Alphabet Is Undervalued

The tech sector has produced outstanding returns over the past several years, and it is not easy to find attractively priced companies in this area of the market these days. Alphabet (GOOG) (GOOGL) could be the exception to the rule, though, since the stock is still offering a fairly compelling entry price for such a high-quality business.

Solid Fundamentals

Google is so powerful that its brand is associated with the name of the product, we generally "google" information as opposed to searching for it online. This privilege is reserved for exceptionally strong and dominant businesses in different markets.

Google has also built an enormous ecosystem with a dominant presence across mobile, video, maps, and cloud computing, among several other areas. Size and reach are key sources of competitive strength because these factors allow Google to capitalize on massive amounts of information in order to improve the quality of its products and to make advertising more efficient.

Beyond Google, Alphabet owns an intriguing portfolio of technologies with big upside potential from current levels. Even if many of these moonshot projects will fail to generate any kind of profitability, the opportunities in areas such as autonomous vehicles or life-extension technologies could be huge.

In any case, these projects are currently producing only expenses on the income statement. The value of a business can never be less than zero, and Alphabet could always sell or even close the companies that don't show any viability.

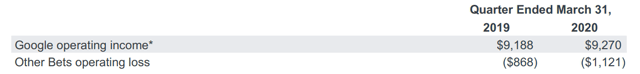

Looking at the company's financials in aggregate underestimates the true profitability of the business and hence its value. To make a ridiculously simple example, if Alphabet decided to sell or close its other bets completely, operating income would automatically jump by 15%. The company would hardly do this, though, since many of these technologies could offer huge opportunities for growth.

Source SEC: fillings

Google has aggressively invested in building its cloud computing capabilities over the past several years, and these investments are paying off in spades. Cloud revenues reached $2.8 billion in the first quarter of 2020, up 52% year-over-year. Demand for all kinds of cloud services is accelerating due to the pandemic, and Alphabet is in the right place to profit from this trend.

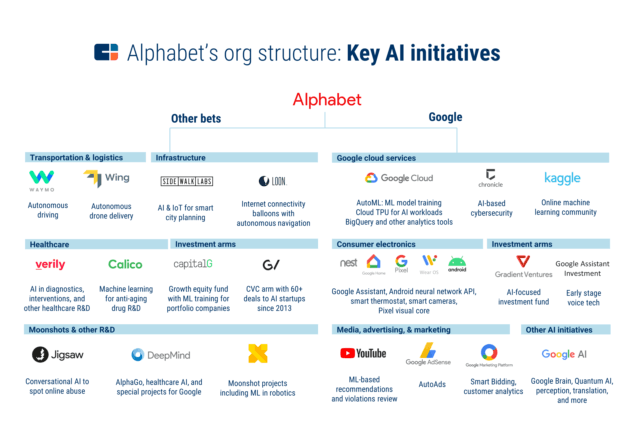

Artificial Intelligence is arguably the most crucial trend in technology over the coming years and decades, and Alphabet has identified AI as a main area of focus several years ago.

AI is probably the most important thing humanity has ever worked on. I think of it as something more profound than electricity or fire.

Google CEO, Sundar Pichai

The company has a wide portfolio of AI initiatives across different areas, and it has the strategic strength, financial resources, and human talent to be one of the leaders of the AI revolution in the years and decades to come.

Source: CBS Insights

Attractive Valuation

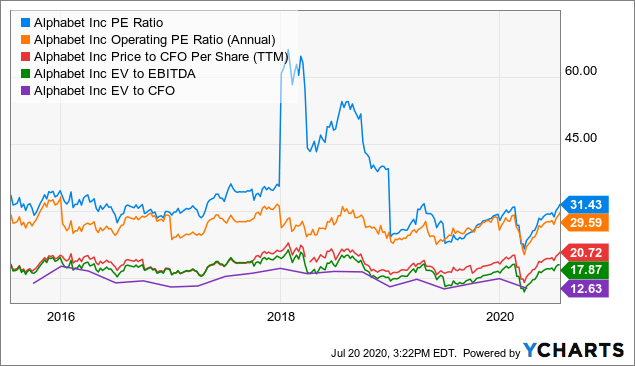

The chart shows different valuation ratios for Alphabet over the past five years. Considering indicators such as price to earnings, operating price to earnings, price to operating cash flow, EV to EBITDA, and EV to operating cash flows, valuation is broadly in line with historical standards.

In times when the stock market is expensively valued and many tech stocks are trading at record-high valuation levels, it is good to see that Alphabet is still trading at valuation ratios that look pretty reasonable from a historical perspective.

Data by YCharts

Historical data can provide some context, but valuation is essentially about future cash flow generation. The true value of the business depends on the cash flows that the company is going to produce in the years ahead, and the past is only a prologue to the future.

The problem is that future can never be known with precision, only estimated, and these estimates necessarily carry a large margin of error. However, if we consider different possible scenarios we can have an interesting picture of valuation from a probabilistic perspective.

