. After a short-term spike and then a pullback due to the lockdowns and the subsequent reopening, e-commerce growth seems to be back on its long-term trend.

Data by YCharts

Regulatory risk is always an issue for Amazon and other big tech players. However, this is more of a "headline risk" that would affect the stock price and probably not so much the fundamental drivers behind the investment thesis in Amazon. It is hard to imagine the government inflicting too much damage on Amazon. After all, consumers love the company, as it strives very hard to offer low prices, wide selection, and world-class service.

In terms of competition, Shopify (SHOP) is perhaps the biggest risk for Amazon. Shopify allows merchants to have full control of the customer experience and the data, which is a big advantage. Shopify is also making smart inroads in social commerce via partnerships with the leading social networks like TikTok while permanently expanding its platform of services to consolidate its competitive position.

That being said, the market opportunity is large enough for both Amazon and Shopify to thrive in the years ahead. Both Amazon and Shopify have smart business models and world-class management teams.

The stock market is usually too simplistic when assessing competitive dynamics in an industry. There are lots of examples in history to consider: Should you buy Coke (KO) or Pepsi (PEP)? Visa (V) or Mastercard (MA)?

The right answer was buying both in those cases, and the answer to Amazon or Shopify will probably be both too.

Risk can never be eliminated in investing, as this would eliminate upside potential too. You have to understand the main risks in investment - while also considering that there are some future risk factors that may not be visible right now - and then you make decisions by weighing both the risks and the upside potential together.

Amazon is a high-quality business with rock-solid competitive strength, outstanding execution at scale, expanding cash flows, plenty of growth opportunities, and trading at an attractive valuation. The risk to reward tradeoff in Amazon stock looks clearly compelling for investors.

Disclosure: I/we have a beneficial long position in the shares of AMZN, SHOP either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, ...

more