Alliant Energy: A Midwest Utility Offering Solid Value And Yield

Image Source: Unsplash

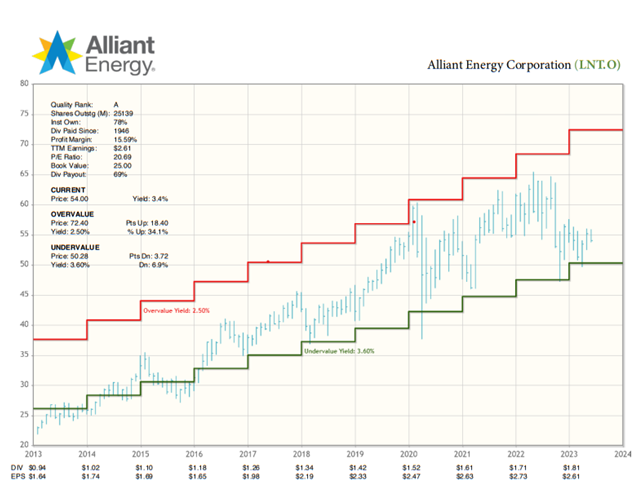

As an investment vehicle, high-quality stocks with long-term track records for consistent, rising profits, and consistent, rising dividends that trade between two repetitive areas of dividend yield offer the least downside price risk and the most upside price potential, all while providing a growing stream of income. Alliant Energy Corp. (LNT) is one such stock to buy, opines Kelley Wright, editor of Investment Quality Trends.

Twenty-five to thirty stocks, purchased at their historically repetitive low-price/high-yield undervalued area, diversified as equally as possible across the nine or ten major industrial sectors, and held until they reach their historically repetitive high-price/low-yield overvalued area, offer the best approach I know of growing cash and income for current and future cash needs.

LNT is one that’s attractive here. Alliant Energy’s primary focus is to provide regulated electric and natural gas service to approximately 985,000 electric and 425,000 natural gas customers in the Midwest through its two public utility subsidiaries, Interstate Power & Light (IPL) and Wisconsin Power & Light (WPL).

IPL is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Iowa. IPL also sells electricity to wholesale customers in Minnesota, Illinois, and Iowa. IPL is also engaged in the generation and distribution of steam for two customers in Cedar Rapids, Iowa.

WPL is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Wisconsin.

Alliant’s strategic priorities include making significant investments toward cleaner energy. Alliant ended 2020 with 42% less carbon emissions than 2005 levels, quickly approaching the planned 75% reduction by 2030. This result was largely driven by the completion of the company’s major wind expansion, making Alliant the third largest owner-operator of regulated wind in the US.

Alliant’s growing renewables portfolio provided 27.5% of the company’s power supply in 2021. Alliant plans to eliminate the use of coal for power generation by 2040 and has a goal of reaching net-zero carbon dioxide emissions from electricity generation by 2050.

My recommended action would be to look into buying LNT.

About the Author

Kelley Wright entered the financial services industry in 1984 as a stock broker, first with a private investment boutique in La Jolla and later with Dean Witter Reynolds. In 1990, he left the retail side of the industry for private portfolio management. In 2002, Mr. Wright succeeded Geraldine Weiss as the managing editor of the Investment Quality Trends newsletter as well as the chief investment officer and portfolio manager for IQ Trends Private Client.

His commentaries have been published in Barron's, Forbes, BusinessWeek, Dow Jones MarketWatch, The Economist, and many other business and financial periodicals. Mr. Wright is an active speaker at trade shows and investment conferences, and is a frequent guest and contributor to radio and CNBC. He is the author of Dividends Still Don't Lie, which was published in February, 2010, by John Wiley & Sons, Inc.

More By This Author:

"Revenge Travel" - A New Wave For Royal CaribbeanCogent Communications: A High-Speed Internet Provider Worth Tapping Into

GLD: Profit from Gold Using this Precious Metals ETF

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.