Alphabet Drops Despite Beating On Revenue And Earnings As Cloud Disappoints

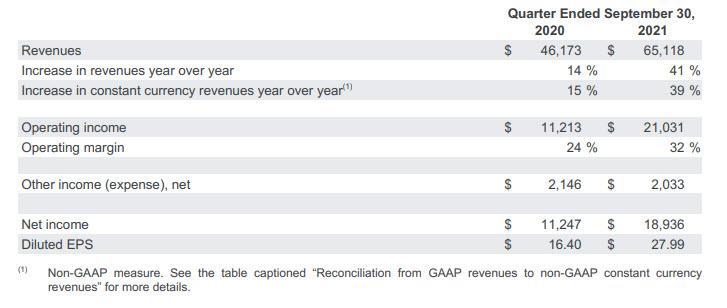

With Microsoft MSFT reporting a beat on the top and bottom line elsewhere, moments ago Google GOOG, GOOGL also posted solid Q3 numbers when it beat on both the top and bottom line, with just a small blemish that Google Cloud revenue missed expectations ever so slightly with CapEx also coming in slightly below expectations. Here are the results:

- Revenue $65.12 billion, +5.2% q/q, beating the estimate of $63.39 billion

- Google Services revenue $59.88 billion, +4.9% q/q, beating estimate $58.16 billion

- Google Cloud revenue $4.99 billion, +7.8% q/q, missing estimate $5.04 billion

- Other Bets revenue $182 million, -5.2% q/q, missing estimate $197.1 million

- EPS $27.99 vs. $16.40 y/y, beating the estimate of $23.50

- Operating income $21.03 billion, +88% y/y, also beating the estimate $18.14 billion

- Google Services operating income $23.97 billion, +7.3% q/q, estimate $21.13 billion

- Google Cloud operating loss $644 million, +9% q/q, estimate loss $935.2 million

- Other Bets operating loss $1.29 billion, -7.9% q/q, estimate loss $1.21 billion

- Operating margin 32% vs. 24% y/y, beating estimate 27.8%

- Capital expenditure $6.82 billion, +26% y/y, missing estimate $6.90 billion.

And visually:

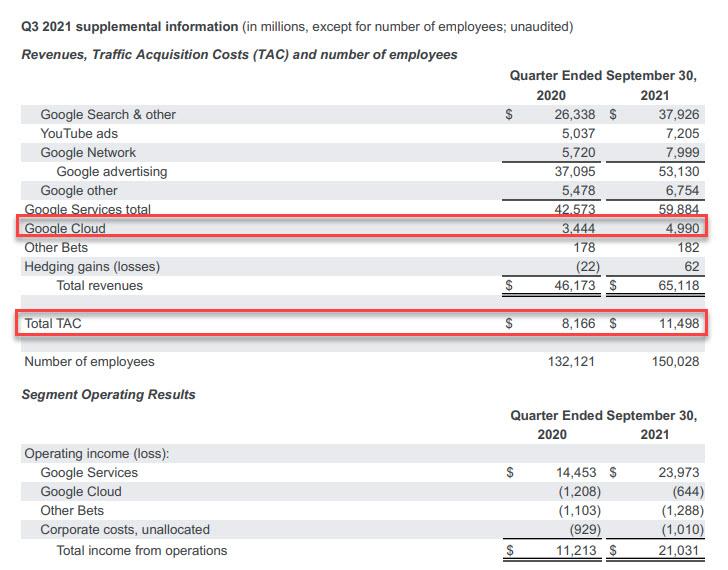

As noted above, while Cloud rose 44% Y/Y to $4.99BN, it came in just below the $5.05BN expected and also dropped sequentially; the Street will likely not be too impressed with this disappointment coming at a time when every major FAAMG is rushing to grab market share in the key segment. The silver lining: Cloud did manage to staunch some of its bleeding during the quarter. It reported $644 million in operating losses, down from a $1.2 billion loss last year (yes, Google's cloud division is still losing money).

Another notable figure: Google’s TAC (its payouts to partners) jumped 40% to $11.5 billion. Google has been trying to curb this number for several years. In other words, while Alphabet’s advertising revenue jumped significantly since last year (to $53.1 billion from $37 billion), so did the price the company pays to partners to aid that growth.

Also worth highlighting: GOOGL's workforce rose by 18K to just over 150K people. As Bloomberg notes, much of that growth likely went to its cloud division.

And in a potentially troubling development, Google's "Other" segment which lumps in devices, app store and YouTube subscriptions, only grew 23% to $6.8 billion. That suggests that its app store and hardware sales aren’t going gangbusters.

Commenting on the results, CFO Ruth Porat said: “Our consistent investments to support long-term growth are reflected in strong financial performance, with revenues of $65.1 billion in the quarter. We continued to deliver across our business by providing helpful and valuable experiences for both consumers and our partners.”

Still, after a blowout second quarter, the narrow beat (and in the case of Cloud, miss) investors appear somewhat underwhelmed with the stock swinging after-hours before drifting slightly lower.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

While "the cloud" as an alternative is still growing, there are some negative considerations that are not so very obvious to most folks. Those are security, availability, and reliability, all of which matter.