Alphabet management does not provide much guidance, so there is always a considerable degree of dispersion in earnings estimates among the analysts following the stock. This uncertainty is now higher than usual due to the pandemic and the global recession affecting the advertising industry.

As a reference, the table shows the average earnings estimate, the growth rate implied by this estimate, the most pessimistic earnings estimate, and the most optimistic estimate for Alphabet from 2020 to 2024.

| Fiscal Period Ending | Avg EPS | YoY Growth | Pessimistic E | Optimistic E |

| Dec 2020 | 42.58 | -18.72% | 37.08 | 49.2 |

| Dec 2021 | 54.98 | 29.14% | 40.8 | 66.33 |

| Dec 2022 | 62.92 | 14.44% | 27.98 | 76.03 |

| Dec 2023 | 75.01 | 19.21% | 71 | 80.05 |

| Dec 2024 | 83.45 | 11.25% | 80.69 | 86.21 |

| Dec 2025 | 95.97 | 15.00% | 90.32 | 101.62 |

| Dec 2026 | 119.19 | 24.20% | 119.19 | 119.19 |

Data Source: Seeking Alpha

Now we can take a look at forward-looking valuation ratios under different earnings assumptions. The table below shows the forward price to earnings ratio for Alphabet based on the average earnings estimate, the most pessimistic estimate, and the most optimistic estimate.

Alphabet is fairly reasonably valued for 2021 and beyond, and a more optimistic earnings estimate makes the stock look like a big bargain.

| Fiscal Period Ending | Average PE | Pessimistic PE | Optimistic PE |

| Dec 2020 | 35.70 | 40.99 | 30.89 |

| Dec 2021 | 27.65 | 37.25 | 22.92 |

| Dec 2022 | 24.16 | 54.32 | 19.99 |

| Dec 2023 | 20.26 | 21.41 | 18.99 |

| Dec 2024 | 18.21 | 18.84 | 17.63 |

| Dec 2025 | 15.84 | 16.83 | 14.96 |

Data Source: Seeking Alpha

Just to do some back of the envelope calculations, if actual earnings come in at the mid-point between the average earnings estimate and the most optimistic earnings estimate, let's call this a cautiously optimistic earnings estimate for Alphabet, this would mean $60.7 in earnings per share for 2021. This number would put Alphabet stock at a forward PE ratio of 25, which looks clearly attractive for such a high-quality business.

Risk And Reward Going Forward

A position in Alphabet is not exempt from risks, although it seems to me like the market may be focusing on the wrong risk factors. Regulatory pressure will continue increasing in the near term, but the company has both the financial resources and the strategic strength to continue thriving in spite of facing more regulations in different markets. Based on past evidence, it doesn't seem likely that more regulatory oversight will derail Alphabet from its long term growth trajectory.

Advertising is a cyclical industry, and it is hard to know to what degree the recession is going to affect Google. Online advertising will keep gaining share versus traditional advertising during the pandemic and beyond, so a higher share of advertising budgets migrating to online channels should compensate for the recession to a good degree. But still, the current context makes the company's financial performance more unpredictable than usual.

The recession is a temporary factor by its own nature, but it can still create some uncertainty and volatility around Alphabet stock over the near term.

Regarding competition, Google is facing rising competitive pressure from titans such as Amazon (AMZN) and Facebook (FB), as well as smaller players making big inroads in programmatic advertising such as like The Trade Desk (TTD) and Roku (ROKU), to name a few noteworthy examples.

Competitive risk can never be disregarded, especially in such a dynamic sector. Alphabet's ability to continue growing strongly in the face of rising competition cannot be taken for granted, and investors need to closely monitor the company's financial performance and the competitive ecosystem going forward.

However, online advertising is a huge and growing market with enormous room for further growth over the long term. Importantly, Alphabet comes second to none in terms of competitive advantages in this promising market.

Investors are usually too short-sighted when analyzing the competitive dynamics in a sector. Trying to pick the winners and avoid the losers is the default approach for most investors, but it is not necessarily the most realistic or profitable way to invest. Buying the best companies in a sector that offers powerful tailwinds for long term growth can produce superior returns.

When the market opportunity is big enough you can have room for multiple winners to do well over time. Participating in the winners is more important than avoiding the losers, and diversifying within the sector can significantly reduce the risks for investors.

I personally own shares of Alphabet, Amazon, Facebook, The Trade Desk, and Roku, and holding these five stocks provides me with exposure to high-quality businesses benefiting from massive tailwinds due to the online advertising revolution while also keeping the competitive risk at bay via diversification.

In any case, risk can never be avoided when investing, nor should investors try to avoid all risks completely. The key is assuming the risks that are well compensated with enough upside potential, and Alphabet makes sense from that point of view.

Alphabet is a fundamentally sound company with rock-solid financial performance and trading at remarkably attractive valuation levels when considering the quality of the business. For these reasons, the stock looks well-positioned to provide healthy returns in the years ahead.

Disclosure: I am/we are long GOOG, AMZN, FB, TTD, ROKU.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more