Alphabet: Winning In Health Losing In Hardware

Alphabet´s (GOOG)(GOOGL) main revenue driver is the advertisement and cloud business, but as the segment plateaus, other segments will have to carry the company's growth. Verily and Google´s hardware are two of the most important segments that could define how Alphabet will grow in the next years.

Verily stepping into health insurance could be a defining catalyst for the company; on the other hand, Google´s hardware is becoming a major disappointment. While Google has developed wonderful products like the Pixel 4 and Nest cameras, the production, distribution, and commercialization of said products has been far from ideal. Google´s hardware division mas major issues preventing it from becoming a significant asset for the company.

Verily Going into Health insurance

Verily is a division of Google focused on life sciences. It is developing several projects with major players in the health industry, and now it is going into health insurance.

Almost a third of deaths in the US are caused by heart conditions, strokes, diabetes, or cardiovascular diseases. Verily has built impressive capabilities in treating and detecting these diseases, and that should allow it to escalate its insurance play quickly and effectively.

Verily has collaborated with Dexcom (DXCM) on continuous glucose monitoring (CGM), making tremendous progress in treating and monitoring diabetes. The newest CGM model, the G7, will fully incorporate Verily's tools, and it is expected to deliver a breakthrough in diabetes care. Verily also collaborated with Sanofi on Onduo, a virtual diabetes clinic that aims to improve diabetes patients' lives. These projects provide data on the diseases' progression and allow Verily to have an edge when calculating insurance risks related to diabetes.

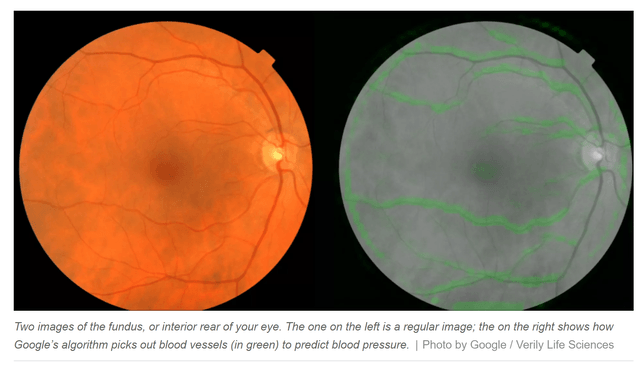

Verily has also made significant progress in predicting cardiovascular risk by examining the back of patients' eyes. This shows how AI can use existing information to better diagnose other diseases or obtain new data without additional tests.

Source: The Verge

Setting aside the specific diseases in which Verily has cultivated an edge, the company has also made meaningful developments in mapping the general health conditions and the prediction of patient outcomes. Project Baseline and the Verily study watch Project do exactly that.

Source: Verily

Having a comprehensive baseline of how health conditions look like allows Artificial Intelligence systems to detect when a person deviates from that baseline. Currently, Project Baseline is working with California´s Department of Public Health to safely track COVID 19 responses and follow up with the patients.

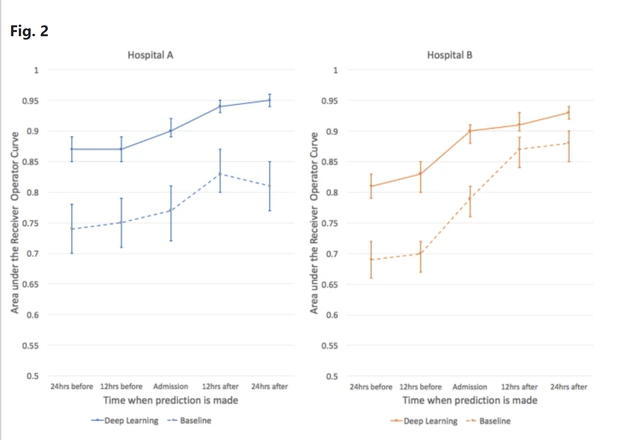

These capabilities were showcased in the NHS intervention program and healthcare performance measurement program. In these programs, Verily has been able to predict the outcome of diseases and patient deaths in hospitals much more accurately than the current state of the art systems. In a study published by nature, Google showed that its model could predict patient outcomes with a 93%-95% accuracy, much higher than the traditional methods.

Source: Nature

Another benefit of the system is that it reduced the need for paperwork, which reduced logistics costs at the hospitals and could provide an additional benefit for hospitals to adopt it.

Verily is entering the insurance industry with stop-loss insurance, which provides insurance only for catastrophic or unpredicted situations, which is the perfect application to exploit the model.

Google misses on hardware

Nationally, Google´s hardware offering has been characterized by an unreliable supply chain worsened by ill-planned product launches. These issues make it hard for regular users to consider switching from iOS to a Pixel phone and crown Amazon as the king of smart-home products.

To exemplify this issue, we can look at last year´s Pixel launch. The new design removed the headphone jack, but Google did not launch its wireless earbuds with the phone, forcing users that got the Pixel 4 at launch to get their wireless earbuds elsewhere. A similar issue arose in the launch of the Pixel 4a as the phone cannibalized some of the demand for the Pixel 4 that had been discounted. Both launches had intense replenishment issues, forcing users to get another phone or wait an uncertain amount of time to get the Pixel. It is too early to tell if these issues will repeat with this year's launch, but the international issues are still present.

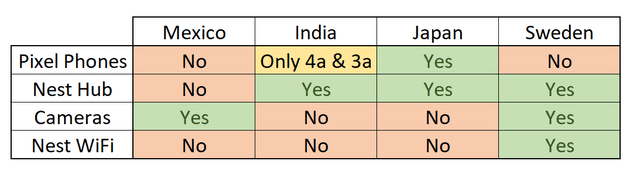

Pixel 5 will only launch in 7 countries outside the US, which cuts the phone's revenue prospects from the start. International availability is even more critical in the Nest products. While Amazon, Samsung, and Apple (AAPL) have made a broad and comprehensive strategy on IoT and smart home devices internationally, Google´s strategy is precarious. If Google cannot deploy a comprehensive international strategy for the relatively small current demand, it will lose significant market growth in the years to come.

Google´s international hardware portfolio is limited, and it is bizarrely arranged. For example, the India Google store does not have Nest cameras, but it does provide the Nest Hub, which is not available in the Mexico store, which does have nest cameras.

Source: Google Store

One might assume that the portfolio is constructed based on the demographics of the countries. Still, looking at the Japanese Google store, it has almost the same portfolio of Nest products as the Indian store but is more limited than the Mexican and Swedish stores. The Swedish store is the only one with Nest Wifi, but it does not support Pixel devices.

These issues limit the segment's prospects, and obliterate the quality of the products that Google develops, raising serious concerns on the segment's future.

Valuation

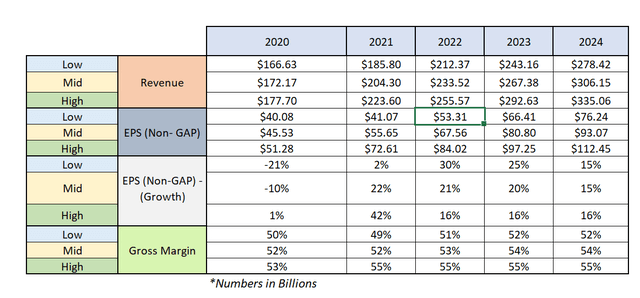

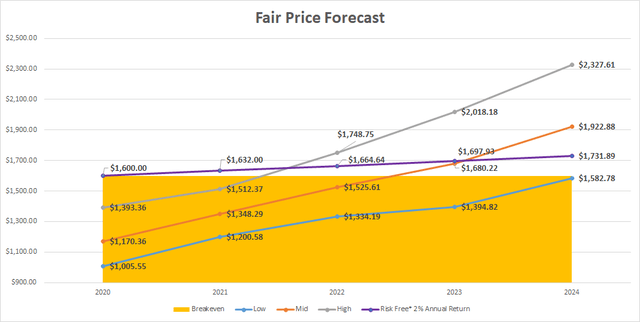

In the past few years, Alphabet´s revenue growth has ranged between 17.8% and 23.7%, with a tendency to decrease. The valuation considers Alphabet´s revenue prospects as a whole, instead of estimating the likely growth for each segment to better model the likely worst and the best-case scenario for the company.

The prediction estimates an average revenue growth of 13.9%. Gross margin has been declining for some time, and it is one of the most concerning factors that could dramatically change Alphabet´s valuation.

Source: Author´s Charts

I like to use Peter Lynch's ratio when valuing a stock. This method uses the ratio between the expected earnings growth plus dividends and the store's P/E to determine its fair value. A stock that has a 1:1 ratio is reasonably priced. The higher the number, the more underpriced the stock is.

Source: Author´s Charts

The valuation considers that Alphabet does not have long term debt, and it has around $120 Billion in cash and short term investments. The growth considered in the valuation is the average yearly growth of the next years, taking as reference non-GAAP earnings.

With this valuation, arguably, the stock is at worst overvalued by 37% and, at best, overvalued by 13%. So the stock is overvalued.

Source: Author´s Charts

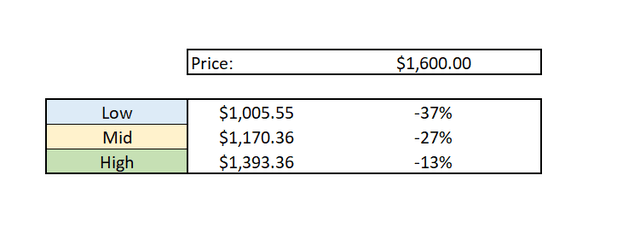

Building an adjusted Beta Pert risk profile for the stock's current fair price, we can calculate the risk profile for purchasing the stock now.

We can calculate its risk profile for the stock's long-term prospects to construct an adjusted Beta Pert risk profile for its long-term prospects.

Source: Author´s Charts

The risk profile shows an 8.01% probability that Alphabet will end up trading at a lower price than it is today. Considering the potential downside, upside, and the likelihood of each, the statistical value of the opportunity of investing now is 4%.

Conclusion

The stock is overpriced for its current results; however, its long-term prospects are still quite attractive. Verily could be a defining catalyst and slowly push the company results to the top side of the estimate if the Hardware business doesn´t drag the results down. While other factors could change Alphabet´s outlook, like Stadia and Waymo, Verily and Google´s hardware segment will have impacts in the short term with the launch of the Pixel 5 and the start of insurance operations.

It is probably not the best time to enter the stock for new investors. The price is not ideal, and the long term prospects are not high enough to justify the short term risk. However, current investors might want to keep their shares and wait to see how these catalysts play out in the next few months.

If there is anything in this article, you agree or disagree with or would like me to expand further, and I would sincerely appreciate you leaving a comment. I will address it as soon as possible.

Disclosure: I am Long GOOG, GOOGL, DXCM.

Good read, thanks.